Spreadsheet information up to date each day

Spreadsheet and Prime 5 Listing Up to date on November twenty eighth, 2025 by Bob Ciura

The communication companies sector has quite a bit to supply buyers, notably these in search of larger funding revenue.

Many communication companies shares generate sturdy earnings and money circulate, which permit them to pay excessive dividend yields to shareholders.

And, the most important communication companies shares broadly have decrease valuations than many different market sectors, making them interesting for worth buyers as nicely.

With this in thoughts, we created a listing of 23 communication companies shares.

You’ll be able to obtain the listing (together with vital monetary ratios corresponding to dividend yields and payout ratios) by clicking on the hyperlink beneath:

Maintain studying this text to be taught extra about the advantages of investing in communication companies shares.

Desk Of Contents

The next desk of contents offers for straightforward navigation:

How To Use The Communication Companies Shares Listing To Discover Funding Concepts

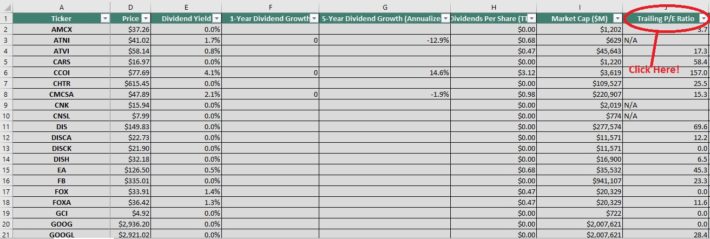

Having an Excel database of all communication companies shares, mixed with vital investing metrics and ratios, could be very helpful.

This device turns into much more highly effective when mixed with information of tips on how to use Microsoft Excel to seek out one of the best funding alternatives.

With that in thoughts, this part will present a fast rationalization of how one can immediately seek for shares with explicit traits, utilizing two screens for example.

The primary display screen that we are going to implement is for shares with price-to-earnings ratios beneath 15.

Display 1: Low P/E Ratios

Step 1: Obtain the Communication Companies Shares Excel Spreadsheet Listing on the hyperlink above.

Step 2: Click on the filter icon on the prime of the price-to-earnings ratio column, as proven beneath.

Step 3: Change the filter subject to ‘Much less Than’, and enter ’15’ into the sphere beside it.

The remaining listing of shares incorporates shares with price-to-earnings ratios lower than 15.

The following part demonstrates tips on how to display screen for shares with excessive dividend yields.

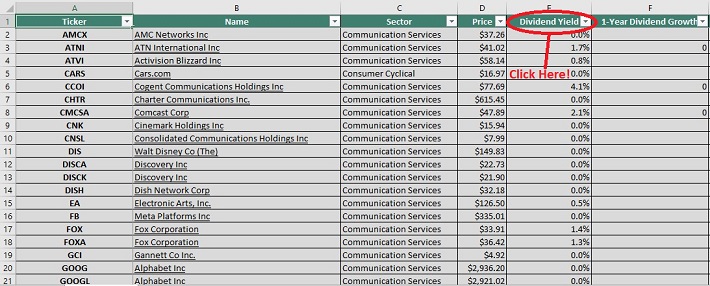

Display 2: Communication Companies Shares With Excessive Dividend Yields

Shares are sometimes categorized primarily based on their dividend yields. That is the share of an funding that an investor will obtain in dividend revenue.

We outline excessive dividend yields as shares with yields of 5% or extra.

Screening for shares with excessive dividend yields might present attention-grabbing funding alternatives for extra risk-averse, income-oriented buyers.

Right here’s tips on how to use the Communication Companies Shares Excel Spreadsheet Listing to seek out such funding alternatives.

Step 1: Obtain the Communication Companies Shares Excel Spreadsheet Listing on the hyperlink above.

Step 2: Click on on the filter icon for the ‘dividend yield’ column, as proven beneath.

Step 3: Change the filter setting to ‘Better Than’ and enter 0.03 into the column beside it. Be aware that 0.03 is equal to three%.

The remaining shares on this listing are these with dividend yields above 3%. This narrowed funding universe is appropriate for buyers in search of low-risk, high-yield securities.

You now have a stable basic understanding of tips on how to use the spreadsheet to its fullest potential. The rest of this text will focus on the highest 5 communication companies shares now.

The Prime 5 Communication Companies Shares Now

The next part discusses our prime 5 communication companies shares at the moment, primarily based on their anticipated annual returns over the subsequent 5 years.

The rankings on this article are derived from our anticipated whole return estimates from the Certain Evaluation Analysis Database.

The 5 shares with the very best projected five-year whole returns are ranked on this article, from lowest to highest.

Associated: Watch the video beneath to learn to calculate anticipated whole return for any inventory.

Rankings are compiled primarily based upon the mixture of present dividend yield, anticipated change in valuation, in addition to anticipated annual earnings-per-share progress.

This determines which communication companies shares supply one of the best whole return potential for shareholders.

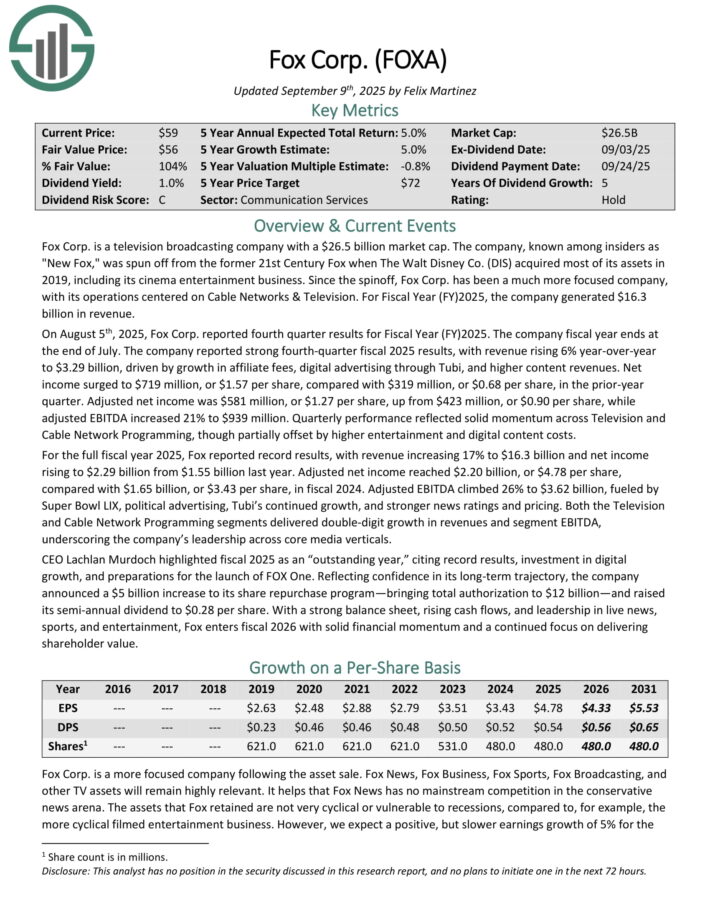

#5: Twenty-First Century Fox (FOXA)

5-year anticipated annual returns: 2.7%

Fox Corp. is a tv broadcasting firm that was spun off from the previous twenty first Century Fox when The Walt Disney Co. (DIS) acquired most of its belongings in 2019, together with its cinema leisure enterprise.

For Fiscal 12 months (FY)2025, the corporate generated $16.3 billion in income.

On August fifth, 2025, Fox Corp. reported fourth quarter outcomes for Fiscal 12 months (FY) 2025. The corporate reported sturdy fourth-quarter fiscal 2025 outcomes, with income rising 6% year-over-year to $3.29 billion, pushed by progress in affiliate charges, digital promoting via Tubi, and better content material revenues.

Web revenue surged to $719 million, or $1.57 per share, in contrast with $319 million, or $0.68 per share, within the prior-year quarter. Adjusted web revenue was $581 million, or $1.27 per share, up from $423 million, or $0.90 per share, whereas adjusted EBITDA elevated 21% to $939 million.

For the complete fiscal yr 2025, Fox reported report outcomes, with income growing 17% to $16.3 billion and web revenue rising to $2.29 billion from $1.55 billion final yr. Adjusted web revenue reached $2.20 billion, or $4.78 per share, in contrast with $1.65 billion, or $3.43 per share, in fiscal 2024.

Click on right here to obtain our most up-to-date Certain Evaluation report on FOXA (preview of web page 1 of three proven beneath):

#4: Alphabet Inc. (GOOG)(GOOGL)

5-year anticipated annual returns: 11.3%

Alphabet is a know-how conglomerate that operates a number of companies corresponding to Google search, Android, Chrome, YouTube, Nest, Gmail, Maps, and lots of extra. Alphabet is a frontrunner in lots of the areas of know-how that it operates.

On October twenty ninth, 2025, Alphabet reported third quarter outcomes for the interval ending September thirtieth, 2025. For the quarter, income grew 16% to $102.4 billion, which was $2.21 billion forward of estimates.

Adjusted earnings-per-share of $2.87 in contrast very favorably to $2.12 within the prior yr and was $0.60 higher than anticipated.

Most companies proceed to carry out very nicely. For the quarter, income for Google Search, the most important contributor to outcomes, improved 14.5% to $56.6 billion.

YouTube adverts grew 15% to $10.3 billion whereas Google Community fell 2.6% to $7.4 billion. Google subscriptions, platforms, and units was up 20.8% to $12.9 billion.

In whole, Google promoting was larger by 12.6% to $74.2 billion whereas Google Companies was up 13.8% to $87.1 billion. Google Cloud grew 33.5% to $15.2 billion.

The corporate’s working margin contracted 100 foundation factors to 31.0%. Excluding a $3.5 billion cost associated to a European Fee fantastic, the working margin was 33.9% for the interval.

Alphabet repurchased $11.5 billion price of inventory in the course of the quarter and $40.2 billion year-to-date.

Click on right here to obtain our most up-to-date Certain Evaluation report on GOOGL (preview of web page 1 of three proven beneath):

#3: Verizon Communications (VZ)

5-year anticipated annual returns: 12.4%

Verizon Communications is without doubt one of the largest wi-fi carriers within the nation. Wi-fi contributes three-quarters of all revenues, and broadband and cable companies account for a couple of quarter of gross sales. The corporate’s community covers ~300 million folks and 98% of the U.S.

On September fifth, 2025, Verizon introduced that it was growing its quarterly dividend 1.8% to $0.69 for the November third, 2025 cost, extending the corporate’s dividend progress streak to 21 consecutive years.

On October twenty ninth, 2025, Verizon reported third quarter outcomes for the interval ending September thirtieth, 2025. For the quarter, income grew 1.5% to $33.8 billion, however this was $470 million beneath estimates. Adjusted earnings-per-share of $1.21 in contrast favorably to $1.19 within the prior yr and was $0.02 higher than anticipated.

For the quarter, Verizon Shopper had postpaid telephone web losses of seven,000, which compares to web additions of 18,000 in the identical interval of final yr. Nonetheless, wi-fi retail core pay as you go web additions grew 47,000, marking the fifth consecutive quarter of optimistic subscriber progress.

Shopper wi-fi retail postpaid telephone churn price stays low at 0.91%. The Shopper phase grew 2.9% to $26.1 billion whereas client wi-fi service income elevated 2.4% to $17.4 billion. Shopper wi-fi postpaid common income per account grew 2.0% to $147.91.

Broadband totaled 306K web new clients in the course of the interval, which marks 13 consecutive quarters of not less than 300K web provides. The whole mounted wi-fi buyer base is nearly 5.4 million. Verizon goals to have 8 to 9 million mounted wi-fi subscribers by 2028.

Wi-fi retail postpaid web additions had been 110K for the interval. Free money circulate was $15.8 billion for the primary three quarters of the yr, up from $14.5 billion for a similar interval in 2024.

Verizon reaffirmed prior steerage for 2025 as nicely, with the corporate nonetheless anticipating wi-fi service income to develop 2% to 2.8% for the yr. Verizon can also be anticipated to provide adjusted EPS progress in a variety of 1% to three%.

Click on right here to obtain our most up-to-date Certain Evaluation report on VZ (preview of web page 1 of three proven beneath):

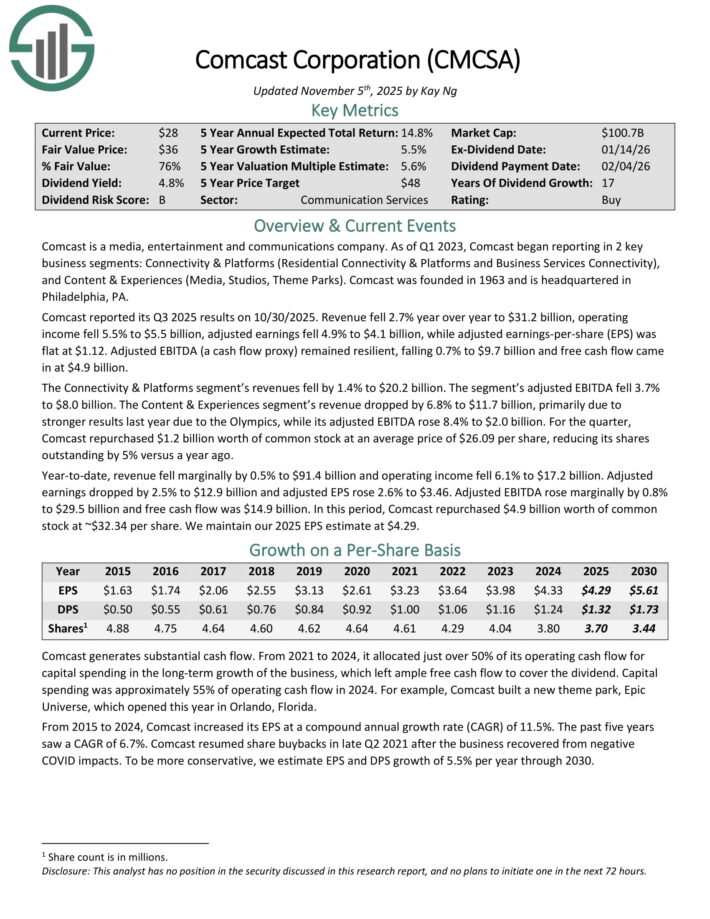

#2: Comcast Company (CMCSA)

5-year anticipated annual return: 15.6%

Comcast is a media, leisure and communications firm. Comcast has two key enterprise segments: Connectivity & Platforms (Residential Connectivity & Platforms and Enterprise Companies Connectivity), and Content material & Experiences (Media, Studios, Theme Parks).

Comcast reported its Q3 2025 outcomes on 10/30/2025. Income fell 2.7% yr over yr to $31.2 billion, working revenue fell 5.5% to $5.5 billion, adjusted earnings fell 4.9% to $4.1 billion, whereas adjusted earnings-per-share (EPS) was flat at $1.12.

The Connectivity & Platforms phase’s revenues fell by 1.4% to $20.2 billion. The phase’s adjusted EBITDA fell 3.7% to $8.0 billion. The Content material & Experiences phase’s income dropped by 6.8% to $11.7 billion, primarily as a result of stronger outcomes final yr because of the Olympics, whereas its adjusted EBITDA rose 8.4% to $2.0 billion.

For the quarter, Comcast repurchased $1.2 billion price of frequent inventory at a mean worth of $26.09 per share, lowering its shares excellent by 5% versus a yr in the past.

Click on right here to obtain our most up-to-date Certain Evaluation report on Comcast (preview of web page 1 of three proven beneath):

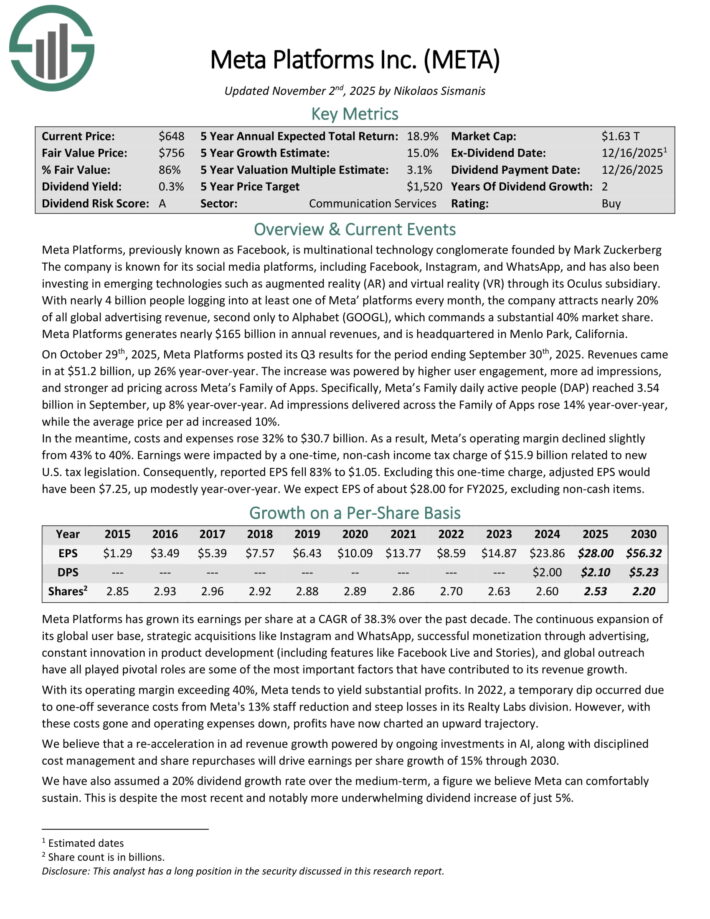

#1: Meta Platforms (META)

5-year anticipated annual returns: 19.3%

Meta Platforms is thought for its social media platforms, together with Fb, Instagram, and WhatsApp, and has additionally been investing in rising applied sciences corresponding to augmented actuality (AR) and digital actuality (VR) via its Oculus subsidiary.

With practically 4 billion folks logging into not less than considered one of Meta’ platforms each month, the corporate attracts practically 20% of all world promoting income, second solely to Alphabet (GOOGL), which instructions a considerable 40% market share.

Meta Platforms generates practically $165 billion in annual revenues, and is headquartered in Menlo Park, California.

On October twenty ninth, 2025, Meta Platforms posted its Q3 outcomes for the interval ending September thirtieth, 2025. Income got here in at $51.2 billion, up 26% year-over-year.

The rise was powered by larger consumer engagement, extra advert impressions, and stronger advert pricing throughout Meta’s Household of Apps. Particularly, Meta’s Household each day energetic folks (DAP) reached 3.54 billion in September, up 8% year-over-year.

Advert impressions delivered throughout the Household of Apps rose 14% year-over-year, whereas the common worth per advert elevated 10%.

Within the meantime, prices and bills rose 32% to $30.7 billion. Consequently, Meta’s working margin declined barely from 43% to 40%.

Earnings had been impacted by a one-time, non-cash revenue tax cost of $15.9 billion associated to new U.S. tax laws. Consequently, reported EPS fell 83% to $1.05. Excluding this one-time cost, adjusted EPS would have been $7.25, up modestly year-over-year.

Click on right here to obtain our most up-to-date Certain Evaluation report on META (preview of web page 1 of three proven beneath):

Remaining Ideas

The communication companies sector is engaging for long-term funding. Demand for varied communication companies corresponding to Web and wi-fi stays excessive, and isn’t prone to decelerate any time quickly.

The sector can also be interesting for revenue buyers, because of the high-yielding telecom shares.

Should you’re prepared to discover concepts outdoors of the communication companies sector, the next databases include a number of the most high-quality dividend shares round:

The Dividend Aristocrats: dividend shares with 25+ years of consecutive dividend will increase.

The Dividend Achievers: dividend shares with 10+ years of consecutive dividend will increase.

The Dividend Kings: Thought-about the best-of-the-best relating to dividend historical past, the Dividend Kings are an elite group of dividend shares with 50+ years of consecutive dividend will increase.

The Blue Chip Shares Listing: dividend shares which are on the Dividend Achievers, Dividend Aristocrats, and/or Dividend Kings listing.

Should you’re in search of different sector-specific shares, the next Certain Dividend databases might be helpful:

Thanks for studying this text. Please ship any suggestions, corrections, or inquiries to assist@suredividend.com.