Beta-weighted delta (or beta-adjusted delta) is a normalized delta that’s comparable throughout totally different property when measuring directional publicity.

Additionally it is generally known as “portfolio delta” as a result of that’s its major use: serving to an investor perceive how a lot the portfolio’s revenue and loss (P&L) will change in relation to actions within the index.

So that’s the quick reply.

To supply an in depth rationalization and description the calculation (in case your buying and selling platform doesn’t do that for you), we are going to first want to know what delta and beta are.

Contents

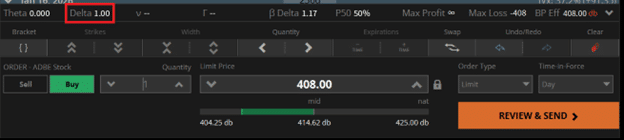

If an investor have been to purchase one share of Adobe (ADBE) on the market value of $408 per share, the Tastytrade platform would present that place to have 1.0 delta…

If the investor have been to purchase 100 shares of ADBE, that Delta quantity would change to 100.00.

That is the uncooked delta, which is the conventional delta that choices traders focus on.

It has many makes use of and interpretations.

A technique you’ll be able to consider this delta is the “share equivalence” of a place.

A delta of 1.0 is equal to proudly owning one share of the underlying asset.

We noticed that purchasing one share of ADBE leads to a 1.0 delta.

And 100 shares of ADBE leads to 100.0 delta.

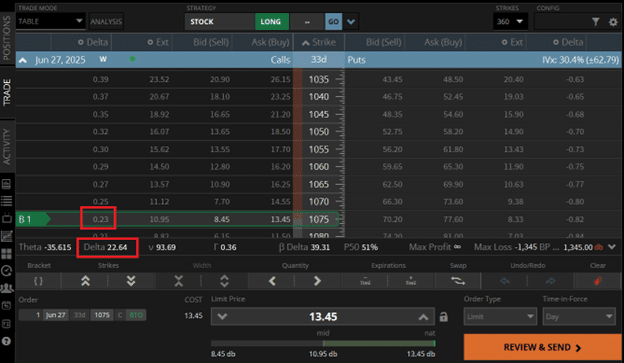

Suppose an investor buys an out-of-the-money (OTM) lengthy name on Costco (COST) with a strike of $1075 expiring in 33 days.

The Tastytrade platform signifies that this place has a positional delta of twenty-two.64, or roughly 23.

This name possibility is alleged to be on the 23-delta on the choice chain as a result of we see 0.23 within the delta column on the choice chain.

This lengthy name, with a positional delta of 23, has the identical directional publicity as one other investor shopping for 23 shares of COST inventory.

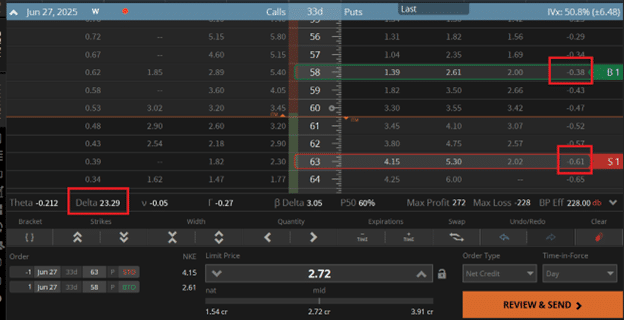

If we have now a bull put credit score unfold on Nike (NKE):

Date: Could 23, 2025

Value: Nike @ $60/share

Promote one June 27 NKE $63 putBuy one June 27 NKE $58 put

Credit score: $272

The platform exhibits that this unfold has a delta of 23.29.

It’s because the lengthy $58-strike put possibility has a delta of -0.38

The $63-strike put possibility has a delta of -0.61.

However since we’re promoting it, the quick $63 put possibility has a delta of +0.61 (reversed the signal).

The mixture is a delta of:

(0.61 – 0.38) x 100 = 23.29

Which is what the platform already calculated for us.

Why did we multiply by 100?

It’s as a result of the delta worth listed within the possibility chain column is on a “per share” foundation.

Since one contract of the put unfold represents 100 shares, this per-share delta is 100 occasions smaller than the place delta.

Regardless, this put unfold has a place delta of 23.29.

That signifies that the directional publicity of this bull put unfold is equal to proudly owning 23.29 shares of NKE.

In our instance, one lengthy name in COST has a positional delta of 23.

And one put unfold in NKE additionally has a positional delta of 23.

Does that imply that our COST place is equal in threat and directional publicity as our NKE put unfold place?

No!

A 23 delta in COST is just not the identical as a 23 delta in NKE.

They aren’t comparable as a result of they’ve totally different underlying property.

It’s like evaluating apples to oranges.

As a result of 23 shares of COST is just not the identical as 23 shares of NKE, the value of COST is $1008/share, whereas the value of NKE is $60/share.

The COST place has a Delta {Dollars} of:

23 x $1008 = $23,184

The NKE place has a Delta {Dollars} of:

23 x $60 = $1,380

The COST place has a notional worth of $23,184.

The NKE is a a lot smaller place, valued at $1,380.

This has nothing to do with the dimensions of the debit or credit score obtained when initiating the commerce.

The definition of place delta is that it measures how a lot the P&L (revenue and loss) of the place will change when the value of the underlying asset modifications by $1.

Primarily based on this definition, it signifies that if the COST value per share will increase by $1 from $1008 to $1009, then our name unfold P&L ought to improve by $23 (as a result of this place has 23 delta).

If NKE goes up in value from $60 to $61 per share, then the P&L of the NKE bull put unfold is anticipated to extend by $23 (assuming all different elements, akin to volatility, and many others, stay the identical).

As a result of the dimensions of the underlying is so totally different, it’s simpler to debate it by way of percentages.

If COST drops by 1%, the P&L of the lengthy name possibility is anticipated to lower by $230.

If NKE drops by 1%, the P&L of the bull put unfold is anticipated to lower by $13.80

The COST place represents an even bigger threat than the NKE place, despite the fact that they each have the identical positional delta.

Aspect word:

The 1% COST drop means the value per share decreases by $10, as 1% of $1008 is $10.

A drop of $10 per share means an anticipated drop in P&L of $230.

NKE’s drop of 1% means a lack of solely $0.60 per share.

If a lack of $1 per share leads to a P&L lack of $23, then a lack of $0.60 per share leads to a lack of $13.80, as calculated by the next…

$23 x 0.60 / 1.00 = $13.80

In any case, we want not get slowed down by the maths.

The purpose is that positional deltas usually are not comparable as a result of the underlying property are totally different.

Suppose an investor has one lengthy name in COST, one bull put unfold in NKE, and one share of ADBE inventory.

How is the investor to know which is the riskiest place?

How a lot directional publicity does the investor have out there?

If the S&P 500 goes down 5%, how would that have an effect on his portfolio?

How a lot greenback threat would that be?

These positions are all bullish in the marketplace.

If the investor desires to hedge (or defend) his portfolio, what number of contracts of put choices on SPY ought to this investor purchase?

This drawback can’t be solved by trying on the positional delta.

Delta {Dollars} can roughly resolve it.

Listed here are the delta {dollars} of the positions as calculated by multiplying the delta with the value per share:

COST place: $23,184NKE place: $1,380ADBE place: $408

Portfolio: $24,972

The $520-strike SPY put possibility, with 67 days till expiration, has a positional delta of -15.37.

To hedge this portfolio, you want 2.8 such put choices, which might give a delta greenback of:

-15.37 x $579 x 2.8 = -$24,918

SPY is buying and selling at $579.

Since you can’t have 2.8 contracts and most traders wouldn’t hedge 100% of the portfolio, they may purchase solely two put contracts, which might have a delta greenback of:

-15.37 x $579 x 2 = -$17,798.

By including these two put choices into the portfolio, it might cut back the delta greenback publicity right down to $7,174, as calculated by:

$24,972 – $17,798 = $7,174

This reduces the general threat within the portfolio within the occasion that the market drops.

This calculation assumes that COST, NKE, and ADBE transfer the identical as SPY would transfer.

They don’t all transfer precisely the identical as SPY, which is why that is an approximate resolution.

That is the place beta involves the rescue.

It measures a inventory’s volatility in relation to the general market.

COST: beta = 0.76NKE: beta 1.06ADBE: beta = 1.3

These are the 5-year beta values from stockcharts.com.

The values could differ barely if obtained from totally different platforms or distributors, relying on the benchmark chosen for the general market, the size of the look-back interval, the calculation methodology, and different elements.

For our functions, we are able to consider SPY, the ETF for the S&P 500, as a proxy for the general market.

So, NKE strikes similar to SPY. A beta of 1 signifies that the inventory is extremely correlated to SPY.

If SPY goes up 1%, NKE is prone to go up 1%.

If SPY goes down 2%, NKE is anticipated to additionally go down 2%.

Word that that is solely statistically anticipated.

It doesn’t imply that it’ll.

The long run can’t be predicted, and it’s attainable for NKE to maneuver in any path it desires.

It can’t account for occasions like earnings, which may trigger a inventory to maneuver up or down whatever the market.

COST tends to maneuver lower than SPY as a result of its beta worth is lower than 1.0.

It’s much less unstable than SPY.

ADBE value (by way of percentages) will swing up and down greater than SPY as a result of its beta worth is bigger than 1.0.

4 Suggestions For Higher Iron Condors

The beta-weighted delta is a normalized delta that considers each the beta and the dimensions of the inventory.

It’s usually normalized to the reference benchmark of SPY.

The beta-weighted delta of the place from the Tastytrade platform is:

COST: beta-weighted delta = 39.31NKE: beta-weighted delta = 3.05ADBE: beta-weighted delta = 1.17

See if yow will discover these numbers within the above screenshots.

Once more, the beta-weighted delta can fluctuate from platform to platform.

These beta-weight deltas are comparable.

Which means which you could evaluate COST’s beta-weighted delta to NKE’s beta-weighted delta.

We at the moment are evaluating apples to apples.

That’s the complete level of normalizing the deltas to a reference benchmark.

Wanting on the beta-weighted delta, COST has greater than ten occasions the directional publicity as NKE.

ADBE is our smallest place, with the least directional publicity to the market, regardless of being probably the most unstable of our underlying property.

This beta-weighted delta can now be added.

Earlier than, they might not be.

The beta-weighted delta of the whole portfolio is 43.53:

39.31 + 3.05 + 1.17 = 43.53

Because of this our three positions are equal to proudly owning 43.53 shares of SPY.

Our portfolio publicity has a notional worth of:

43.53 x $579 = $25,204

(Recall that SPY is at the moment buying and selling at $579 per share.)

That is very near the delta {dollars} of $24,972 beforehand calculated.

Recall that delta {dollars} don’t take note of beta.

A beta-weighted delta of 43.53 signifies that a $1 improve in SPY is anticipated to lead to a P&L change in our portfolio of $43.53.

A 5% drop out there may lead to $1260 value of harm to the portfolio, as calculated by:

A 5% drop in SPY = 0.05 x $579 = $28.95

P&L change = -$28.95 x 43.53 = -$1,260

Suppose we have been so as to add the 2 put choices as a hedge.

The platform exhibits that a type of put choices would have a beta-weighted delta of -15.37.

So, two of them would give a beta-weighted delta of -30.74.

This reduces the beta-weighted delta of the portfolio to 12.79.

Actually, the equivalency of proudly owning 12.79 shares of SPY is much less dangerous than proudly owning 43.53 shares.

This would scale back the notional worth of the portfolio to:

12.79 x $579 = $7,405

Beta-weighted delta is a technique for normalizing disparate property, enabling the comparability and summation of threat and place measurement.

That is obligatory after we need to perceive the overall market publicity of a portfolio containing totally different property.

Is it attainable for an asset to have a detrimental beta?

Sure, when they’re negatively correlated to the benchmark.

For instance, VXX and SPY are usually inversely correlated.

When SPY goes up, VXX goes down, and vice versa.

Therefore, the beta for VXX is -2.82.

If my platform doesn’t give me a beta-weighted delta, how can it’s manually calculated?

Utilizing COST for example:

(Value of SPY) x (beta-weighted delta) = (beta of COST) x (Value of COST) x (Delta of COST)

Fixing for what we would like:

Beta-weighted delta = (beta of COST) x (Value of COST) x (Delta of COST) / (Value of SPY)

The place:

Value of COST = $1008Delta of COST = 23Beta of COST = 0.76Price of SPY = $579

Beta-weighted delta for COST = 0.76 x $1008 x 23 / $579 = 30.4

Doing equally:

Beta-weighted delta for NKE = 1.06 x $60 x 23 / $579 = 2.5

Beta-weighted delta for ADBE = 1.17 x $408 x 1 / $579 = 0.8

Why is the manually calculated beta-weighted delta, not the identical as given by the platform?

The beta worth differs from platform to platform.

The beta used right here is from stockcharts.com, which can be static knowledge.

In distinction, buying and selling platforms could use dynamic beta values or internally licensed knowledge that might be calculated utilizing totally different regression strategies and pattern sizes.

Even if you happen to evaluate the beta worth from stockcharts.com with barchart.com and with Yahoo Finance, you can see them to be considerably totally different.

Even if you happen to have been to know the precise beta of a inventory, whether or not it’ll transfer that means or not on a given day remains to be unpredictable.

Positional delta may also differ barely from platform to platform.

Sorry, buying and selling is just not a precise science.

We hope you loved this text on beta-weighted delta.

When you’ve got any questions, ship an e-mail or go away a remark under.

Entry The Prime 5 Instruments For Choice Merchants

Commerce protected!

Disclaimer: The knowledge above is for instructional functions solely and shouldn’t be handled as funding recommendation. The technique offered wouldn’t be appropriate for traders who usually are not acquainted with change traded choices. Any readers on this technique ought to do their very own analysis and search recommendation from a licensed monetary adviser.