XLP is the Client Staples Sector ETF, consisting of firms that promote important items individuals purchase whatever the financial system (e.g., meals, drinks, and family merchandise).

Buyers are likely to put money into these firms as a defensive play in the event that they consider the financial outlook will not be good.

Contents

XLY is the Client Discretionary Sector ETF, consisting of firms that promote non-essential items and providers, like luxurious objects, leisure, and leisure.

In different phrases, these are issues that folks purchase when the financial system is nice and when shoppers have extra disposable earnings throughout financial growth.

Buyers in a “threat on” mode will rotate funds out of Client Staples and into Client Discretionary.

Therefore, it will drive the value of XLY increased sooner than XLP.

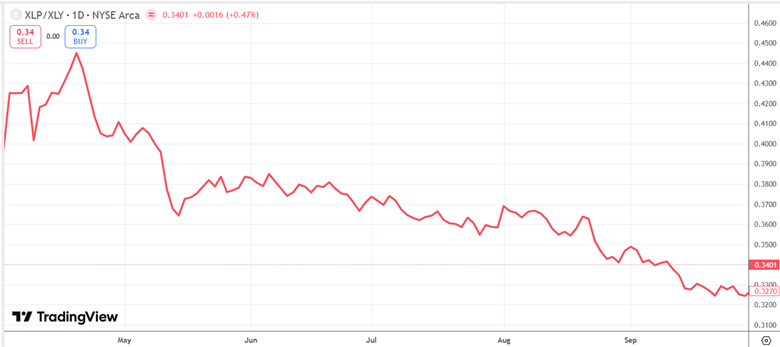

If we take a look at the value ratio of XLP to XLY, we see it has been declining since Might 2025, suggesting funds are being rotated out of XLP and into XLY.

A reducing ratio implies that XLY is appreciating sooner than XLP.

Supply: You may create this ratio graph by coming into “XLP/XLY” into the ticker field of Tradingview.com.

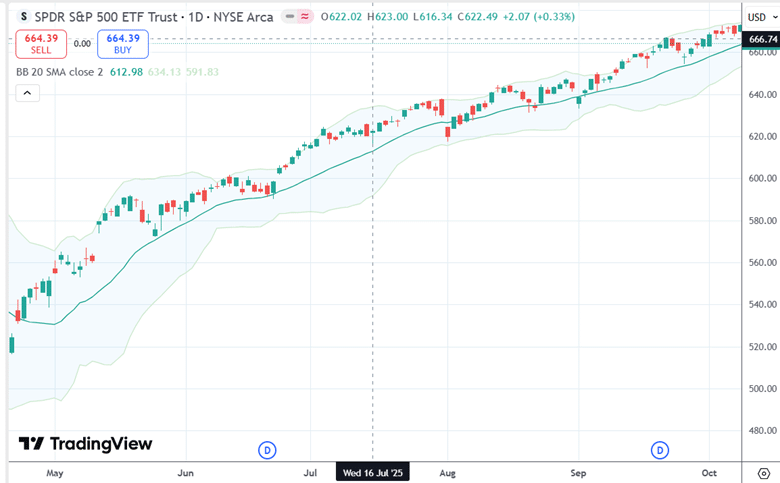

This bullish sentiment is obvious in risk-on investor habits, because the market (SPY) continues to achieve new highs.

Let’s say that an investor notices this development in June.

As a result of XLP is out of favor, the investor can apply a bear name unfold on XLP:

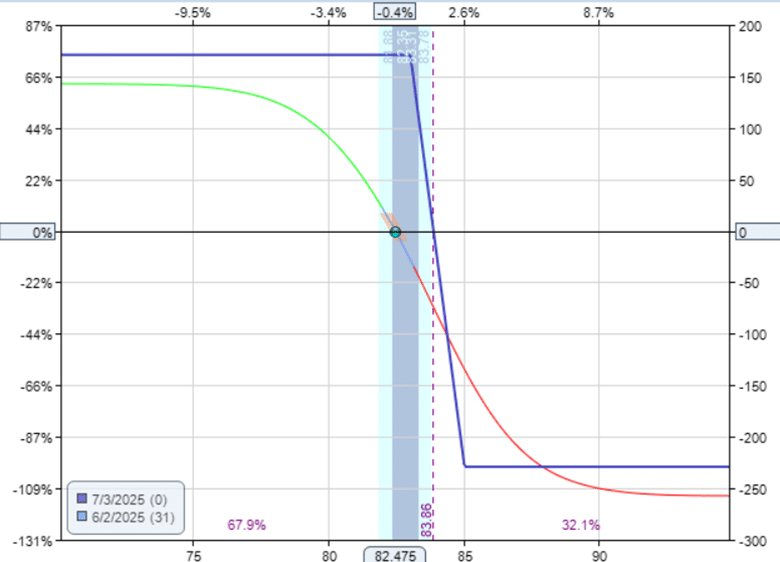

Date: June 2, 2025

Worth: XLP @ $82.27

Promote two contracts July 3 XLP $83 name @ $1.00Buy two contracts July 3 XLP $85 name @ $0.15

Internet credit score: $170

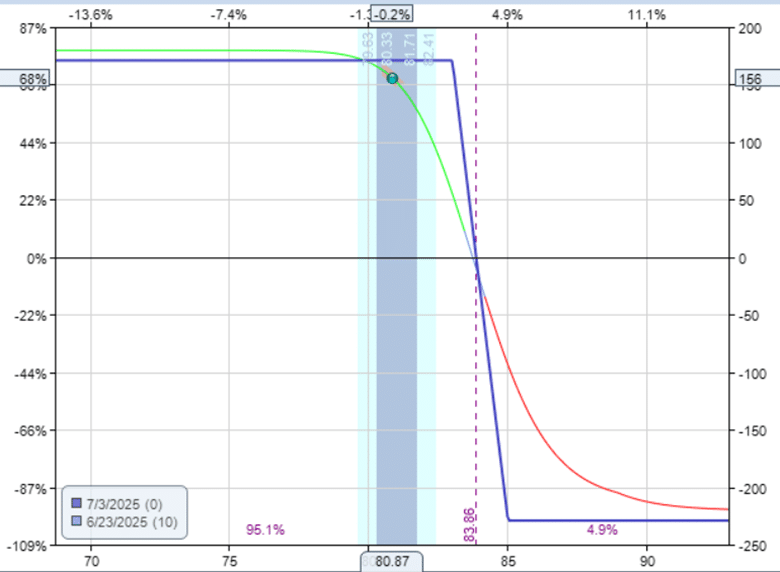

The credit score unfold was positioned close to the cash, so the utmost threat within the commerce is $229, with a possible most revenue of $170.

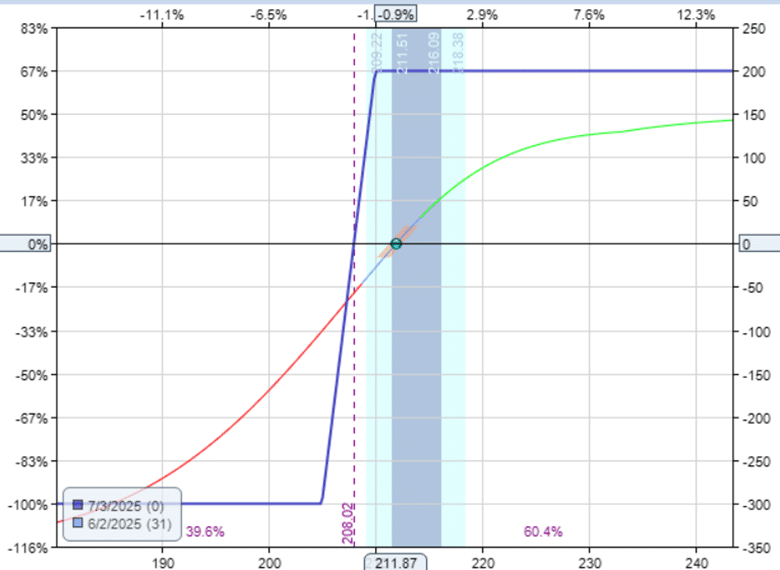

On the similar time, the investor applies a bull put credit score unfold on XLY, attempting to construction it with the identical threat and reward as the primary commerce.

Date: June 2, 2025

Worth: XLY @ $82.27

Promote one contract July 3 XLY $210 put @ 4.18Buy one contract July 3 XLY $205 put @ $2.18

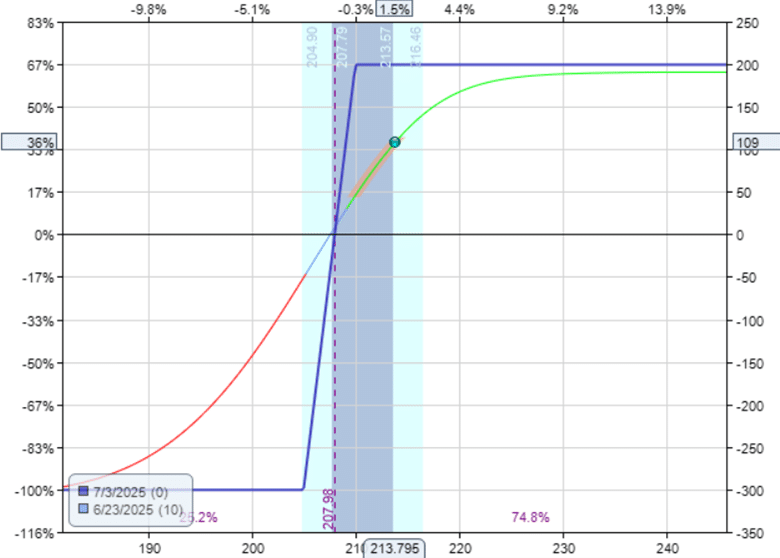

Internet Credit score: $200

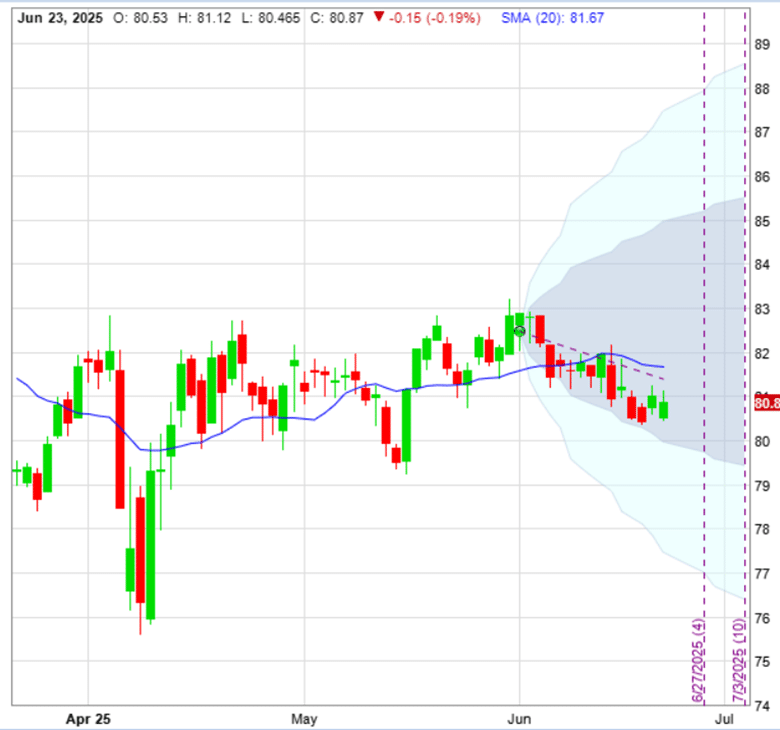

After 21 days within the commerce, on June twenty third, XLP had in actual fact gone down:

This transfer gave a revenue of $156 on the bear name unfold:

Entry The High 5 Instruments For Choice Merchants

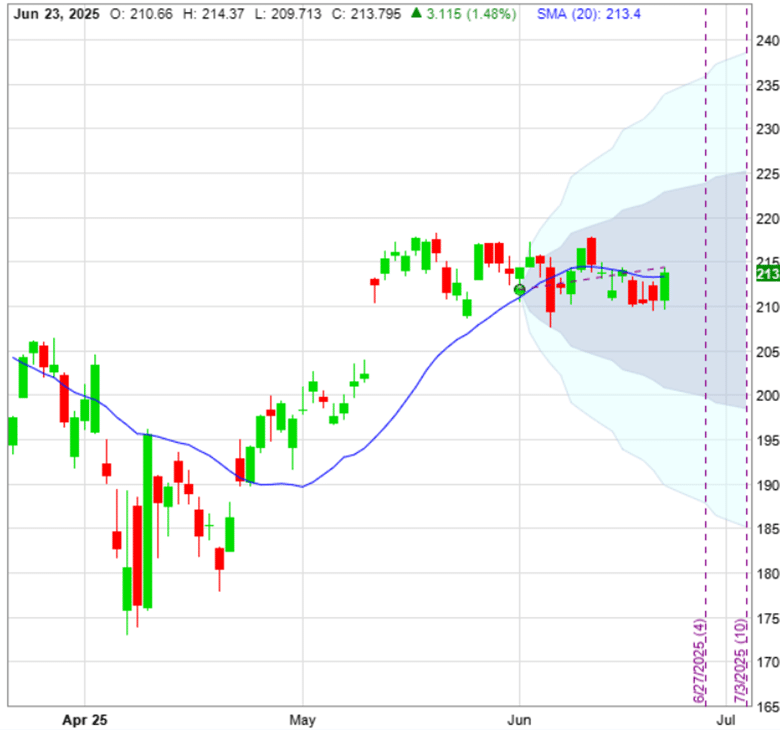

For Client Discretionary XLY, it moved sideways:

Nevertheless it went up simply sufficient to provide a slight constructive theta, leading to a revenue of $109 on the bull put unfold:

For the mixed commerce, the web revenue is $265 ($156 + $109).

The max mixed complete threat in each trades is $530 ($230+ $300).

That’s a couple of 50% return on the capital in danger in three weeks.

Buyers usually evaluate XLY vs XLP as a gauge of shopper sentiment.

XLP represents what shoppers want.

XLY represents what shoppers need.

If you happen to plot the ratio of XLP over XLY and see a development in a single course or the opposite, which will counsel a rotation of funds from one to a different.

Therefore, the investor can construction a bearish commerce on one whereas having a bullish commerce on the opposite.

In our instance, we had been bearish on XLP and bullish on XLY.

However since XLY is greater than twice as large as XLP, we had to make use of two contracts of XLP for each contract of XLY to measurement each trades to roughly the identical measurement.

We hope you loved this text on the XLP and XLY sector rotation commerce technique.

When you have any questions, please ship an e-mail or go away a remark under.

Commerce protected!

Disclaimer: The knowledge above is for instructional functions solely and shouldn’t be handled as funding recommendation. The technique offered wouldn’t be appropriate for buyers who will not be aware of trade traded choices. Any readers on this technique ought to do their very own analysis and search recommendation from a licensed monetary adviser.