Merchants,

For anybody struggling to adapt or to navigate the market proper now, Bella just lately put out a unbelievable publish and video. In case you’re in a drawdown, struggling to adapt, and/or simply seeking to repeatedly enhance your sport, test it out on this video. He goes over, intimately, 8 buying and selling classes from a painful drawdown and the remedy.

Now, admittedly, this has not been the simplest market. After some hiccups, final week I discovered success and consistency by specializing in move2move buying and selling/ scalping and very selective swing buying and selling. I lowered expectations, targeted on base hits somewhat than dwelling run trades, and allowed consistency and selectivity to compound. I took what the market gave every day, with out attempting to drive dwelling run intraday trades or swing trades.

It’s not a tape proper now to be swinging the bat laborious on swing trades, and coming into the week, I don’t have any A+ intraday alternatives for Monday / Tuesday that I’m stalking. So, as a dealer, you’ve got a call to make throughout such a market. 1) Are you going to only sit round and complain a few sluggish, troublesome market? Or 2) Are you going to take this problem in your stride, deal with increasing your playbook, and collaborate with merchants and reverse engineer trades that they’re having success with? Doubling down on what’s working effectively and reducing out what’s now not working? And many others., and many others.,

Hopefully, it’s quantity 2.

Silver: It’s solely becoming to start out with Silver. Forward of the futures open this night, it’s anybody’s guess. Now, are we overextended? Sure, after all. Does that imply we now have to selloff as one would count on with an fairness? Nope. My solely plan for the upcoming week with silver, given the historic transfer and growth above 100, is solely reactive. Both there’s a catalyst/headline, just like final week’s headline (Greenland framework), that supplied an superior short-scalp breaking information opp in silver. Or, Silver blow-offs in spectacular vogue for an A+ intraday brief towards a well-defined key degree of failed follow-through or decrease excessive. Or I see silver take out a day’s low/prior key help and maintain beneath it with out reclaiming (change of character), and look to brief it intraday. If nothing units up, it gained’t be on my screens.

*Please observe that the costs and different statistics on this web page are hypothetical, and don’t mirror the influence, if any, of sure market components similar to liquidity, slippage and commissions.

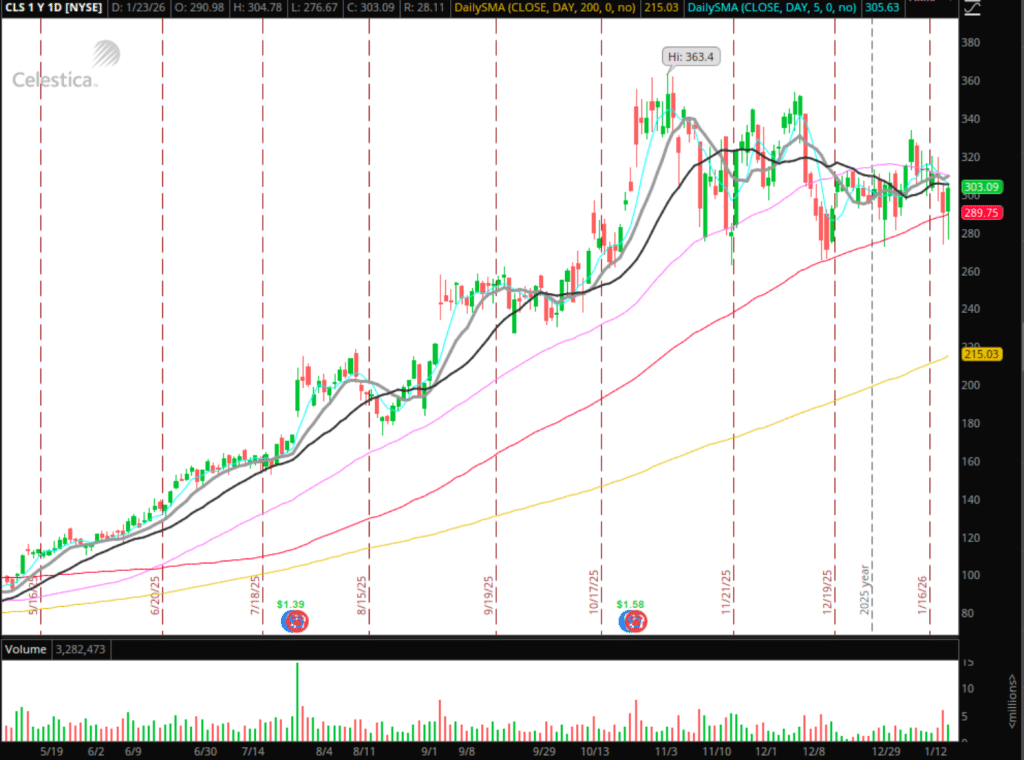

Stalking the Digital Parts / Fiber Optics Gamers: From reminiscence to aerospace and protection, lots of the A+ swing lengthy trades largely performed out already. In case you weren’t uncovered early within the yr, you seemingly missed the transfer. One area that’s holding up, although, is the digital parts gamers. I’m seeing lots of good bases which have been constructed. As earnings strategy, behind my thoughts, I’m questioning whether or not blowout earnings from the primary main participant to report might catalyze a sector/business push. If that have been to occur, I wish to be ready. Listed below are a number of the names that I’m stalking:

*Please observe that the costs and different statistics on this web page are hypothetical, and don’t mirror the influence, if any, of sure market components similar to liquidity, slippage and commissions.

Others embody: COHR, VIAV, LITE, CIEN, LUMN, FN, TTMI, AAOI.

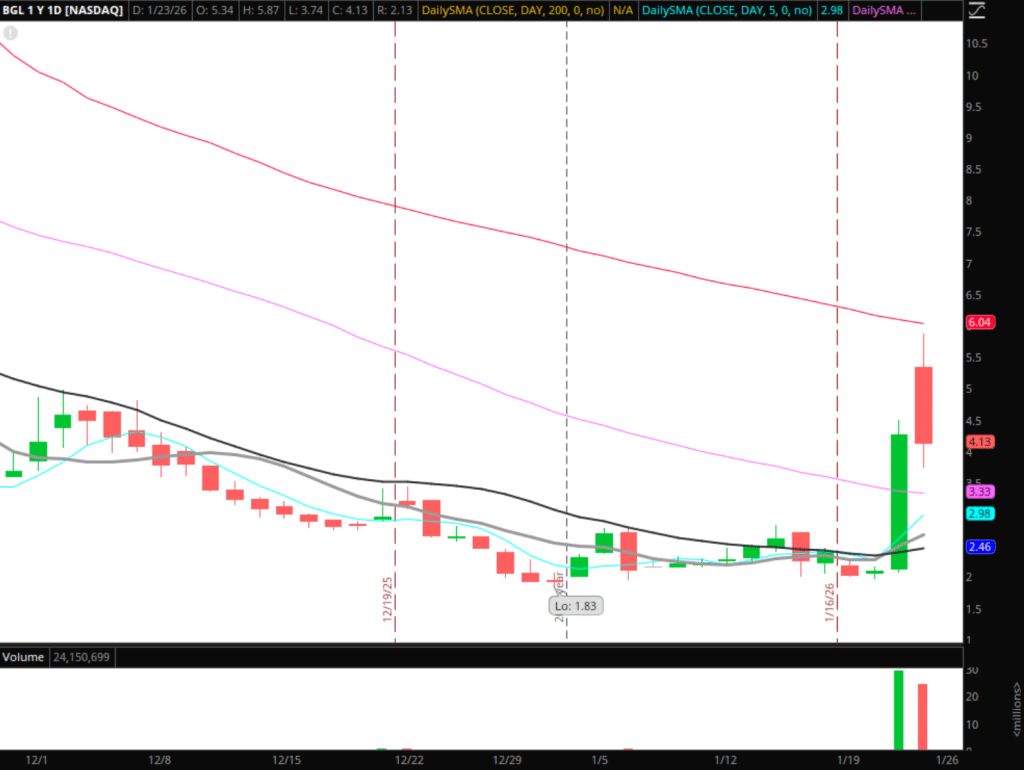

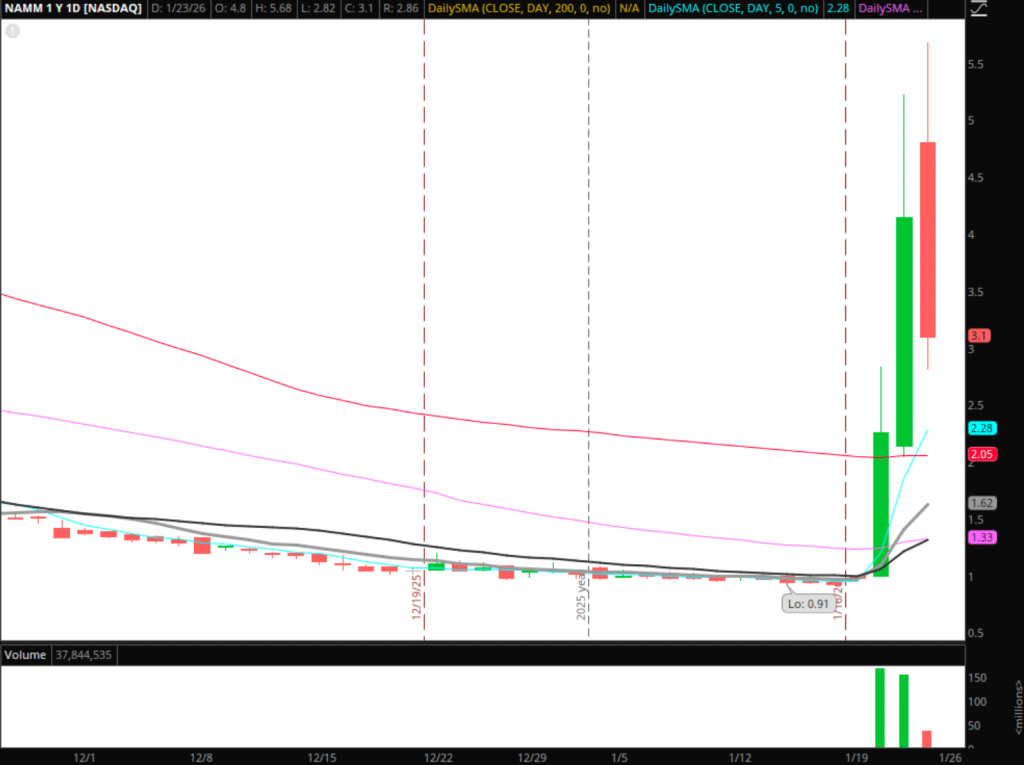

Intraday Shorts in NAMM and BGL: Each NAMM and BGL have been sympathy low float runners to the essential supplies sector run. After Friday’s intense sell-off in each names, while commodities held up extraordinarily effectively, I’d be inclined to brief pops. Given the market situations, I’d react somewhat than scale on the entrance aspect. For instance, if BGL popped again towards VWAP from Friday, I’d anticipate it to stuff earlier than shorting. The identical goes for NAMM. In the event that they push greater and fail, I’d brief towards the day’s excessive and path on the 5-min.

*Please observe that the costs and different statistics on this web page are hypothetical, and don’t mirror the influence, if any, of sure market components similar to liquidity, slippage and commissions.

*Please observe that the costs and different statistics on this web page are hypothetical, and don’t mirror the influence, if any, of sure market components similar to liquidity, slippage and commissions.

Extra Names on Watch:

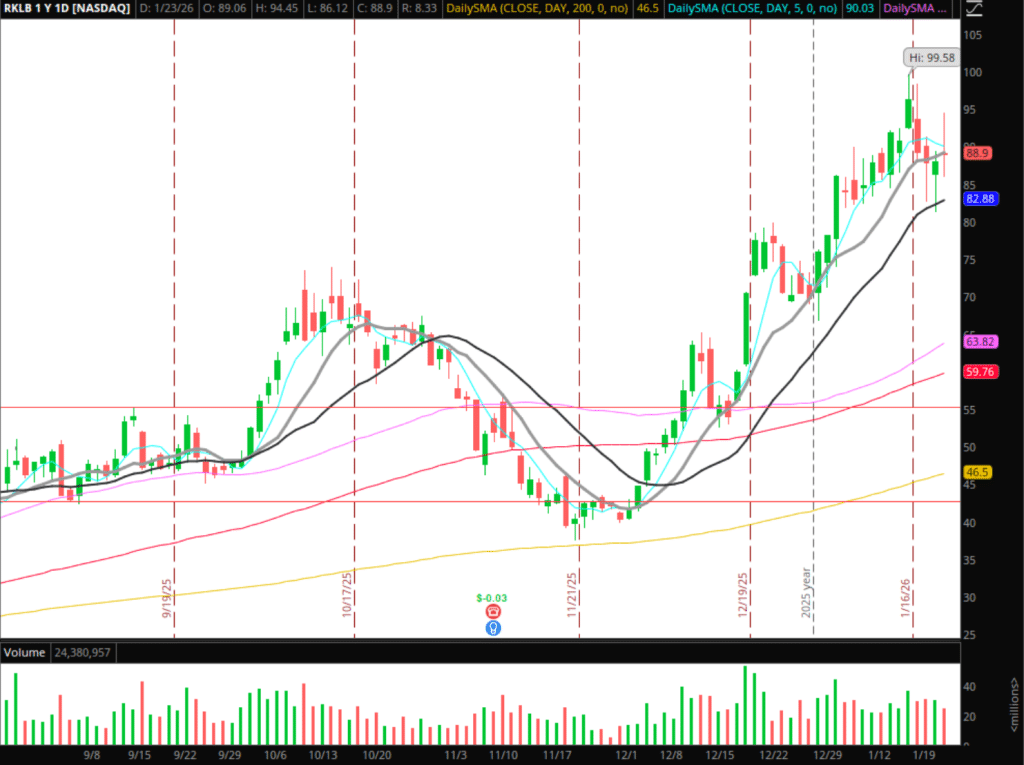

RKLB: Eyeing the higher-low and a base to construct above Thursday’s low for one more leg greater.

*Please observe that the costs and different statistics on this web page are hypothetical, and don’t mirror the influence, if any, of sure market components similar to liquidity, slippage and commissions.

PL: Eyeing the bottom at the moment being constructed for a possible momentum breakout intraday.

*Please observe that the costs and different statistics on this web page are hypothetical, and don’t mirror the influence, if any, of sure market components similar to liquidity, slippage and commissions.

VRT: Lovely base and bull-flag creating on the each day and weekly.

*Please observe that the costs and different statistics on this web page are hypothetical, and don’t mirror the influence, if any, of sure market components similar to liquidity, slippage and commissions.

Get the SMB Swing Buying and selling Analysis Template Right here!

Essential Disclosures