Up to date on August 18th, 2025 by Bob Ciura

Because of the surge of inflation to a 40-year excessive final 12 months, the Federal Reserve raised rates of interest at a speedy tempo over the previous two years to chill the financial system.

However with inflation just lately perking up once more and the potential influence of tariffs, some economists now anticipate the Fed to decrease rates of interest as soon as once more.

Condominium REITs have proved resilient to recessions due to the important nature of their enterprise. Additionally they extensively have excessive dividend yields properly above the S&P 500 Index common.

And, condo REITs would profit from falling rates of interest, which might decrease their price of capital.

You possibly can obtain our full REIT record, together with necessary metrics equivalent to dividend yields and market caps, by clicking on the hyperlink beneath:

Consequently, condo REITs are attention-grabbing candidates for revenue traders.

This text will focus on the prospects of the highest 10 condo REITs in our Certain Evaluation Analysis Database.

The next 10 condo REITs are listed by five-year anticipated annual returns, so as of lowest to highest:

Desk of Contents

You possibly can immediately leap to any particular part of the article through the use of the hyperlinks beneath:

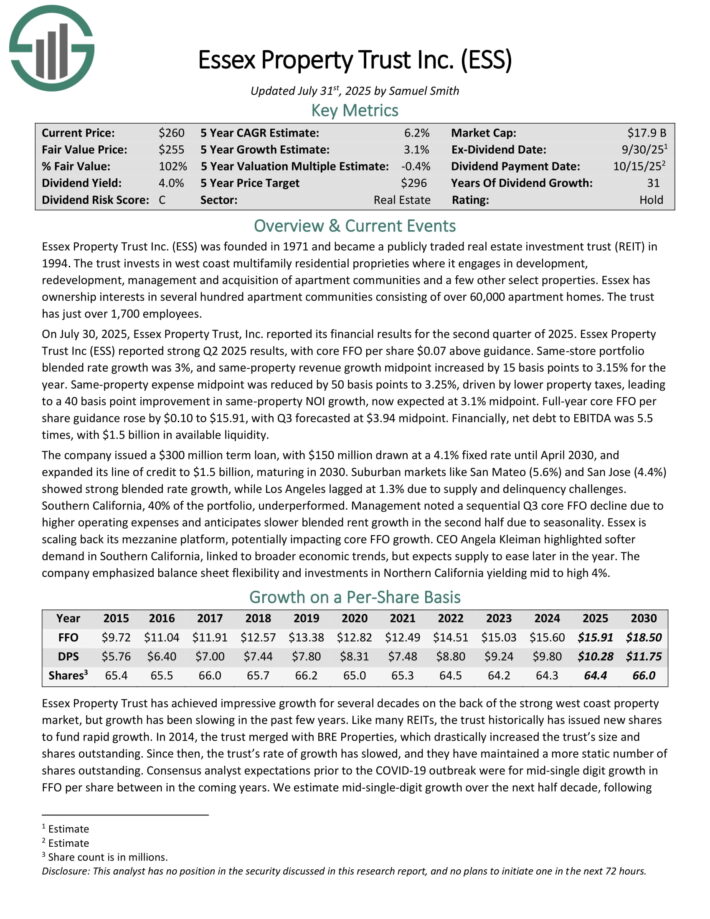

Condominium REITs #10: Essex Property Belief (ESS)

Annual Anticipated Returns: 6.6%

Essex Property Belief was based in 1971. The belief invests in West Coast multi-family residential proprieties the place it engages in improvement, redevelopment, administration and acquisition of condo communities and some different choose properties.

Essex has possession pursuits in a number of hundred condo communities consisting of over 60,000 condo houses. The belief has about 1,800 workers and produces roughly $1.6 billion in annual income.

Essex is targeting the West Coast of the U.S., together with cities like Seattle and San Francisco.

On July 30, 2025, Essex Property Belief, Inc. reported its monetary outcomes for the second quarter of 2025. Essex Property Belief Inc (ESS) reported robust Q2 2025 outcomes, with core FFO per share $0.07 above steering.

Identical-store portfolio blended fee progress was 3%, and same-property income progress midpoint elevated by 15 foundation factors to three.15% for the 12 months.

Identical-property expense midpoint was lowered by 50 foundation factors to three.25%, pushed by decrease property taxes, resulting in a 40 foundation level enchancment in same-property NOI progress, now anticipated at 3.1% midpoint. Full-year core FFO per share steering rose by $0.10 to $15.91, with Q3 forecasted at $3.94 midpoint.

Financially, web debt to EBITDA was 5.5 instances, with $1.5 billion in accessible liquidity.

Click on right here to obtain our most up-to-date Certain Evaluation report on ESS (preview of web page 1 of three proven beneath):

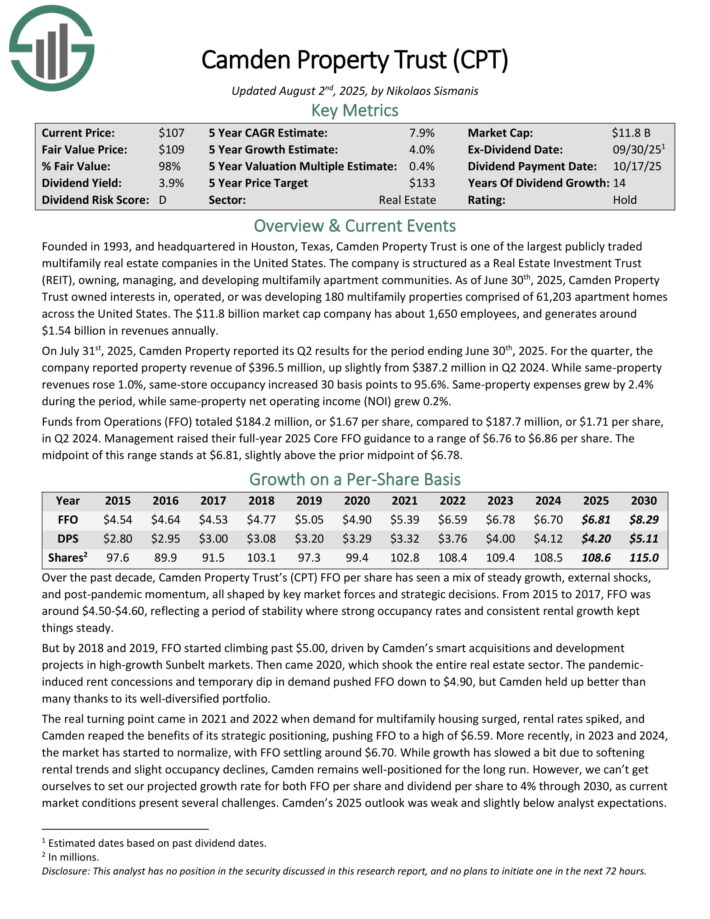

Condominium REITs #9: Camden Property Belief (CPT)

Annual Anticipated Returns: 7.9%

Based in 1993 and headquartered in Houston, Texas, Camden Property Belief is likely one of the largest publicly traded multifamily actual property corporations within the U.S.

The REIT owns, manages and develops multifamily condo communities. It at present owns 172 properties that include over 58,000 residences.

On July thirty first, 2025, Camden Property reported its Q2 outcomes. For the quarter, the corporate reported property income of $396.5 million, up barely from $387.2 million in Q2 2024.

Whereas same-property revenues rose 1.0%, same-store occupancy elevated 30 foundation factors to 95.6%. Identical-property bills grew by 2.4% throughout the interval, whereas same-property web working revenue (NOI) grew 0.2%.

Funds from Operations (FFO) totaled $184.2 million, or $1.67 per share, in comparison with $187.7 million, or $1.71 per share, in Q2 2024.

Camden has a aggressive benefit in its place as one of many largest multifamily REITs within the U.S. Its scale and experience permit it to leverage its expertise throughout a large portfolio of properties and actively pursue developments.

The corporate’s FFO payout ratio has hovered within the 60% to 70% vary for the final decade. CPT has elevated its dividend for 14 consecutive years.

Click on right here to obtain our most up-to-date Certain Evaluation report on Camden Property Belief (CPT) (preview of web page 1 of three proven beneath):

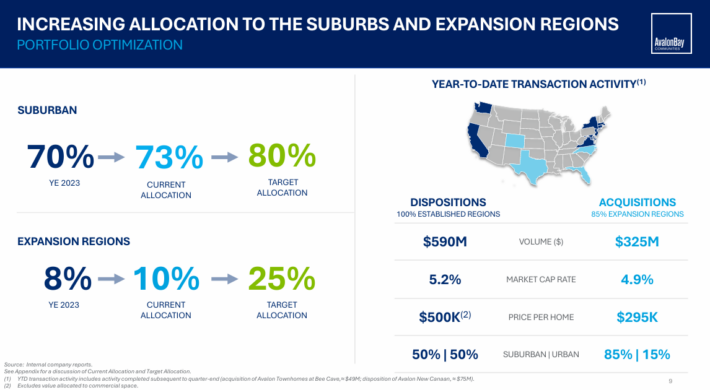

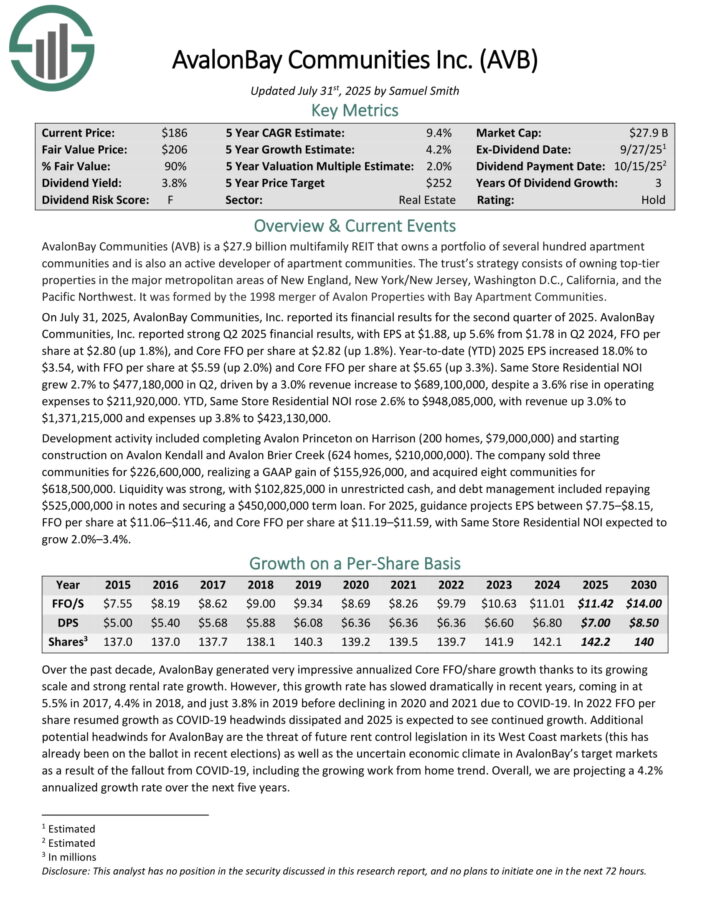

Condominium REITs #8: AvalonBay Communities (AVB)

Annual Anticipated Returns: 9.1%

AvalonBay Communities is a multifamily REIT that owns a portfolio of a number of hundred condo communities and can be an lively developer of condo communities.

The technique of the REIT entails proudly owning top-tier properties within the main metropolitan areas of New England, New York/New Jersey, Washington D.C., California, and the Pacific Northwest.

Supply: Investor Presentation

On July 31, 2025, AvalonBay Communities, Inc. reported its monetary outcomes for the second quarter of 2025. AvalonBay reported EPS at $1.88, up 5.6% from $1.78 in Q2 2024, FFO per share at $2.80 (up 1.8%), and Core FFO per share at $2.82 (up 1.8%).

12 months-to-date (YTD) 2025 EPS elevated 18.0% to $3.54, with FFO per share at $5.59 (up 2.0%) and Core FFO per share at $5.65 (up 3.3%).

Identical Retailer Residential NOI grew 2.7% to $477,180,000 in Q2, pushed by a 3.0% income enhance to $689,100,000, regardless of a 3.6% rise in working bills to $211,920,000.

12 months-to-date, Identical Retailer Residential NOI rose 2.6% to $948,085,000, with income up 3.0% to $1,371,215,000 and bills up 3.8% to $423,130,000.

Click on right here to obtain our most up-to-date Certain Evaluation report on AvalonBay Communities (AVB) (preview of web page 1 of three proven beneath):

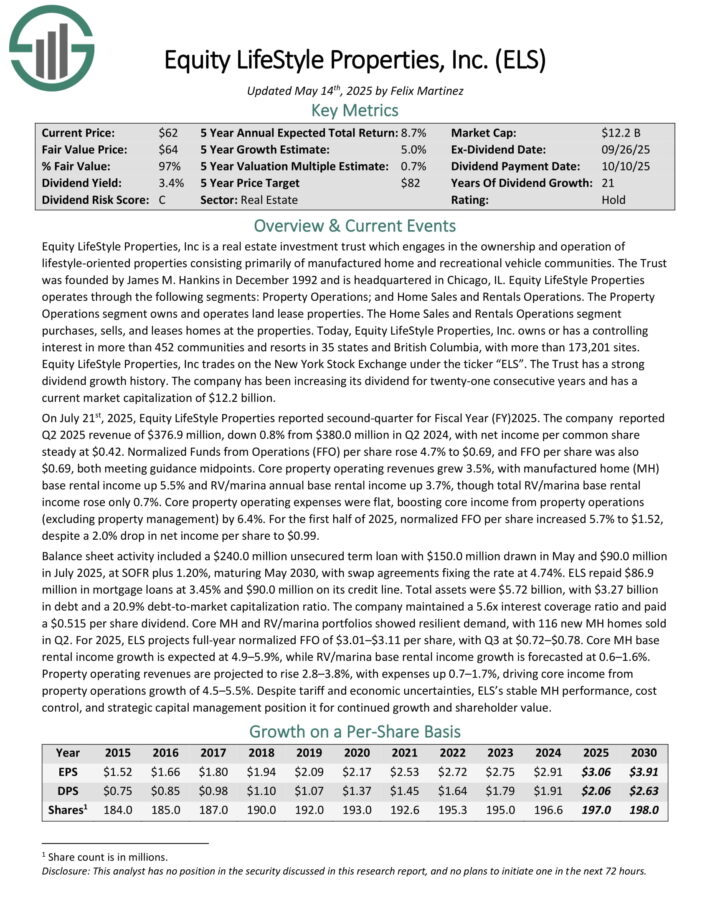

Condominium REITs #7: Fairness LifeStyle Properties (ELS)

Annual Anticipated Returns: 9.1%

Fairness LifeStyle Properties, Inc is an actual property funding belief which engages within the possession and operation of lifestyle-oriented properties consisting primarily of manufactured house and leisure car communities.

Fairness LifeStyle Properties operates by means of the next segments: Property Operations; and Dwelling Gross sales and Leases Operations.

The Property Operations section owns and operates land lease properties. The Dwelling Gross sales and Leases Operations section purchases, sells, and leases houses on the properties.

In the present day, Fairness LifeStyle Properties, Inc. owns or has a controlling curiosity in additional than 400 communities and resorts in 33 states and British Columbia, with greater than 165,000 websites.

On July twenty first, 2025, Fairness LifeStyle Properties reported second-quarter for Fiscal 12 months (FY) 2025. The corporate reported Q2 2025 income of $376.9 million, down 0.8% from $380.0 million in Q2 2024, with web revenue per widespread share regular at $0.42.

Normalized Funds from Operations (FFO) per share rose 4.7% to $0.69, and FFO per share was additionally $0.69, each assembly steering midpoints.

Core property working revenues grew 3.5%, with manufactured house (MH) base rental revenue up 5.5% and RV/marina annual base rental revenue up 3.7%, although complete RV/marina base rental revenue rose solely 0.7%.

Click on right here to obtain our most up-to-date Certain Evaluation report on ELS (preview of web page 1 of three proven beneath):

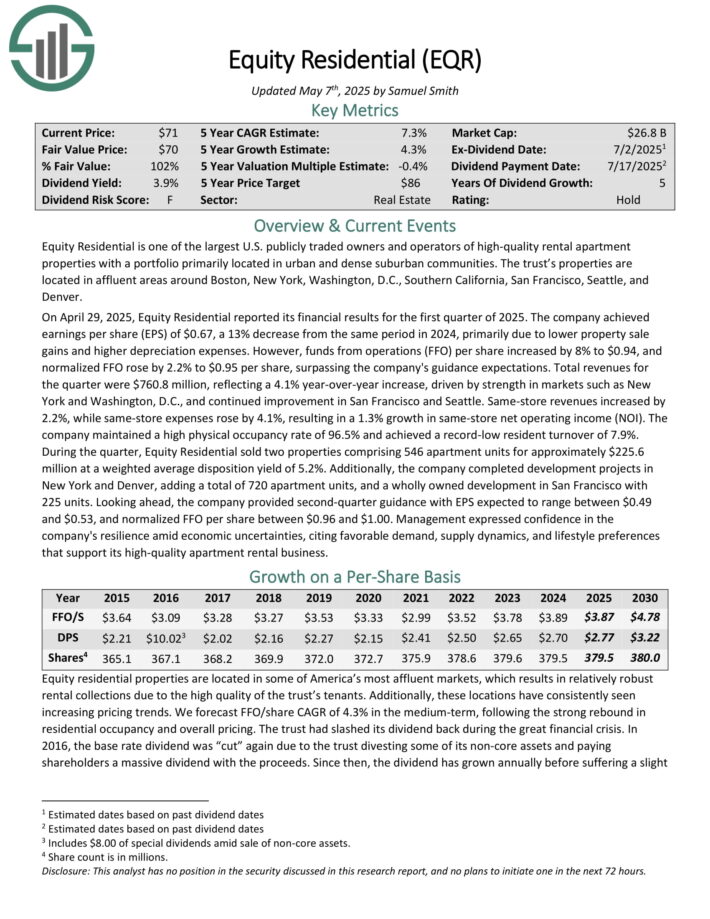

Condominium REITs #6: Fairness Residential (EQR)

Annual Anticipated Returns: 9.6%

Fairness Residential is likely one of the largest U.S. publicly-traded house owners and operators of high-quality rental condo properties with a portfolio primarily positioned in city and dense suburban communities.

The properties of the belief are positioned in prosperous areas round Boston, New York, Washington, D.C., Southern California, San Francisco, Seattle, and Denver.

Fairness Residential vastly advantages from the favorable traits of its goal group. Prosperous renters are extremely educated, properly employed and earn excessive incomes.

Consequently, they pay roughly 20% of their incomes on lease and therefore they aren’t burdened by their lease. Because of their robust earnings potential, the REIT can simply develop its lease charges 12 months after 12 months.

On April 29, 2025, Fairness Residential reported its monetary outcomes for the primary quarter of 2025. The corporate achieved earnings per share (EPS) of $0.67, a 13% lower from the identical interval in 2024, primarily attributable to decrease property sale positive factors and better depreciation bills.

Nonetheless, funds from operations (FFO) per share elevated by 8% to $0.94, and normalized FFO rose by 2.2% to $0.95 per share, surpassing the corporate’s steering expectations.

Whole revenues for the quarter have been $760.8 million, reflecting a 4.1% year-over-year enhance, pushed by power in markets equivalent to New York and Washington, D.C., and continued enchancment in San Francisco and Seattle.

Click on right here to obtain our most up-to-date Certain Evaluation report on Fairness Residential (EQR) (preview of web page 1 of three proven beneath):

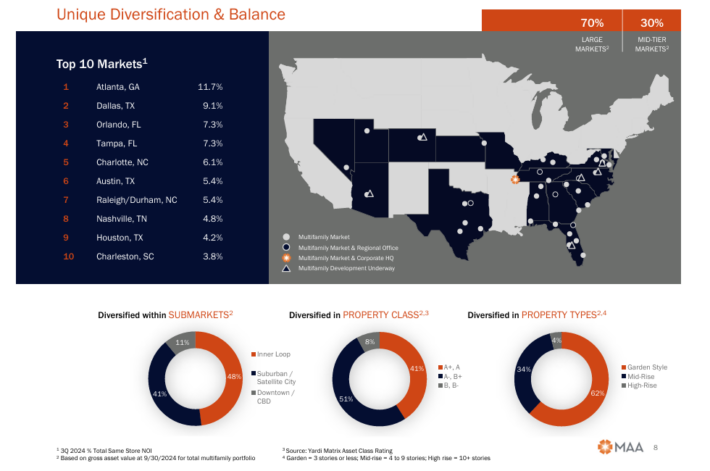

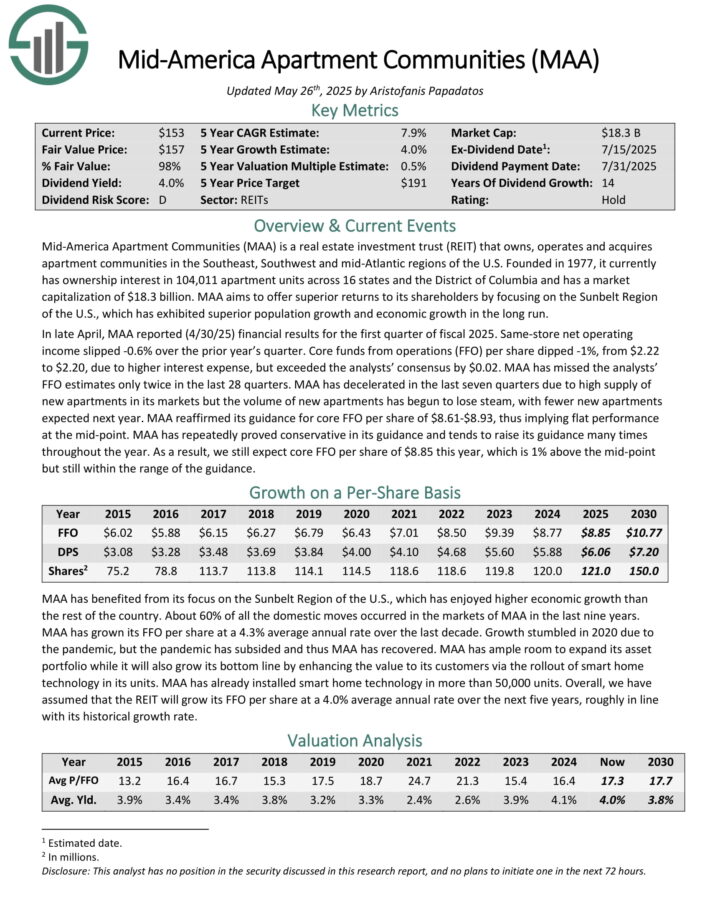

Condominium REITs #5: Mid-America Condominium Communities (MAA)

Annual Anticipated Returns: 9.8%

Mid-America Condominium Communities is a REIT that owns, operates and acquires condo communities within the Southeast, Southwest and mid-Atlantic areas of the U.S.

It at present has possession curiosity in ~102,000 condo models throughout 16 states and the District of Columbia.

MAA is concentrated on the Sunbelt Area of the U.S., which has exhibited superior inhabitants progress and financial progress in the long term.

Supply: Investor Presentation

In late April, MAA reported (4/30/25) monetary outcomes for the primary quarter of fiscal 2025. Identical-store web working revenue slipped -0.6% over the prior 12 months’s quarter. Core funds from operations (FFO) per share dipped -1%, from $2.22 to $2.20, attributable to larger curiosity expense, however exceeded the analysts’ consensus by $0.02.

MAA has missed the analysts’ FFO estimates solely twice within the final 28 quarters. MAA has decelerated within the final seven quarters attributable to excessive provide of recent residences in its markets however the quantity of recent residences has begun to lose steam, with fewer new residences anticipated subsequent 12 months.

MAA reaffirmed its steering for core FFO per share of $8.61-$8.93.

Click on right here to obtain our most up-to-date Certain Evaluation report on Mid-America Condominium Communities (MAA) (preview of web page 1 of three proven beneath):

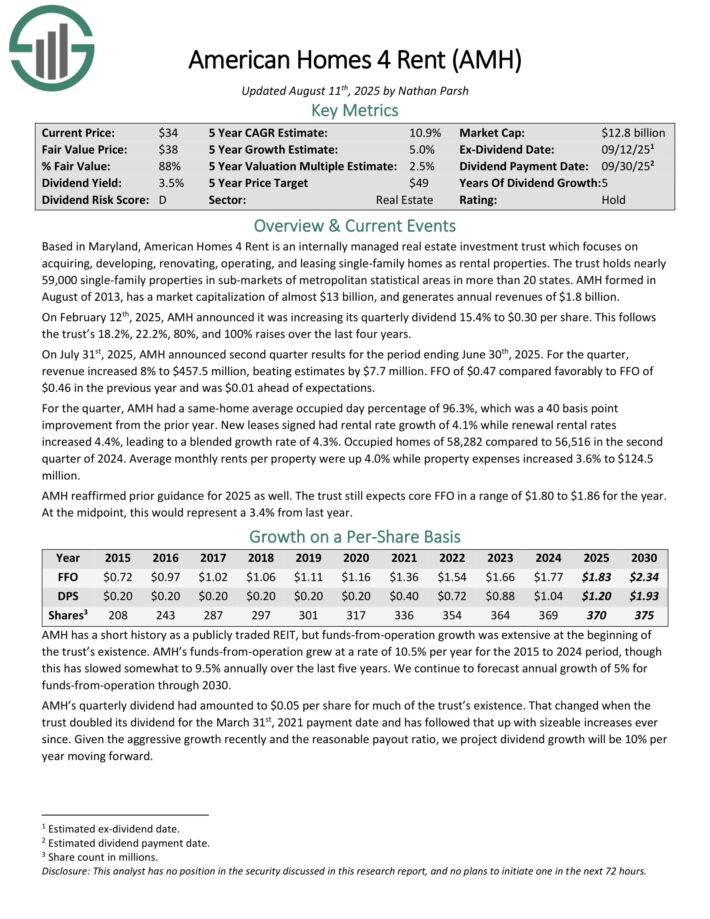

Condominium REITs #4: American Houses 4 Hire (AMH)

Annual Anticipated Returns: 10.2%

Primarily based in Maryland, American Houses 4 Hire is an internally managed REIT that focuses on buying, growing, renovating, working and leasing single-family houses as rental properties. AMH was shaped in 2013 and has a market capitalization of $14 billion.

The REIT holds practically 58,000 single-family properties in additional than 30 sub-markets of metropolitan statistical areas in 21 states.

On February twelfth, 2025, AMH introduced it was rising its quarterly dividend 15.4% to $0.30 per share.

On July thirty first, 2025, AMH introduced second quarter outcomes for the interval ending June thirtieth, 2025. For the quarter, income elevated 8% to $457.5 million, beating estimates by $7.7 million. FFO of $0.47 in contrast favorably to FFO of $0.46 within the earlier 12 months and was $0.01 forward of expectations.

For the quarter, AMH had a same-home common occupied day proportion of 96.3%, which was a 40 foundation level enchancment from the prior 12 months. New leases signed had rental fee progress of 4.1% whereas renewal rental charges elevated 4.4%, resulting in a blended progress fee of 4.3%.

Occupied houses of 58,282 in comparison with 56,516 within the second quarter of 2024. Common month-to-month rents per property have been up 4.0% whereas property bills elevated 3.6% to $124.5 million.

Click on right here to obtain our most up-to-date Certain Evaluation report on American Houses 4 Hire (AMH) (preview of web page 1 of three proven beneath):

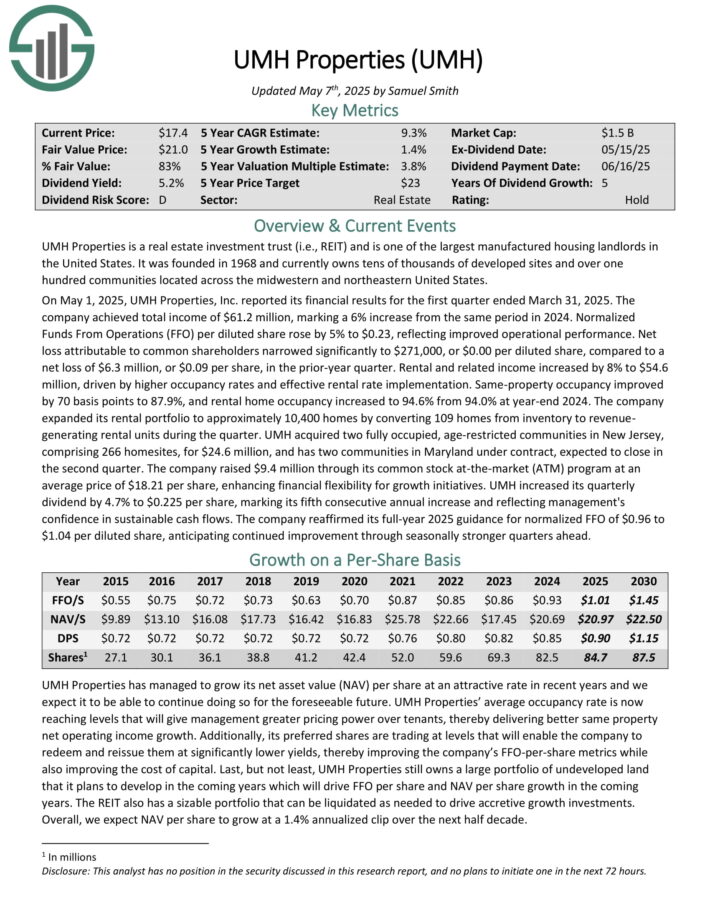

Condominium REITs #3: UMH Properties (UMH)

Annual Anticipated Returns: 11.7%

UMH Properties is a REIT that is likely one of the largest manufactured housing landlords within the U.S. It was based in 1968 and at present owns tens of hundreds of developed websites and 135 communities positioned throughout the midwestern and northeastern U.S.

As manufactured houses are cheaper than typical houses, UMH Properties has proved resilient to recessions.

Supply: Investor Presentation

On Could 1, 2025, UMH Properties, Inc. reported its monetary outcomes for the primary quarter ended March 31, 2025. The corporate achieved complete revenue of $61.2 million, marking a 6% enhance from the identical interval in 2024. Normalized Funds From Operations (FFO) per diluted share rose by 5% to $0.23, reflecting improved operational efficiency.

Internet loss attributable to widespread shareholders narrowed considerably to $271,000, or $0.00 per diluted share, in comparison with a web lack of $6.3 million, or $0.09 per share, within the prior-year quarter. Rental and associated revenue elevated by 8% to $54.6 million, pushed by larger occupancy charges and efficient rental fee implementation.

Identical-property occupancy improved by 70 foundation factors to 87.9%, and rental house occupancy elevated to 94.6% from 94.0% at year-end 2024.

Click on right here to obtain our most up-to-date Certain Evaluation report on UMH Properties (UMH) (preview of web page 1 of three proven beneath):

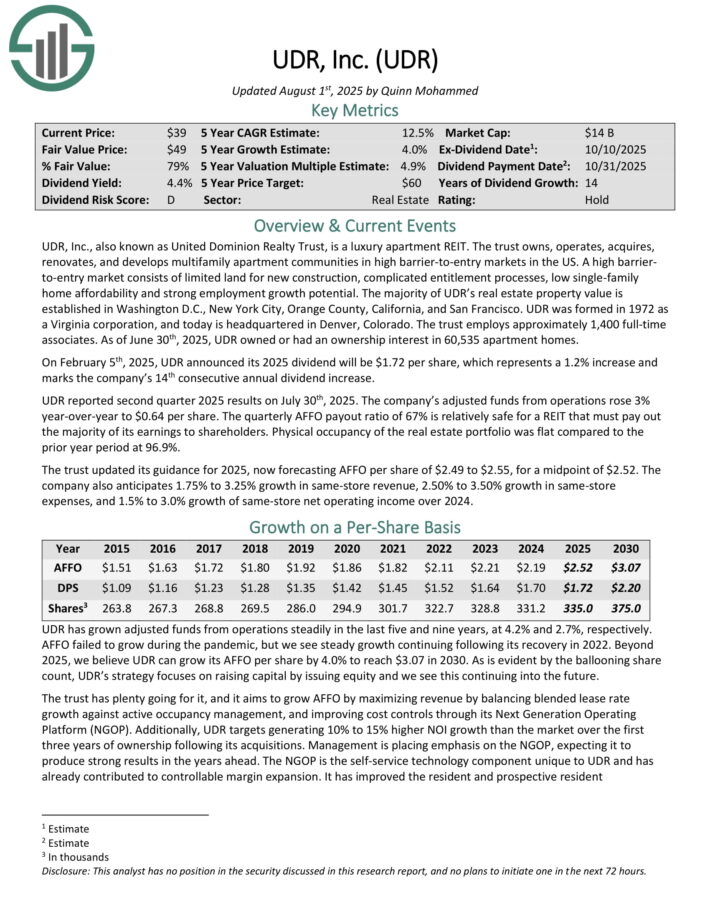

Condominium REITs #2: UDR, Inc. (UDR)

Annual Anticipated Returns: 12.6%

UDR, also referred to as United Dominion Realty Belief, is a luxurious condo REIT. The belief owns, operates, acquires, renovates, and develops multifamily condo communities in excessive barrier-to-entry markets within the U.S.

A excessive barrier-to-entry market consists of restricted land for brand spanking new development, difficult entitlement processes, low single-family house affordability and powerful employment progress potential.

The vast majority of UDR’s actual property property worth is established in Washington D.C., New York Metropolis, Orange County, California, and San Francisco.

Supply: Investor Presentation

On February fifth, 2025, UDR introduced its 2025 dividend might be $1.72 per share, which represents a 1.2% enhance and marks the corporate’s 14th consecutive annual dividend enhance.

UDR reported second quarter 2025 outcomes on July thirtieth, 2025. Adjusted funds from operations rose 3% year-over-year to $0.64 per share. The quarterly AFFO payout ratio of 67% is comparatively protected for a REIT that should pay out the vast majority of its earnings to shareholders.

Bodily occupancy of the true property portfolio was flat in comparison with the prior 12 months interval at 96.9%. The belief up to date its steering for 2025, now forecasting AFFO per share of $2.49 to $2.55, for a midpoint of $2.52.

Click on right here to obtain our most up-to-date Certain Evaluation report on UDR (preview of web page 1 of three proven beneath):

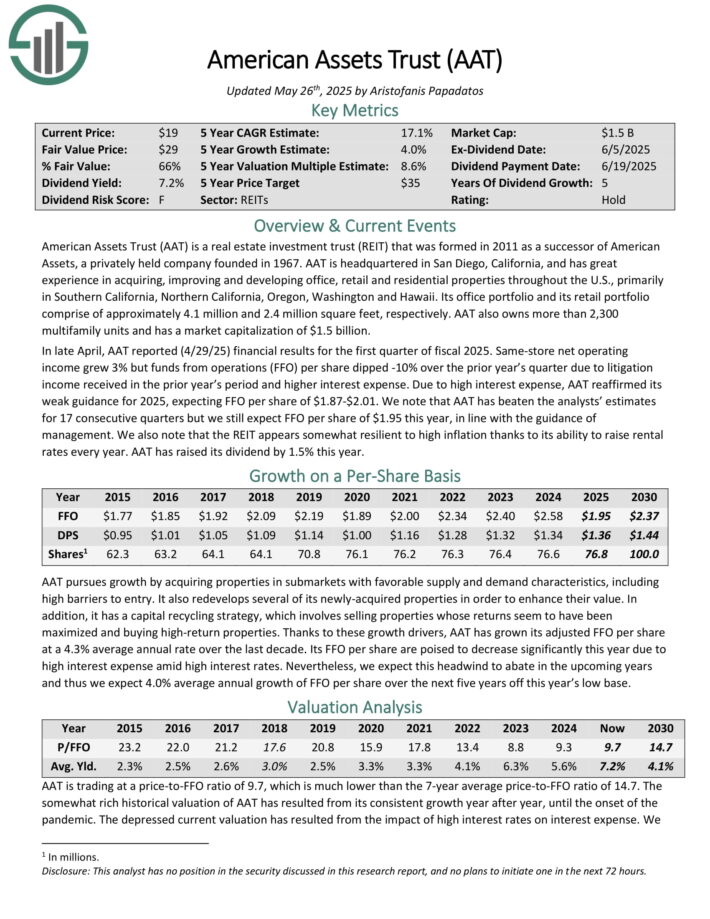

Condominium REITs #1: American Property Belief (AAT)

Annual Anticipated Returns: 16.8%

American Property Belief is a REIT that was shaped in 2011 as a successor of American Property, a privately held firm based in 1967.

AAT has nice expertise in buying, enhancing and growing workplace, retail and residential properties all through the U.S., primarily in Southern California, Northern California, Oregon, Washington and Hawaii.

Its workplace portfolio and its retail portfolio comprise of roughly 4.0 million and three.1 million sq. ft, respectively. AAT additionally owns greater than 2,000 multifamily models.

Supply: Investor Presentation

In late April, AAT reported (4/29/25) monetary outcomes for the primary quarter of fiscal 2025. Identical-store web working revenue grew 3% however funds from operations (FFO) per share dipped -10% over the prior 12 months’s quarter attributable to litigation revenue acquired within the prior 12 months’s interval and better curiosity expense.

As a consequence of excessive curiosity expense, AAT reaffirmed its weak steering for 2025, anticipating FFO per share of $1.87-$2.01.

Click on right here to obtain our most up-to-date Certain Evaluation report on American Property Belief (AAT) (preview of web page 1 of three proven beneath):

Remaining Ideas

Many condo REITs go underneath the radar of the vast majority of traders attributable to their mundane enterprise mannequin.

Nonetheless, a few of these REITs have supplied exceptionally excessive returns to their shareholders. As well as, condo REITs have proved resilient to recessions, because the demand for housing stays robust even throughout tough financial intervals.

The above 10 condo REITs are attention-grabbing candidates for the portfolios of income-oriented traders, particularly given the rising threat of an upcoming recession.

If you’re inquisitive about discovering high-quality dividend progress shares and/or different high-yield securities and revenue securities, the next Certain Dividend sources might be helpful:

Excessive-Yield Particular person Safety Analysis

Different Certain Dividend Assets

Thanks for studying this text. Please ship any suggestions, corrections, or inquiries to help@suredividend.com.