SPY is the ticker image for the S&P 500 ETF.

As such, its worth motion displays the broader market’s motion.

If an investor expects a big market transfer (or a larger-than-expected transfer), the SPY lengthy strangle commerce is a technique aligned with that outlook.

The choices technique often called the “lengthy strangle” entails shopping for an out-of-the-money put choice and shopping for an out-of-the-money name choice.

Within the case of the SPY strangle, we’re doing the underlying SPY asset.

It’s important to qualify the technique with the phrase “lengthy” to keep away from confusion with the “brief strangle,” which entails promoting choices.

The expiry of the choices is chosen to replicate the investor’s expectation of when the market transfer may happen.

Contents

Let’s have a look at an instance initiated on September 15, 2025:

Date: September 15, 2025

Worth: SPY @ $660

Purchase one contract November 21 SPY $630 put @ $6.80Sell one contract November 21 SPY $685 name @ $5.27

Web debit: -$1,207

Shopping for these two choices prices the investor $1207.

This debit paid is the utmost potential loss within the commerce.

This max loss is realized if the worth of SPY is between $630 and $685 on the expiration of the choices.

The max loss is barely realized if the commerce is held to expiration.

For that reason, most traders will keep away from holding this commerce to expiration.

In our instance, we supplied choices with greater than two months till expiry.

This offers us sufficient time to be proper on the larger-than-expected market motion that’s taking place.

Having long-dated choice expiry additionally decreases the speed of theta decay of our lengthy choices.

Any choice we purchase begins to lose worth as time passes.

This is called theta or time decay.

This decay accelerates as the choice approaches its expiration date.

Due to this fact, we set this commerce with 67 days to expiration (DTE), planning to exit nicely earlier than reaching half of that period.

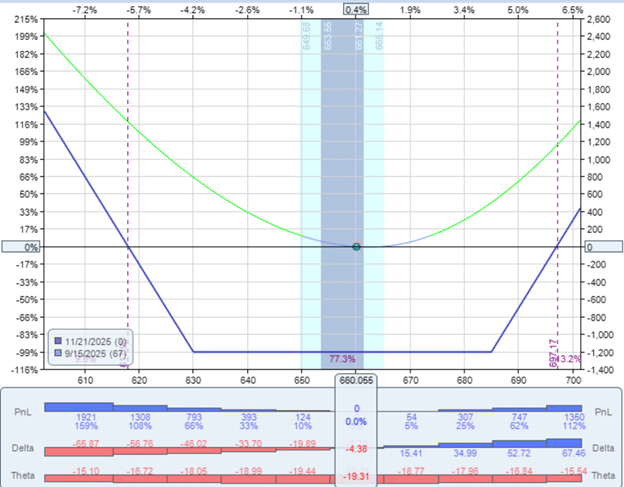

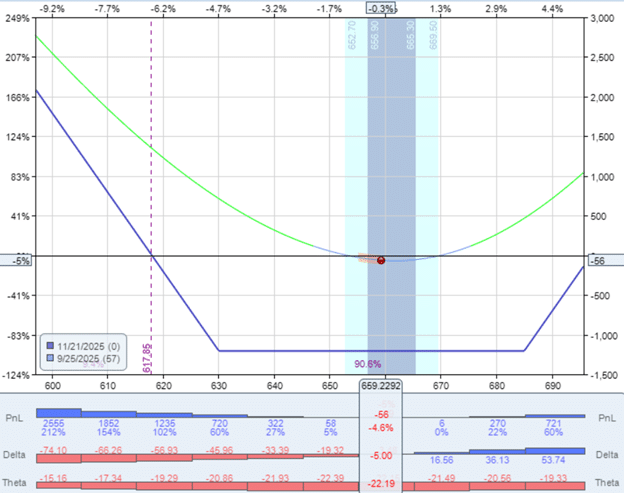

In a modelling software program, we are able to see that we have now a detrimental theta of -19.31, indicating that our commerce loses cash with the passage of time:

We additionally see that we are able to make cash whether or not the market goes up or down.

We lose cash if the market doesn’t transfer.

Initially of the commerce, it’s delta-neutral, neither favoring one route nor the opposite.

The delta of -4.38 could be very near zero as the worth of SPY is on the flat backside portion of at the moment’s revenue graph (the inexperienced line).

As the worth of SPY strikes round, the place delta of the commerce will change:

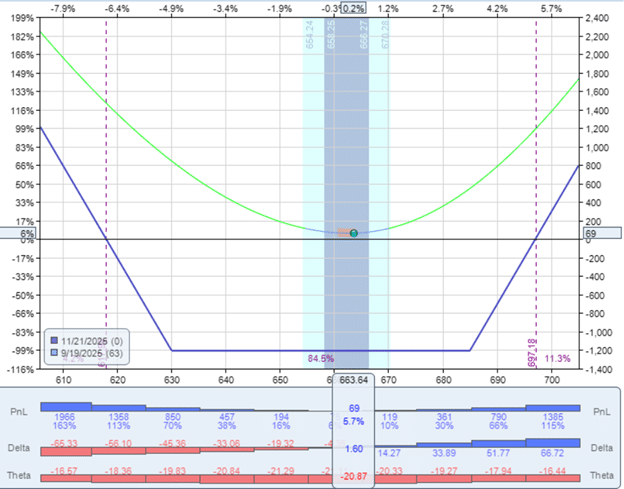

4 days later, on September 19, the commerce has a constructive delta of 1.60.

Free Lined Name Course

On September 22, the commerce is up $158, which is a 13% return on capital:

$158 / $1206 = 13%

So the investor might shut the commerce and take early income right here.

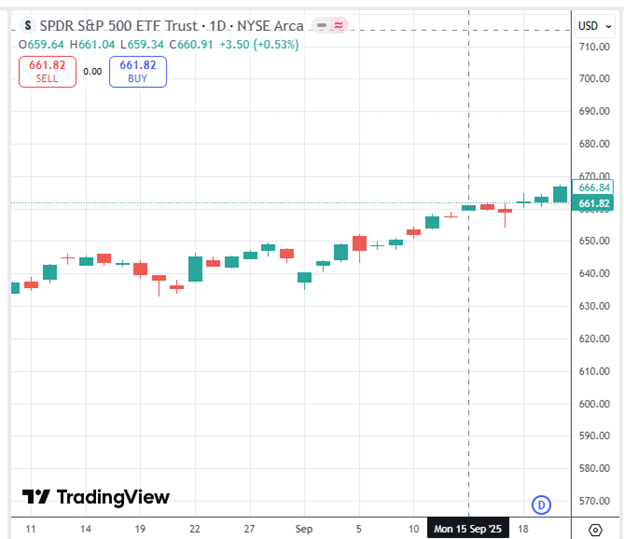

The commerce labored as a result of SPY made a big transfer up:

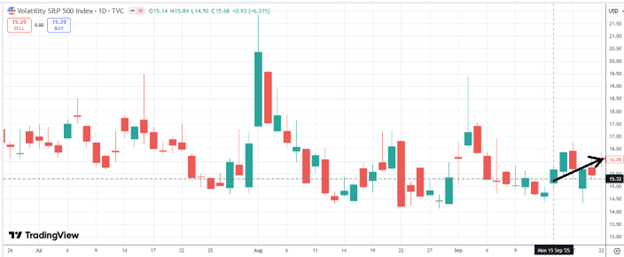

And volatility elevated as measured by the VIX:

VIX is the image for the volatility of the S&P 500 index.

Lengthy choices usually profit from a rise in implied volatility.

Since this commerce has two lengthy choices, it benefited from the rise in VIX.

Vega is the choice Greek that measures the rise in worth of an choice when volatility will increase.

We are saying that this can be a constructive vega commerce since its worth will increase with growing volatility (with all different components thought of being equal).

Typically with these trades, you merely should take the income after they come.

As a result of the commerce is affected by each delta and vega, the P&L of the commerce can fluctuate fairly a bit.

Since theta places us below time strain, we can not maintain the commerce for lengthy.

In actual fact, if the investor held the commerce three extra days afterward September 25, when SPY got here again right down to $659, close to the place it began, all of the income disappeared and the lengthy strangle can be down -$56, or near -5%

The lengthy strangle technique also can function a hedge for theta-positive earnings methods.

Vary-bound earnings methods usually contain promoting choices with the expectation that the market will stay comparatively secure, whereas a protracted strangle entails shopping for choices in anticipation of great market actions.

Thus, the 2 methods function in opposition, and one generally is a hedge for the opposite.

We hope you loved this text on the SPY lengthy strangle commerce.

When you have any questions, ship an e mail or depart a remark beneath.

Commerce protected!

Disclaimer: The data above is for academic functions solely and shouldn’t be handled as funding recommendation. The technique introduced wouldn’t be appropriate for traders who usually are not conversant in trade traded choices. Any readers on this technique ought to do their very own analysis and search recommendation from a licensed monetary adviser.