Gainify is a inventory analysis platform that goals to offer institutional-grade knowledge to retail buyers by means of a visually intuitive interface.

Different enticing options embrace the usage of AI evaluation, graphical visualization of basic knowledge, and screening of shares based mostly on quite a lot of firm knowledge.

Let’s have a look.

Contents

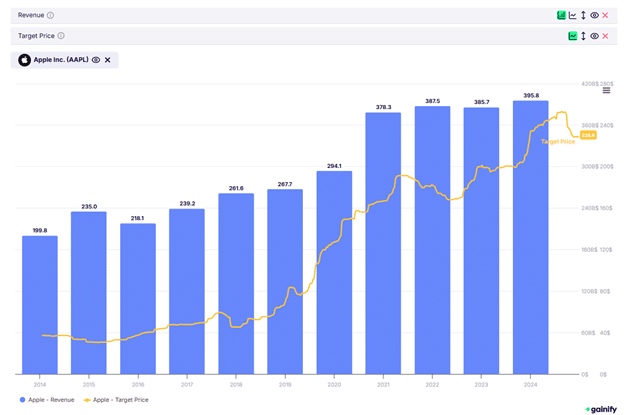

One in all Gainify’s key strengths is its capacity to visualise basic knowledge.

Right here is Apple’s (AAPL) income development charted in relation to its goal value…

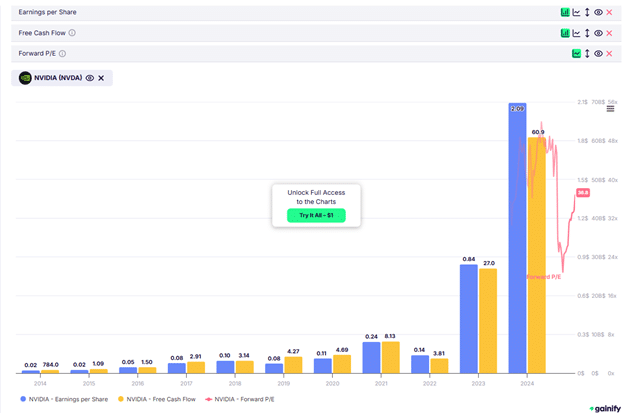

Right here is NVDA with earnings per share, free money circulate, and ahead PE:

You may discover all potential mixtures of knowledge you need.

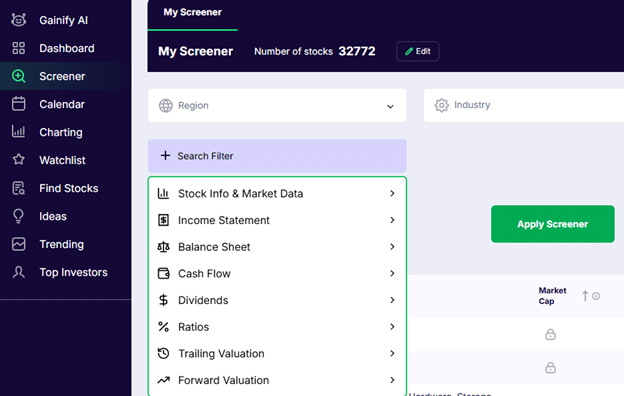

Gainify’s inventory screener is likely one of the extra detailed basic knowledge screeners I’ve seen.

You may scan based mostly on varied basic knowledge, together with earnings statements, steadiness sheets, PE ratios, valuations, and extra.

Moreover the usual inventory knowledge, corresponding to market cap, beta, float, and others, it permits you to display for CapEx, EBITDA, CAGR, COGS, and plenty of extra.

It distinguishes Free Money Circulation from Unlevered Free Money Circulation, from Money Circulation Per Share, to Money from Operations, and a complete lot extra.

After all, there are numerous value ratios, corresponding to ahead PE, PEG, EPS, dividend per share, e-book worth per share, and money circulate per share, amongst others.

You may display for extra complicated basic ratios corresponding to:

(EBITDA – Capex) / Curiosity Expense

Simply to call an instance.

As for technical evaluation screens, it does have just a few, like:

Value development inside sure timeframes

Value proportion from a 52-week excessive or low

Value proportion from a 50-day SMA or 200-day SMA

Rebound from 52-week low

RSI

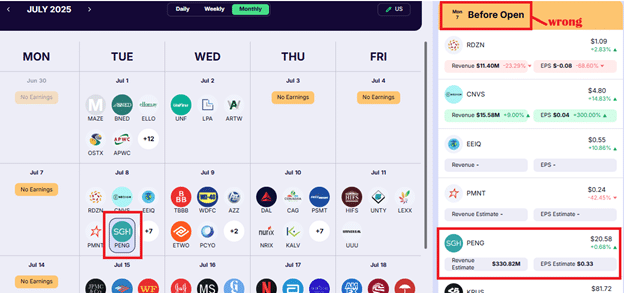

Whereas the screener does allow you to display by earnings date, I just like the weekly and month-to-month calendar view of high-profile earnings:

That means, I see at a look when there is perhaps any “common” earnings studies developing.

By default, solely the “common” earnings are proven.

This fashion, it doesn’t muddle my thoughts with unimportant firm earnings which might be of little consequence.

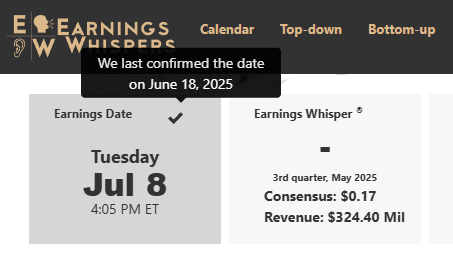

When it says July 8 has no earnings, it signifies that July 8 has no “common earnings”.

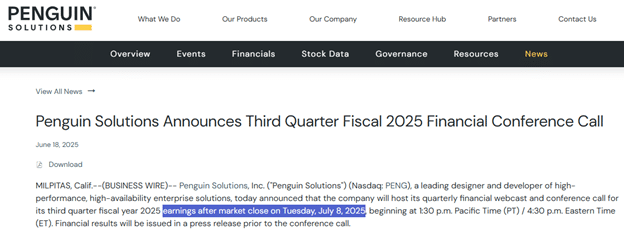

Penguin Options is scheduled to launch its earnings announcement after the market closes on July 8.

However do I care about Penguin Options?

For me, possibly not.

Nonetheless, when you do care about Penguin Options, you’ll be able to alter the filter to show all US shares.

And Penguin Options (PENG) would appropriately seem within the calendar for Tuesday, July 8…

Supply: gainify

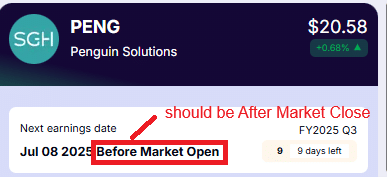

Nonetheless, there seems to be a glitch within the software program as a result of, on the precise sidebar, it’s inconsistently labeled as ‘reporting’ earlier than the open on Monday, the seventh, which is inaccurate.

That is essential data to get appropriate, as some buyers could need to exit a inventory or place earlier than the earnings announcement.

I can perceive that earnings data can differ if the earnings announcement has not been confirmed but.

However this can be a confirmed earnings report back to be introduced Tuesday, July 8, after the market closes, in accordance with EarningsWhispers:

Supply: EarningsWhispers.com.

It’s additional confirmed on the Penguin Options web site.

If I had been to click on on PENG for particulars, Gainify now has the proper incomes date, however the time is flawed…

It was formally based in 2024 and relies in Vilnius, Lithuania. It’s a nice-looking place, as proven within the photograph on their web site.

The imaginative and prescient for the product took place in 2020.

Gainify makes use of monetary knowledge, analytics, and instruments licensed from S&P World Market Intelligence.

Due to this fact, we can not decide whether or not the earnings knowledge for Penguin Options is inaccurate as a result of Gainify software program or S&P World Market Intelligence knowledge.

S&P World Market Intelligence is a well-respected monetary knowledge supplier utilized by many funding banks and different monetary establishments.

The Gainify crew seems to be highlighting their Gainify AI, as it’s listed as the primary merchandise within the platform’s left menu.

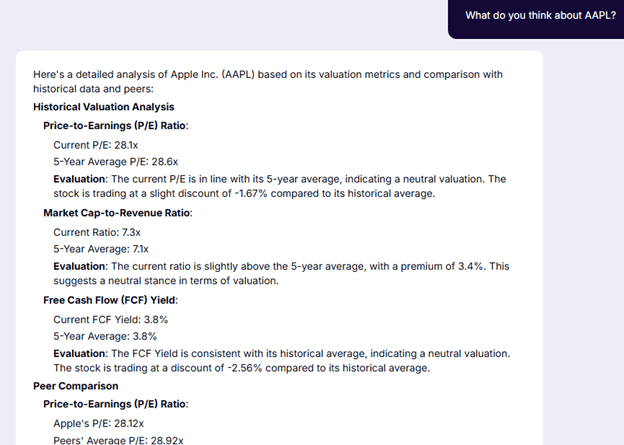

Once I requested Gainify AI about Apple, it gave me first rate basic knowledge…

Free Earnings Season Mastery eBook

Gainify’s analysis of shares relies extra on basic evaluation than on technical evaluation.

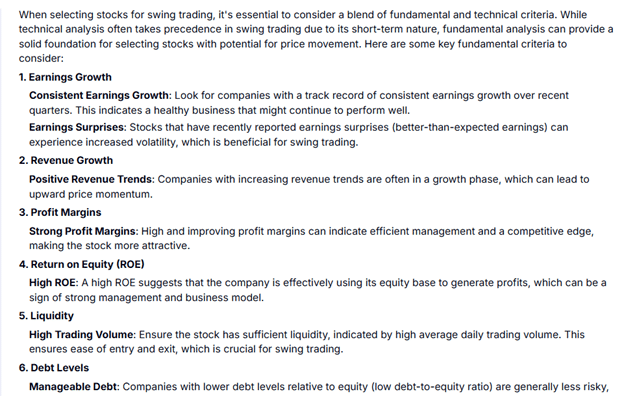

So I requested it.

To search out good shares for swing buying and selling, what basic standards ought to I search for?

It gave this reply, which is fairly good:

It continues to listing objects 7, 8, and 9 to be “Trade and Financial Components”, “Valuation”, and “Information and Catalysts”.

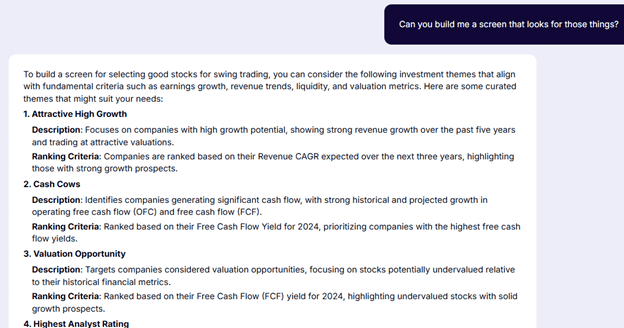

I had a follow-up query:

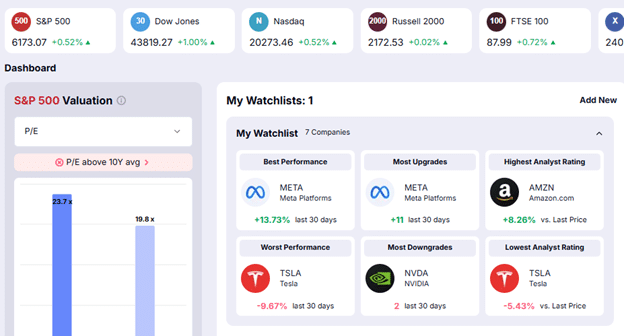

The dashboard exhibits you the efficiency of the foremost indices and that of your favourite shares in your watchlist:

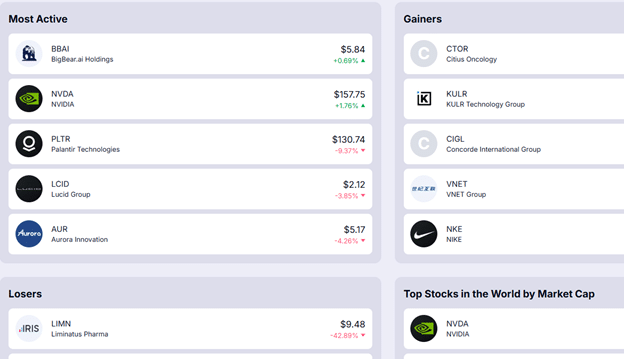

The Discover Shares part shows inventory lists, together with high gainers, high losers, and most energetic shares, amongst others.

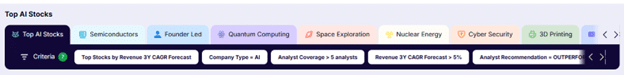

The Concepts part helps you discover commerce concepts for shares in varied classes utilizing pre-built queries of basic knowledge:

Should you discover some shares that you just like, you’ll be able to add them to your watchlist.

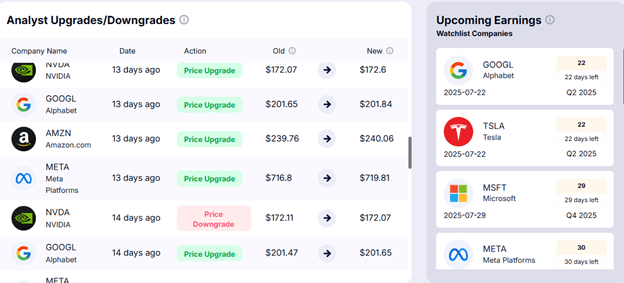

The Watchlist part will inform you if there are any analyst upgrades/downgrades in your watched shares and inform you what number of days until their subsequent earnings announcement.

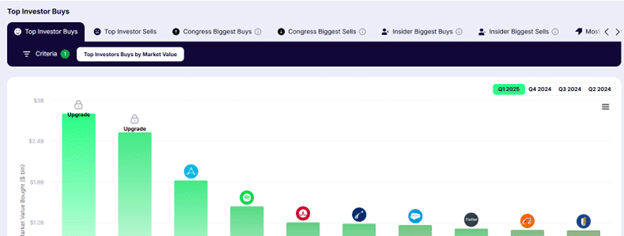

The Trending part tells you what high buyers, congresspersons, and insiders are shopping for or promoting,

There’s a part in Gainify that tracks the portfolios of high buyers.

They embrace well-known buyers corresponding to:

Warren Buffett of Berkshire Hathaway

Cathie Wooden of Ark Funding Administration

James Simons of Renaissance Applied sciences

Ray Dalio of Bridgewater Advisors

Al Gore of Era Funding Administration

Invoice Gates of the Invoice and Melinda Gates Basis Belief

George Soros of Soros Fund Administration

Paul Tudor Jones of Tudor Funding Company

And plenty of others

With all these options – most of which can be found with the free pricing plan – an investor can generate some good commerce concepts and use the screener to determine longer-term holdings based mostly on quite a lot of basic knowledge.

Many would additionally discover the charting of basic knowledge fairly helpful.

We hope you loved this text on Gainify.io.

You probably have any questions, ship an e-mail or depart a remark beneath.

Commerce protected!

Disclaimer: The knowledge above is for academic functions solely and shouldn’t be handled as funding recommendation. The technique introduced wouldn’t be appropriate for buyers who aren’t acquainted with alternate traded choices. Any readers on this technique ought to do their very own analysis and search recommendation from a licensed monetary adviser.