Skilled merchants typically have massive orders to fill.

Whereas one motive for scaling their trades is to keep away from shifting the market with a single massive order, there are a number of different strategic advantages as nicely.

By the tip of this text, you’ll perceive why scaling out and in is a standard apply amongst skilled merchants.

Contents

If a dealer commits their whole allocation to a single massive order, they threat an unfavorable fill or poor pricing on account of short-term market fluctuations.

To handle this threat, professionals enter their positions in smaller parts over time.

For instance, they may purchase one-third of their supposed place initially, then add the remaining two-thirds at later intervals.

This strategy helps them obtain a extra balanced common entry value.

Another excuse merchants scale in is to handle threat dynamically.

Knowledgeable may begin with a smaller place, and if the commerce begins to maneuver of their favor, they’ll add to it – primarily rewarding trades that verify their thesis.

Then again, if the commerce doesn’t work out, their publicity stays small, limiting potential losses.

On the subject of exiting, skilled merchants typically take earnings in phases fairly than unexpectedly.

They might promote a part of their place when a selected revenue goal is reached, locking in features, whereas leaving the remaining portion to run if the pattern continues.

This manner, they seize earnings alongside the way in which however nonetheless preserve some publicity if the commerce turns into a much bigger winner.

Scaling into and out of fairness positions is as simple as shopping for and promoting shares.

An choices commerce entails including a number of contracts.

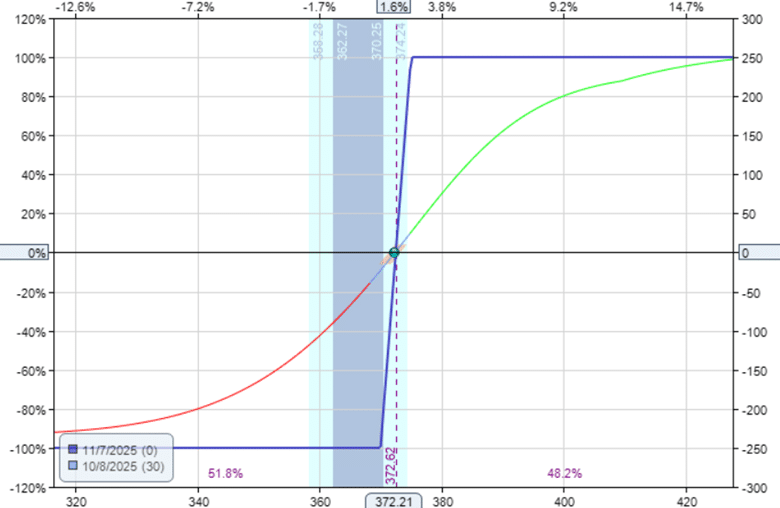

The gold ETF (GLD) is at $372 per share on October eighth, 2025, and an choices dealer buys a bull name debit unfold, anticipating continued upward motion.

Date: Oct 8, 2025

Value: GLD @ $372.21

Purchase to open one contract Nov 7 GLD $370 name @ $10.23Sell to open one contract Nov 7 GLD $375 name @ $7.73

Debit: -$250

She paid $250 for the unfold.

That is solely half of her supposed place dimension.

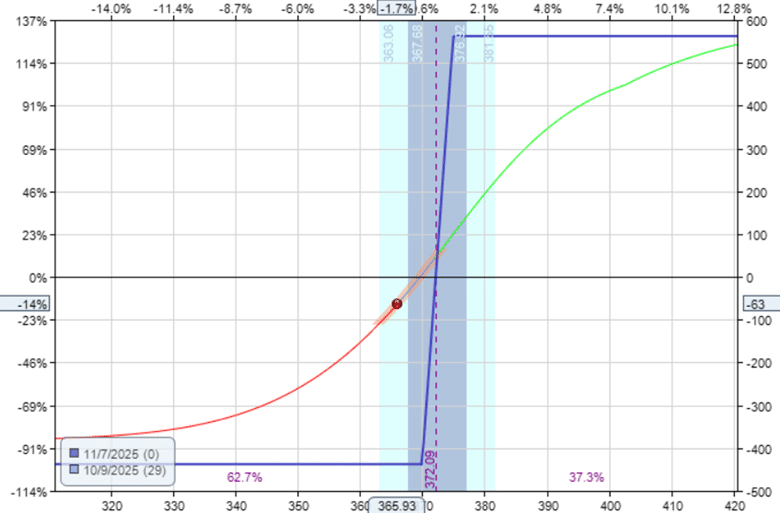

The following day, GLD dropped in value to $366.

Equally, the bull name unfold of the identical strikes prices much less.

It’s not a critical drop.

Only a pullback within the value.

Nice! Gold and gold name spreads are on sale as we speak.

So she provides one other contract to her present place.

Date: Oct 9, 2025

Value: GLD @ $365.93

Purchase to open one contract Nov 7 GLD $370 name @ $6.93Sell to open one contract Nov 7 GLD $375 name @ $5.05

Debit: -$188

The identical name unfold that she purchased yesterday for $250 now prices $188.

Her full place, with two contracts, now appears like this, with a max potential threat within the commerce of $438, equal to the sum of the debits from each orders.

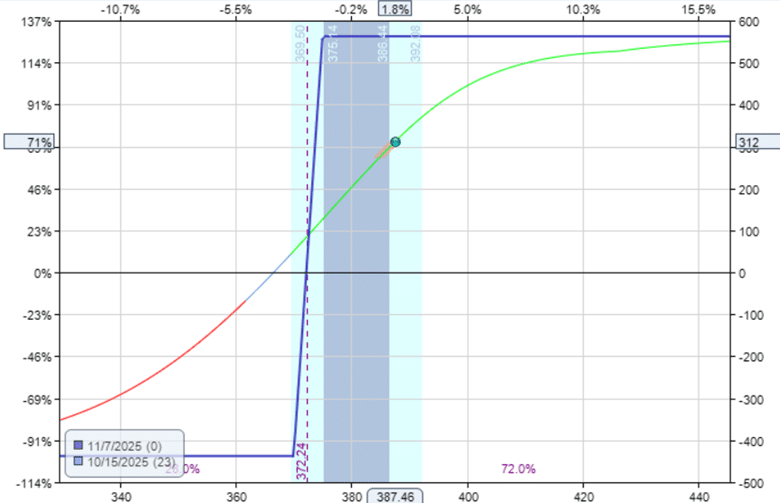

Per week later, she was in a position to shut the place for a revenue of $312 when GLD rose to $387 per share.

She offered to shut the two-contract bull name unfold place for a credit score of $750.

She might have scaled out of the place as nicely.

However we’ll show that within the following instance.

This instance was to point out that by scaling into the place, she was in a position to purchase her bull name spreads for a lower cost than if she had entered into her full place on October eighth.

And a lower cost means decrease commerce threat and the next return on funding.

When it comes to greenback worth, her revenue within the commerce is bigger than if she had entered the complete place on October eighth.

By how a lot? By $62 extra revenue.

She saved $62 by shopping for the second contract at a lower cost.

Free Earnings Season Mastery eBook

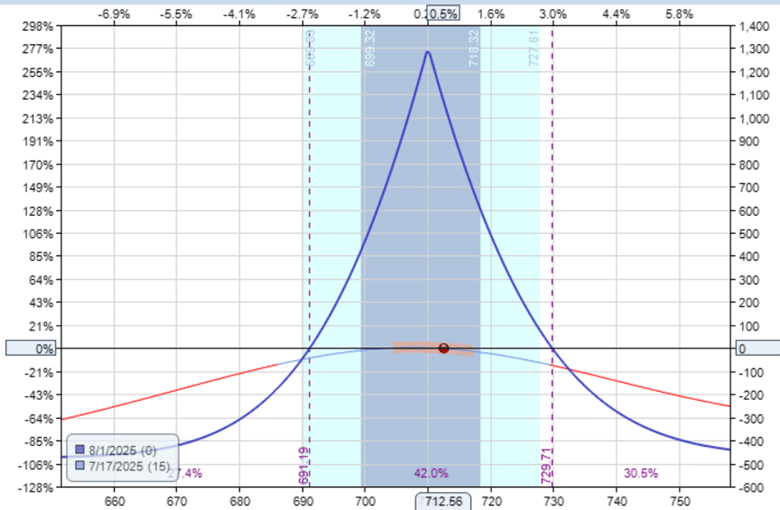

Let’s take an instance of scaling out of a calendar unfold on the inventory Goldman Sachs (GS).

To scale out, there should be at the very least two contracts to start with.

Date: July 17, 2025

Value: GS @ $712.50

Promote to open two contracts of Aug 1st GS $710 put @ $12.08Buy to open two contracts of Aug eighth GS $710 put @ $14.43

Web debit: -$470

This can be a two-contract calendar, with every calendar costing a debit of $235.

Therefore, the max threat in the whole commerce is $470 (or the entire debit paid).

The commerce began out with 15 days to expiration.

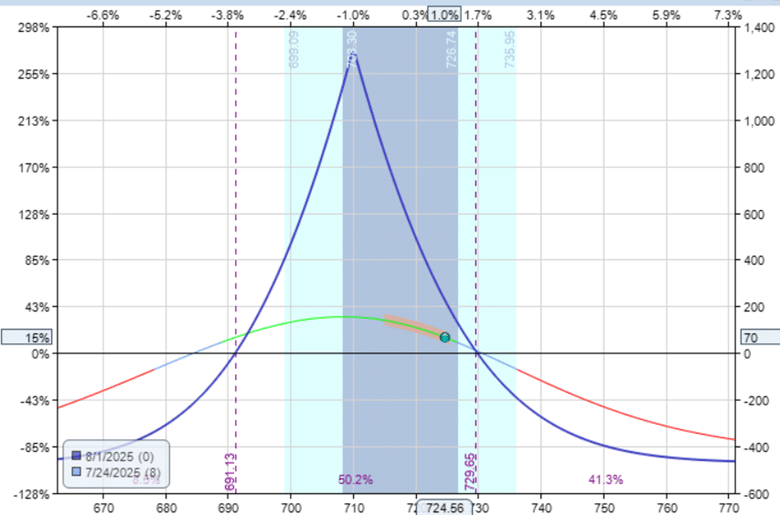

Midway into the commerce with 7 days left until expiration, the worth has moved to the sting of the expiration graph revenue tent:

Date: July twenty fourth, 2025

Value: GS @ $724.50

P&L in commerce: $70

The commerce has made a 15% revenue, however not on the authentic 30% goal the dealer desired.

What to do?

If GS continues to go up in value, it is going to transfer out of the revenue tent and the whole revenue would probably be misplaced.

If GS goes down in value, the calendar revenue will enhance and doubtlessly attain the 30% revenue goal.

The dilemma is:

Ought to the dealer be conservative and take the decrease revenue now?

Higher to safe some assured revenue than to threat ending up with nothing in any respect.

Or ought to the dealer be aggressive and go for the win?

This certainly could be a dilemma if there have been just one contract.

As a result of there are two contracts, the dealer decides to shut out half of the place.

Purchase to shut one contract Aug 1st GS $710 put @ $4.38Sell to shut one contract Aug eighth GS $710 put @ $7.08

Credit score: $270

The dealer primarily took earnings on one of many calendars and let the opposite calendar run.

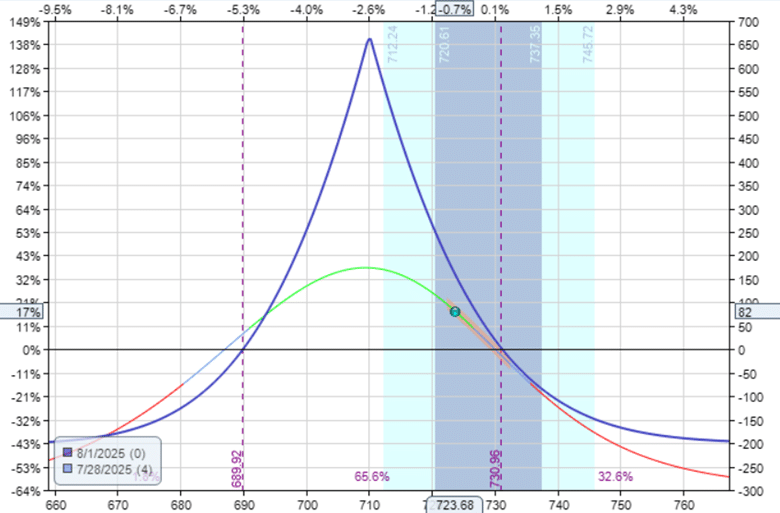

A number of days later, with 4 days remaining till the near-term possibility expires, the general commerce reveals a internet revenue of $82.

The dealer might exit the place now if desired.

However for the reason that dealer had already scaled out and locked in a portion of the earnings, he’s prepared to take some threat on this smaller place and maintain the commerce nearer to expiration.

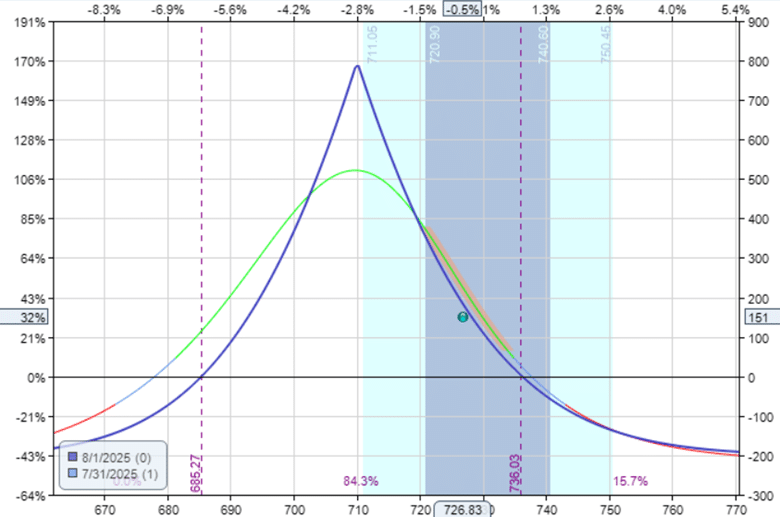

On the day earlier than expiration, the commerce hit its 30% revenue goal, with a internet revenue of $151.

It’s true that on this explicit case, the dealer would have made much more cash if he had not scaled out.

Nevertheless it might have simply gone the opposite approach, and the dealer would have misplaced extra money if he had not scaled out.

Nonetheless, two contracts are higher than one (so long as it doesn’t exceed correct place dimension).

As a result of it provides you a straightforward option to resolve your dilemma with no need to commit to 1 determination or the opposite, you’ll be able to have your cake and eat it too (because the saying goes).

Scaling out and in permits skilled merchants to handle each threat and alternative, defending themselves from unfavorable pricing, whereas positioning for potential upside.

We hope you loved this text on how skilled merchants scale in and scale out of trades.

You probably have any questions, please ship an e-mail or go away a remark beneath.

Click on Right here For Our Prime 7 Indicators

Commerce protected!

Disclaimer: The data above is for instructional functions solely and shouldn’t be handled as funding recommendation. The technique introduced wouldn’t be appropriate for buyers who should not aware of alternate traded choices. Any readers on this technique ought to do their very own analysis and search recommendation from a licensed monetary adviser.