Hybrid vehicles make the most of each gasoline and electrical energy to generate energy.

Hybrid choice buildings make the most of each a vega-negative element and a vega-positive element to generate potential revenue.

We’ll clarify Vega shortly.

As we speak, we’ll look at a number of hybrid buildings: the Flyagonal, the A14, the Combo Commerce, and the Rhino.

They’re non-directional methods that try to revenue from time decay, hoping that the underlying doesn’t transfer an excessive amount of in a single path.

Contents

Whereas these hybrid buildings are generally employed in bigger indices, they can be utilized to the underlying inventory if the dealer so needs.

The video under exhibits Steve Ganz giving an instance of his Flyagonal commerce on the inventory PayPal (PYPL):

Supply: YouTube

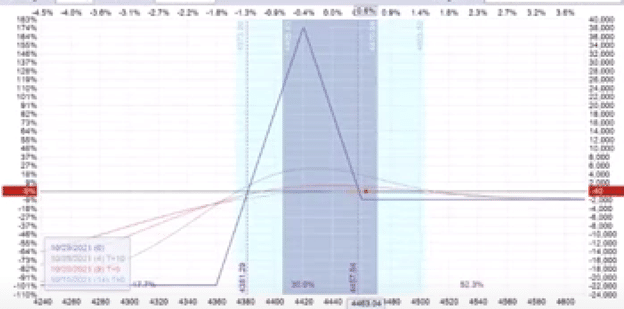

He calls it the Flyagonal, as a result of the element on the correct is a butterfly (or fly) constructed with name choices.

The element on the left is a diagonal time unfold constructed utilizing put choices.

As proven within the OptionStrat modeling software program above, the commerce consists of 5 completely different strike costs (5 legs).

Since most buying and selling platforms solely permit as much as 4 legs per order, this hybrid construction requires putting two separate orders to attain the specified consequence.

Nonetheless, the 2 elements collectively are thought of one commerce.

By doing so, you see that it provides a variety between the 2 breakeven factors at expiration.

So long as PayPal falls within the inexperienced shaded space of the graph at expiration, the commerce is worthwhile.

Amy Meissner’s A14 commerce begins as a non-directional broken-wing butterfly:

Supply: YouTube

This butterfly construction is non-directional, which means it doesn’t rely available on the market shifting up or down.

The choice Greek delta, which measures directionality, is near zero.

As time passes, the place good points worth because of optimistic theta (or time decay).

The butterfly advantages if volatility decreases.

That is mirrored by its choice Greek vega being unfavourable.

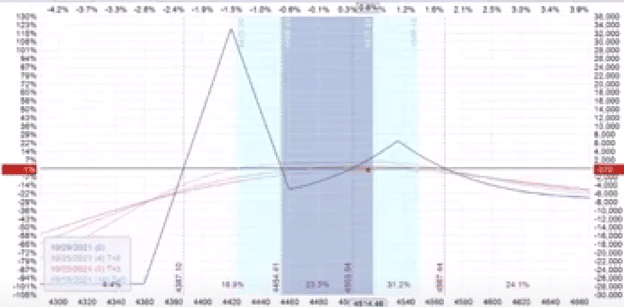

When the underlying worth strikes above the butterfly’s expiration tent, the commerce is adjusted right into a hybrid construction.

The adjustment includes including an upside calendar unfold above the present worth.

Supply: YouTube

The calendar itself has optimistic theta.

And it has optimistic Vega.

Because of this the calendar will acquire worth when volatility will increase.

That is the alternative impact from that of the butterfly.

Subsequently, when the butterfly (unfavourable Vega) and the calendar (optimistic Vega) are mixed, their general volatility results are muted.

The mixed commerce is much less delicate to volatility than if every have been to face by itself.

One could ask whether it is higher to position the time unfold to the left of the butterfly (as within the Flyagonal)?

Or place the time unfold to the correct of the butterfly (as within the A14)?

Right here is the argument for spreading the time to the left of the fly.

If the market drops, volatility will increase.

The time unfold will profit from the rise in volatility, in addition to from the worth shifting down in direction of it.

If the underlying worth rises in direction of the strike, then volatility typically decreases.

This advantages the unfavourable vega fly.

The fly additionally advantages from the transfer into its expiration graph.

Now, right here is the argument for having the time unfold above the fly on the correct.

If the market drops, the time unfold will probably be damage because of directionality as a result of the worth is shifting away from it.

Nonetheless, volatility is growing when that occurs, which might profit the time unfold.

Subsequently, it is not going to be damage as badly.

If the market goes up, the fly is damage as a result of the worth is shifting towards it.

Nonetheless, volatility will drop when this occurs, which advantages the fly.

The brief reply is that it most likely doesn’t make a major distinction whether or not you place the time unfold under or above the fly.

Or, should you can’t determine, you’ll be able to place a time unfold to the left and to the correct of the fly.

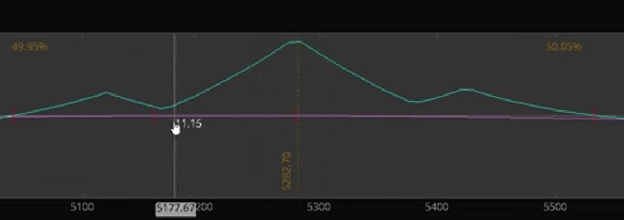

This was what Mark Fenton did on the SPX index as he overlaid a double-diagonal on high of a broken-wing-butterfly…

Supply: YouTube

Free Earnings Season Mastery eBook

This commerce has seven legs and may be very large.

Because the index turns into bigger and maybe begins to make bigger strikes, some merchants are discovering that they’ll enhance the profitability vary on the commerce by combining two or extra choice construction parts into one commerce.

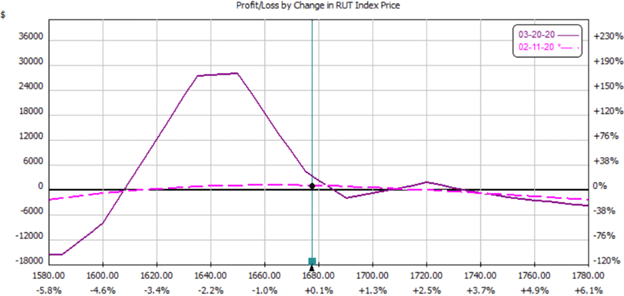

And if commerce doesn’t have sufficient strikes for you, how in regards to the eight-legged Rhino commerce with two butterflies merged on the left and one calendar to the correct:

As a result of it has this many legs, it most likely isn’t a good suggestion to regulate them too regularly to save lots of on commissions.

That’s why it’s a longer 60+ DTE (days to expiration) commerce.

You could have seen a number of delta-neutral positive-theta choice buildings which have each optimistic Vega and unfavourable Vega parts.

The choice construction is only a instrument.

What can be wanted is a technique for using that instrument.

The technique contains figuring out when and the way a lot to regulate, when to take earnings, and when to exit a commerce, amongst different concerns.

It isn’t sufficient to check the construction a few instances, get a few losses, and say it doesn’t work.

It’s worthwhile to develop and refine your technique over time with apply.

A selected technique that works for one dealer could not work for an additional.

“You can also make all the above buildings work when you have practiced with them sufficient to grasp learn how to handle them efficiently.

We hope you loved this text on hybrid choices buildings.

In case you have any questions, ship an e-mail or depart a remark under.

Commerce secure!

Disclaimer: The knowledge above is for academic functions solely and shouldn’t be handled as funding recommendation. The technique introduced wouldn’t be appropriate for traders who will not be conversant in change traded choices. Any readers on this technique ought to do their very own analysis and search recommendation from a licensed monetary adviser.