In a earlier article, we had talked about promoting cash-secured places and its varied metrics, equivalent to its potential annualized return, break-even value, and so forth.

Contents

On this article, we are going to present you methods to use our Money Secured Put Calculator to calculate these metrics.

You will get your free money secured put calculator right here:

Get Your Free Put Promoting Calculator

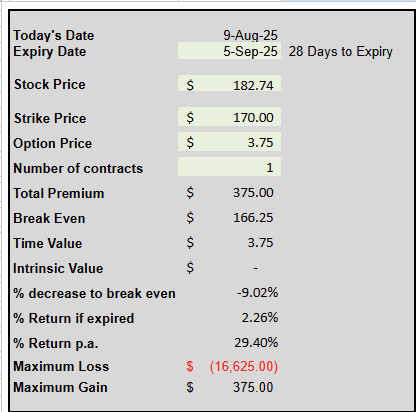

For example, suppose an investor needs to promote a cash-secured put choice on Nvidia (NVDA) with the potential of getting possession of 100 shares of that inventory.

Subsequently, the investor units apart sufficient money to purchase these 100 shares.

That’s what makes the commerce “cash-secured”.

If the investor have been to promote the $170 strike put choice, that might require $17,000 of reserved {dollars}.

It’s because if the NVDA value is beneath $170 at expiration, the investor is obligated to buy the 100 shares at $170 per share.

NVDA is at the moment buying and selling at $182.74 per share.

Most traders will promote an choice with a strike value that’s decrease than the present inventory value.

This is named an out-of-the-money put choice.

If NVDA doesn’t drop beneath $170 at expiration, the investor would preserve the premium that was acquired for promoting the put choice.

We are saying that the choice expired nugatory.

For this instance, suppose the investor sells the $170 put choice that expires on September fifth, 2025.

This selection’s market worth on the time is $3.75 quoted on a per share foundation.

That implies that the investor acquired $375 for promoting one choice contract, since one contract represents 100 shares.

We now have all the data to place into the inexperienced cells of the spreadsheet calculator:

You solely have to enter numbers into the inexperienced cells.

You don’t want to the touch the opposite cells.

It already is aware of in the present day’s date and calculates that the commerce nonetheless has 28 days until expiration.

The inventory value and the choice value needs to be entered on a per-share foundation.

You additionally have to enter the strike value and expiration of the choice being offered, and the variety of contracts being offered.

The calculator calculates the remainder of the data.

That is the {dollars} acquired for promoting the put contracts.

It relies on the worth of the put choice and the variety of contracts you’ve got offered.

Whole premium = worth of the contract on a per share foundation x 100 x variety of contracts

How far can the inventory value drop, and the commerce nonetheless be worthwhile?

That is the break-even value.

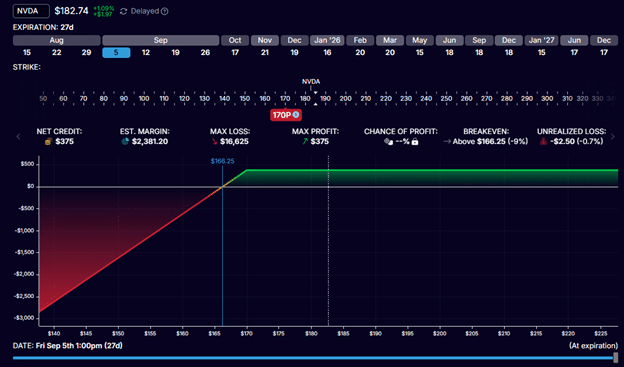

If we have a look at the P&L (revenue and loss) graph at expiration:

NVDA might be wherever above $166.25 per share at expiration, and the investor would make not less than a penny or extra on the commerce.

If NVDA is beneath $166.25, the investor would lose cash on the commerce.

$166.25 is the break-even value.

How is that this calculated?

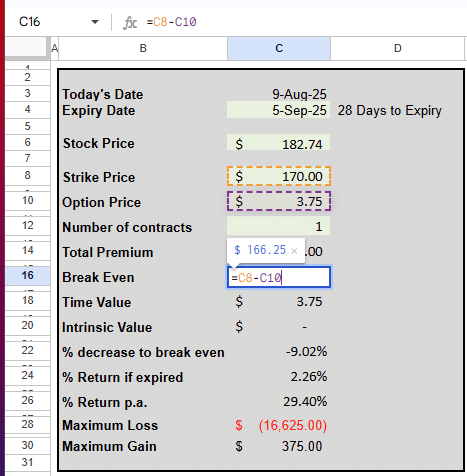

Should you double-click on the cell for break-even value:

You possibly can see the method getting used.

The worth in cell C10 on the spreadsheet is being subtracted from the worth in cell C8.

It’s the strike value minus the choice value.

In our instance:

Break even value = $170 – $3.75 = $166.25

If NVDA drops to $170, our earnings start to drop.

However NVDA can drop even additional earlier than we lose cash as a result of we had gotten a credit score primarily based on the choice value that we offered the choice for.

That is the share drop that the inventory value can expertise and nonetheless be worthwhile within the commerce.

On this case, NVDA can drop from $182.74 to $166.25 and nonetheless break even. It could actually drop 9%.

% to interrupt even = ($166.25 – $182.74) / $182.75 = -9%

This tells us the worth of the time the investor offered.

One other time period of time worth is “extrinsic worth”.

Choice sellers earn money by promoting extrinsic worth.

The extra time until expiration, the extra extrinsic worth.

Therefore the time period “time worth”.

As a result of the investor’s put choice is out-of-the-money with a strike value beneath the present value of the inventory, the complete choice worth is time worth.

The commerce at the moment has a time worth of $3.75 per share.

An choice’s worth consists of each intrinsic and extrinsic worth.

For the reason that entirety of this feature worth is extrinsic worth, there isn’t a intrinsic worth for this feature.

However that may change as the value of NVDA strikes within the cash.

You possibly can replace the inexperienced cells every day to see the values recalculate.

Free Coated Name Course

The max achieve from this commerce is the credit score initially acquired, which is $375.

That is true no matter how excessive the NVDA inventory value might go (as a result of the investor doesn’t personal the inventory).

The investor solely offered the put choice to seize its premium.

This max achieve is achieved if the put choice expires nugatory with out the inventory being assigned.

In different phrases, if NVDA is not less than above $170 at expiration.

The worst-case state of affairs (nonetheless unlikely) is for the NVDA inventory value to go to zero, and the investor is assigned 100 shares (shopping for at $170 per share).

That will be like dropping $17,000 on the 100 shares of inventory, however compensated by the $375 credit score initially acquired.

Therefore, the max loss in our instance is:

Max loss = $17,000 – $375 = $16,625

That is the share return on the commerce if the put choice expires nugatory with out the inventory being assigned.

In that case, the investor retains the $375 preliminary credit score.

The return of $375 out of a most capital susceptible to $16,625 is a 2.26% return.

This commerce solely tied up capital for 28 days.

If we have been to extrapolate this type of return for an entire 12 months (twelve months), it could be

2.26% x 365 / 28 = 29.4% per 12 months.

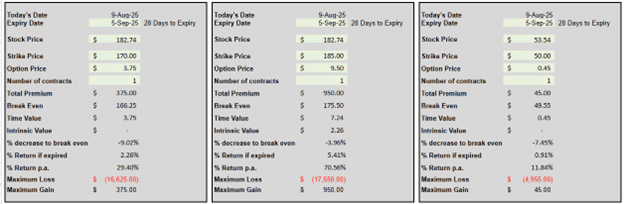

With three calculator panels out there, an investor can run the numbers to see completely different situations of promoting completely different put choices with completely different strike costs and expirations.

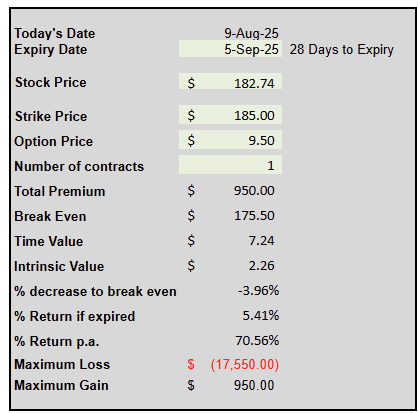

The second panel exhibits a extra aggressive commerce by promoting an in-the-money put choice on the strike value of $185:

Since NVDA is buying and selling at $182.74, there may be $2.26 of intrinsic worth on this choice:

$185 – $182.74 = $2.26

This commerce has the next return of 5.41% if the choice expires nugatory.

However for the reason that share lower to interrupt even is smaller at -3.96%, it’s extra prone to be assigned than within the first instance.

And it has the next max potential loss.

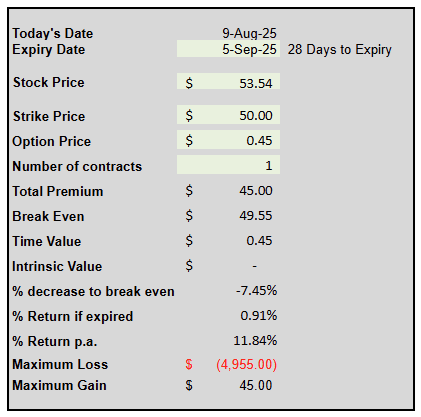

If $17,550 is an excessive amount of capital you need to have placed on reserve, the third panel compares a brief put sale on GM inventory, which is priced at solely $53.54 per share:

Its max loss is lower than $5000.

It’s a much less aggressive commerce. However doing comparable trades all through the entire 12 months may end up in a possible annual return of $11.84%.

Study Choices the Proper Means — Step by Step

Money-secured places symbolize simply considered one of many refined choices methods that may improve your buying and selling arsenal.

Should you’re eager about studying a scientific strategy to choices buying and selling:

Choices Revenue Mastery: Study confirmed choice methods with correct threat administration strategies ($397). 1-month program.

The Accelerator Program: 12-month program protecting 9 main methods with complete portfolio administration for critical choices merchants ($1,497).

Each packages embrace detailed modules on managing project situations, technical evaluation, buying and selling psychology, and correct place sizing strategies.

The cash-secured put calculator helps you shortly get these numbers to resolve on which put sale to make.

We hope you loved this text on methods to use the money secured put calculator.

If in case you have any questions, ship an e mail or go away a remark beneath.

Commerce secure!

Disclaimer: The knowledge above is for academic functions solely and shouldn’t be handled as funding recommendation. The technique offered wouldn’t be appropriate for traders who usually are not acquainted with alternate traded choices. Any readers on this technique ought to do their very own analysis and search recommendation from a licensed monetary adviser.