Printed on December ninth, 2025 by Bob Ciura

There’s a magnificence to simplicity.

And investing doesn’t get a lot easier than shopping for and holding prime quality dividend development shares for the long term.

Lengthy-term dividend development inventory investing combines the first purpose most individuals make investments – passive earnings – with the tried-and-true knowledge that underlies profitable investing.

For a corporation to pay rising dividends year-after-year for many years, it should have favorable long-term financial traits and a fairly competent and trustworthy administration staff.

In consequence, we advocate earnings traders buy excessive dividend shares.

You possibly can obtain your free full checklist of all excessive dividend shares (together with vital monetary metrics equivalent to dividend yield and payout ratio) by clicking on the hyperlink beneath:

Nonetheless, not all high-yield shares make equally good investments.

This text will talk about 10 excessive dividend shares with yields above 5%, that even have lengthy histories of elevating their dividends every year, even throughout recessions.

These 10 dividend shares have all raised their payouts for not less than 25 consecutive years. This implies they’ve demonstrated the underlying enterprise energy to proceed elevating dividends for the long term.

Desk Of Contents

The ten excessive dividend shares are listed by payout ratio, in ascending order.

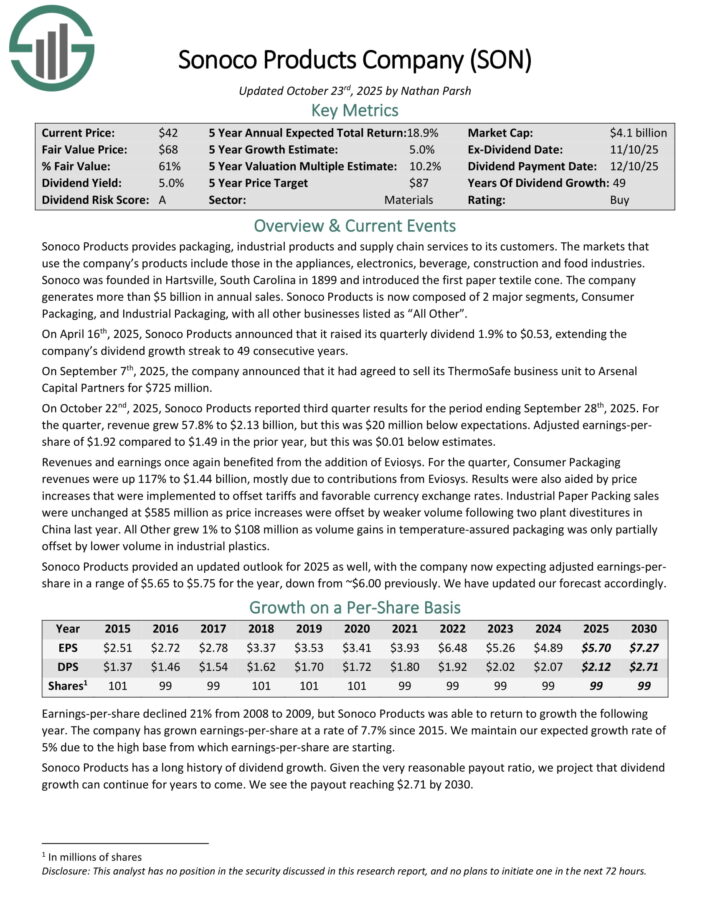

Excessive Dividend Inventory For The Lengthy Run: Sonoco Merchandise (SON)

Sonoco Merchandise gives packaging, industrial merchandise and provide chain providers to its prospects. The markets that use the corporate’s merchandise embrace these within the home equipment, electronics, beverage, building and meals industries.

The corporate generates greater than $5 billion in annual gross sales. Sonoco Merchandise is now composed of two main segments, Shopper Packaging, and Industrial Packaging, with all different companies listed as “All Different”.

On October twenty second, 2025, Sonoco Merchandise reported third quarter outcomes for the interval ending September twenty eighth, 2025. For the quarter, income grew 57.8% to $2.13 billion, however this was $20 million beneath expectations. Adjusted earnings-per-share of $1.92 in comparison with $1.49 within the prior 12 months, however this was $0.01 beneath estimates.

Revenues and earnings as soon as once more benefited from the addition of Eviosys. For the quarter, Shopper Packaging revenues have been up 117% to $1.44 billion, largely resulting from contributions from Eviosys. Outcomes have been additionally aided by value will increase that have been applied to offset tariffs and favorable forex alternate charges.

Industrial Paper Packing gross sales have been unchanged at $585 million as value will increase have been offset by weaker quantity following two plant divestitures in China final 12 months. All Different grew 1% to $108 million as quantity positive factors in temperature-assured packaging was solely partially offset by decrease quantity in industrial plastics.

Sonoco Merchandise supplied an up to date outlook for 2025 as effectively, with the corporate now anticipating adjusted earnings-per-share in a variety of $5.65 to $5.75 for the 12 months, down from ~$6.00 beforehand.

Click on right here to obtain our most up-to-date Certain Evaluation report on SON (preview of web page 1 of three proven beneath):

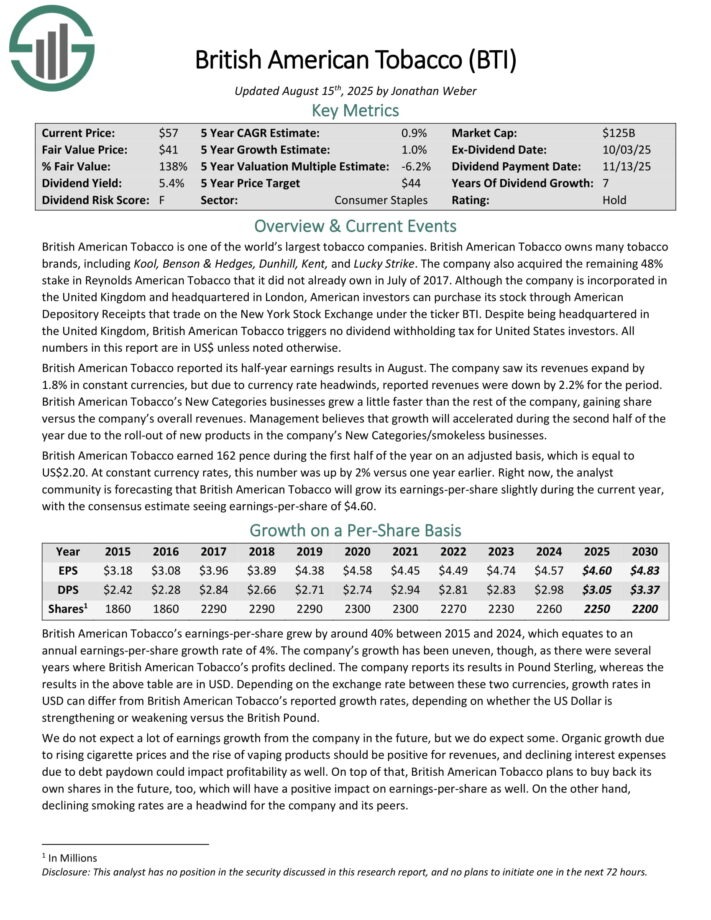

Excessive Dividend Inventory For The Lengthy Run: British American Tobacco plc (BTI)

British American Tobacco is likely one of the largest tobacco firms on this planet. It owns the next tobacco manufacturers, amongst others: Kool, Benson & Hedges, Dunhill, Kent, and Fortunate Strike.

British American Tobacco reported its half-year earnings leads to August. The corporate noticed its revenues increase by 1.8% in fixed currencies, however resulting from forex charge headwinds, reported revenues have been down by 2.2% for the interval.

British American Tobacco’s New Classes companies grew a bit of sooner than the remainder of the corporate, gaining share versus the corporate’s total revenues. Administration believes that development will accelerated throughout the second half of the 12 months because of the roll-out of recent merchandise within the firm’s New Classes/smokeless companies.

British American Tobacco earned 162 pence throughout the first half of the 12 months on an adjusted foundation, which is the same as US$2.20. At fixed forex charges, this quantity was up by 2% versus one 12 months earlier.

Natural development resulting from rising cigarette costs and the rise of vaping merchandise must be optimistic for revenues, and declining curiosity bills resulting from debt paydown might influence profitability as effectively. On prime of that, British American Tobacco plans to purchase again its personal shares sooner or later which could have a optimistic influence on earnings-per-share as effectively.

Click on right here to obtain our most up-to-date Certain Evaluation report on BTI (preview of web page 1 of three proven beneath):

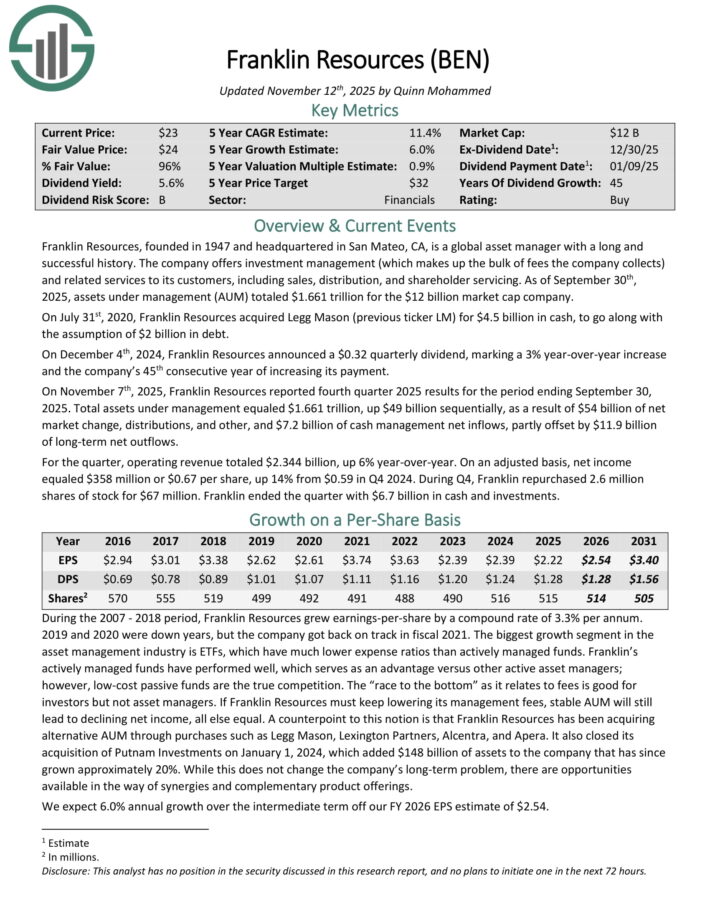

Excessive Dividend Inventory For The Lengthy Run: Franklin Assets (BEN)

Franklin Assets gives funding administration (which makes up the majority of charges the corporate collects) and associated providers to its prospects, together with gross sales, distribution, and shareholder servicing.

As of September thirtieth, 2025, property beneath administration (AUM) totaled $1.661 trillion. On July thirty first, 2020, Franklin Assets acquired Legg Mason (earlier ticker LM) for $4.5 billion in money, to go together with the belief of $2 billion in debt.

On November seventh, 2025, Franklin Assets reported fourth quarter 2025 outcomes. Complete property beneath administration equaled $1.661 trillion, up $49 billion sequentially, because of $54 billion of internet market change, distributions, and different, and $7.2 billion of money administration internet inflows, partly offset by $11.9 billion of long-term internet outflows.

For the quarter, working income totaled $2.344 billion, up 6% year-over-year. On an adjusted foundation, internet earnings equaled $358 million or $0.67 per share, up 14% from $0.59 in This fall 2024. Throughout This fall, Franklin repurchased 2.6 million shares of inventory for $67 million.

Click on right here to obtain our most up-to-date Certain Evaluation report on BEN (preview of web page 1 of three proven beneath):

Excessive Dividend Inventory For The Lengthy Run: Enbridge Inc. (ENB)

Enbridge is an oil & gasoline firm that operates the next segments: Liquids Pipelines, Gasoline Distributions, Power Companies, Gasoline Transmission & Midstream, and Inexperienced Energy & Transmission.

Enbridge reported its third quarter earnings leads to November. The corporate generated revenues of CAD$14.6 billion throughout the interval, which was down 2% in comparison with the earlier 12 months’s quarter, and which pencils out to US$10.5 billion.

Throughout the quarter, Enbridge grew its adjusted EBITDA by 2% 12 months over 12 months, to CAD$4.3 billion, up from CAD$4.2 billion throughout the earlier 12 months’s quarter.

Throughout the third quarter, Enbridge was capable of generate distributable money flows of CAD$2.6 billion, which equates to US$1.9 billion, or US$0.87 on a per-share foundation.

Whereas distributable money flows in 2024 have been down in US {Dollars}, that was resulting from forex charge actions – outcomes have been greater in Canadian {Dollars}. The identical holds true for Enbridge’s dividend, which was elevated by 3% in Canadian {Dollars}, to CAD$0.9424 originally of the present 12 months.

Enbridge is forecasting distributable money flows in a variety of CAD$5.50 – CAD$5.90 per share for the present 12 months. Utilizing present alternate charges, this equates to USD$4.08 on the midpoint of the steering vary, which might be up 6% versus 2024.

Click on right here to obtain our most up-to-date Certain Evaluation report on ENB (preview of web page 1 of three proven beneath):

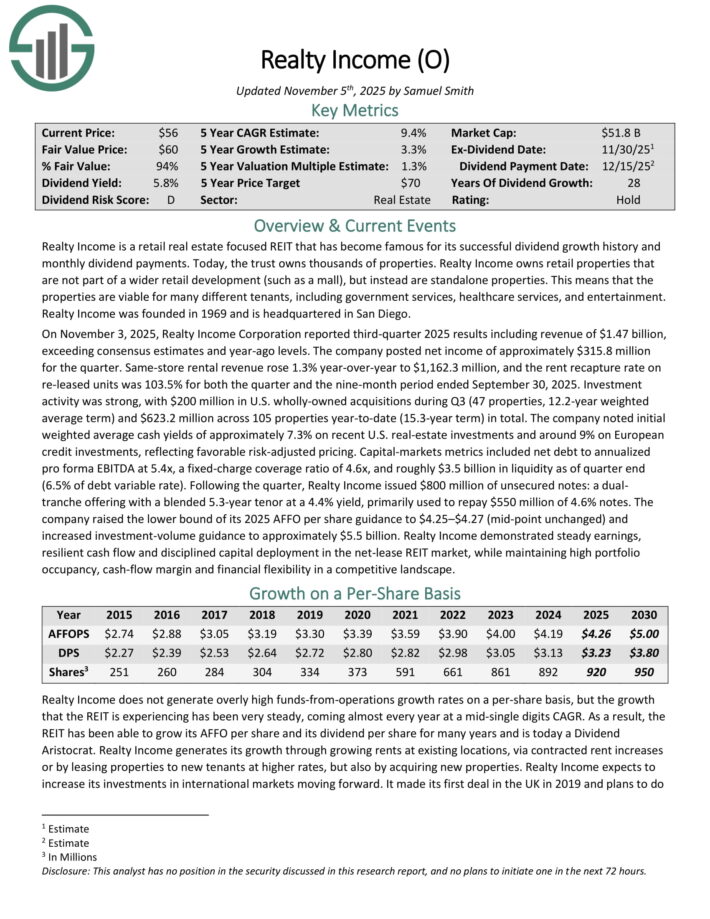

Excessive Dividend Inventory For The Lengthy Run: Realty Revenue (O)

Realty Revenue is a retail actual property centered REIT that has turn into well-known for its profitable dividend development historical past and month-to-month dividend funds. At present, the belief owns 1000’s of properties.

Realty Revenue owns retail properties that aren’t a part of a wider retail improvement (equivalent to a mall), however as a substitute are standalone properties. Which means the properties are viable for a lot of completely different tenants, together with authorities providers, healthcare providers, and leisure.

On November 3, 2025, Realty Revenue Company reported third-quarter 2025 outcomes together with income of $1.47 billion, exceeding consensus estimates and year-ago ranges.

The corporate posted internet earnings of roughly $315.8 million for the quarter. Identical-store rental income rose 1.3% year-over-year to $1,162.3 million, and the hire recapture charge on re-leased items was 103.5% for each the quarter and the nine-month interval ended September 30, 2025.

Funding exercise was robust, with $200 million in U.S. wholly-owned acquisitions throughout Q3 (47 properties, 12.2-year weighted common time period) and $623.2 million throughout 105 properties year-to-date (15.3-year time period) in whole.

The corporate raised the decrease sure of its 2025 AFFO per share steering to $4.25–$4.27 (mid-point unchanged) and elevated investment-volume steering to roughly $5.5 billion.

Click on right here to obtain our most up-to-date Certain Evaluation report on O (preview of web page 1 of three proven beneath):

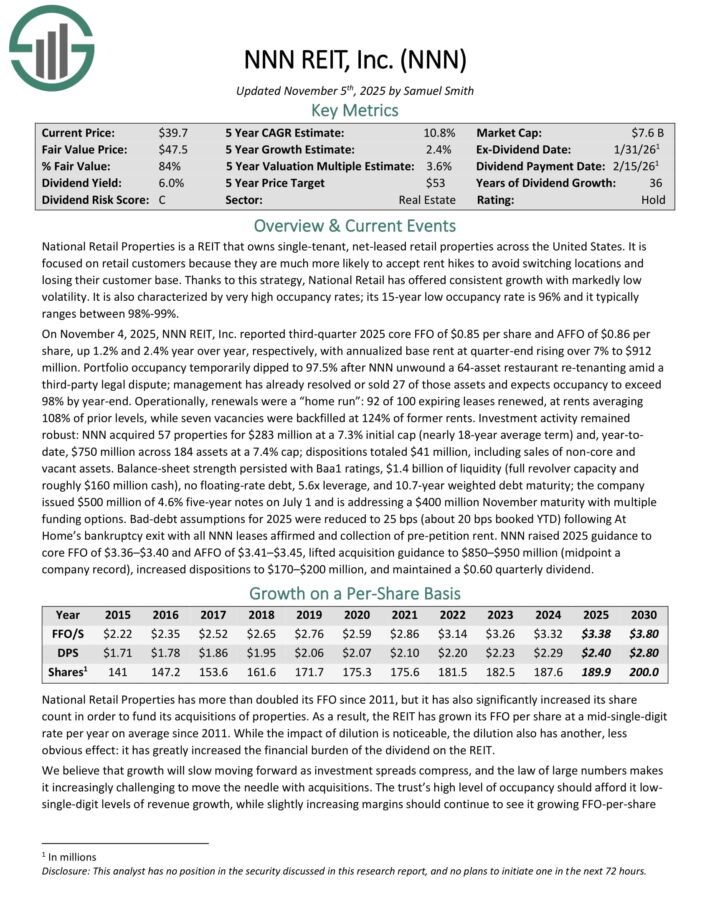

Excessive Dividend Inventory For The Lengthy Run: NNN REIT (NNN)

Nationwide Retail Properties is a REIT that owns single-tenant, net-leased retail properties throughout the USA.

Nationwide Retail has supplied constant development with markedly low volatility. Additionally it is characterised by very excessive occupancy charges; its 15-year low occupancy charge is 96% and it sometimes ranges between 98%-99%.

On November 4, 2025, NNN REIT reported third-quarter 2025 core FFO of $0.85 per share and AFFO of $0.86 per share, up 1.2% and a couple of.4% 12 months over 12 months, respectively, with annualized base hire at quarter-end rising over 7% to $912 million.

Portfolio occupancy quickly dipped to 97.5% after NNN unwound a 64-asset restaurant re-tenanting amidthird-party authorized dispute; administration has already resolved or offered 27 of these property and expects occupancy to exceed 98% by year-end.

Operationally, renewals have been a “residence run”: 92 of 100 expiring leases renewed, at rents averaging 108% of prior ranges, whereas seven vacancies have been back-filled at 124% of former rents.

Funding exercise remained strong: NNN acquired 57 properties for $283 million at a 7.3% preliminary cap (practically 18-year common time period) and, year-to-date, $750 million throughout 184 property at a 7.4% cap.

Click on right here to obtain our most up-to-date Certain Evaluation report on NNN (preview of web page 1 of three proven beneath):

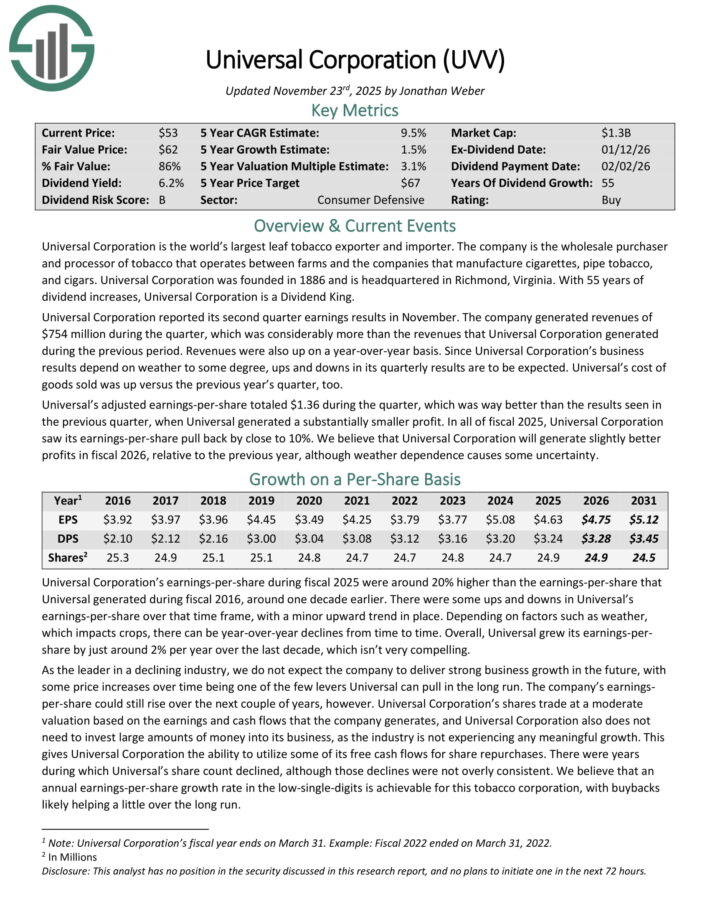

Excessive Dividend Inventory For The Lengthy Run: Common Corp. (UVV)

Common Company is the world’s largest leaf tobacco exporter and importer. The corporate is the wholesale purchaser and processor of tobacco that operates between farms and the businesses that manufacture cigarettes, pipe tobacco, and cigars.

Common Company was based in 1886 and is headquartered in Richmond, Virginia. With 55 years of dividend will increase, Common Company is a Dividend King.

Common Company reported its second quarter earnings leads to November. The corporate generated income of $754 million throughout the quarter, which was significantly greater than the revenues that Common Company generated throughout the earlier interval.

Revenues have been additionally up on a year-over-year foundation. Since Common Company’s enterprise outcomes rely upon climate to a point, ups and downs in its quarterly outcomes are to be anticipated. Common’s value of products offered was up versus the earlier 12 months’s quarter.

Common’s adjusted earnings-per-share totaled $1.36 throughout the quarter. In fiscal 2025, Common Company noticed its earnings-per-share pull again by near 10%.

Click on right here to obtain our most up-to-date Certain Evaluation report on UVV (preview of web page 1 of three proven beneath):

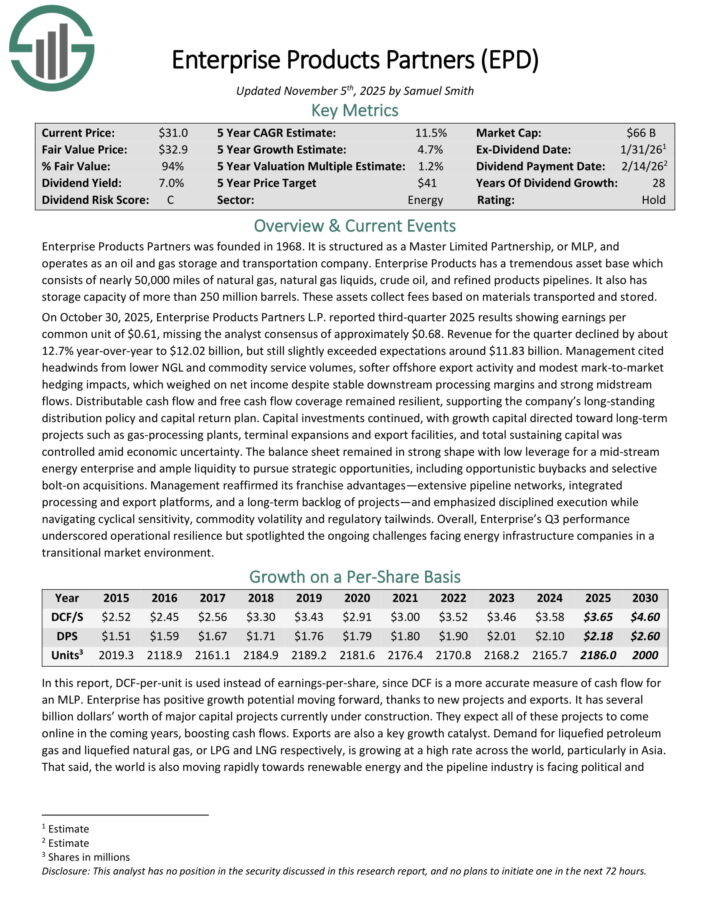

Excessive Dividend Inventory For The Lengthy Run: Enterprise Merchandise Companions LP (EPD)

Enterprise Merchandise Companions was based in 1968. It’s structured as a Grasp Restricted Partnership, or MLP, and operates as an oil and gasoline storage and transportation firm.

Enterprise Merchandise has an amazing asset base which consists of practically 50,000 miles of pure gasoline, pure gasoline liquids, crude oil, and refined merchandise pipelines. It additionally has storage capability of greater than 250 million barrels. These property gather charges based mostly on supplies transported and saved.

On October 30, 2025, Enterprise Merchandise Companions L.P. reported third-quarter 2025 outcomes displaying earnings per widespread unit of $0.61, lacking the analyst consensus of roughly $0.68. Income for the quarter declined by about 12.7% year-over-year to $12.02 billion, however nonetheless barely exceeded expectations round $11.83 billion.

Administration cited headwinds from decrease NGL and commodity service volumes, softer offshore export exercise and modest mark-to-market hedging impacts, which weighed on internet earnings regardless of steady downstream processing margins and robust midstream flows.

Click on right here to obtain our most up-to-date Certain Evaluation report on EPD (preview of web page 1 of three proven beneath):

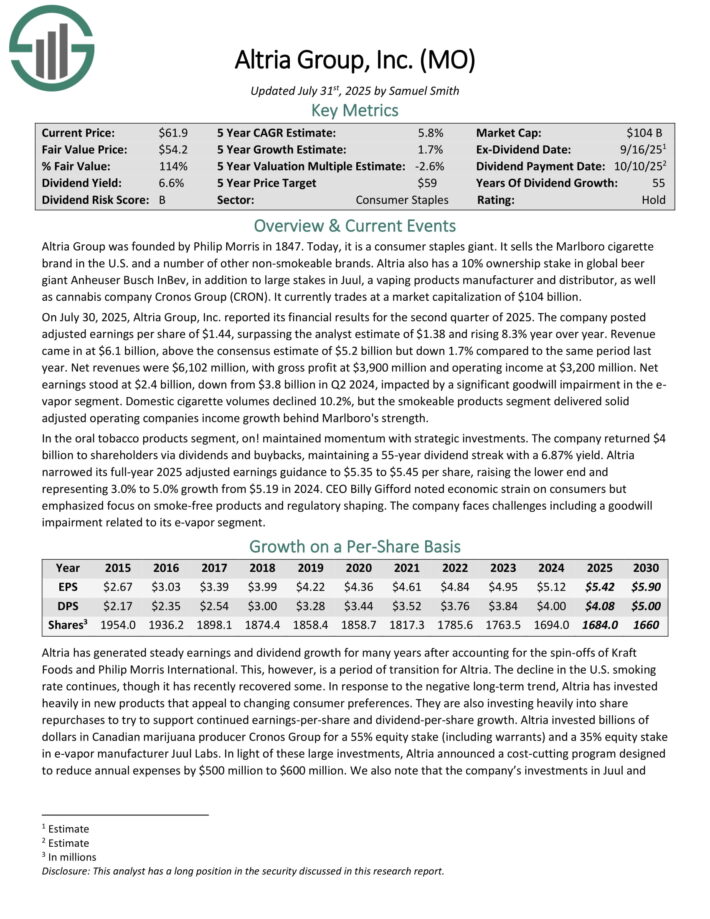

Excessive Dividend Inventory For The Lengthy Run: Altria Group (MO)

Altria is a tobacco inventory that sells cigarettes, chewing tobacco, cigars, e-cigarettes, and extra beneath a wide range of manufacturers, together with Marlboro, Skoal, and Copenhagen, amongst others.

This can be a interval of transition for Altria. The decline within the U.S. smoking charge continues. In response, Altria has invested closely in new merchandise that attraction to altering client preferences, because the smoke-free class continues to develop.

The corporate additionally has a 35% funding stake in e-cigarette maker JUUL, and a forty five% stake within the Canadian hashish producer Cronos Group (CRON).

On July 30, 2025, Altria Group, Inc. reported its monetary outcomes for the second quarter of 2025. The corporate posted adjusted earnings per share of $1.44, surpassing the analyst estimate of $1.38 and rising 8.3% 12 months over 12 months.

Income got here in at $6.1 billion, above the consensus estimate of $5.2 billion however down 1.7% in comparison with the identical interval final 12 months. Web revenues have been $6,102 million, with gross revenue at $3,900 million and working earnings at $3,200 million.

Web earnings stood at $2.4 billion, down from $3.8 billion in Q2 2024, impacted by a major goodwill impairment within the e-vapor phase.

Home cigarette volumes declined 10.2%, however the smokeable merchandise phase delivered strong adjusted working firms earnings development behind Marlboro’s energy.

Click on right here to obtain our most up-to-date Certain Evaluation report on Altria (preview of web page 1 of three proven beneath):

Excessive Dividend Inventory For The Lengthy Run: Common Well being Realty Revenue Belief (UHT)

Common Well being Realty Revenue Belief operates as an actual property funding belief (REIT), specializing within the healthcare sector. The belief owns healthcare and human service-related amenities.

Its property portfolio consists of acute care hospitals, medical workplace buildings, rehabilitation hospitals, behavioral healthcare amenities, sub-acute care amenities and childcare facilities. Common Well being’s portfolio consists of 76 properties situated in 21 states.

On October 27, 2025, Common Well being Realty Revenue Belief (UHT) reported third quarter 2025 internet earnings of $4.0 million, or $0.29 per diluted share, unchanged from the identical quarter in 2024.

Outcomes included a one-time $275,000 achieve ($0.02 per share) from a settlement and launch settlement associated to considered one of its medical workplace buildings, partially offset by a $256,000 lower in combination property earnings, which included $900,000 of nonrecurring depreciation expense.

Funds from operations (FFO) rose to $12.2 million, or $0.88 per diluted share, up from $11.3 million, or $0.82 per share, within the prior 12 months interval.

Click on right here to obtain our most up-to-date Certain Evaluation report on UHT (preview of web page 1 of three proven beneath):

Extra Studying

If you’re keen on discovering different high-yield securities, the next Certain Dividend assets will likely be helpful:

Excessive-Yield Particular person Safety Analysis

Thanks for studying this text. Please ship any suggestions, corrections, or inquiries to assist@suredividend.com.