When the market begins exhibiting cracks, most traders freeze.

They watch their portfolios bleed, hoping issues will flip round.

However good merchants know that hope isn’t a technique – insurance coverage is.

Contents

Understanding Portfolio Safety

Portfolio safety utilizing put choices is like shopping for insurance coverage to your inventory holdings.

Simply as you wouldn’t drive with out automobile insurance coverage, important inventory positions deserve safety throughout unsure market circumstances.

The idea is simple: you buy put choices on the shares you personal (or on index ETFs that monitor your holdings).

If the market drops, your places improve in worth, offsetting losses in your inventory positions.

This technique is especially precious for traders with concentrated positions or substantial unrealized positive factors they need to shield.

Nonetheless, like all insurance coverage, protecting places include a value.

The bottom line is understanding when safety is smart and the best way to implement it effectively with out destroying your returns.

Place Sizing And Safety Ratios

The primary determination you’ll face is figuring out how a lot of your portfolio really wants safety.

You have got a number of choices, every with completely different value implications and threat profiles.

Full Safety (1:1 Ratio)

This implies shopping for one put contract for each 100 shares you personal.

In case you maintain 1,000 shares of a inventory, you’d purchase 10 put contracts.

This offers full draw back safety under your chosen strike value.

Full safety is smart whenever you’re sitting on important unrealized positive factors that you simply’re not prepared to comprehend for tax functions, or when you will have excessive conviction a couple of place long-term however are involved about short-term volatility.

Partial Safety

A more cost effective method is hedging 50-75% of your place.

This reduces your insurance coverage prices whereas nonetheless offering significant draw back safety.

Consider it as having the next deductible in your insurance coverage coverage.

For instance, with 1,000 shares, you may purchase 5-7 put contracts.

If the inventory drops 15%, your unhedged portion takes the total hit, however your hedged portion is protected.

This balanced method works effectively for diversified portfolios the place you’re managing general portfolio threat slightly than defending particular person positions.

Keep in mind, the objective of hedging isn’t to get rid of all threat—that might additionally get rid of your upside potential.

It’s about managing the magnitude of potential losses whereas sustaining your potential to take part in positive factors.

Strike Choice Technique

Choosing the proper strike value is a balancing act between value and safety stage.

Your strike choice ought to replicate each your threat tolerance and the way a lot paper loss you’re prepared to simply accept earlier than your insurance coverage kicks in.

10% Out-of-the-Cash Places

These supply essentially the most cost-effective safety however depart you uncovered to the primary 10% of any decline.

In case you personal inventory at $100, you’d purchase $90 strike places.

This technique works greatest whenever you’re defending in opposition to catastrophic strikes slightly than regular market volatility.

The benefit?

Decrease premium prices imply much less drag in your general returns.

The drawback?

You’ll really feel the ache of smaller corrections that don’t attain your strike value.

5% Out-of-the-Cash Places

That is the candy spot for many traders.

Utilizing the identical $100 inventory instance, you’d buy $95 strike places.

You’re accepting reasonable threat (the primary 5% decline) whereas getting significant safety in opposition to bigger strikes.

This strike choice presents affordable premium prices whereas offering safety in opposition to strikes past regular market noise.

It’s notably efficient during times of elevated uncertainty whenever you need safety with out overpaying.

At-the-Cash Places

ATM places present most safety beginning out of your present inventory value, however they’re additionally the most costly.

These make sense solely whenever you’re extremely assured about an imminent decline or whenever you’re defending extraordinary positive factors.

For many long-term traders, ATM safety is overkill.

The premium value sometimes outweighs the good thing about defending in opposition to small, short-term value fluctuations.

Delta Concerns For Hedging

Understanding delta helps you steadiness safety effectiveness in opposition to value.

Delta represents how a lot your possibility worth modifications for each $1 transfer within the underlying inventory.

20-30 Delta Places

These are your cost-effective safety choices.

A 25-delta put prices considerably lower than larger delta alternate options however offers much less draw back safety initially.

Because the inventory value falls and the put strikes nearer to the cash, the delta will increase, providing extra safety exactly whenever you want it most.

This delta vary works effectively for defense in opposition to important market dislocations slightly than minor corrections.

Consider these as catastrophic protection—they gained’t assist a lot with small drops, however they’ll be there when issues actually crumble.

30-40 Delta Places

For extra sturdy hedging, take into account this delta vary.

These places value extra however reply extra instantly to cost declines.

A 35-delta put will acquire roughly $35 in worth for each $100 drop within the inventory value (initially—this ratio modifications because the inventory strikes).

This vary represents a center floor between value effectivity and rapid safety.

They’re perfect when market circumstances are deteriorating, and also you need your hedges to kick in rapidly.

Keep in mind, a decrease delta means a less expensive premium however much less rapid safety.

The next delta means larger value however higher safety from the beginning.

Your selection ought to replicate your threat tolerance and market outlook.

Selecting The Proper Expiration

Expiration choice considerably impacts each your value and the effectiveness of your safety technique.

Too brief, and also you’re continually rolling and paying transaction prices.

Too lengthy, and also you’re overpaying for time you won’t want.

30-45 Days Till Expiration

This shorter timeframe requires lively administration.

You’ll have to roll your places usually, paying commissions and coping with bid-ask spreads a number of occasions per yr.

Nonetheless, the month-to-month premium is comparatively low.

This method works if you happen to’re snug with lively portfolio administration and need flexibility to regulate your safety stage incessantly primarily based on altering market circumstances.

The draw back?

Time decay accelerates within the remaining 30 days, so that you’re continually combating theta.

60-90 Days: The Candy Spot

That is my most well-liked expiration vary for many portfolio safety methods.

You get significant safety with out overpaying for extreme time premium.

Rolling each 60-90 days retains transaction prices affordable whereas sustaining steady protection.

At this timeframe, theta decay is manageable, and you’ve got sufficient time to your safety to work if market circumstances deteriorate.

You’re not continually managing your hedges, however you’re additionally not committing to long-term safety prices.

3-6 Months

Longer-dated places value extra upfront attributable to larger time premium, however they require much less upkeep.

In case you’re taking a multi-month journey or just need set-and-forget safety, this timeframe is smart.

The trade-off is obvious: you pay extra for comfort and longer protection, however you scale back the danger of being unprotected if you happen to overlook to roll or if markets hole down all of a sudden.

I usually keep away from shopping for safety with lower than 30 days to expiration as a result of time decay accelerates dramatically.

You’re paying for quickly eroding worth, which makes the insurance coverage inefficient.

Actual-World Hedging Instance

Let’s stroll by way of a sensible state of affairs to see how this works in motion.

The State of affairs

You personal 1,000 shares of XYZ Corp, at the moment buying and selling at $100 per share.

Your place is value $100,000, and also you’ve bought a pleasant revenue you’d like to guard.

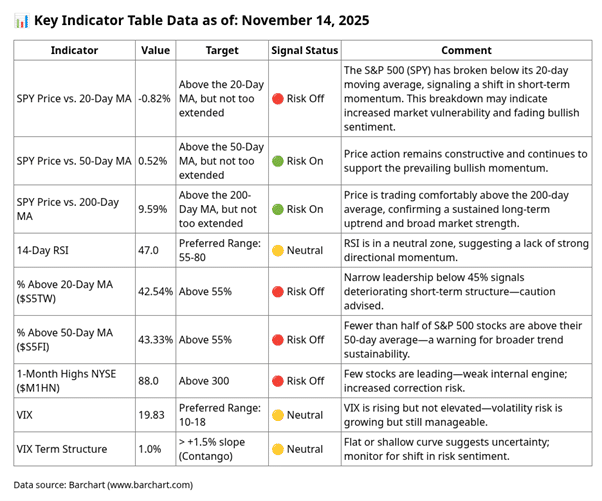

Market circumstances are exhibiting some warning indicators—volatility is choosing up, breadth is deteriorating, and also you’re seeing regarding patterns within the main indices.

The Safety Technique

Based mostly on our pointers, right here’s the way you may construction your hedge:

Place Measurement: Purchase 10 put contracts for full safety, or 5-7 contracts for partial safety (50-70% hedge)

Strike Choice: Select the $95 strike (5% OTM) to steadiness value with significant safety

Expiration: Choose places with 75 days to expiration (center of our 60-90 day candy spot)

Delta Goal: Search for places with 25-30 delta for cost-effective safety

Value Evaluation

Let’s say these $95 strike places are buying and selling at $2.50 per share ($250 per contract):

Full hedge (10 contracts): $2,500 whole value (2.5% of place worth)

Partial hedge (7 contracts): $1,750 whole value (1.75% of place worth)

The Safety Payoff

If XYZ drops to $85 (a 15% decline):

Your inventory loses $15,000 in worth

Your 10 places are actually value roughly $10 every ($100 intrinsic worth – authentic value)

Put revenue: $7,500 (10 contracts × $7.50 acquire per share × 100 shares)

Internet portfolio loss: $7,500 as an alternative of $15,000

With the partial hedge (7 contracts), you’d recuperate about $5,250, lowering your web loss to $9,750.

You’ve minimize your drawdown by roughly one-third whereas spending considerably much less on insurance coverage.

Get Your Free Put Promoting Calculator

Value Administration Methods

The most important objection to protecting places is value.

In case you’re persistently spending 2-3% per quarter on insurance coverage, that’s a severe drag on returns.

Listed here are methods to make safety extra inexpensive:

The Collar Technique

As a substitute of simply shopping for places, concurrently promote out-of-the-money lined calls in opposition to your shares.

The premium you gather from the calls helps finance the places, typically lowering your web value to zero.

Instance: Purchase $95 places for $2.50, promote $110 requires $2.00.

Your web value is simply $0.50 per share, or $500 for 1,000 shares.

The trade-off?

Your upside is capped at $110.

This works superbly whenever you’re prepared to promote shares at a predetermined revenue stage anyway.

You’re basically saying, “I need safety under $95, however I’m completely happy to promote at $110.”

Use Put Spreads As a substitute

Somewhat than shopping for straight places, take into account put spreads.

Purchase the next strike put and promote a decrease strike put.

This reduces your value but additionally caps your safety.

Instance: Purchase $95 places for $2.50, promote $85 places for $1.00.

Your web value is $1.50, however your most safety is $10 per share (the unfold width) minus your value.

Put spreads make sense whenever you’re defending in opposition to reasonable declines slightly than crashes.

They’re notably efficient in range-bound markets the place catastrophic drops are unlikely.

Time Your Hedges When IV Is Low

Implied volatility instantly impacts possibility costs.

Shopping for safety when the VIX is at 30+ means you’re overpaying.

At any time when potential, set up your hedges when volatility is comparatively subdued.

This doesn’t imply attempting to time the market completely—it means being strategic about whenever you pay for insurance coverage.

If you understand you’ll need safety for the following quarter, shopping for when IV spikes after a small correction will value considerably greater than shopping for throughout calm intervals.

Alter Strike Width Based mostly on Situations

When safety is pricey, take into account going additional out of the cash.

As a substitute of 5% OTM places, take a look at 10% and even 15% OTM choices.

You’re accepting extra threat whereas protecting prices manageable.

Consider this as adjusting your insurance coverage deductible primarily based on premium prices.

When insurance coverage is affordable, purchase complete protection.

When it’s costly, go for catastrophic-only protection.

When To Implement Hedges

Timing your hedges is essential.

The worst time to purchase insurance coverage is after the accident has already occurred.

Right here’s when you need to critically take into account implementing portfolio safety:

Market Warning Indicators

Don’t look ahead to the market to crash earlier than shopping for safety.

Look ahead to early warning indicators:

VIX backwardation (near-term volatility larger than longer-term)

Deteriorating market breadth (fewer shares collaborating in rallies)

Distribution days clustering in main indices

Credit score spreads are widening considerably

Technical breakdowns of key assist ranges

These indicators gained’t completely predict each correction, however they typically precede important market strikes.

Having safety in place when these warnings flash provides you peace of thoughts and portfolio stability.

Defending Vital Positive aspects

In case you’re sitting on substantial unrealized earnings, particularly in concentrated positions, take into account safety even within the absence of clear market warnings.

The larger your positive factors, the extra painful it’s to observe them evaporate.

That is notably related for workers with giant concentrated inventory positions or traders who’ve captured extraordinary returns in particular holdings.

Generally defending positive factors is extra essential than searching for extra upside.

Concentrated Place Threat

Place sizing self-discipline suggests no single holding ought to exceed 10-15% of your portfolio.

In case you’ve violated this rule (actually because a place has run up considerably), hedging turns into extra vital.

Concentrated positions expose you to company-specific threat past broader market threat.

Protecting places can help you keep your place whereas lowering tail threat.

Seasonal Patterns

Traditionally, September and October see elevated market volatility.

Whereas previous efficiency doesn’t assure future outcomes, {many professional} traders implement hedges heading into these historically unstable months.

Occasion-Pushed Safety

Earnings bulletins, Fed conferences, elections, and different main occasions can set off volatility.

In case you’re nervous a couple of particular occasion however don’t need to promote, short-term safety is smart.

Frequent Errors To Keep away from

Even skilled merchants make errors when hedging.

Listed here are the pitfalls to be careful for:

Ready Too Lengthy to Hedge

The time to purchase insurance coverage is earlier than you want it, not after the market has already dropped 10%.

As soon as volatility spikes, safety turns into extraordinarily costly.

Many traders make the error of shopping for places after a decline, paying peak costs for protection once they’ve already absorbed important losses.

Over-Hedging Your Portfolio

Some traders turn into insurance coverage addicts, continually sustaining costly hedges that drag down returns yr after yr.

In case you’re paying 8-12% yearly for defense, you want outsized returns simply to interrupt even.

Keep in mind, markets go up extra typically than they go down.

Over-hedging is like shopping for fireplace insurance coverage on each piece of clothes you personal—theoretically, it protects you, however virtually, it bankrupts you.

Ignoring Value in Return Calculations

Many merchants set up protecting places however fail to consider the associated fee when calculating their return expectations.

In case you’re persistently spending 3% per quarter on places, that’s 12% yearly you have to overcome.

Be sincere in regards to the prices of safety and whether or not your technique can maintain them.

Generally the maths merely doesn’t work, and also you’re higher off with different threat administration approaches like place sizing or diversification.

Shopping for Too Quick-Dated Choices

Buying places with lower than 30 days to expiration means combating accelerated time decay.

Except you’re hedging a selected short-term occasion, keep away from very short-dated safety.

The theta burn makes the insurance coverage inefficient.

Forgetting to Roll or Alter

Suppose you determine a hedge, set calendar reminders to roll earlier than expiration.

Nothing is worse than realizing your safety expired two weeks in the past, proper because the market begins promoting off.

Deal with your hedges like recurring bills that require lively administration.

Remaining Ideas On Threat Administration

Portfolio safety with places isn’t about eliminating threat—it’s about managing the magnitude of losses whereas sustaining your potential to take part in positive factors.

Consider it as threat administration, not threat elimination.

The objective isn’t to hedge the whole lot on a regular basis.

That may destroy your returns and get rid of the upside that makes inventory investing worthwhile.

As a substitute, use protecting places strategically when market circumstances warrant further warning or when defending important unrealized positive factors.

At all times consider the price of safety when calculating your general return expectations.

Insurance coverage is effective, nevertheless it’s not free.

In case you’re persistently paying for defense, you want larger returns simply to remain even.

Be real looking about whether or not your technique can maintain the continuing value.

Concentrate on course of over perfection.

You gained’t time hedges completely—typically you’ll pay for insurance coverage you don’t use, and typically you’ll want you had extra safety.

That’s regular.

What issues is having a scientific risk-management method that retains you within the sport in the long run.

As I all the time inform my college students: “It’s not about avoiding losses—it’s about managing the dimensions of losses.”

Small, manageable losses are a part of investing.

Catastrophic losses that destroy your capital and confidence are what we’re attempting to stop.

Keep in mind, the most effective traders aren’t those that by no means lose cash—they’re those who survive lengthy sufficient to capitalize on alternatives when the following bull market arrives.

Safety methods assist make sure you’ll nonetheless be enjoying the sport when the following bull market arrives.

Entry 9 Free Possibility Books

Need to Grasp Portfolio Safety Methods?

Understanding protecting places is only one element of complete threat administration.

Whether or not you’re managing a six-figure portfolio or constructing towards that objective, systematic threat administration separates profitable long-term traders from those that wash out through the subsequent market correction.

In case you’re interested by studying extra about choices methods for earnings technology and portfolio safety:

Choices Earnings Mastery: Be taught the foundational methods for utilizing choices to generate constant earnings whereas managing threat successfully ($397)

The Accelerator Program: Superior coaching protecting refined hedging methods, adjustment methods, and portfolio-level threat administration for severe traders ($997)

Associated Articles

We hope you loved this text on the portfolio safety with places.

When you have any questions, please ship an e-mail or depart a remark under.

Commerce safely!

Get Your Free Put Promoting Calculator

Commerce protected!

Disclaimer: The data above is for academic functions solely and shouldn’t be handled as funding recommendation. The technique offered wouldn’t be appropriate for traders who will not be conversant in trade traded choices. Any readers on this technique ought to do their very own analysis and search recommendation from a licensed monetary adviser.