Merchants,

I hope you’re all having fun with your vacation season!

In case you’re like me, the vacation festivities have been minimize quick considerably as a result of unprecedented motion in Silver. It’s historical past within the making. Whereas I’ve taken a while off, I used to be again at my desk on Friday and plan to be current all through subsequent week to the motion.

So, with that being stated, let’s get proper into this week’s watchlist, which, for me, is totally dominated by Silver.

Silver’s Gone Parabolic…

*Please be aware that the costs and different statistics on this web page are hypothetical, and don’t mirror the affect, if any, of sure market components corresponding to liquidity, slippage and commissions.

$SLV, the iShares Silver Belief, was up 20% final week, 53% on the month, and 170% YTD. The RSI is now nearing historic ranges close to $86, as each vary and quantity have expanded. From the prior day’s shut, SLV traded virtually 3x ATR on Friday, and over 3x common quantity. Not dangerous for a Friday following Christmas.

Earlier than I get into my plan, listed here are some attention-grabbing factors on the latest motion. China just lately introduced a government-issued export license on silver, starting on January 1 – a transfer that might additional tighten the provision of the already-strained commodity globally.

CME has simply raised margin necessities on treasured metals, together with Silver, starting December 29 (Monday). That particularly issues for leveraged futures merchants, as they may very well be compelled to liquidate if undercapitalized.

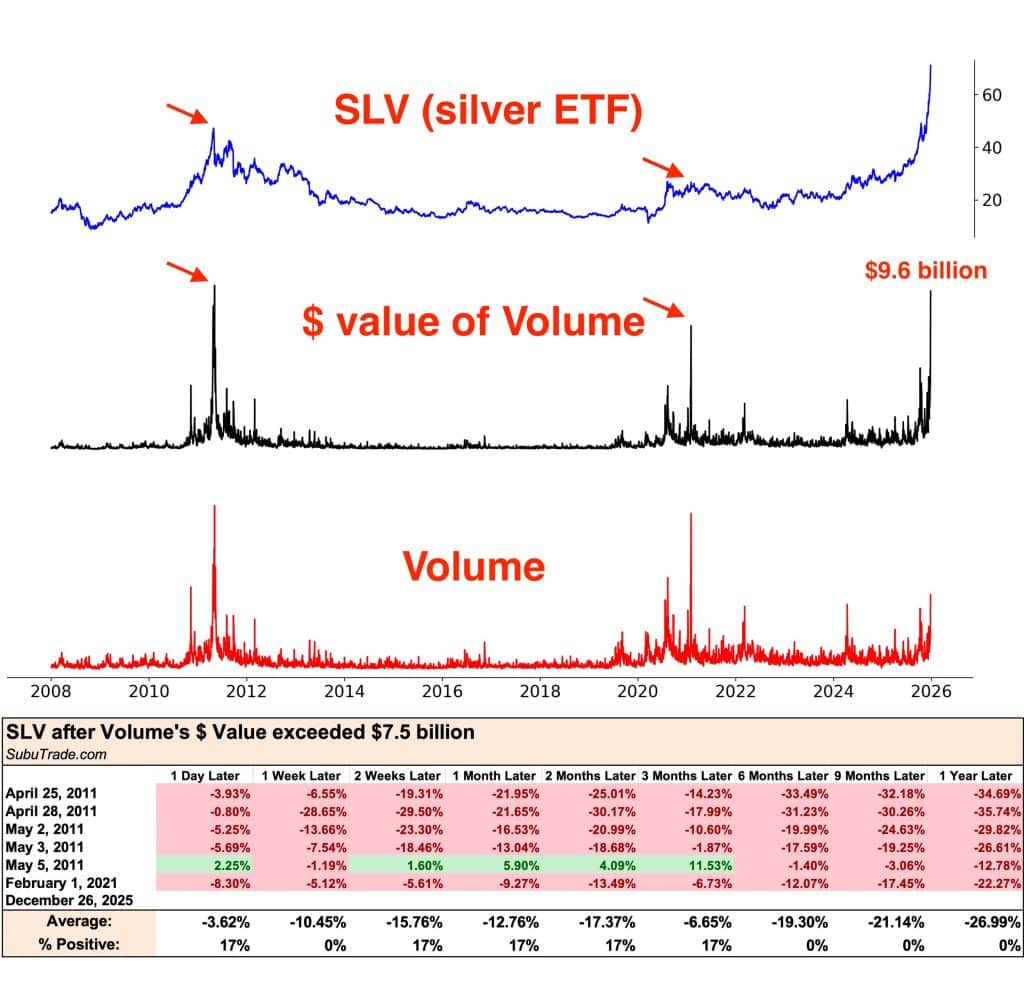

$SLV ETF quantity surged on Friday to ranges solely seen twice earlier than. Final time that occurred, with quantity $ higher than $7.5 billion on common, SLV was detrimental 3.6% the next day, and virtually 10.5% every week later.

(Under graphic from subutrade on X)

*Please be aware that the costs and different statistics on this web page are hypothetical, and don’t mirror the affect, if any, of sure market components corresponding to liquidity, slippage and commissions.

However may this time be completely different? Might it even be that the motion on Friday was dominated by market makers delta-hedging? And will the blow-off high be on Sunday night/Monday morning, with weekend euphoria and FOMO, main retail to chase the thrill earlier than actuality units in?

A+ Imply Reversion in Silver

I consider the short-term high is shut, when it comes to timing. And I’m ready to be quick this week and might be stalking SLV for a personality change Monday – Tuesday. That stated, it would solely materialize and ensure up 5% + from Friday’s shut. I consider it’s close to, however it’s a idiot’s errand to measurement quick forward of time. I’ve the thought; now I want the setup and price-action affirmation.

So, what is going to my autos of selection be for taking part in a imply reversion? I’ll give attention to $SLV and $ZSL.

*Please be aware that the costs and different statistics on this web page are hypothetical, and don’t mirror the affect, if any, of sure market components corresponding to liquidity, slippage and commissions.

The perfect A+ setup could be a gap-up Sunday futes into Monday am, adopted by a blow-off / failed follow-through. In that state of affairs, the place SLV re-tests resistance / or decrease highs and fails, I’ll look to provoke a starter quick in opposition to the pivot excessive. The change in character and risk-on for me could be a maintain beneath the intraday VWAP and decrease lows, or a consolidation breakdown to measurement in. After all, if this reclaims VWAP or holds firmly above, I cannot be quick with any significant threat. The secret is to attend for a shift in momentum – decrease highs / maintain sub LOD or VWAP / trendline break/blow-off high, and so forth. I plan to quick as soon as I discover a shift in momentum, with A+ measurement, closing over 50% into intraday targets, and holding a core as a multi-day swing commerce.

Alternatively, we get a FRD setup in Silver, and I’ll commerce it accordingly…as outlined many instances for the FRD setup in earlier watchlists.

And lastly, what would my lofty targets be for the core place that I plan on holding quick as a swing commerce be? Mid to low $60s could be ultimate. I’ll look to take care of a core place from day 1, focusing on a reversion towards the 5-day and 10-day SMAs. After all, any basing motion and better low affirmation on the every day will end in closing the commerce forward of targets.

Keep in mind, having an thought is one factor; executing effectively is one other.

Get the SMB Swing Buying and selling Analysis Template Right here!

Essential Disclosures