Printed on September sixteenth, 2025 by Bob Ciura

Buyers within the US shouldn’t overlook Canadian shares, a lot of which have excessive dividend yields than their U.S. counterparts.

The TSX 60 Index is a inventory market index of the 60 largest corporations that commerce on the Toronto Inventory Trade.

As a result of the Canadian inventory market is closely weighted in direction of giant monetary establishments and vitality corporations, the TSX is an affordable benchmark for Canadian equities efficiency. Additionally it is an important place to search for funding concepts.

You possibly can obtain a database of the businesses throughout the TSX 60 (together with related monetary metrics reminiscent of dividend yields and price-to-earnings ratios) by clicking on the hyperlink beneath:

The TSX 60 Shares Record obtainable for obtain above accommodates the next info for each safety throughout the index:

Inventory Value

Dividend Yield

Market Capitalization

Value-to-Earnings Ratio

The entire monetary information within the database are listed in Canadian {dollars}.

Notice: Canada imposes a 15% dividend withholding tax on U.S. traders. In lots of instances, investing in Canadian shares by a U.S. retirement account waives the dividend withholding tax from Canada, however examine together with your tax preparer or accountant for extra on this concern.

This text will rank the ten highest yielding Canadian dividend shares within the Certain Evaluation Analysis Database.

Desk of Contents

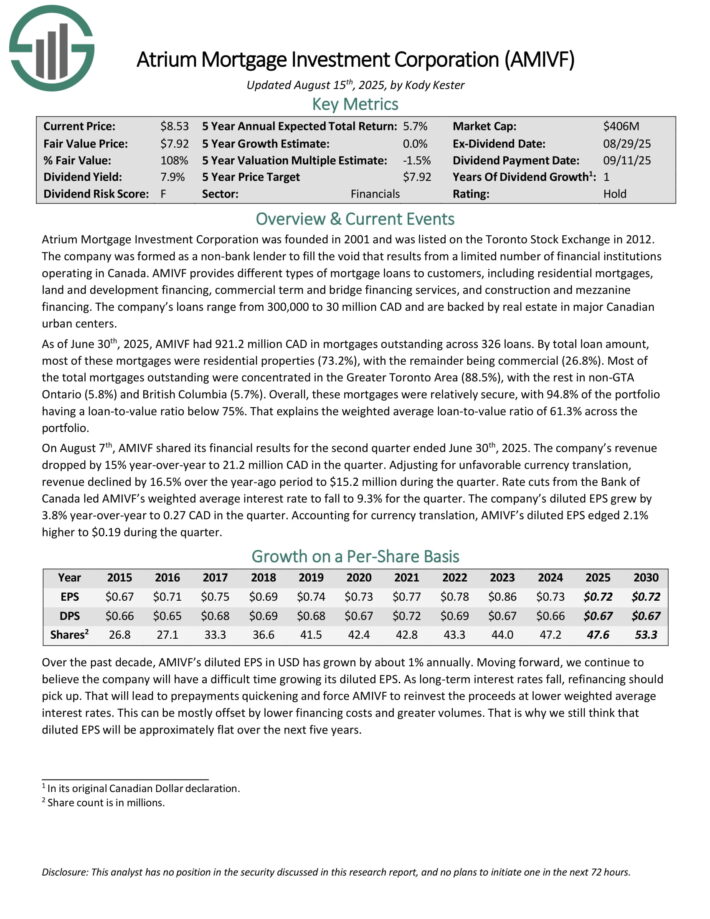

Highest Yielding Canadian Dividend Inventory #10: Atrium Mortgage Funding Company (AMIVF)

Atrium Mortgage Funding Company was based in 2001 and was listed on the Toronto Inventory Trade in 2012. AMIVF supplies several types of mortgage loans to prospects, together with residential mortgages, land and improvement financing, industrial time period and bridge financing providers, and building and mezzanine financing.

The corporate’s loans vary from 300,000 to 30 million CAD and are backed by actual property in main Canadian city facilities. As of June thirtieth, 2025, AMIVF had 921.2 million CAD in mortgages excellent throughout 326 loans.

By whole mortgage quantity, most of those mortgages have been residential properties (73.2%), with the rest being industrial (26.8%).

A lot of the whole mortgages excellent have been concentrated within the Higher Toronto Space (88.5%), with the remainder in non GTA Ontario (5.8%) and British Columbia (5.7%).

Total, these mortgages have been comparatively safe, with 94.8% of the portfolio having a loan-to-value ratio beneath 75%. That explains the weighted common loan-to-value ratio of 61.3% throughout the portfolio.

On August seventh, AMIVF shared its monetary outcomes for the second quarter ended June thirtieth, 2025. The corporate’s income dropped by 15% year-over-year to 21.2 million CAD within the quarter.

Adjusting for unfavorable forex translation, income declined by 16.5% over the year-ago interval to $15.2 million through the quarter.

Fee cuts from the Financial institution of Canada led AMIVF’s weighted common rate of interest to fall to 9.3% for the quarter. The corporate’s diluted EPS grew by 3.8% year-over-year to 0.27 CAD within the quarter.

Click on right here to obtain our most up-to-date Certain Evaluation report on AMIVF (preview of web page 1 of three proven beneath):

Highest Yielding Canadian Dividend Inventory #9: Freehold Royalties Ltd. (FRHLF)

Freehold Royalties is a Canadian vitality firm. Shares are dual-listed in Canada beneath the ticker “FRU” and the U.S. with the over-the-counter ticker “FRHLF”. The corporate’s base reporting forex is Canadian {Dollars}, however this report will use U.S. Greenback figures besides when in any other case famous.

Freehold Royalties doesn’t personal upstream oil manufacturing services instantly. Reasonably it companions with operators, offering upfront money in return for a reduce of future oil and fuel manufacturing volumes. Freehold at the moment has about 360 royalty companions and has publicity to greater than 7 million gross acres of land throughout the U.S. and Canada.

The corporate’s prime three manufacturing areas are the Midland and Eagle Ford basins within the U.S. together with Canadian heavy oil manufacturing within the province of Alberta.

On July thirtieth , 2025, Freehold Royalties reported its Q2 2025 outcomes. The corporate’s top-line revenues slumped 7% to C$78 million in the identical quarter of 2024. This was a very disappointing outcome as the corporate had spent considerably on M&A over the previous 12 months, which helped trigger the corporate’s internet debt to leap from C$101 million on the finish of 2023 to C$282 million on the finish of 2024.

Regardless of share dilution and better curiosity prices, revenues have dropped and earnings declined even sooner, falling to simply 4 cents per share CAD in Q2 2025 in comparison with 26 cents in the identical interval of final 12 months. The corporate made a large acquisition of Midland basin royalties in December that was supposed to assist bolster 2025 earnings, however falling oil costs greater than offset that power.

The one silver lining is that the corporate’s money stream per share got here in at 35 cents CAD, which declined by a extra modest 5 cents versus the prior 12 months. Regardless, profitability is down and the corporate’s already tenuous dividend protection is now even weaker.

Click on right here to obtain our most up-to-date Certain Evaluation report on FRHLF (preview of web page 1 of three proven beneath):

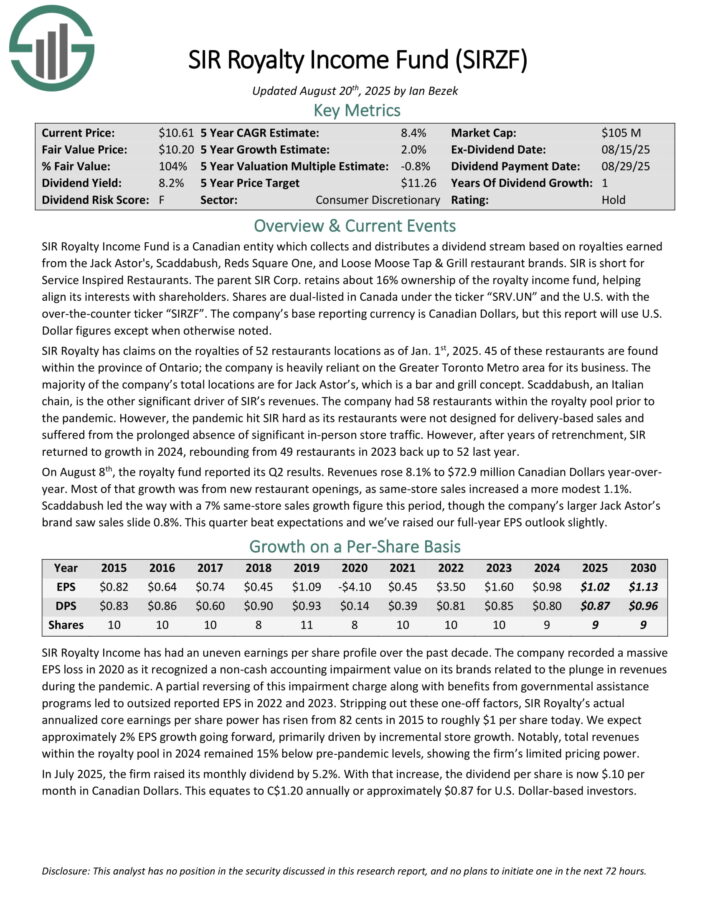

Highest Yielding Canadian Dividend Inventory #9: SIR Royalty Earnings Fund (SIRZF)

SIR Royalty Earnings Fund is a Canadian entity which collects and distributes a dividend stream primarily based on royalties earned from the Jack Astor’s, Scaddabush, Reds Sq. One, and Free Moose Faucet & Grill restaurant manufacturers.

The mum or dad SIR Corp. retains about 16% possession of the royalty earnings fund, serving to align its pursuits with shareholders.

SIR Royalty has claims on the royalties of 52 eating places places as of Jan. 1st, 2025. 45 of those eating places are discovered throughout the province of Ontario; the corporate is closely reliant on the Higher Toronto Metro space for its enterprise.

The vast majority of the corporate’s whole places are for Jack Astor’s, which is a bar and grill idea. Scaddabush, an Italian chain, is the opposite vital driver of SIR’s revenues.

On August eighth, the royalty fund reported its Q2 outcomes. Revenues rose 8.1% to $72.9 million Canadian {Dollars} year-over-year. Most of that progress was from new restaurant openings, as same-store gross sales elevated a extra modest 1.1%.

Scaddabush led the best way with a 7% same-store gross sales progress determine this era, although the corporate’s bigger Jack Astor’s model noticed gross sales slide 0.8%.

Click on right here to obtain our most up-to-date Certain Evaluation report on SIRZF (preview of web page 1 of three proven beneath):

Highest Yielding Canadian Dividend Inventory #8: Slate Grocery REIT (SRRTF)

Slate Grocery REIT is a Toronto-based, but U.S.-focused actual property funding belief centered on grocery-anchored retail facilities.

It owns 116 properties, totaling 15.3 million sq. toes and valued at about $2.4 billion. Its portfolio is deeply rooted in necessity-based retail. A few of its prime tenants together with Kroger, Walmart, and Ahold Delhaize, whereas it boasts anchor occupancy price of 98.8%.

On August sixth, 2025, Slate Grocery REIT posted its Q2 outcomes for the interval ending June thirtieth, 2025. Whole income grew 2.1% year-over-year to $53.4 million.

The expansion was primarily pushed by rental price will increase, robust leasing spreads, and contractual hire escalations, notably on renewed leases that proceed to mirror resilient demand for grocery anchored retail.

Regardless of the income uplift, profitability was modestly pressured by increased basic and administrative bills in addition to curiosity and finance prices.

FFO totaled $15.0 million, or $0.25 per unit, unchanged from a 12 months in the past. Leasing exercise remained wholesome, supporting a steady occupancy price and reinforcing the REIT’s place in necessity-based retail.

Click on right here to obtain our most up-to-date Certain Evaluation report on SRRTF (preview of web page 1 of three proven beneath):

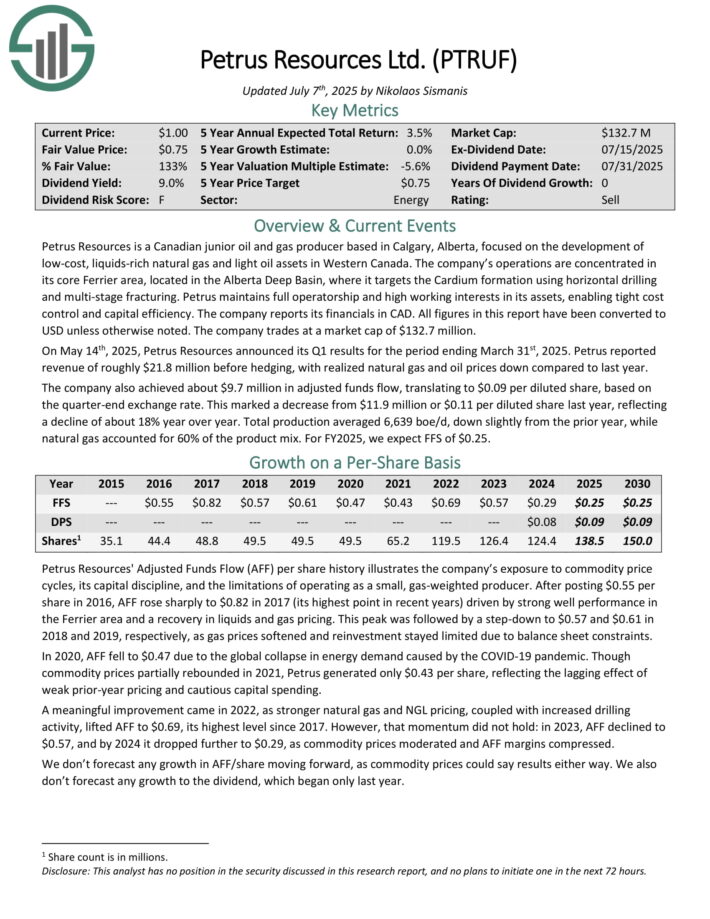

Highest Yielding Canadian Dividend Inventory #7: Petrus Assets Ltd. (PTRUF)

Petrus Assets is a Canadian junior oil and fuel producer primarily based in Calgary, Alberta, centered on the event of low-cost, liquids-rich pure fuel and light-weight oil property in Western Canada.

The corporate’s operations are concentrated in its core Ferrier space, positioned within the Alberta Deep Basin, the place it targets the Cardium formation utilizing horizontal drilling and multi-stage fracturing. Petrus maintains full operatorship and excessive working pursuits in its property, enabling tight value management and capital effectivity.

On Could 14th, 2025, Petrus Assets introduced its Q1 outcomes for the interval ending March thirty first, 2025. Petrus reported income of roughly $21.8 million earlier than hedging, with realized pure fuel and oil costs down in comparison with final 12 months.

The corporate additionally achieved about $9.7 million in adjusted funds stream, translating to $0.09 per diluted share, primarily based on the quarter-end change price.

This marked a lower from $11.9 million or $0.11 per diluted share final 12 months, reflecting a decline of about 18% 12 months over 12 months. Whole manufacturing averaged 6,639 boe/d, down barely from the prior 12 months, whereas pure fuel accounted for 60% of the product combine.

Click on right here to obtain our most up-to-date Certain Evaluation report on PTRUF (preview of web page 1 of three proven beneath):

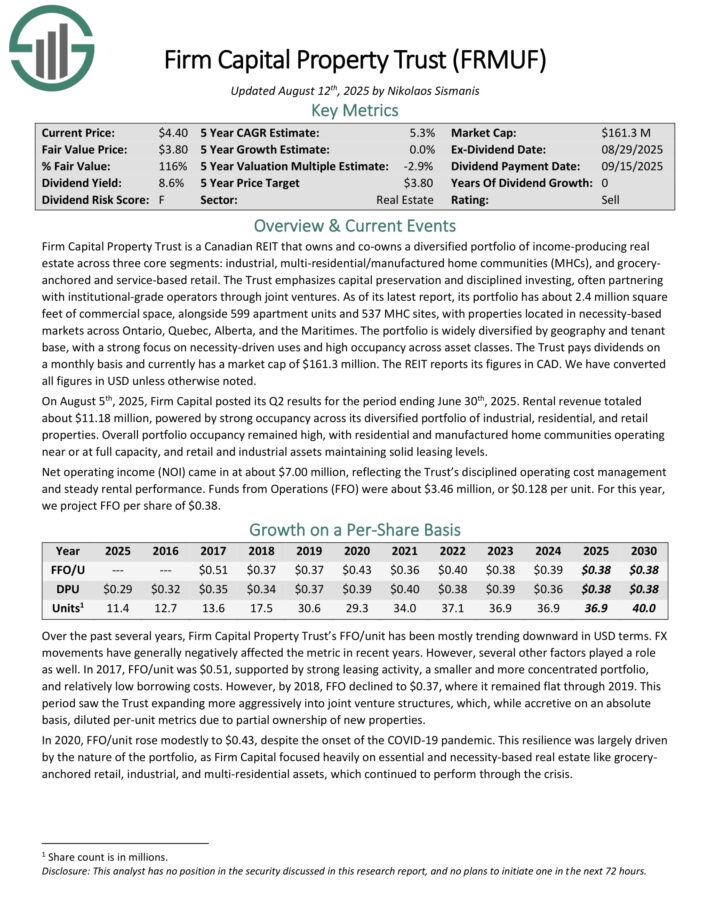

Highest Yielding Canadian Dividend Inventory #6: Agency Capital Property Belief (FRMUF)

Agency Capital Property Belief is a Canadian REIT that owns and co-owns a diversified portfolio of income-producing actual property throughout three core segments: industrial, multi-residential/manufactured house communities (MHCs), and grocery anchored and service-based retail.

The Belief emphasizes capital preservation and disciplined investing, typically partnering with institutional-grade operators by joint ventures.

As of its newest report, its portfolio has over 2.5 million sq. toes of business house, alongside practically 600 house items and 537 MHC websites, with properties positioned in necessity primarily based markets throughout Ontario, Quebec, Alberta, and the Maritimes.

On August fifth, 2025, Agency Capital posted its Q2 outcomes for the interval ending June thirtieth, 2025. Rental income totaled about $11.18 million, powered by robust occupancy throughout its diversified portfolio of business, residential, and retail properties.

Total portfolio occupancy remained excessive, with residential and manufactured house communities working close to or at full capability, and retail and industrial property sustaining stable leasing ranges.

Web working earnings (NOI) got here in at about $7.00 million, reflecting the Belief’s disciplined working value administration and regular rental efficiency.

Funds from Operations (FFO) have been about $3.46 million, or $0.128 per unit. For this 12 months, we venture FFO per share of $0.38.

Click on right here to obtain our most up-to-date Certain Evaluation report on FRMUF (preview of web page 1 of three proven beneath):

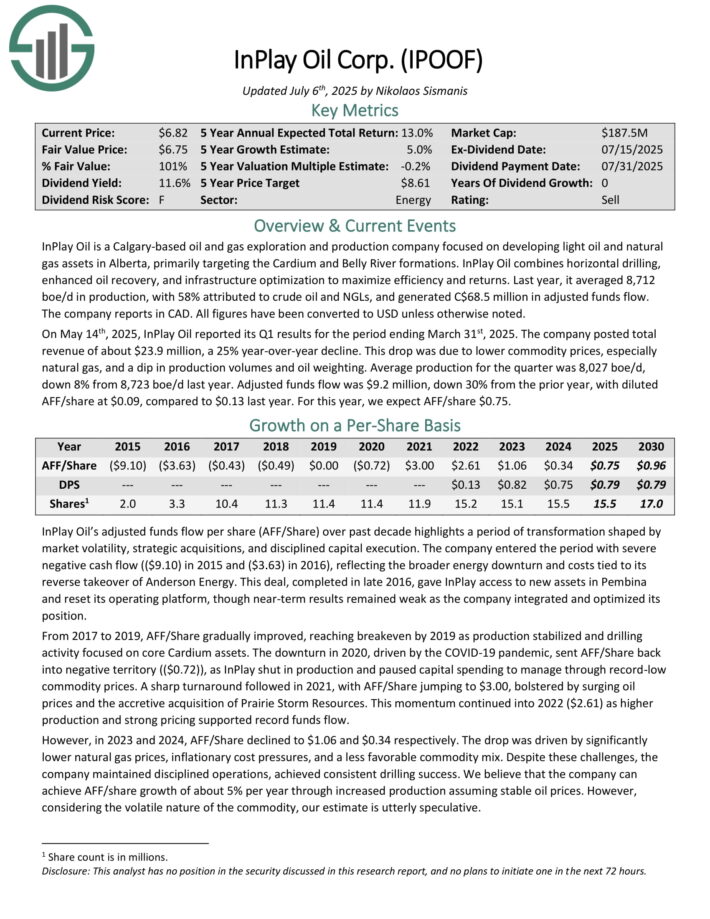

Highest Yielding Canadian Dividend Inventory #5: InPlay Oil Corp. (IPOOF)

InPlay Oil is a Calgary-based oil and fuel exploration and manufacturing firm centered on growing mild oil and pure fuel property in Alberta, primarily focusing on the Cardium and Stomach River formations. InPlay Oil combines horizontal drilling, enhanced oil restoration, and infrastructure optimization to maximise effectivity and returns.

Final 12 months, it averaged 8,712 boe/d in manufacturing, with 58% attributed to crude oil and NGLs, and generated C$68.5 million in adjusted funds stream.

On Could 14th, 2025, InPlay Oil reported its Q1 outcomes for the interval ending March thirty first, 2025. The corporate posted whole income of about $23.9 million, a 25% year-over-year decline. This drop was as a consequence of decrease commodity costs, particularly pure fuel, and a dip in manufacturing volumes and oil weighting.

Common manufacturing for the quarter was 8,027 boe/d, down 8% from 8,723 boe/d final 12 months. Adjusted funds stream was $9.2 million, down 30% from the prior 12 months, with diluted AFF/share at $0.09, in comparison with $0.13 final 12 months. For this 12 months, we anticipate AFF/share $0.75.

Click on right here to obtain our most up-to-date Certain Evaluation report on IPOOF (preview of web page 1 of three proven beneath):

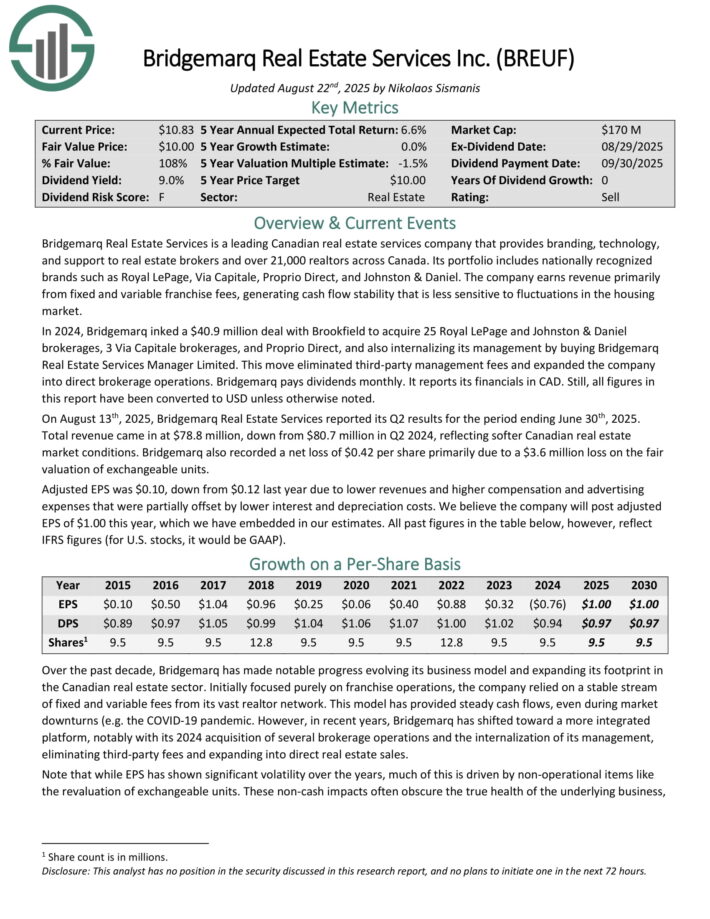

Highest Yielding Canadian Dividend Inventory #4: Bridgemarq Actual Property Companies (BREUF)

Bridgemarq Actual Property Companies is a number one Canadian actual property providers firm that gives branding, know-how, and assist to actual property brokers and over 21,000 realtors throughout Canada. Its portfolio contains nationally acknowledged manufacturers reminiscent of Royal LePage, By way of Capitale, Proprio Direct, and Johnston & Daniel.

The corporate earns income primarily from fastened and variable franchise charges, producing money stream stability that’s much less delicate to fluctuations within the housing market.

On August thirteenth, 2025, Bridgemarq Actual Property Companies reported its Q2 outcomes. Whole income got here in at $78.8 million, down from $80.7 million in Q2 2024, reflecting softer Canadian actual property market circumstances.

Bridgemarq additionally recorded a internet lack of $0.42 per share primarily as a consequence of a $3.6 million loss on the truthful valuation of exchangeable items.

Adjusted EPS was $0.10, down from $0.12 final 12 months as a consequence of decrease revenues and better compensation and promoting bills that have been partially offset by decrease curiosity and depreciation prices.

Click on right here to obtain our most up-to-date Certain Evaluation report on BREUF (preview of web page 1 of three proven beneath):

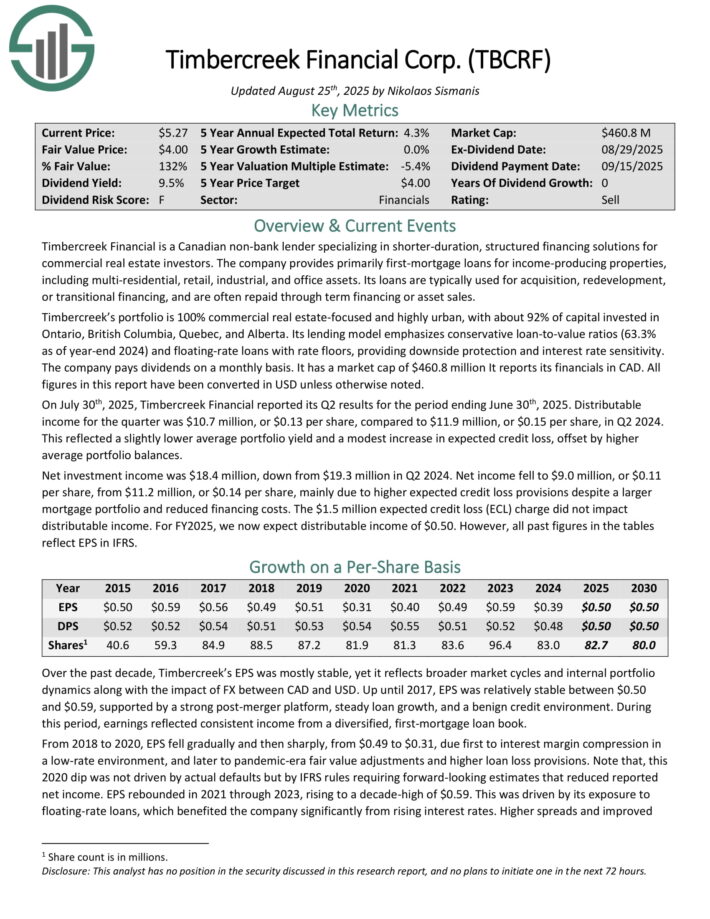

Highest Yielding Canadian Dividend Inventory #3: Timbercreek Monetary Corp. (TBCRF)

Timbercreek Monetary is a Canadian non-bank lender specializing in shorter-duration, structured financing options for industrial actual property traders.

The corporate supplies primarily first-mortgage loans for income-producing properties, together with multi-residential, retail, industrial, and workplace property. Its loans are sometimes used for acquisition, redevelopment, or transitional financing, and are sometimes repaid by time period financing or asset gross sales.

Timbercreek’s portfolio is 100% industrial actual estate-focused and extremely city, with about 92% of capital invested in Ontario, British Columbia, Quebec, and Alberta.

On July thirtieth, 2025, Timbercreek Monetary reported its Q2 outcomes. Distributable earnings for the quarter was $10.7 million, or $0.13 per share, in comparison with $11.9 million, or $0.15 per share, in Q2 2024.

This mirrored a barely decrease common portfolio yield and a modest enhance in anticipated credit score loss, offset by increased common portfolio balances.

Web funding earnings was $18.4 million, down from $19.3 million in Q2 2024. Web earnings fell to $9.0 million, or $0.11 per share, from $11.2 million, or $0.14 per share, primarily as a consequence of increased anticipated credit score loss provisions regardless of a bigger mortgage portfolio and lowered financing prices.

Click on right here to obtain our most up-to-date Certain Evaluation report on TBCRF (preview of web page 1 of three proven beneath):

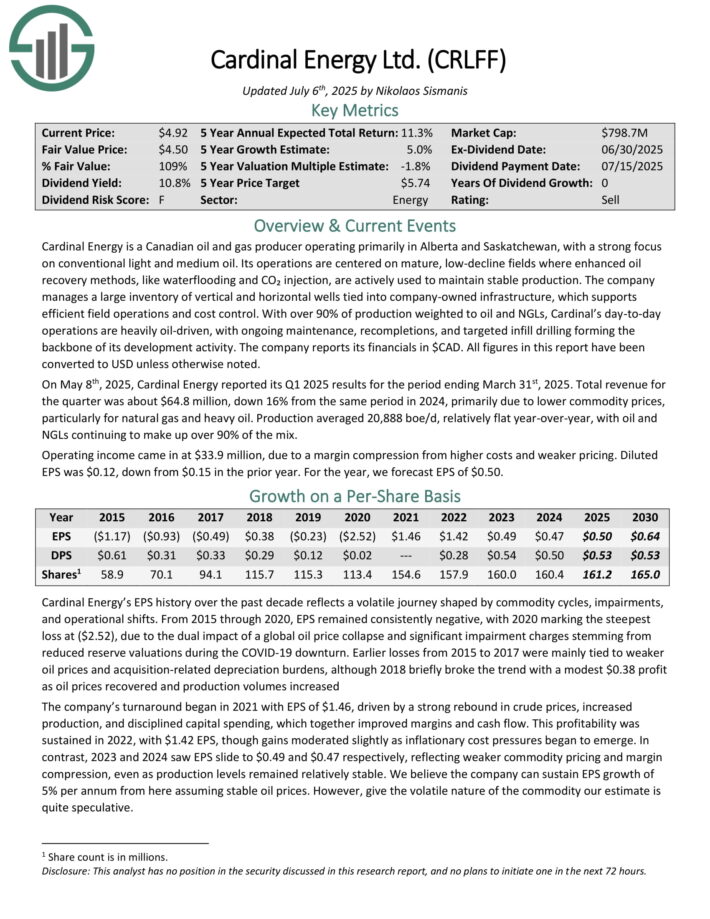

Highest Yielding Canadian Dividend Inventory #1: Cardinal Vitality Ltd. (CRLFF)

Cardinal Vitality is a Canadian oil and fuel producer working primarily in Alberta and Saskatchewan, with a robust concentrate on typical mild and medium oil.

Its operations are centered on mature, low-decline fields the place enhanced oil restoration strategies, like waterflooding and CO₂ injection, are actively used to take care of steady manufacturing.

The corporate manages a big stock of vertical and horizontal wells tied into company-owned infrastructure, which helps environment friendly area operations and price management.

With over 90% of manufacturing weighted to grease and NGLs, Cardinal’s day-to-day operations are closely oil-driven, with ongoing upkeep, recompletions, and focused infill drilling forming the spine of its improvement exercise.

On Could eighth, 2025, Cardinal Vitality reported its Q1 2025 outcomes for the interval ending March thirty first, 2025. Whole income for the quarter was about $64.8 million, down 16% from the identical interval in 2024, primarily as a consequence of decrease commodity costs, notably for pure fuel and heavy oil.

Manufacturing averaged 20,888 boe/d, comparatively flat year-over-year, with oil and NGLs persevering with to make up over 90% of the combo. Working earnings got here in at $33.9 million, as a consequence of a margin compression from increased prices and weaker pricing.

Click on right here to obtain our most up-to-date Certain Evaluation report on CRLFF (preview of web page 1 of three proven beneath):

Further Studying

In case you are focused on discovering high-quality dividend progress shares and/or different high-yield securities and earnings securities, the next Certain Dividend sources can be helpful:

Canadian Dividend Shares

Different Certain Dividend Assets

Thanks for studying this text. Please ship any suggestions, corrections, or inquiries to assist@suredividend.com.