Merchants, I hope you’ve all had a beautiful weekend.

I look ahead to sharing a number of of my prime concepts with you for the upcoming week, together with swing and intraday potential trades, in addition to exit and entry situations.

So, let’s bounce proper into it.

Pullback in QS: Unbelievable run and momentum over the earlier weeks in QS. However, with the RSI closing within the 90s on Friday, vital vary and quantity enlargement over the earlier two days, and a serious enlargement from shifting averages, I’m now leaning firmly on the brief facet.

It’s additionally vital to recollect earnings mid-week for the inventory. Now, given the earnings, no matter my private bias, I received’t be trying to maintain this for a swing. Relatively, I’m simply searching for a profit-taking, one-day selloff occasion. Now, I feel we’re within the closing innings, contemplating the worth motion over the earlier two days, however I’ll solely brief as soon as I see a serious change of character.

*Please be aware that the costs and different statistics on this web page are hypothetical, and don’t replicate the affect, if any, of sure market components equivalent to liquidity, slippage and commissions.

Particularly, to get brief I must see one of many following: the inventory expertise failed comply with via close to a key stage (HOD for instance) and holds beneath vwap (change of character from earlier days). Or, I’d must see a First Purple Day setup materialize. Lastly, and better of all, can be a niche up and blow off within the morning.

Relating to a imply reversion/pullback commerce, I’m monitoring JOBY for the same alternative, though I fee it decrease than the setup in QS.

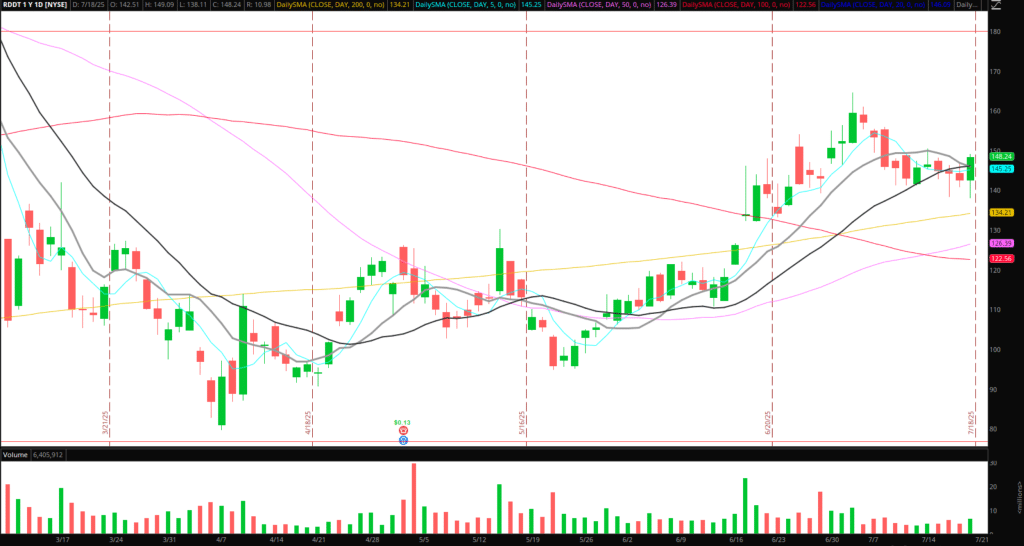

Continuation in RDDT: Beautiful chart forming throughout larger timeframes. I particularly just like the 200-day SMA reclaim, adopted by a good consolidation at converging 10-20-day SMAs. If the inventory can push and maintain above Friday’s excessive and intraday VWAP, I’d take into account going lengthy in opposition to the LOD for a multi-day swing.

*Please be aware that the costs and different statistics on this web page are hypothetical, and don’t replicate the affect, if any, of sure market components equivalent to liquidity, slippage and commissions.

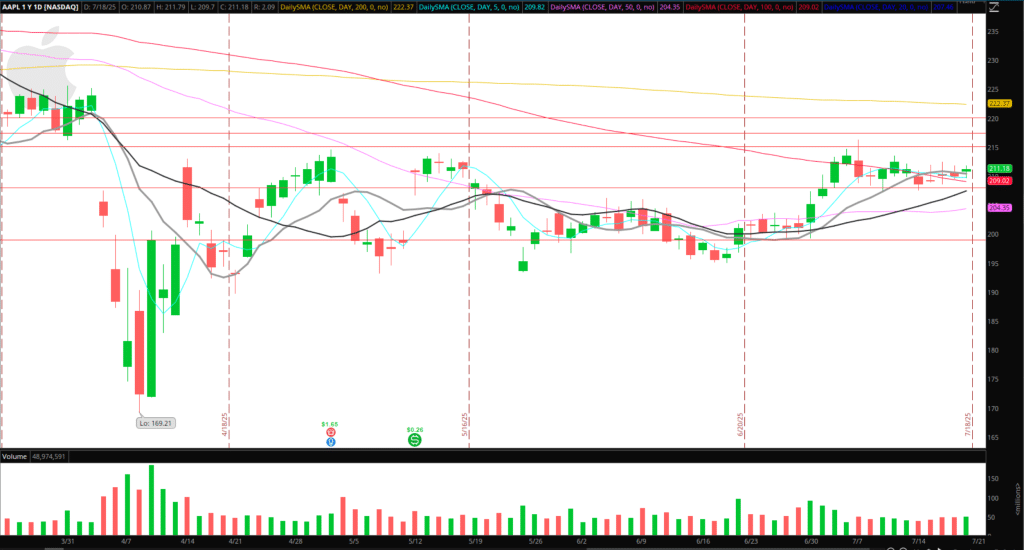

Breakout in AAPL: Beautiful setup forming in AAPL as effectively. The one distinction between this and RDDT is that AAPL stays beneath its 200-day SMA. On condition that, I wouldn’t be aggressive, contemplating the general development and overhead. However, if AAPL can take out final week’s excessive and show notable relative power on the day – a major change in character – I’d go lengthy in opposition to the LOD for a multi-day swing lengthy.

*Please be aware that the costs and different statistics on this web page are hypothetical, and don’t replicate the affect, if any, of sure market components equivalent to liquidity, slippage and commissions.

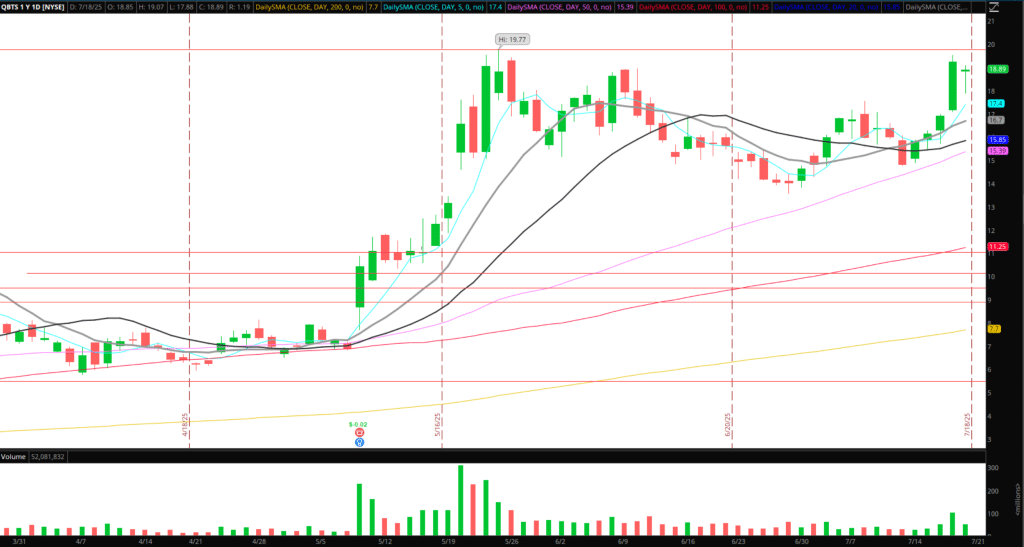

Intraday Momentum Breakouts in Quantum (IONQ, QBTS): The 2 best-looking charts within the trade for me are IONQ and QBTS. Now, basic bias apart, from a technical perspective, with severe momentum and clear ranges, I’d actually be open to momentum intraday longs on a clear breakout via vital resistance. So, for QBTS, that’s round $19.70. For IONQ, Friday’s excessive is the KL to look at for quantity and agency assist above.

*Please be aware that the costs and different statistics on this web page are hypothetical, and don’t replicate the affect, if any, of sure market components equivalent to liquidity, slippage and commissions.

Extra Concepts:

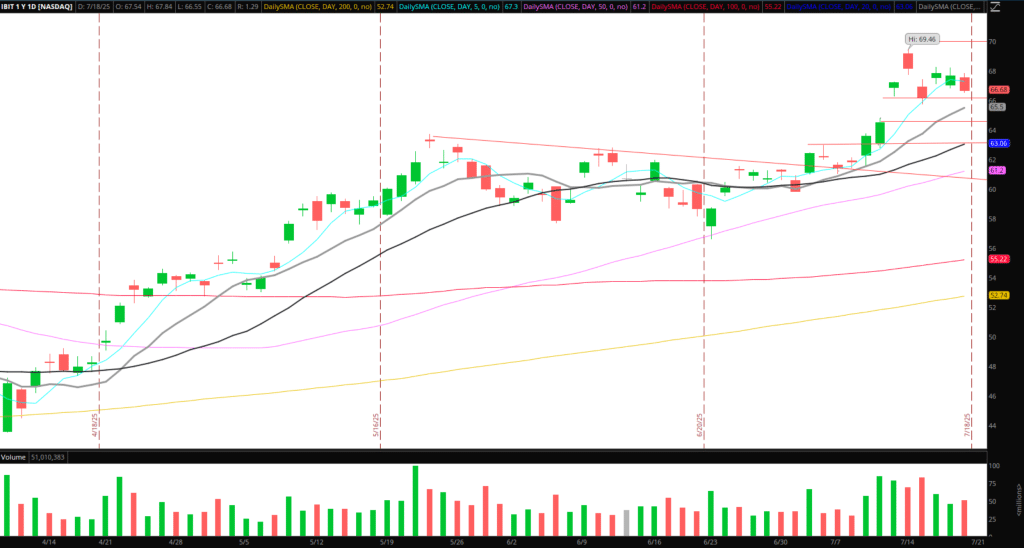

Bitcoin / Ethereum: Relating to Bitcoin, crypto, and crypto-related names – Nothing has modified week over week for me. Similar ideas as final week.

*Please be aware that the costs and different statistics on this web page are hypothetical, and do notreflect the affect, if any, of sure market components equivalent to liquidity, slippage and commissions.

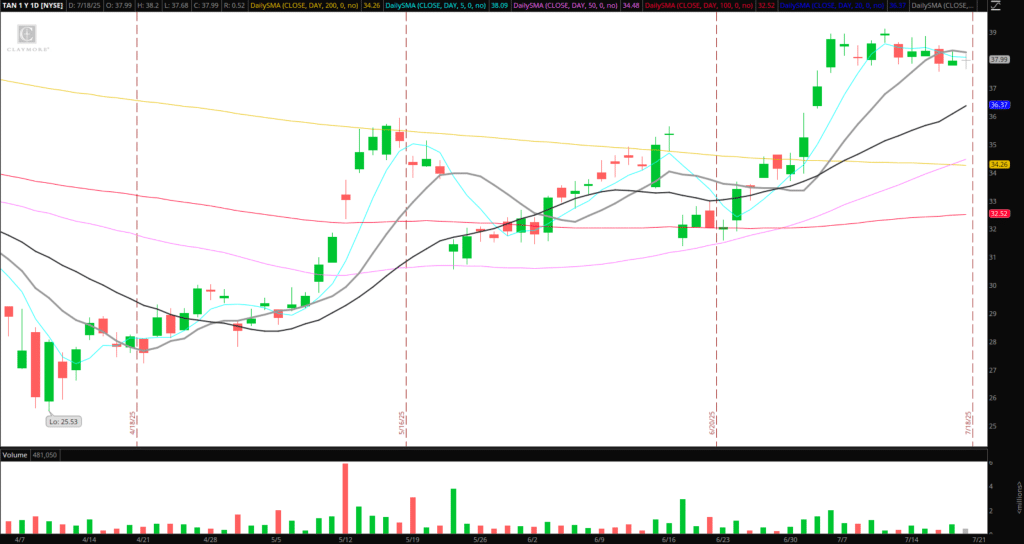

Photo voltaic Names Appearing Properly: TAN, SEDG, FSLR are holding up exceptionally effectively and forming bullish bases. On watch within the coming days/weeks for a breakout entry.

*Please be aware that the costs and different statistics on this web page are hypothetical, and don’t replicate the affect, if any, of sure market components equivalent to liquidity, slippage and commissions.

Pops to Quick in TELO: I’m uncertain, based mostly on its historical past, but when TELO pops up early subsequent week $2.5 – $3, I’d look to re-short submit failed follow-through.

*Please be aware that the costs and different statistics on this web page are hypothetical, and don’t replicate the affect, if any, of sure market components equivalent to liquidity, slippage and commissions.

Get the SMB Swing Buying and selling Analysis Template Right here!

Necessary Disclosures