A diagonal unfold consists of two choices with completely different expirations and strike costs.

The 2 choices might be each put choices or they are often each name choices.

Contents

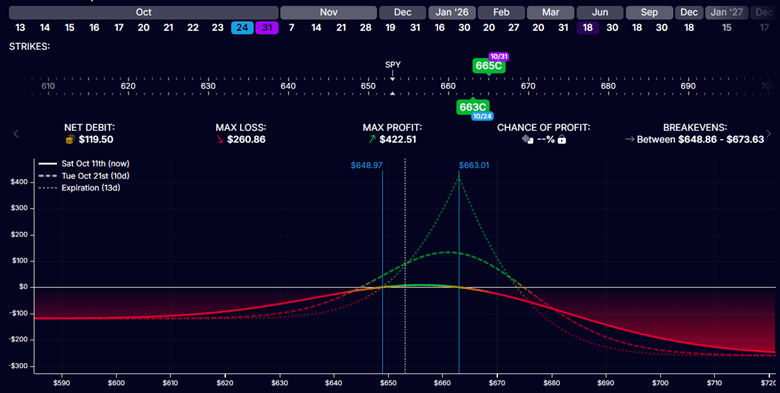

Right here is an instance of two name choices on SPY that create the diagonal unfold:

Date: Oct 10, 2025

Worth: SPY @ $653

Promote one contract Oct 24 SPY $663 name @ $4.98Buy one contract Oct 31 SPY $665 name @ $6.17

Internet Debit: -$119.50

As a result of we offered a name possibility for $498 and acquired another choice for $617, the web debit paid for the unfold is $119 and a few change.

The danger graph of the diagonal is proven under.

The stable curve line is the revenue graph immediately.

It is usually generally known as the T+0 line (the present time plus zero days prematurely).

The revenue graph on October 24 is proven within the dotted line, which outlines the “tent” form of the diagonal – October twenty fourth is the sooner expiration of the 2 choices expirations.

The choice that was offered is all the time the one with the sooner expiration date.

On this case, the $663 name possibility expires in two weeks on October 24.

We name this the quick possibility as a result of we’re promoting the choice.

The $665 name possibility is the lengthy possibility that we’re shopping for.

It has an expiration on October 31, which is one week after the quick possibility’s expiration.

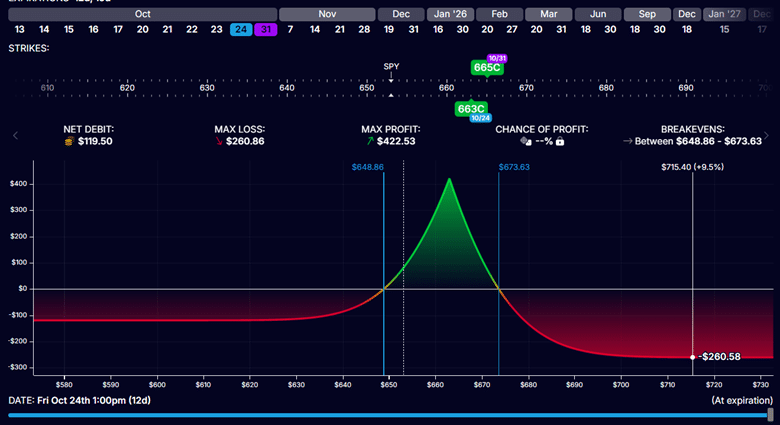

The form of the diagonal expiration danger graph seems to be very very similar to the form of a calendar danger graph, the place the height revenue might be a lot bigger than the most loss.

Besides that the diagonal’s danger graph is just not as symmetrical because the calendar.

It’s skewed to 1 aspect.

On this case, there may be extra danger to the upside than the draw back.

If SPY have been to go to a really excessive worth by the expiration of the quick possibility, the loss might be round $260 based mostly on studying the danger graph proven under, the place I’ve slid the expiration slider all the best way to the correct to indicate the revenue curve at expiration.

The precise quantity of the loss is just not deterministic forward of time.

As a result of on the time of the expiration of the quick possibility, it isn’t doable to know the way a lot exterior time worth remains to be left within the lengthy possibility.

If SPY crashes and is at a really low worth at expiration, then each name choices shall be out of the cash and expire nugatory.

In that case.

The utmost loss if the market crashes is the debit paid initially.

On this case, it’s $119.50.

4 Ideas For Higher Iron Condors

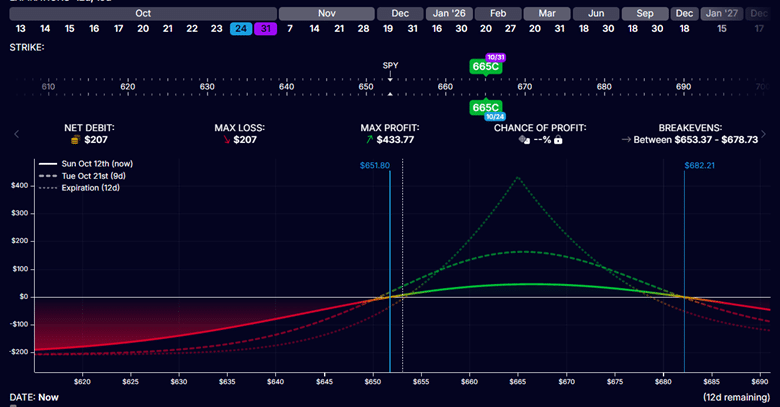

Contemplate one other investor who initiated a calendar unfold on the similar time and expiration dates.

Within the calendar unfold, each the quick and lengthy choices have the identical strike worth.

On this case, we use the $665 strike worth for each.

Date: Oct 10, 2025

Worth: SPY @ $653

Promote one contract Oct 24 SPY $665 name @ $4.10Buy one contract Oct 31 SPY $665 name @ $6.17

Internet Debit: -$207

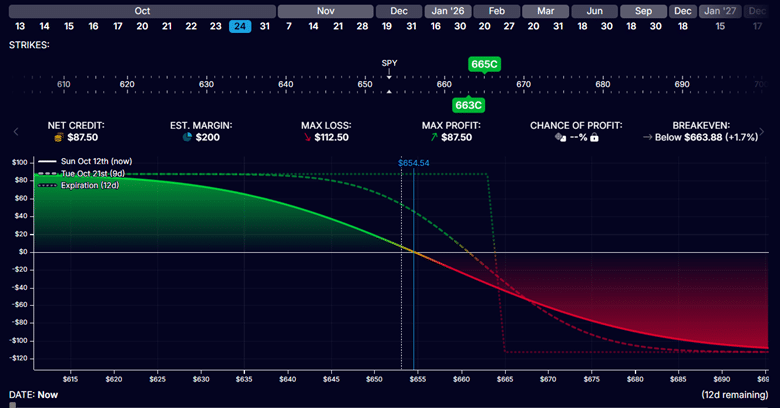

Instantly after filling the calendar unfold, the investor initiates a bear name unfold for the October twenty fourth expiration…

Date: Oct 10, 2025

Worth: SPY @ $653

Promote one contract Oct 24 SPY $663 name @ $4.98Buy one contract Oct 24 SPY $665 name @ $4.10

Internet Credit score: $88

What’s attention-grabbing is that these two trades, mixed, are equal to a diagonal unfold.

As a result of the bear name unfold order includes shopping for again the Oct 24 SPY $665 name that was offered within the calendar order, each trades happen on the $4.10 worth.

Therefore, that possibility cancels out, leaving solely these two choices:

Purchase one contract Oct 31 SPY $665 name @ $6.17Sell one contract Oct 24 SPY $663 name @ $4.98

These are precisely the 2 choices on the diagonal.

Clearly, if that was the intent, one ought to have positioned a single order as a diagonal as an alternative of two orders to avoid wasting on transaction prices and slippage.

When you sum the -$207 debit for the calendar with the $88 credit score for the bear name unfold, the web debit is -$119, which is about the identical because the debit for the diagonal.

The choices Greeks from the calendar and bear name spreads add as much as the identical Greeks because the diagonal.

Simply as a tough gauge of delta, the current-day revenue curve reveals the calendar is bullish and can profit if the value of the underlying rises.

And the bear name unfold is bearish.

When you mix the 2, they hedge one another and lead to a delta-neutral curve just like that of the diagonal.

The diagonal is only a calendar with an embedded vertical unfold.

In our specific instance, the decision diagonal is equal to a name calendar with a bear name unfold.

We hope you loved this text on the choices diagonal unfold.

When you’ve got any questions, please ship an e-mail or depart a remark under.

Commerce secure!

Disclaimer: The knowledge above is for academic functions solely and shouldn’t be handled as funding recommendation. The technique offered wouldn’t be appropriate for buyers who are usually not acquainted with alternate traded choices. Any readers on this technique ought to do their very own analysis and search recommendation from a licensed monetary adviser.