Monetary establishments face mounting stress as regulatory necessities intensify and monetary crime grows extra subtle, with the monetary crime compliance operations market now valued at $155B yearly. Banks wrestle with handbook, error-prone processes that create backlogs, enhance threat, and explode prices whereas compliance groups are overwhelmed by alert volumes that may bury operations. WorkFusion addresses these important challenges by delivering AI Brokers particularly designed for monetary crime compliance, providing pre-built digital employees that automate Stage 1 analyst capabilities throughout sanctions screening, transaction monitoring, KYC, and opposed media monitoring. The corporate’s AI Brokers presently course of over 1 million alert hits every day and save prospects roughly 40,000 hours of handbook work per day, serving 10 of the highest 20 banks and main monetary establishments worldwide. After pivoting in 2022 to focus solely on monetary crime compliance, WorkFusion has achieved 60% year-over-year development in its AI Agent options whereas increasing its world footprint.

AlleyWatch sat down with WorkFusion CEO and Founder Adam Famularo to be taught extra in regards to the enterprise, its future plans, current funding spherical, and far, far more…

Who had been your traders and the way a lot did you increase?

We simply closed a $45M development spherical led by Georgian, with participation from Serengeti Asset Administration; Nokia Development Companions III; Teralys Capital; Hawk Fairness; Chubb INA Holdings; Declaration Companions; WorkFusion CEO Adam Famularo and different members of the management group; SVB Innovation Credit score Fund VIII, L.P.; Konrad Investments LLC; and George John.

Inform us in regards to the services or products that WorkFusion gives.

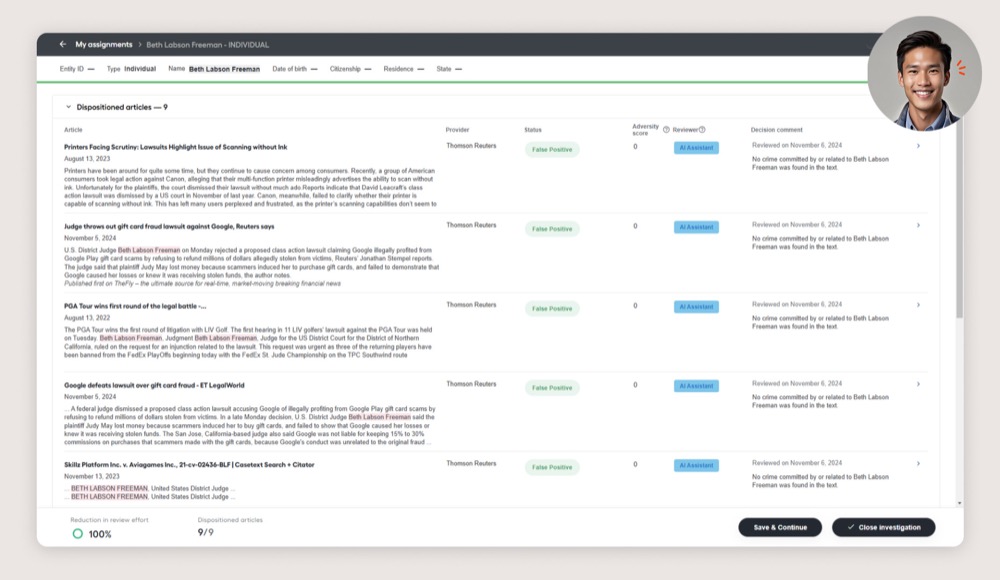

WorkFusion builds AI Brokers to combat monetary crime compliance (FCC). These are purpose-built digital employees educated to tackle important compliance analyst capabilities at banks, similar to sanctions screening, KYC refresh, transaction monitoring, fraud overview, and opposed media monitoring. Our AI Brokers come “out of the field” with years of job-specific coaching, making them straightforward to rent, configure, and scale.

What impressed the beginning of WorkFusion?

WorkFusion was initially based out of MIT Labs in 2010 with the imaginative and prescient of utilizing automation to remodel work. Within the early days, we tried to automate something for anyone. However by 2021, after surveying our prospects, it grew to become clear that our most profitable use instances had been in preventing monetary crime. That’s once we made the choice to focus completely on constructing AI Brokers for FCC, and in February 2022, we relaunched the corporate with this new technique.

How is WorkFusion totally different?

In contrast to general-purpose automation or AI instruments, WorkFusion delivers pre-built, job-specific AI Brokers that monetary establishments can rent like they might an analyst. They arrive educated with years of area experience, combine shortly, and ship work at a stage of consistency and scale that people merely can’t. Briefly, our prospects don’t must spend years constructing their very own AI capabilities as a result of they will put our brokers to work instantly.

What market does WorkFusion goal and the way huge is it?

We goal the monetary crime compliance operations market, primarily at banks and monetary establishments, which is valued at round $155B. It’s one of many fastest-growing, most resource-constrained areas in monetary companies. We’re already working with 10 of the highest 20 banks within the U.S. plus different main monetary establishments globally.

What’s your online business mannequin?

We function on an on-prem and SaaS mannequin, licensing AI Brokers to banks and monetary establishments. Prospects can scale utilization up or down relying on their workload, which supplies them flexibility whereas avoiding the prices of hiring or outsourcing.

How are you getting ready for a possible financial slowdown?

Financial slowdowns typically put extra stress on compliance groups, since fraud and monetary crime are inclined to rise in unsure markets. Banks are additionally below stress to do extra with much less. That’s the place our AI Brokers shine as a result of they cut back handbook work, scale capability 3–5X, and save hundreds of man hours a day for our prospects. In some ways, we’re positioned as a cost-saving and risk-reducing resolution when monetary establishments want it most.

What was the funding course of like?

We had been lucky that a lot of our present traders doubled down and new traders got here in, which speaks to each the energy of our traction and the urgency of the market drawback we’re fixing. It was a collaborative course of centered on how we scale responsibly into the subsequent section of development.

What are the most important challenges that you simply confronted whereas elevating capital?

The largest problem was focus. AI is in every single place proper now, and traders see hundreds of AI pitches. We needed to clearly differentiate how Agentic AI for FCC isn’t just one other AI story, however a confirmed, revenue-generating product with a selected, large market.

What elements about your online business led your traders to put in writing the examine?

A number of issues:

We’re already working with 25 main monetary establishments, together with 10 of the highest 20 U.S. banks and main monetary establishments around the globe.

Our AI Brokers save prospects 40,000 hours of handbook work a day, which is transformative for compliance groups.

Our pivot in 2022 has proven we will adapt shortly to satisfy market wants and construct wanted know-how.

We’re seeing 60% year-over-year development in our AI Agent options.

What are the milestones you intend to realize within the subsequent six months?

We’ll be increasing our buyer base in North America and Europe whereas opening up new alternatives within the Center East. On the product aspect, we’re persevering with to boost our brokers’ capabilities and scaling our group.

What recommendation are you able to supply corporations in New York that do not need a recent injection of capital within the financial institution?

I’d say it’s to focus relentlessly in your prospects’ greatest issues and resolve them higher than anybody else. That’s what carried WorkFusion by way of our pivot in 2022, by figuring out the place we might have essentially the most impression, doubling down, and letting buyer traction drive investor curiosity.

The place do you see the corporate going now over the close to time period?

Within the close to time period, we see ourselves changing into the usual for delivering AI brokers for FCC operations throughout world banks. The demand is big, the necessity is pressing, and our know-how is already confirmed at scale.

What’s your favourite fall vacation spot in and across the metropolis?

It’s all the time enjoyable to stroll round Central Park within the Fall. We additionally take pleasure in touring out to Montauk and the Hamptons within the Fall. Quieter and enjoyable ambiance.