Printed on January seventh, 2026 by Bob Ciura

Excessive dividend shares are engaging for earnings traders. With the S&P 500 common yield at simply 1.1%, it has gotten more durable to seek out appropriate yields within the inventory market.

And with the Federal Reserve slicing rates of interest, earnings yields on financial savings accounts and CDs are more likely to decline as effectively.

Luckily, there are nonetheless loads of high quality excessive dividend shares to select from. With that in thoughts, we now have created a free listing of over 200 excessive dividend shares with dividend yields above 5%.

You’ll be able to obtain your copy of the excessive dividend shares listing beneath:

Nevertheless, traders ought to do not forget that extraordinarily excessive yields might be deceiving. There are numerous examples of excessive dividend shares decreasing or eliminating their dividends.

In consequence, traders ought to search for excessive dividend shares that even have sustainable payouts. This implies traders will obtain the advantages of excessive earnings for a few years.

The ten excessive dividend shares beneath have been discovered based mostly on a qualitative evaluation of their particular person enterprise fashions and future progress prospects.

Desk of Contents

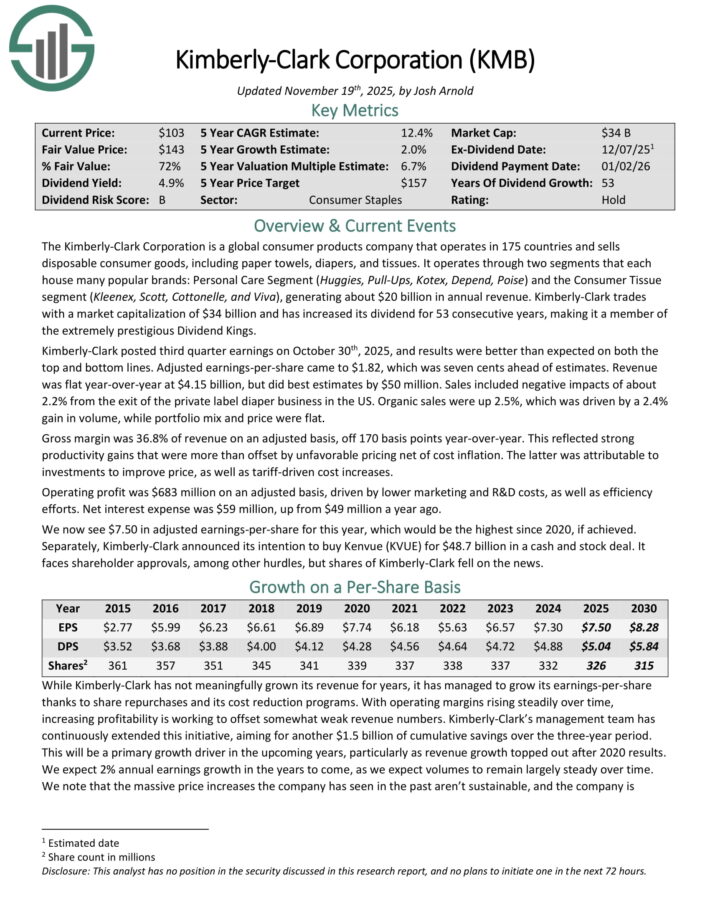

Excessive Dividend Inventory For The Lengthy Run #10: Kimberly-Clark Corp. (KMB)

The Kimberly-Clark Company is a world client merchandise firm that operates in 175 nations and sells disposable client items, together with paper towels, diapers, and tissues.

It operates by way of two segments that every home many fashionable manufacturers: Private Care Phase (Huggies, Pull-Ups, Kotex, Rely, Poise) and the Client Tissue phase (Kleenex, Scott, Cottonelle, and Viva), producing about $20 billion in annual income.

Kimberly-Clark has elevated its dividend for 53 consecutive years, making it a member of the Dividend Kings.

Kimberly-Clark posted third quarter earnings on October thirtieth, 2025, and outcomes have been higher than anticipated on each the highest and backside traces. Adjusted earnings-per-share got here to $1.82, which was seven cents forward of estimates.

Income was flat year-over-year at $4.15 billion, however did finest estimates by $50 million. Gross sales included adverse impacts of about 2.2% from the exit of the personal label diaper enterprise within the US.

Natural gross sales have been up 2.5%, which was pushed by a 2.4% acquire in quantity, whereas portfolio combine and value have been flat.

On November third, 2025, Kimberly-Clark agreed to buy Kenvue (KVUE) in a money and inventory deal valued at $48.7 billion. It will make the brand new firm a number one well being and wellness firm.

Click on right here to obtain our most up-to-date Positive Evaluation report on KMB (preview of web page 1 of three proven beneath):

Excessive Dividend Inventory For The Lengthy Run #9: Hormel Meals Corp. (HRL)

Hormel Meals was based in 1891 in Minnesota. Since that point, the corporate has grown right into a juggernaut within the meals merchandise business with about $12 billion in annual income.

The corporate sells its merchandise in 80 nations worldwide, and its manufacturers embrace Skippy, SPAM, Applegate, Justin’s, and greater than 30 others.

As well as, Hormel is a member of the Dividend Kings, having elevated its dividend for 60 consecutive years.

Hormel posted fourth quarter and full-year earnings on December 4th, 2025. The corporate noticed 32 cents in adjusted earnings-per-share for the quarter, beating estimates by two cents.

Income was up 1.6% year-over-year and missed estimates by $30 million, coming in at $3.19 billion.

Hormel’s fundamental aggressive benefit is its ~40 merchandise which might be both #1 or #2 of their class. Hormel has brandsthat are confirmed, and that management place is troublesome for opponents to supplant.

Click on right here to obtain our most up-to-date Positive Evaluation report on HRL (preview of web page 1 of three proven beneath):

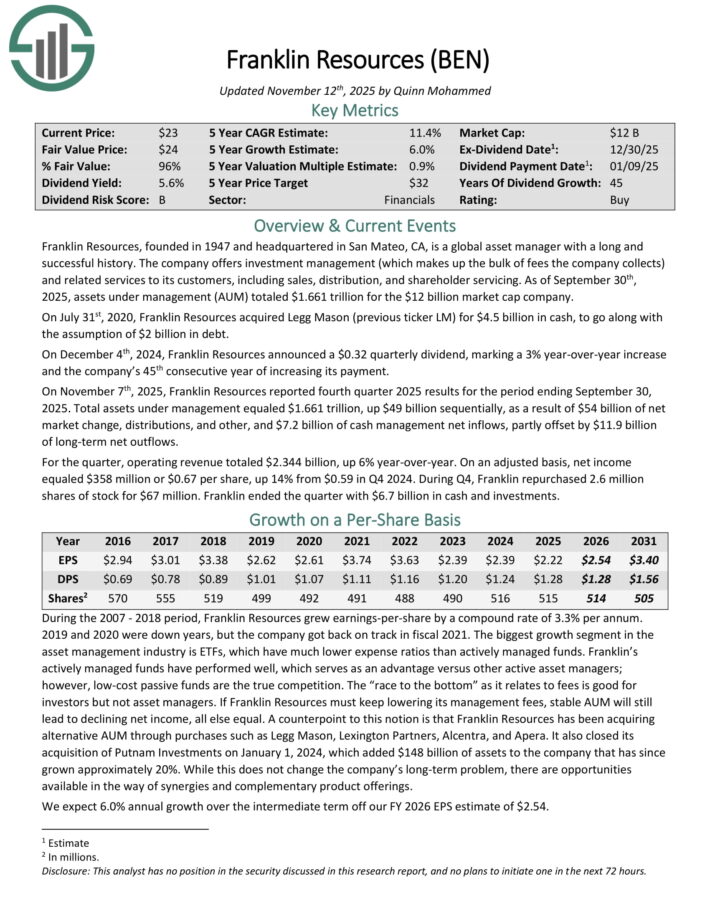

Excessive Dividend Inventory For The Lengthy Run #8: Franklin Sources (BEN)

Franklin Sources gives funding administration (which makes up the majority of charges the corporate collects) and associated providers to its clients, together with gross sales, distribution, and shareholder servicing.

As of September thirtieth, 2025, property below administration (AUM) totaled $1.661 trillion. On July thirty first, 2020, Franklin Sources acquired Legg Mason (earlier ticker LM) for $4.5 billion in money, to go together with the idea of $2 billion in debt.

On November seventh, 2025, Franklin Sources reported fourth quarter 2025 outcomes. Whole property below administration equaled $1.661 trillion, up $49 billion sequentially, on account of $54 billion of internet market change, distributions, and different, and $7.2 billion of money administration internet inflows, partly offset by $11.9 billion of long-term internet outflows.

For the quarter, working income totaled $2.344 billion, up 6% year-over-year. On an adjusted foundation, internet earnings equaled $358 million or $0.67 per share, up 14% from $0.59 in This autumn 2024. Throughout This autumn, Franklin repurchased 2.6 million shares of inventory for $67 million.

Click on right here to obtain our most up-to-date Positive Evaluation report on BEN (preview of web page 1 of three proven beneath):

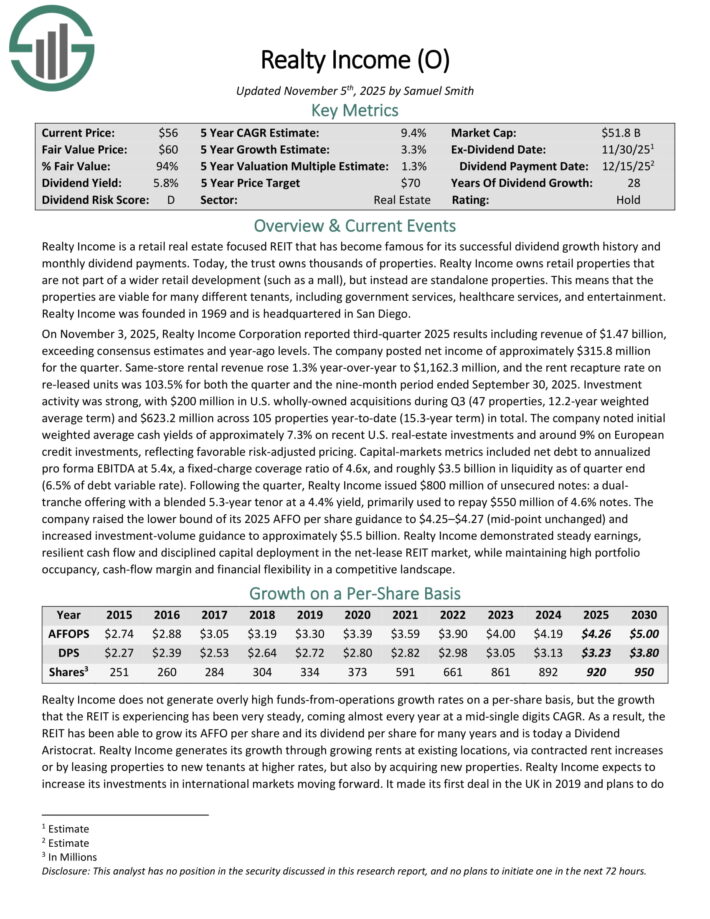

Excessive Dividend Inventory For The Lengthy Run #7: Realty Revenue (O)

Realty Revenue is a retail actual property targeted REIT that has grow to be well-known for its profitable dividend progress historical past and month-to-month dividend funds.

Realty Revenue owns retail properties that aren’t a part of a wider retail improvement (comparable to a mall), however as a substitute are standalone properties. Which means that the properties are viable for a lot of totally different tenants, together with authorities providers, healthcare providers, and leisure.

On November 3, 2025, Realty Revenue Company reported third-quarter 2025 outcomes together with income of $1.47 billion, exceeding consensus estimates and year-ago ranges.

The corporate posted internet earnings of roughly $315.8 million for the quarter. Identical-store rental income rose 1.3% year-over-year to $1,162.3 million, and the lease recapture price on re-leased items was 103.5% for each the quarter and the nine-month interval ended September 30, 2025.

Funding exercise was robust, with $200 million in U.S. wholly-owned acquisitions throughout Q3 (47 properties, 12.2-year weighted common time period) and $623.2 million throughout 105 properties year-to-date (15.3-year time period) in complete.

Realty Revenue’s most essential aggressive benefit is its world-class administration workforce that has efficiently guided the belief previously.

It has elevated its dividend for 28 consecutive years, and is on the listing of Dividend Aristocrats.

Click on right here to obtain our most up-to-date Positive Evaluation report on Realty Revenue (preview of web page 1 of three proven beneath):

Excessive Dividend Inventory For The Lengthy Run #6: Enbridge Inc. (ENB)

Enbridge is a Canadian oil & gasoline firm that operates the next segments: Liquids Pipelines, Fuel Distributions, Power Companies, Fuel Transmission & Midstream, and Inexperienced Energy & Transmission.

Enbridge reported its third quarter earnings ends in November. The corporate generated revenues of CAD$14.6 billion in the course of the interval, which was down 2% in comparison with the earlier yr’s quarter, and which pencils out to US$10.5 billion.

Through the quarter, Enbridge grew its adjusted EBITDA by 2% yr over yr, to CAD$4.3 billion, up from CAD$4.2 billion in the course of the earlier yr’s quarter.

Through the third quarter, Enbridge was in a position to generate distributable money flows of CAD$2.6 billion, which equates to US$1.9 billion, or US$0.87 on a per-share foundation.

Whereas distributable money flows in 2024 have been down in US {Dollars}, that was attributable to foreign money price actions – outcomes have been increased in Canadian {Dollars}. The identical holds true for Enbridge’s dividend, which was elevated by 3% in Canadian {Dollars}, to CAD$0.9424 initially of the present yr.

Enbridge is forecasting distributable money flows in a spread of CAD$5.50 – CAD$5.90 per share for the present yr. Utilizing present change charges, this equates to USD$4.08 on the midpoint of the steering vary, which might be up 6% versus 2024.

Click on right here to obtain our most up-to-date Positive Evaluation report on ENB (preview of web page 1 of three proven beneath):

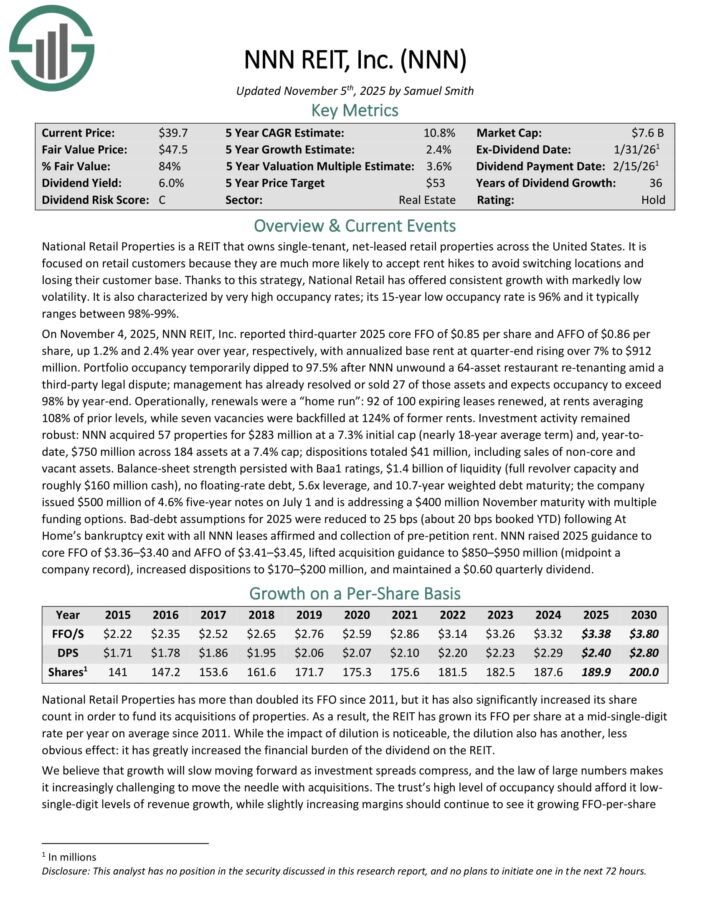

Excessive Dividend Inventory For The Lengthy Run #5: NNN REIT (NNN)

Nationwide Retail Properties is a REIT that owns single-tenant, net-leased retail properties throughout the US.

Nationwide Retail has provided constant progress with markedly low volatility. Additionally it is characterised by very excessive occupancy charges; its 15-year low occupancy price is 96% and it usually ranges between 98%-99%.

On November 4, 2025, NNN REIT reported third-quarter 2025 core FFO of $0.85 per share and AFFO of $0.86 per share, up 1.2% and a couple of.4% yr over yr, respectively, with annualized base lease at quarter-end rising over 7% to $912 million.

Portfolio occupancy briefly dipped to 97.5% after NNN unwound a 64-asset restaurant re-tenanting amidthird-party authorized dispute; administration has already resolved or offered 27 of these property and expects occupancy to exceed 98% by year-end.

Operationally, renewals have been a “residence run”: 92 of 100 expiring leases renewed, at rents averaging 108% of prior ranges, whereas seven vacancies have been back-filled at 124% of former rents.

Funding exercise remained strong: NNN acquired 57 properties for $283 million at a 7.3% preliminary cap (almost 18-year common time period) and, year-to-date, $750 million throughout 184 property at a 7.4% cap.

Click on right here to obtain our most up-to-date Positive Evaluation report on NNN (preview of web page 1 of three proven beneath):

Excessive Dividend Inventory For The Lengthy Run #4: Verizon Communications (VZ)

Verizon Communications is without doubt one of the largest wi-fi carriers within the nation. Wi-fi contributes three-quarters of all revenues, and broadband and cable providers account for a few quarter of gross sales. The corporate’s community covers ~300 million folks and 98% of the U.S.

On September fifth, 2025, Verizon elevated its quarterly dividend 1.8% to $0.69 for the November third, 2025 fee, extending the corporate’s dividend progress streak to 21 consecutive years.

On October twenty ninth, 2025, Verizon reported third quarter outcomes for the interval ending September thirtieth, 2025. For the quarter, income grew 1.5% to $33.8 billion, however this was $470 million beneath estimates. Adjusted earnings-per-share of $1.21 in contrast favorably to $1.19 within the prior yr and was $0.02 higher than anticipated.

For the quarter, Verizon Client had postpaid telephone internet losses of seven,000, which compares to internet additions of 18,000 in the identical interval of final yr. Nevertheless, wi-fi retail core pay as you go internet additions grew 47,000, marking the fifth consecutive quarter of optimistic subscriber progress.

Client wi-fi retail postpaid telephone churn price stays low at 0.91%. The Client phase grew 2.9% to $26.1 billion whereas client wi-fi service income elevated 2.4% to $17.4 billion. Client wi-fi postpaid common income per account grew 2.0% to $147.91.

Broadband totaled 306K internet new clients in the course of the interval, which marks 13 consecutive quarters of not less than 300K internet provides. The whole mounted wi-fi buyer base is sort of 5.4 million. Verizon goals to have 8 to 9 million mounted wi-fi subscribers by 2028.

Wi-fi retail postpaid internet additions have been 110K for the interval. Free money circulate was $15.8 billion for the primary three quarters of the yr, up from $14.5 billion for a similar interval in 2024.

Verizon reaffirmed prior steering for 2025 as effectively, with the corporate nonetheless anticipating wi-fi service income to develop 2% to 2.8% for the yr. Verizon can be anticipated to supply adjusted EPS progress in a spread of 1% to three%.

Click on right here to obtain our most up-to-date Positive Evaluation report on VZ (preview of web page 1 of three proven beneath):

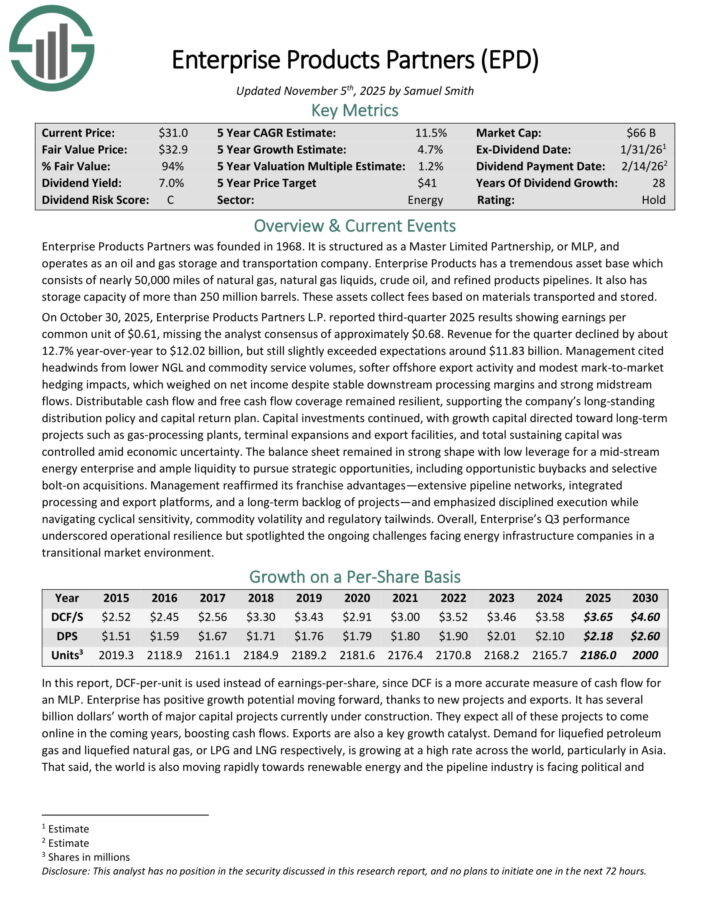

Excessive Dividend Inventory For The Lengthy Run #3: Enterprise Merchandise Companions LP (EPD)

Enterprise Merchandise Companions was based in 1968. It’s structured as a Grasp Restricted Partnership, or MLP, and operates as an oil and gasoline storage and transportation firm.

Enterprise Merchandise has an amazing asset base which consists of almost 50,000 miles of pure gasoline, pure gasoline liquids, crude oil, and refined merchandise pipelines. It additionally has storage capability of greater than 250 million barrels. These property accumulate charges based mostly on supplies transported and saved.

On October 30, 2025, Enterprise Merchandise Companions L.P. reported third-quarter 2025 outcomes exhibiting earnings per widespread unit of $0.61, lacking the analyst consensus of roughly $0.68. Income for the quarter declined by about 12.7% year-over-year to $12.02 billion, however nonetheless barely exceeded expectations round $11.83 billion.

Administration cited headwinds from decrease NGL and commodity service volumes, softer offshore export exercise and modest mark-to-market hedging impacts, which weighed on internet earnings regardless of secure downstream processing margins and powerful midstream flows.

Click on right here to obtain our most up-to-date Positive Evaluation report on EPD (preview of web page 1 of three proven beneath):

Excessive Dividend Inventory For The Lengthy Run #2: Common Well being Realty Revenue Belief (UHT)

Common Well being Realty Revenue Belief operates as an actual property funding belief (REIT), specializing within the healthcare sector. The belief owns healthcare and human service-related services.

Its property portfolio contains acute care hospitals, medical workplace buildings, rehabilitation hospitals, behavioral healthcare services, sub-acute care services and childcare facilities. Common Well being’s portfolio consists of 76 properties positioned in 21 states.

On October 27, 2025, Common Well being Realty Revenue Belief (UHT) reported third quarter 2025 internet earnings of $4.0 million, or $0.29 per diluted share, unchanged from the identical quarter in 2024.

Outcomes included a one-time $275,000 acquire ($0.02 per share) from a settlement and launch settlement associated to one in all its medical workplace buildings, partially offset by a $256,000 lower in combination property earnings, which included $900,000 of nonrecurring depreciation expense.

Funds from operations (FFO) rose to $12.2 million, or $0.88 per diluted share, up from $11.3 million, or $0.82 per share, within the prior yr interval.

Click on right here to obtain our most up-to-date Positive Evaluation report on UHT (preview of web page 1 of three proven beneath):

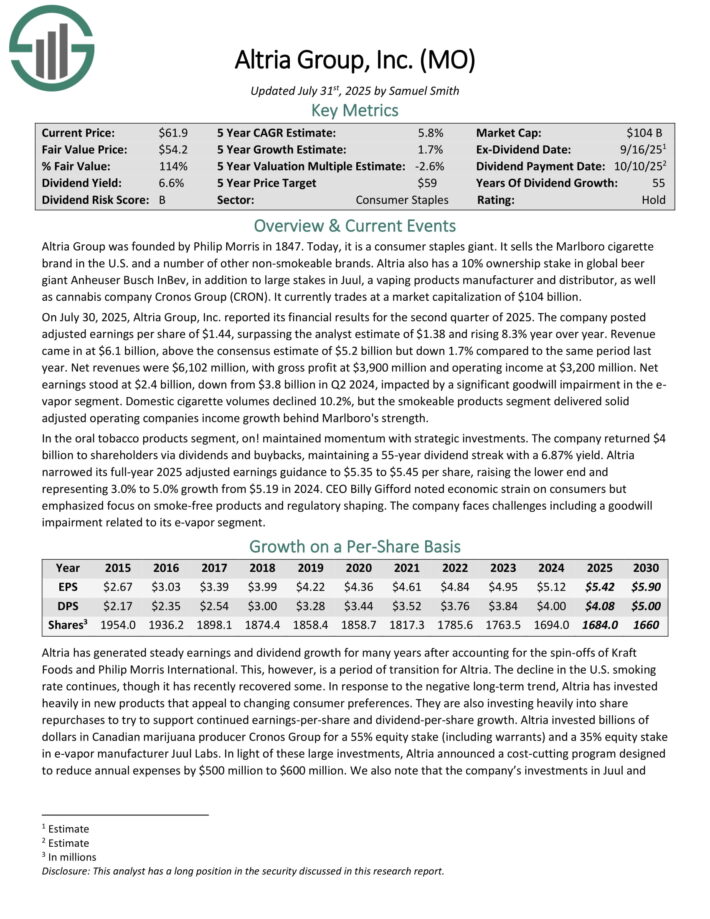

Excessive Dividend Inventory For The Lengthy Run #1: Altria Group (MO)

Altria is a tobacco inventory that sells cigarettes, chewing tobacco, cigars, e-cigarettes, and extra below a wide range of manufacturers, together with Marlboro, Skoal, and Copenhagen, amongst others.

The decline within the U.S. smoking price continues, although it has lately recovered some. In response to the adverse long-term pattern, Altria has invested closely in new merchandise that attraction to altering client preferences.

Additionally it is investing closely into share repurchases to attempt to help continued earnings-per-share and dividend-per-share progress.

Altria invested billions of {dollars} in Canadian marijuana producer Cronos Group for a 55% fairness stake (together with warrants) and a 35% fairness stake in e-vapor producer Juul Labs.

Altria enjoys robust manufacturers throughout its product portfolio, together with the No. 1 cigarette model. In consequence, it has pricing energy and model loyalty.

As well as, tobacco firms get pleasure from low manufacturing and distribution prices, due to its economies of scale.

This has fueled Altria’s great dividend progress, enabling it to boast a formidable dividend progress streak of 55 years.

Click on right here to obtain our most up-to-date Positive Evaluation report on Altria (preview of web page 1 of three proven beneath):

Extra Studying

If you’re interested by discovering high-quality dividend progress shares and/or different high-yield securities and earnings securities, the next Positive Dividend assets will likely be helpful:

Excessive-Yield Particular person Safety Analysis

Thanks for studying this text. Please ship any suggestions, corrections, or inquiries to help@suredividend.com.