Printed on December third, 2025 by Bob Ciura

Excessive dividend shares are shares with a dividend yield effectively in extra of the market common dividend yield of ~1.3%.

We outline a excessive dividend inventory as having a present yield above 5%, which is greater than 4 occasions the S&P 500 common.

Excessive-yield shares may be very useful to shore up earnings after retirement.

For instance, a $120,000 funding in shares with a mean dividend yield of 5% creates a mean of $500 a month in dividends.

With that in thoughts, we have now created a free record of over 200 excessive dividend shares with dividend yields above 5%.

You may obtain your copy of the excessive dividend shares record beneath:

Nevertheless, not all excessive dividend shares are equally protected.

There are numerous examples of excessive dividend shares decreasing or eliminating their dividends. General, regardless of the optimistic attributes hooked up to excessive dividend shares, their threat profile may be elevated.

On this article, we talk about the ten excessive dividend shares from our Certain Evaluation Analysis Database with the most secure dividends based mostly on their dividend payout ratios.

The ten most secure excessive dividend shares beneath have the bottom dividend payout ratios amongst all shares with present yields above 5% and Dividend Danger Scores of ‘C’ or higher.

The shares are listed beneath in accordance with their payout ratio, in ascending order.

Desk of Contents

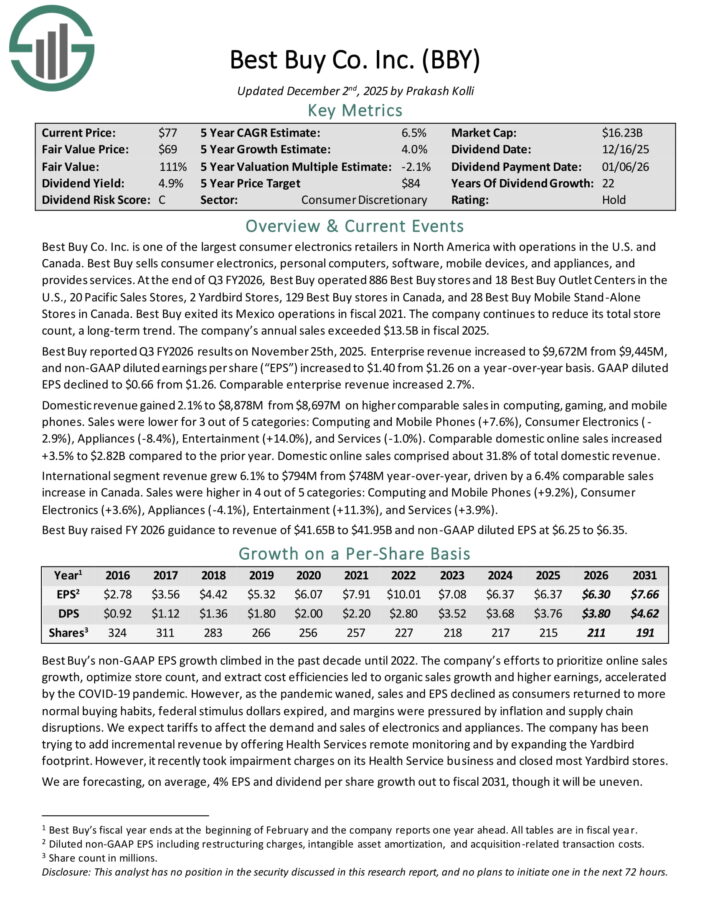

Protected Excessive Dividend Inventory #10: Finest Purchase Co. (BBY)

Finest Purchase Co. Inc. is among the largest shopper electronics retailers in North America with operations within the U.S. and Canada. Finest Purchase sells shopper electronics, private computer systems, software program, cell gadgets, and home equipment, and offers providers.

On the finish of Q3 FY2026, Finest Purchase operated 886 Finest Purchase shops and 18 Finest Purchase Outlet Facilities within the U.S., 20 Pacific Gross sales Shops, 2 Yardbird Shops, 129 Finest Purchase shops in Canada, and 28 Finest Purchase Cellular Stand-Alone Shops in Canada. Finest Purchase exited its Mexico operations in fiscal 2021.

The corporate continues to cut back its complete retailer rely, a long-term pattern. Annual gross sales exceeded $13.5B in fiscal 2025.

Finest Purchase reported Q3 FY2026 outcomes on November twenty fifth, 2025. Enterprise income elevated to $9,672M from $9,445M, and non-GAAP diluted earnings per share elevated to $1.40 from $1.26 on a year-over-year foundation. GAAP diluted EPS declined to $0.66 from $1.26. Comparable enterprise income elevated 2.7%.

Home income gained 2.1% on increased comparable gross sales in computing, gaming, and cell phones. Gross sales had been decrease for 3 out of 5 classes: Computing and Cellular Telephones (+7.6%), Shopper Electronics (2.9%), Home equipment (-8.4%), Leisure (+14.0%), and Providers (-1.0%).

Comparable home on-line gross sales elevated +3.5% to $2.82B in comparison with the prior 12 months. Home on-line gross sales comprised about 31.8% of complete home income. Worldwide phase income grew 6.1% to $794M from $748M year-over-year, pushed by a 6.4% comparable gross sales improve in Canada.

Gross sales had been increased in 4 out of 5 classes: Computing and Cellular Telephones (+9.2%), Shopper Electronics (+3.6%), Home equipment (-4.1%), Leisure (+11.3%), and Providers (+3.9%).

Finest Purchase raised FY 2026 steering to income of $41.65B to $41.95B and non-GAAP diluted EPS at $6.25 to $6.35.

Click on right here to obtain our most up-to-date Certain Evaluation report on BBY (preview of web page 1 of three proven beneath):

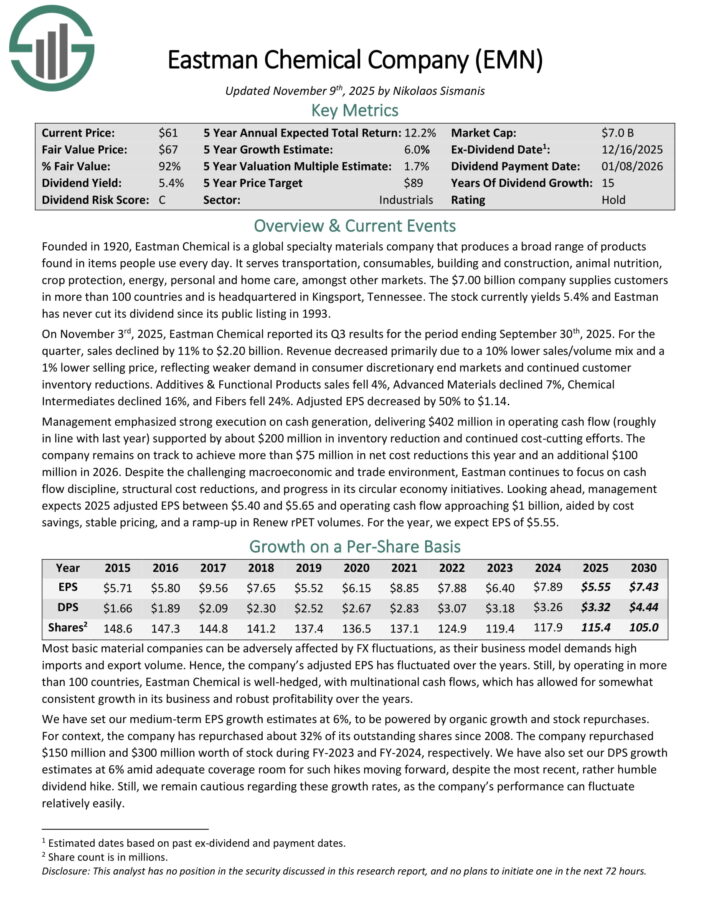

Protected Excessive Dividend Inventory #9: Eastman Chemical (EMN)

Eastman Chemical is a worldwide specialty supplies firm that produces a broad vary of merchandise present in gadgets individuals use day by day.

It serves transportation, consumables, constructing and building, animal vitamin, crop safety, vitality, private and residential care, amongst different markets.

On November third, 2025, Eastman Chemical reported its Q3 outcomes. For the quarter, gross sales declined by 11% to $2.20 billion.

Income decreased primarily attributable to a ten% decrease gross sales/quantity combine and a 1% decrease promoting value, reflecting weaker demand in shopper discretionary finish markets and continued buyer stock reductions.

Components & Useful Merchandise gross sales fell 4%, Superior Supplies declined 7%, Chemical Intermediates declined 16%, and Fibers fell 24%. Adjusted EPS decreased by 50% to $1.14.

Administration emphasised robust execution on money era, delivering $402 million in working money circulation (roughly in keeping with final 12 months) supported by about $200 million in stock discount and continued cost-cutting efforts.

The corporate stays on monitor to attain greater than $75 million in internet price reductions this 12 months and an extra $100 million in 2026.

Regardless of the difficult macroeconomic and commerce surroundings, Eastman continues to concentrate on money circulation self-discipline, structural price reductions, and progress in its round economic system initiatives.

Trying forward, administration expects 2025 adjusted EPS between $5.40 and $5.65 and working money circulation approaching $1 billion, aided by price financial savings, steady pricing, and a ramp-up in Renew rPET volumes.

Click on right here to obtain our most up-to-date Certain Evaluation report on EMN (preview of web page 1 of three proven beneath):

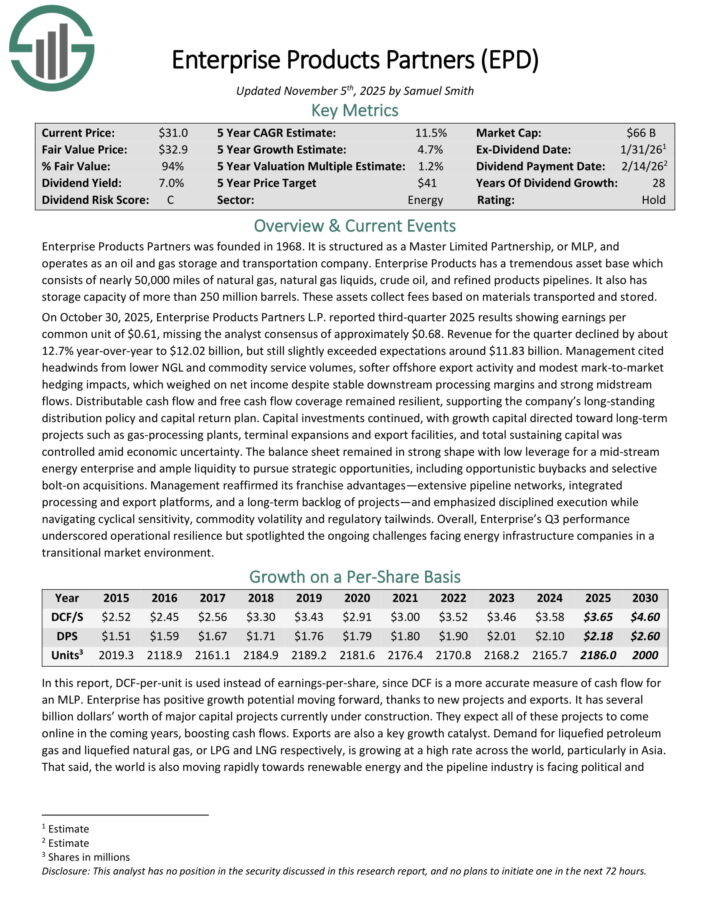

Protected Excessive Dividend Inventory #8: Enterprise Merchandise Companions LP (EPD)

Enterprise Merchandise Companions was based in 1968. It’s structured as a Grasp Restricted Partnership, or MLP, and operates as an oil and gasoline storage and transportation firm.

Enterprise Merchandise has an amazing asset base which consists of practically 50,000 miles of pure gasoline, pure gasoline liquids, crude oil, and refined merchandise pipelines. It additionally has storage capability of greater than 250 million barrels. These property acquire charges based mostly on supplies transported and saved.

On October 30, 2025, Enterprise Merchandise Companions L.P. reported third-quarter 2025 outcomes displaying earnings per frequent unit of $0.61, lacking the analyst consensus of roughly $0.68. Income for the quarter declined by about 12.7% year-over-year to $12.02 billion, however nonetheless barely exceeded expectations round $11.83 billion.

Administration cited headwinds from decrease NGL and commodity service volumes, softer offshore export exercise and modest mark-to-market hedging impacts, which weighed on internet earnings regardless of steady downstream processing margins and powerful midstream flows.

Click on right here to obtain our most up-to-date Certain Evaluation report on EPD (preview of web page 1 of three proven beneath):

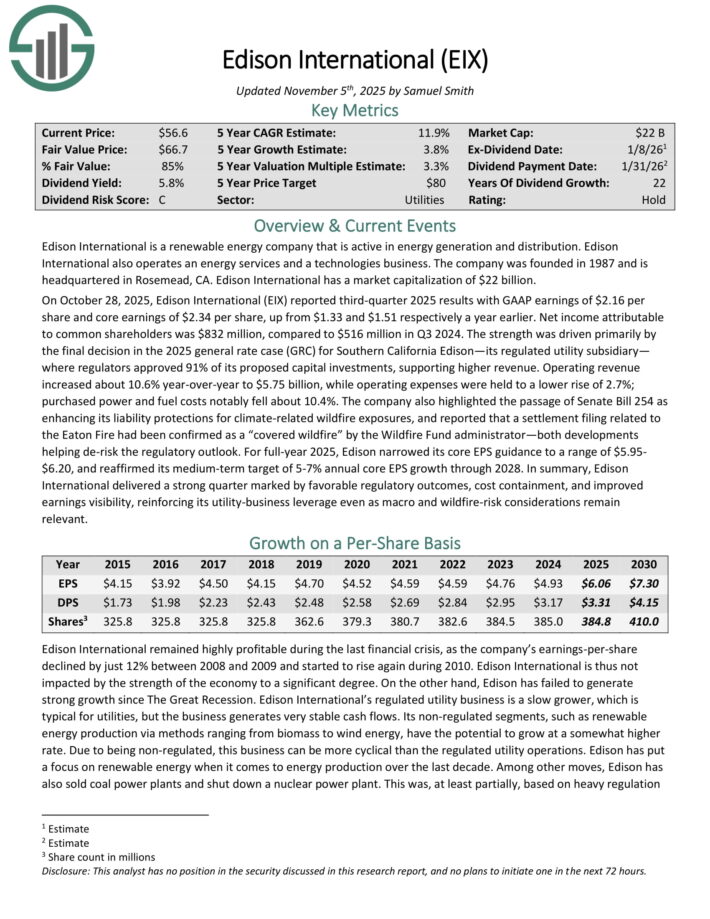

Protected Excessive Dividend Inventory #7: Edison Worldwide (EIX)

Edison Worldwide is a renewable vitality firm that’s lively in vitality era and distribution. Edison Worldwide additionally operates an vitality providers and a applied sciences enterprise. The corporate was based in 1987 and is headquartered in Rosemead, CA.

On October 28, 2025, Edison Worldwide (EIX) reported third-quarter 2025 outcomes with GAAP earnings of $2.16 per share and core earnings of $2.34 per share, up from $1.33 and $1.51 respectively a 12 months earlier.

Internet earnings attributable to frequent shareholders was $832 million, in comparison with $516 million in Q3 2024. Working income elevated about 10.6% year-over-year to $5.75 billion, whereas working bills had been held to a decrease rise of two.7%; bought energy and gas prices notably fell about 10.4%.

For full-year 2025, Edison narrowed its core EPS steering to a variety of $5.95 to $6.20, and reaffirmed its medium-term goal of 5-7% annual core EPS progress by way of 2028.

Click on right here to obtain our most up-to-date Certain Evaluation report on EIX (preview of web page 1 of three proven beneath):

Protected Excessive Dividend Inventory #6: United Bancorp (UBCP)

United Bancorp a monetary holding firm based mostly in the USA, working primarily by way of its wholly-owned subsidiary, United Financial institution.

The corporate presents a variety of banking providers together with retail and business banking, mortgage lending, and funding providers.

A few of its different options embrace checking and financial savings accounts, private and enterprise loans, in addition to wealth administration.

It generated $39.5 million in complete curiosity earnings final 12 months, and is predicated in Martins Ferry, Ohio. On August twenty first, 2025, United Bancorp raised its dividend by 4.2% (YoY) to a quarterly charge of $0.1850, marking the nineteenth consecutive sequential (QoQ) improve.

On November sixth, 2025, United Bancorp reported its Q3 outcomes for the interval ending September thirtieth, 2025. The corporate introduced complete curiosity earnings of $10.6 million, representing a 7.0% year-over-year improve.

This progress was primarily supported by increased mortgage yields and a 4.5% growth in gross loans to $496.5 million, in addition to new investments in municipal securities at favorable yields.

Internet curiosity earnings rose 9.6% to $6.7 million, pushed by a 16 basis-point growth within the internet curiosity margin to three.66%.

Whole curiosity expense rose modestly by 2.7%, with curiosity expense to common property rising by 3 foundation factors year-over-year to 1.80%.

Regardless of the next provision for credit score losses, which grew to $186,000 from $70,000 final 12 months, internet earnings improved to $1.93 million, up 6.1% year-over-year.

EPS was $0.34, marking a 9.7% improve from the prior 12 months’s $0.31, reflecting continued stability sheet progress, disciplined expense administration, and steady credit score high quality.

Click on right here to obtain our most up-to-date Certain Evaluation report on UBCP (preview of web page 1 of three proven beneath):

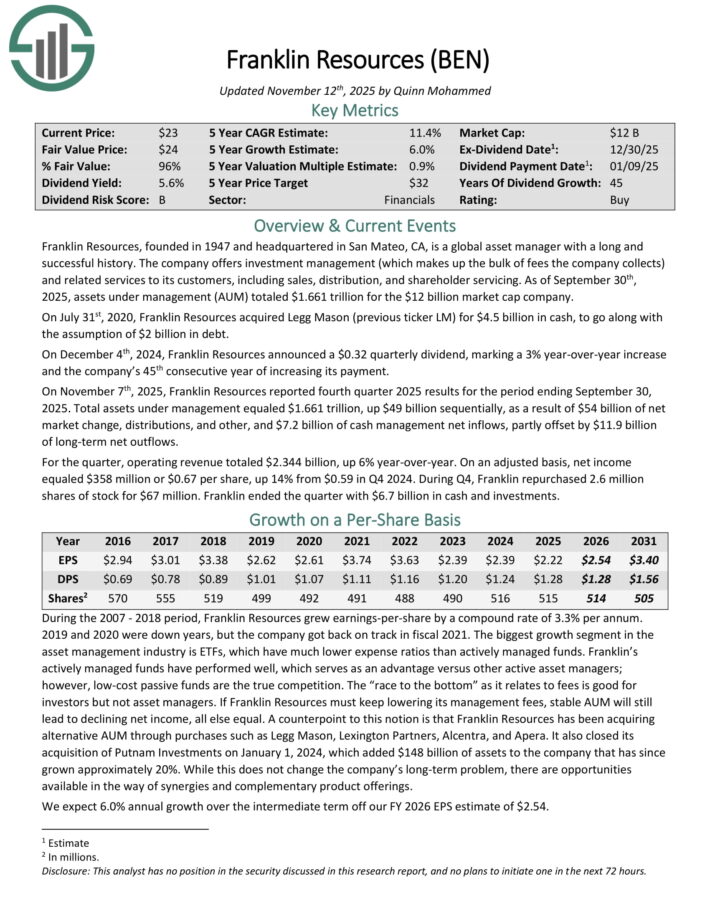

Protected Excessive Dividend Inventory #5: Franklin Sources (BEN)

Franklin Sources presents funding administration (which makes up the majority of charges the corporate collects) and associated providers to its clients, together with gross sales, distribution, and shareholder servicing.

As of September thirtieth, 2025, property underneath administration (AUM) totaled $1.661 trillion. On July thirty first, 2020, Franklin Sources acquired Legg Mason (earlier ticker LM) for $4.5 billion in money, to associate with the idea of $2 billion in debt.

On November seventh, 2025, Franklin Sources reported fourth quarter 2025 outcomes. Whole property underneath administration equaled $1.661 trillion, up $49 billion sequentially, because of $54 billion of internet market change, distributions, and different, and $7.2 billion of money administration internet inflows, partly offset by $11.9 billion of long-term internet outflows.

For the quarter, working income totaled $2.344 billion, up 6% year-over-year. On an adjusted foundation, internet earnings equaled $358 million or $0.67 per share, up 14% from $0.59 in This autumn 2024. Throughout This autumn, Franklin repurchased 2.6 million shares of inventory for $67 million.

Click on right here to obtain our most up-to-date Certain Evaluation report on BEN (preview of web page 1 of three proven beneath):

Protected Excessive Dividend Inventory #4: Bristol-Myers Squibb (BMY)

Bristol-Myers Squibb is a number one drug maker of cardiovascular and anti-cancer therapeutics, and has annual revenues of about $46 billion.

On October thirtieth, 2025, Bristol-Myers reported third quarter outcomes for the interval ending September thirtieth, 2025. For the quarter, income grew 2.8% to $12.2 billion, which was $420 million above estimates. Adjusted earnings-per-share of $1.63 in contrast unfavorably to $1.80 within the prior 12 months, however this was $0.11 greater than anticipated.

Excluding forex change, gross sales had been up 2%. U.S. revenues grew 1% to $8.3 billion. Worldwide grew 6% to $3.9 billion, however income was up 3% when excluding forex change.

Eliquis, which prevents blood clots, grew 25% to $3.75 billion as demand was robust for the product. Eliquis stays the highest oral anticoagulant exterior of the U.S. and generated greater than $13 billion in income for 2024, which was a 9% improve from the prior 12 months.

Opdivo, which treats cancers equivalent to superior renal carcinoma, was increased by 7% to $2.5 billion as world demand stays excessive.

Bristol-Myers offered revised steering for 2025 as effectively. Adjusted earnings-per-share at the moment are projected to be in a variety of $6.40 to $6.60 for the 12 months.

Click on right here to obtain our most up-to-date Certain Evaluation report on BMY (preview of web page 1 of three proven beneath):

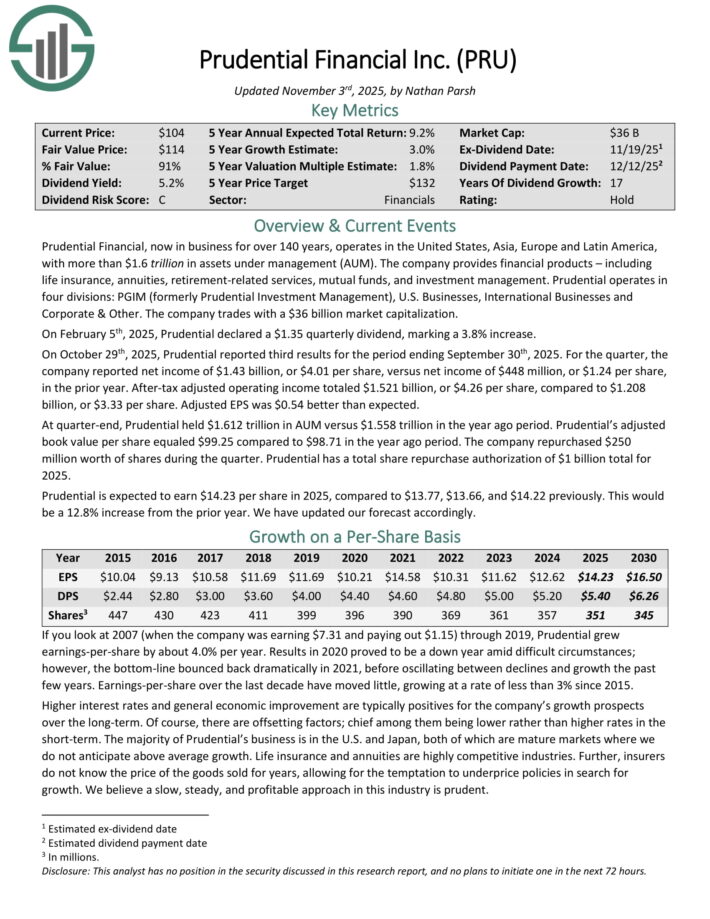

Protected Excessive Dividend Inventory #3: Prudential Monetary (PRU)

Prudential Monetary, now in enterprise for over 140 years, operates in the USA, Asia, Europe and Latin America, with greater than $1.5 trillion in property underneath administration (AUM).

The corporate offers monetary merchandise – together with life insurance coverage, annuities, retirement-related providers, mutual funds, and funding administration.

Prudential operates in 4 divisions: PGIM (previously Prudential Funding Administration), U.S. Companies, Worldwide Companies and Company & Different.

On October twenty ninth, 2025, Prudential reported third outcomes. For the quarter, the corporate reported internet earnings of $1.43 billion, or $4.01 per share, versus internet earnings of $448 million, or $1.24 per share, within the prior 12 months.

After-tax adjusted working earnings totaled $1.521 billion, or $4.26 per share, in comparison with $1.208 billion, or $3.33 per share. Adjusted EPS was $0.54 higher than anticipated.

At quarter-end, Prudential held $1.612 trillion in AUM versus $1.558 trillion within the 12 months in the past interval. Prudential’s adjusted e-book worth per share equaled $99.25 in comparison with $98.71 within the 12 months in the past interval.

The corporate repurchased $250 million value of shares through the quarter. Prudential has a complete share repurchase authorization of $1 billion complete for 2025.

Click on right here to obtain our most up-to-date Certain Evaluation report on PRU (preview of web page 1 of three proven beneath):

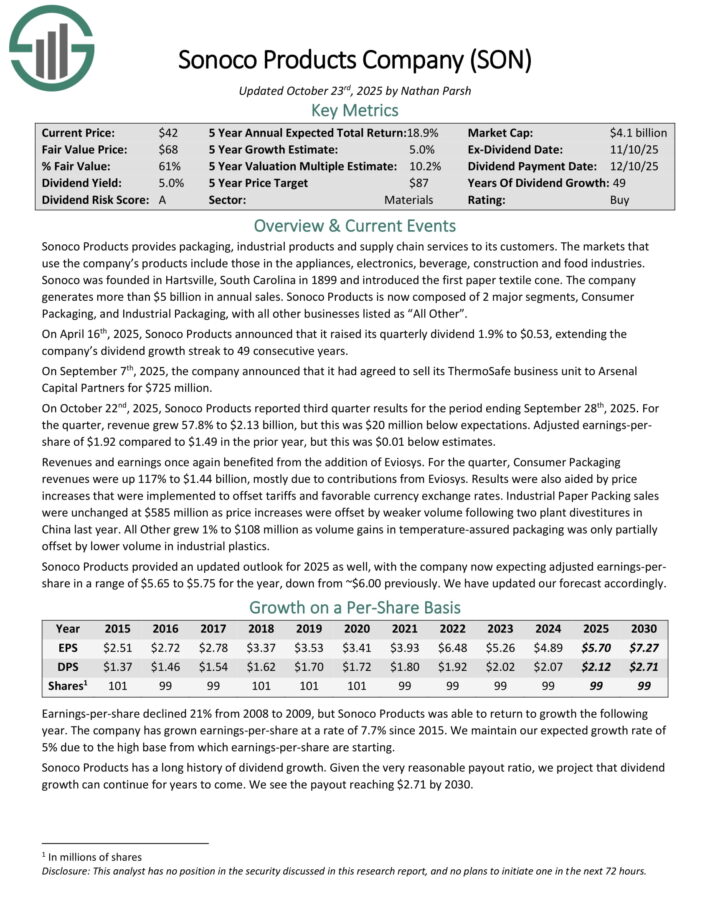

Protected Excessive Dividend Inventory #2: Sonoco Merchandise (SON)

Sonoco Merchandise offers packaging, industrial merchandise and provide chain providers to its clients. The markets that use the corporate’s merchandise embrace these within the home equipment, electronics, beverage, building and meals industries.

The corporate generates greater than $5 billion in annual gross sales. Sonoco Merchandise is now composed of two main segments, Shopper Packaging, and Industrial Packaging, with all different companies listed as “All Different”.

On October twenty second, 2025, Sonoco Merchandise reported third quarter outcomes for the interval ending September twenty eighth, 2025. For the quarter, income grew 57.8% to $2.13 billion, however this was $20 million beneath expectations. Adjusted earnings-per-share of $1.92 in comparison with $1.49 within the prior 12 months, however this was $0.01 beneath estimates.

Revenues and earnings as soon as once more benefited from the addition of Eviosys. For the quarter, Shopper Packaging revenues had been up 117% to $1.44 billion, principally attributable to contributions from Eviosys. Outcomes had been additionally aided by value will increase that had been carried out to offset tariffs and favorable forex change charges.

Industrial Paper Packing gross sales had been unchanged at $585 million as value will increase had been offset by weaker quantity following two plant divestitures in China final 12 months. All Different grew 1% to $108 million as quantity features in temperature-assured packaging was solely partially offset by decrease quantity in industrial plastics.

Sonoco Merchandise offered an up to date outlook for 2025 as effectively, with the corporate now anticipating adjusted earnings-per-share in a variety of $5.65 to $5.75 for the 12 months, down from ~$6.00 beforehand.

Click on right here to obtain our most up-to-date Certain Evaluation report on SON (preview of web page 1 of three proven beneath):

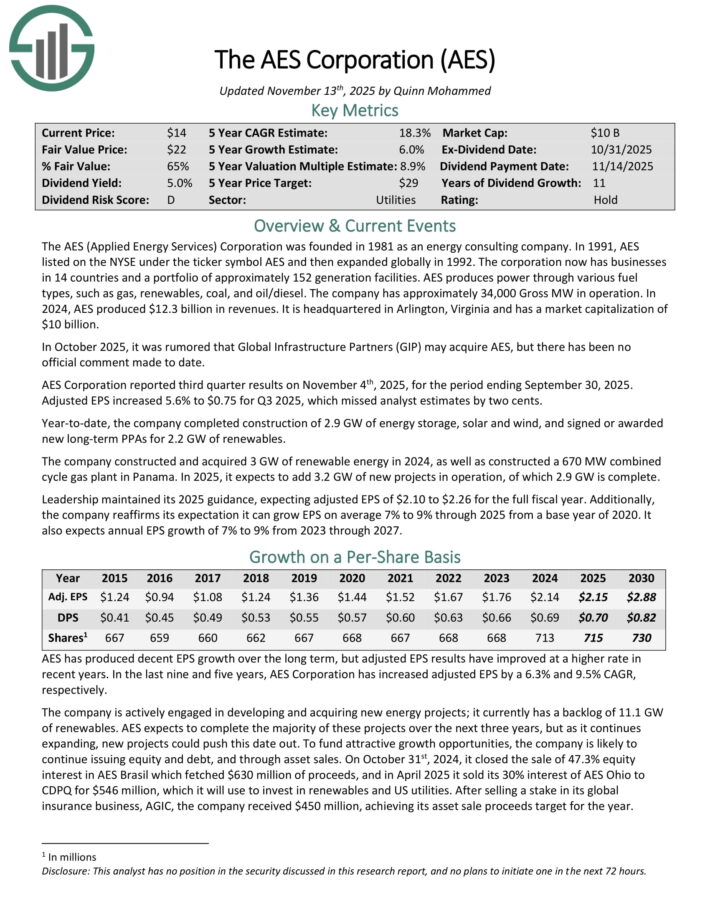

Protected Excessive Dividend Inventory #1: AES Corp. (AES)

AES is a utility inventory with companies in 14 nations and a portfolio of roughly 152 era services. AES produces energy by way of varied gas sorts, equivalent to gasoline, renewables, coal, and oil/diesel.

The corporate has roughly 34,000 Gross MW in operation. In 2024, AES produced $12.3 billion in revenues.

AES Company reported third quarter outcomes on November 4th, 2025, for the interval ending September 30, 2025. Adjusted EPS elevated 5.6% to $0.75 for Q3 2025, which missed analyst estimates by two cents.

12 months-to-date, the corporate accomplished building of two.9 GW of vitality storage, photo voltaic and wind, and signed or awarded new long-term PPAs for two.2 GW of renewables.

The corporate constructed and purchased 3 GW of renewable vitality in 2024, in addition to constructed a 670 MW mixed cycle gasoline plant in Panama. In 2025, it expects so as to add 3.2 GW of recent tasks in operation, of which 2.9 GW is full.

Management maintained its 2025 steering, anticipating adjusted EPS of $2.10 to $2.26 for the complete fiscal 12 months.

Moreover, the corporate reaffirms its expectation it will possibly develop EPS on common 7% to 9% by way of 2025 from a base 12 months of 2020. It additionally expects annual EPS progress of seven% to 9% from 2023 by way of 2027.

Click on right here to obtain our most up-to-date Certain Evaluation report on AES (preview of web page 1 of three proven beneath):

Further Studying

In case you are focused on discovering high-quality dividend progress shares and/or different high-yield securities and earnings securities, the next Certain Dividend assets can be helpful:

Excessive-Yield Particular person Safety Analysis

And see the assets beneath for extra compelling funding concepts for dividend progress shares and/or high-yield funding securities.

Thanks for studying this text. Please ship any suggestions, corrections, or inquiries to help@suredividend.com.