Merchants, after a busy week, we’re returning to the extra acquainted watchlist format with the define under.

My method final week was well-suited for the high-volatility setting, marked by concern, uncertainty, and important headline danger. It performed out properly all through the week.

Whereas volatility and uncertainty are nonetheless elevated, volatility may start to relax and subside because of the tariff exemption headline that dropped late Friday.

The exemptions, which primarily profit shopper tech, pc, and semiconductor firms, will possible set off a major hole when futures open, particularly within the Nasdaq.

That mentioned, something can occur on this market. However there’s clearly a shift in sentiment and narrative.

So, listed below are my plans, which largely revolve round Friday evening’s information. I’ll concentrate on two particular person names, Apple and NVIDIA, which confirmed spectacular relative energy on Friday and have been positively impacted by the exemption information.

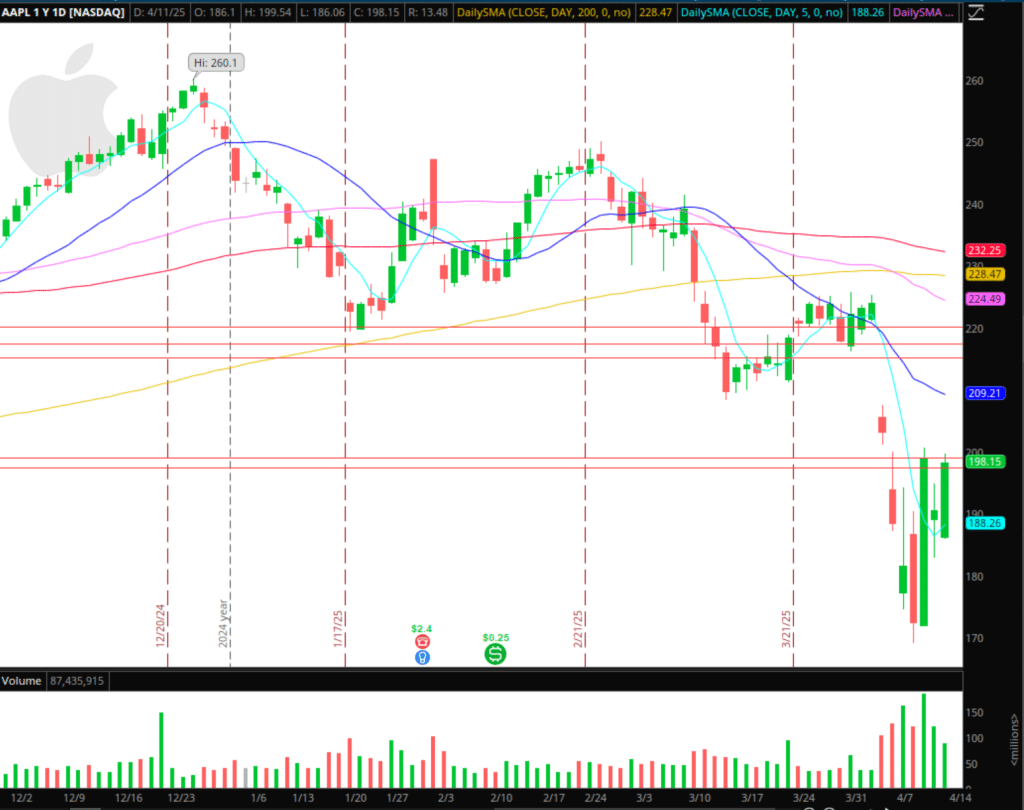

Hole, Give, and Go in Apple

Sadly, the headline got here out whereas the market was closed. Many different merchants and I had been getting ready for the exemption headline, and we might have been fast to react to it intraday.

Now that the breaking information alternative is gone, the plans have modified. As an alternative, with the inventory prone to hole considerably, I’ll search for a possible larger low or hole give-and-go setup to enter lengthy for follow-through intraday.

*Please observe that the costs and different statistics on this web page are hypothetical, and don’t replicate the affect, if any, of sure market elements akin to liquidity, slippage and commissions.

$200 is a major space of resistance, however for now, I discover it exhausting to consider that the inventory re-tests that early on Monday, confirming newfound assist. So, I’m extra open to a spot towards $208 on the low-end, liberation day 1 hole, and the earlier pivot-low and 20-day SMA, or larger finish nearer to a spot fill between $215 – $220.

The one alternative to go lengthy is that if the inventory offers up a few of its hole within the pre-market or off the open earlier than confirming the next low and stabilizing above its intraday VWAP. That Hole larger, Giving again early on, and reclaiming VWAP following the next low can be the setup I search for with the intention to go lengthy for intraday continuation larger.

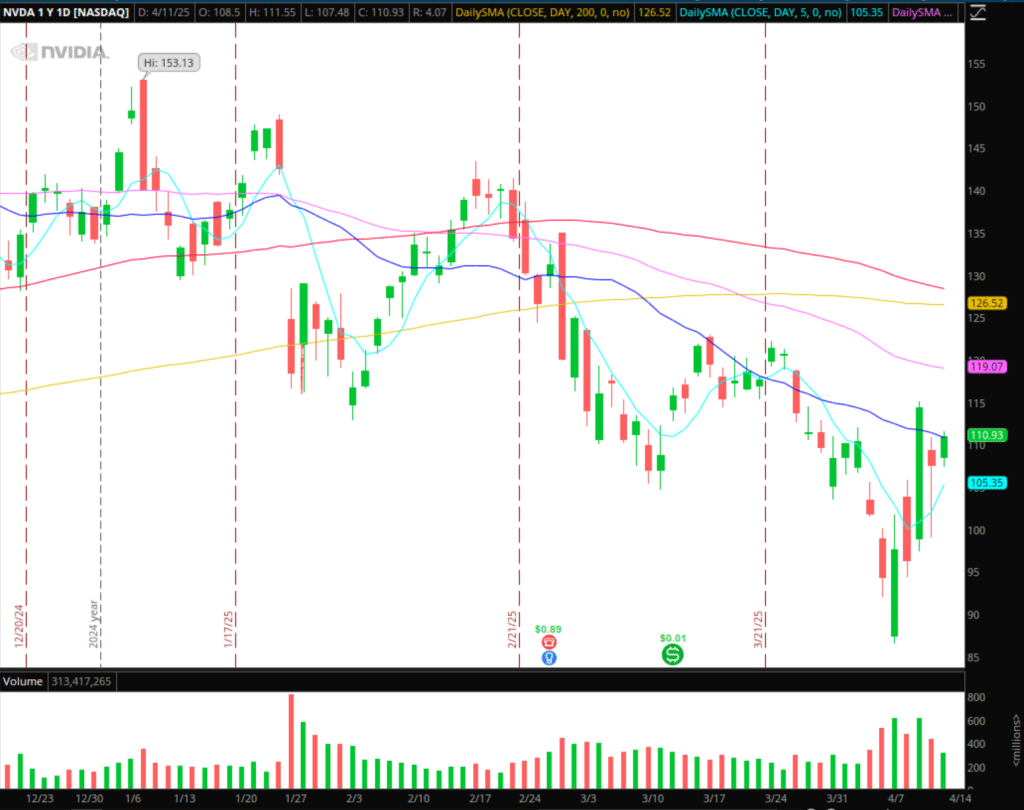

Equally, I’ll be NVDA for a similar factor.

Intraday Momentum Larger in NVDA

With the inventory set to hole larger on Monday, I’m not trying to chase energy in NVDA, AAPL, or the index ETFs. The skewed risk-reward alternative will solely be current with Excessive EV in the event that they proceed to show relative energy after a morning flush.

So, if NVDA, after gapping up a number of %, pulls again within the morning and confirms the next low, together with relative energy to the market and its sector, I’d look to go lengthy versus the earlier larger low or LOD for a transfer larger. Particularly, in each circumstances, I’d wish to see a reclaim of VWAP intraday and failure to carry under thereafter, which could affirm institutional shopping for and a gradual intraday uptrend.

*Please observe that the costs and different statistics on this web page are hypothetical, and don’t replicate the affect, if any, of sure market elements akin to liquidity, slippage and commissions.

In each circumstances, I’d look to path my cease intraday utilizing a maintain above VWAP, larger lows on the 5-minute timeframe.

Conversely, suppose the hole fails to comply with by means of and each names and the general market maintain weak beneath intraday VWAP and pre-market assist. In that case, I’d be open to momentum intraday quick scalps if the information proves to be a sell-the-news alternative that provides exit liquidity for some. Whereas unlikely, I stay open to that chance if the hole is big and an outlier.

Extra Ideas and Concepts:

Different Methods of Expressing the Thought: I’d additionally take into account doubtlessly expressing the thought with intraday momentum scalps in QQQ and SOXL, a 3X semiconductor bull instrument.

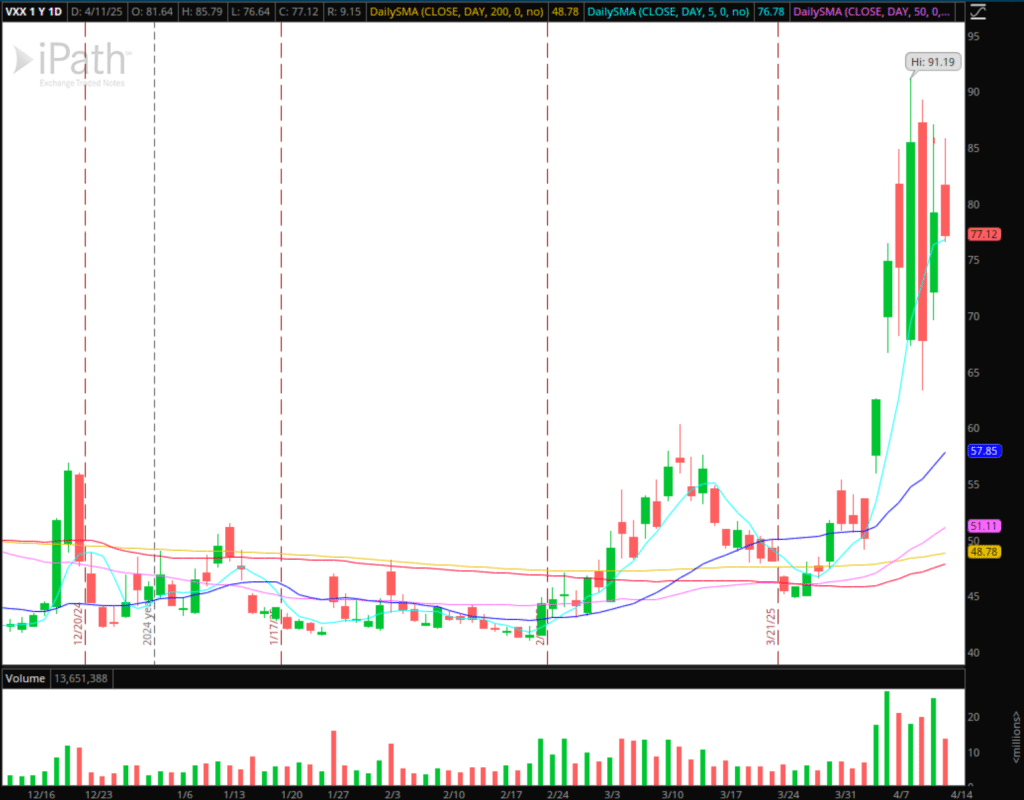

Then, barring any main, sweeping unfavorable headlines or developments for the financial system and market that end in considerably elevated concern and uncertainty, I’ll even be maintaining a tally of volatility to disconnect barely and current a brief alternative as concern maybe subsides. If the market continues to base above its now rising 5-day transferring common and might shut sturdy for a day or two, VXX would be the go-to focus there for some decay.

*Please observe that the costs and different statistics on this web page are hypothetical, and don’t replicate the affect, if any, of sure market elements akin to liquidity, slippage and commissions.

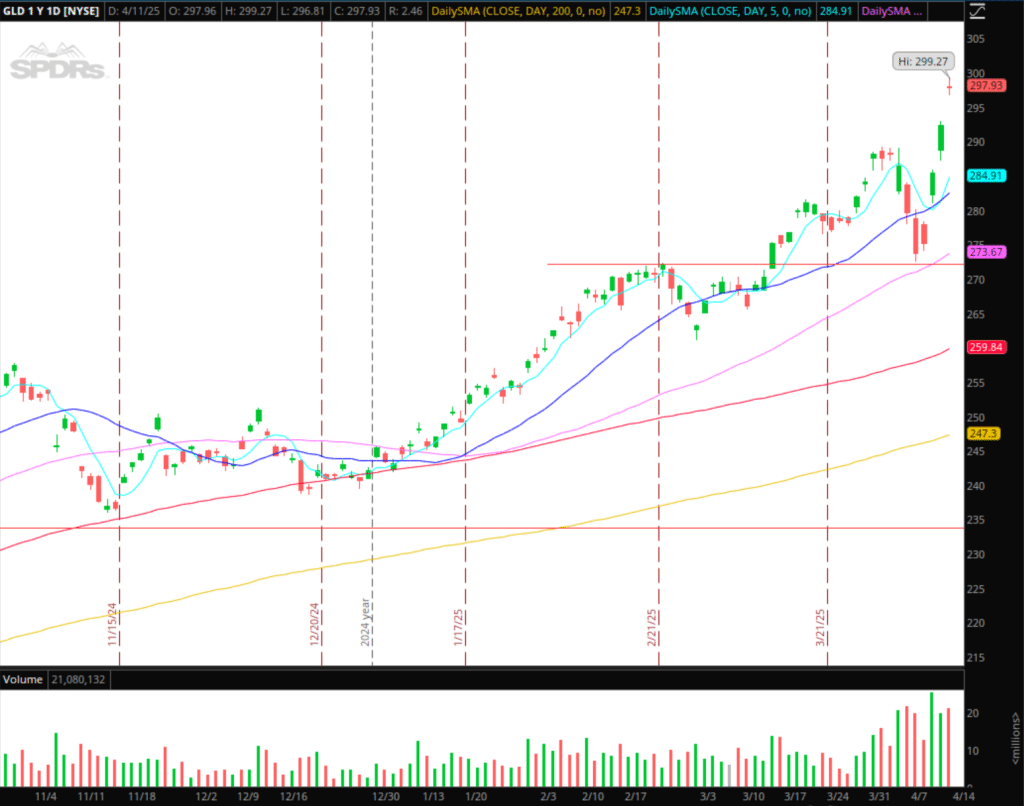

Lastly, I’ll even be conserving a detailed eye on GLD and gold miners (GDX) for potential failed follow-through for a brief alternative after their historic run larger. If we see some offers introduced this week with commerce, bonds stabilize, and equities agency up, we might see some air out of GLD and miners. In GLD, for instance, I’m particularly on the lookout for both a FRD setup after three consecutive gaps, or a fourth consecutive hole and failed follow-through setup to get quick for a possible multi-day swing.

*Please observe that the costs and different statistics on this web page are hypothetical, and don’t replicate the affect, if any, of sure market elements akin to liquidity, slippage and commissions.

Get the SMB Swing Buying and selling Analysis Template Right here!

Essential Disclosures