Merchants,

Completely happy New 12 months!

I’ll be easing again into issues this week, after a quick trip.

Now, with out additional ado, let’s get proper into this week’s watchlist:

Blow-Off in SIDU: SIDU’s reclaim on Friday was the perfect situation. Bearish sentiment has been overwhelming for this small-cap, pushed by basic and dilution biases. Nevertheless it’s stored trapping shorts and ticking alongside. I’m short-biased, however I’ve but to brief it. To represent an A+ brief, I have to see this blowout, cussed shorts, after which fail to observe by thereafter.

Particularly, I’d prefer to see one other day or two of hole and continuation, together with vary growth—alternatively, a big hole and a blow-off within the morning earlier than failing to observe by, or an FRD. As soon as the highest is in, I’ll deal with shorting lower-highs / failed re-tests of prior resistance, concentrating on a transfer again towards $3, with a core place in opposition to the prior day’s excessive or multi-day VWAP reclaim.

*Please word that the costs and different statistics on this web page are hypothetical, and don’t replicate the impression, if any, of sure market elements akin to liquidity, slippage and commissions.

Continuation in Area/Protection Shares: A number of names stood out final week for his or her relative energy and bullish technical positioning.

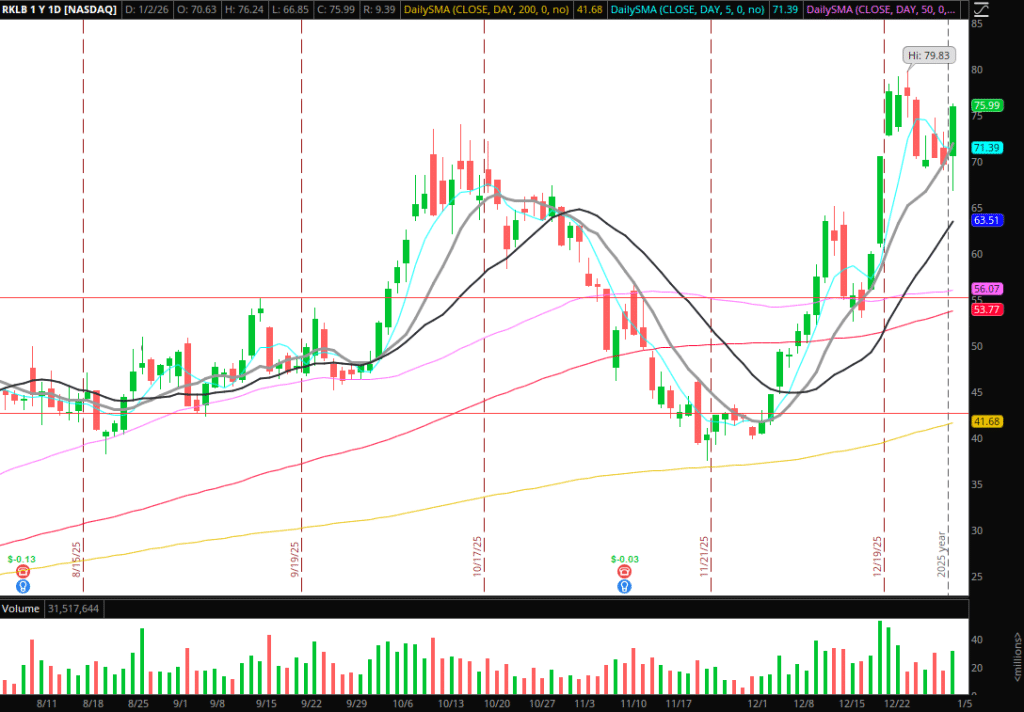

Rocket Lab (RKLB) is likely one of the standout performers. On the next timeframe, it held key assist close to $70 within the short-term, which was prior resistance from October. If a dip into the multi-day VWAP companies, or if this bases above Friday’s excessive, I’d look to get lengthy for a momentum lengthy commerce by $80.

*Please word that the costs and different statistics on this web page are hypothetical, and don’t replicate the impression, if any, of sure market elements akin to liquidity, slippage and commissions.

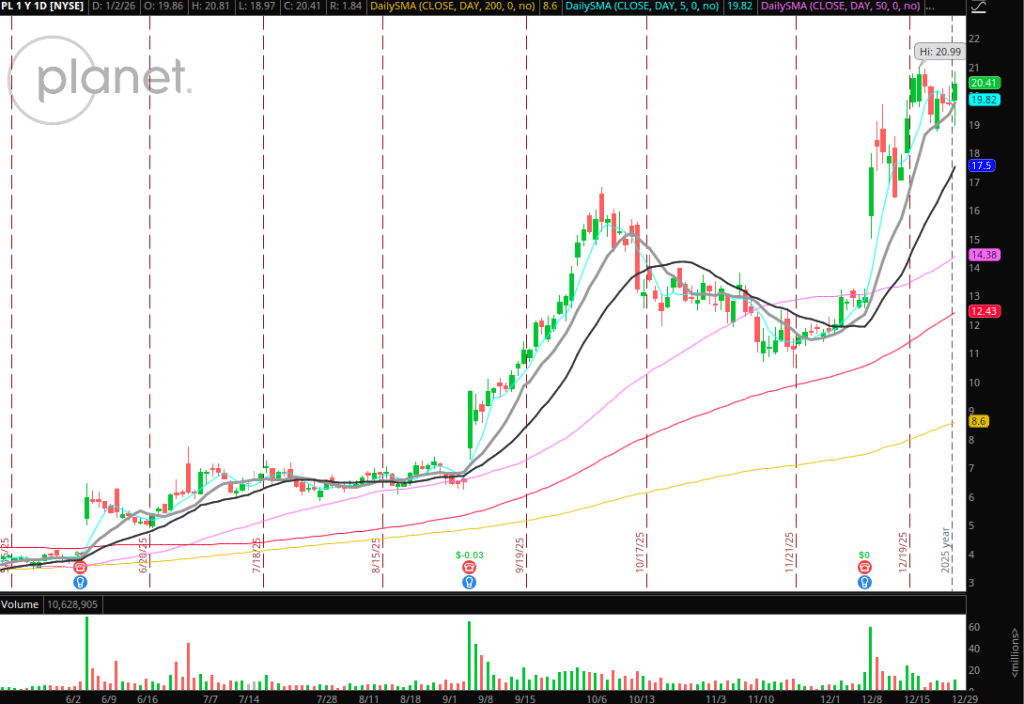

PL is one other title inside the theme that’s holding up exceptionally effectively. Equally, it’s discovering assist and constructing a base close to prior resistance round $20. I’ll have an interest to place lengthy if the relative energy continues and the inventory can push above Friday’s excessive. My cease could be LOD for a multi-day continuation lengthy swing.

*Please word that the costs and different statistics on this web page are hypothetical, and don’t replicate the impression, if any, of sure market elements akin to liquidity, slippage and commissions.

Different names inside the sector that I’ll proceed to watch: ASTS, RDW, LUNR.

Uptrend Improvement in BABA: It’s not but clear how the information re: Venezuela will impression the market this week, or whether or not it might negatively impression Chinese language names. However because it pertains to current energy (BIDU breakout) in rising markets and Chinese language shares, BABA is trying nice. Particularly, I like how the inventory lately pulled again towards prior resistance on the upper timeframe close to $148 and caught a bid. Subsequent up could be a maintain above Friday’s excessive / consolidation breakout after a number of days of consolidation/breakout above $160 and maintain. I’d path in opposition to the prior day’s low if it units up.

*Please word that the costs and different statistics on this web page are hypothetical, and don’t replicate the impression, if any, of sure market elements akin to liquidity, slippage and commissions.

Extra Names on Watch:

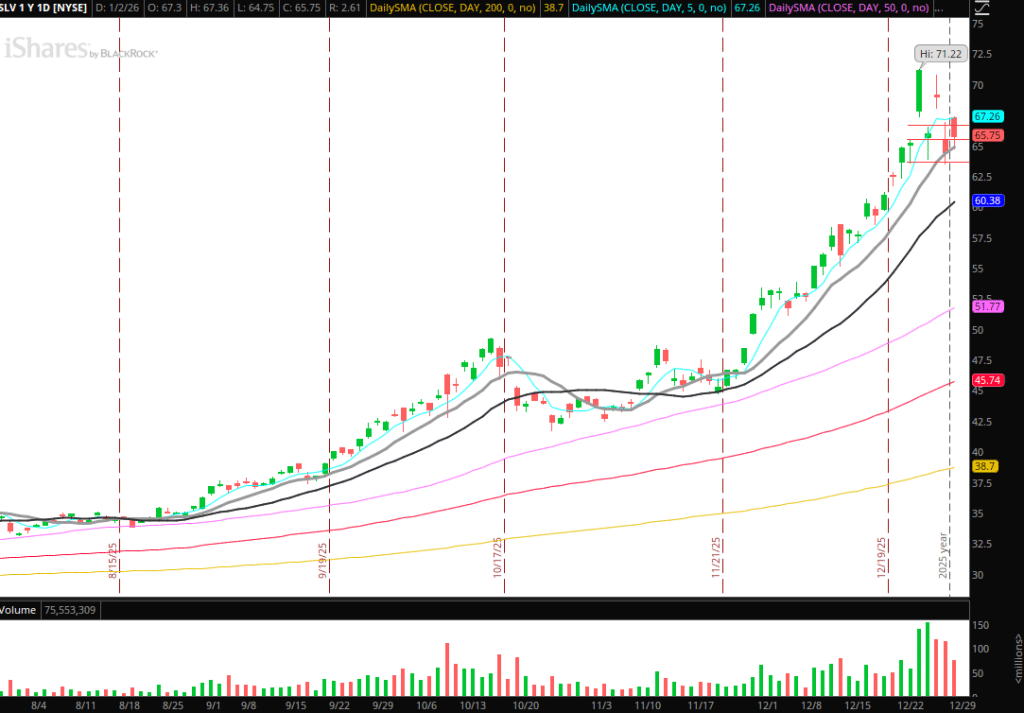

SLV Momentum Shift: Tight consolidation after the A+ parabolic commerce in SLV. Vital assist has now emerged close to the 10-day SMA and $63.50 zone. I’ll be intently watching that space to present method and place brief. Alternatively, watching $70 in SLV for a possible failed follow-through brief or momentum increased.

*Please word that the costs and different statistics on this web page are hypothetical, and don’t replicate the impression, if any, of sure market elements akin to liquidity, slippage and commissions.

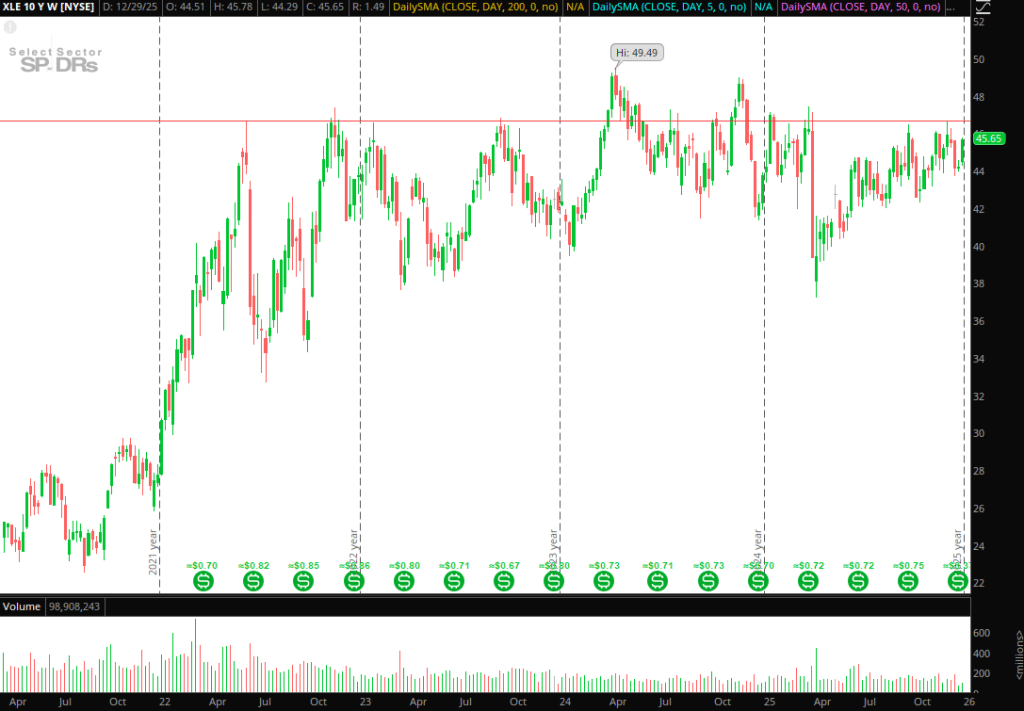

XLE – Power is Coiled: The power sector has been range-bound for fairly a while now on the next timeframe. If the information over the weekend catalyzes the trade within the coming days or perhaps weeks, I need to be prepared. A number of names of curiosity to me: XLE (sector ETF), OXY, COP, XOM.

*Please word that the costs and different statistics on this web page are hypothetical, and don’t replicate the impression, if any, of sure market elements akin to liquidity, slippage and commissions.

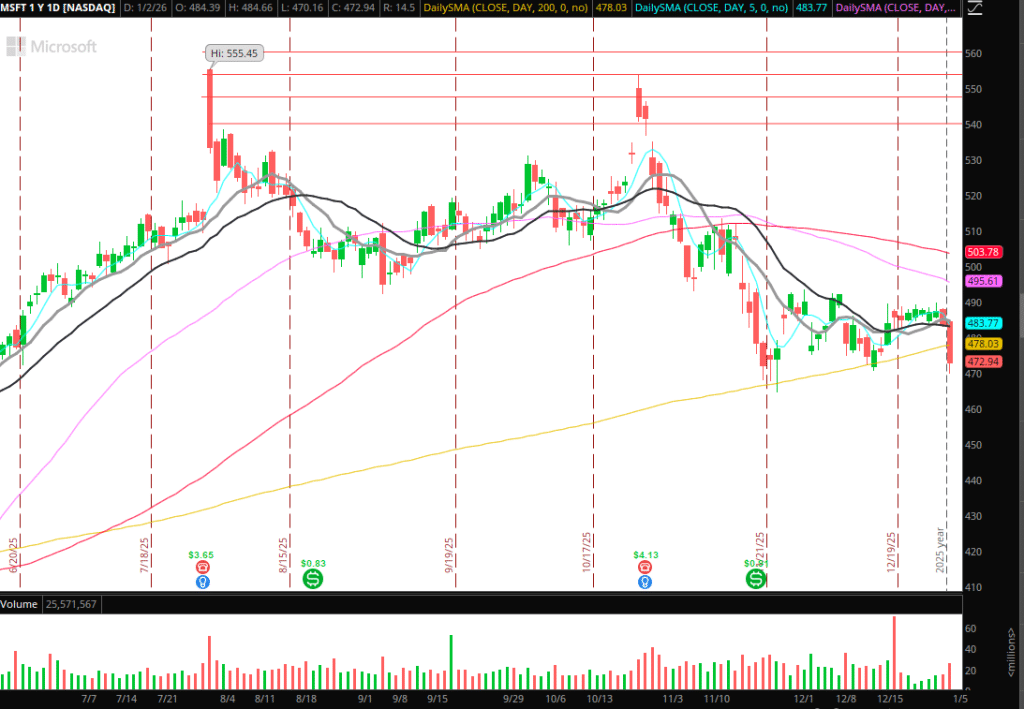

MSFT: Bearish look right here after giving solution to the 200-day SMA on Friday and shutting close to lows. On look ahead to sustained relative weak point and momentum brief scalps sub Friday’s low and better timeframe assist.

*Please word that the costs and different statistics on this web page are hypothetical, and don’t replicate the impression, if any, of sure market elements akin to liquidity, slippage and commissions.

Get the SMB Swing Buying and selling Analysis Template Right here!

Vital Disclosures