What’s the distinction between the inventory ticker symbols KO and COKE?

They’re two utterly completely different firms.

The inventory ticker image for The Coca-Cola Firm, the beverage firm everybody is aware of, is KO.

The ticker image COKE represents Coca-Cola Consolidated, Inc.

This firm is a bottling facility licensed to supply Coca-Cola drinks.

Nevertheless, it isn’t owned by the Coca-Cola Firm, the model firm.

Because the names of the 2 firms sound related, we’ll use “KO” and “COKE” to seek advice from the respective firms.

It’s a lot shorter to jot down than writing “Coca-Cola Firm” and “Coca-Cola Consolidated Inc.” respectively.

Contents

KO is the corporate that owns the Coca-Cola model, the trademark, its brand, and most significantly, the “secret recipe” for the world-renowned Coca-Cola beverage.

Some traders want to put money into KO partly on account of its dividend yield.

Warren Buffett, by way of his firm Berkshire Hathaway, has traditionally owned KO.

As of mid-2025, KO has an annual dividend yield of two.8%.

KO is a choose group of 69 shares which are often known as Dividend Aristocrats.

To qualify, the corporate should be a member of the S&P 500 and have paid constant or rising dividends for at the least 25 consecutive years.

These are typically steady, giant blue-chip shopper merchandise companies and producers.

In 1985, Coca-Cola grew to become the primary comfortable drink to be consumed in area when it was carried aboard the Area Shuttle Challenger in a specifically designed “Coca-Cola Area Can.”

COKE began as a family-owned enterprise in 1902 and has grown to change into the most important Coca-Cola bottler in the US.

Again then, it was often known as the Coca-Cola Bottling Firm.

It modified its title to Coca-Cola Consolidated Inc. in 2019.

Coca-Cola relies in Atlanta, Georgia, and markets.

It distributes nonalcoholic drinks, primarily merchandise akin to bottled water, ready-to-drink espresso and tea, enhanced water, juices, and sports activities drinks.

Roughly half of its income comes from Coca-Cola-branded merchandise particularly.

COKE additionally has quarterly dividends.

Nevertheless, with an annual yield of 0.8%, it’s considerably decrease in comparison with KO.

That is the relative efficiency of KO (blue line) versus COKE (crimson line) over the previous 5 years from mid-2020 to mid-2025:

Final Information To The Inventory Restore Technique

COKE is rising greater than KO over the previous 5 years.

The truth is, COKE had grown a lot that it underwent a 10-to-1 inventory cut up on Could 27, 2025.

What had been $1,157.30 per share has change into $115.73 per share.

The shareholders proudly owning the shares would have 10 occasions as many, in fact.

KO – even with its excessive dividend yield – couldn’t meet up with the funding returns of COKE.

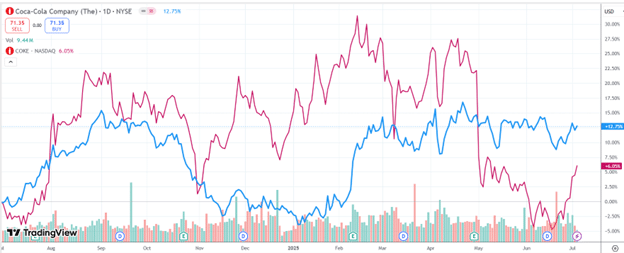

Right here is the chart comparability of KO (blue line) versus COKE (crimson line) for the trailing twelve months:

We see that COKE is rather more risky than KO.

That’s, its value swings are a lot bigger.

Throughout the trailing twelve months, COKE has a peak-to-trough ratio of about 35%, whereas KO has a peak-to-trough ratio of about 20%.

That is in keeping with the truth that COKE has a a lot decrease float than KO – a float of 87 million versus 4.3 billion.

Usually, low-float shares are typically extra risky.

Float refers back to the variety of shares accessible for public buying and selling.

The bigger the quantity, the tougher it’s for anyone investor or group to maneuver the worth.

We are able to additionally take a look at the beta. COKE’s 60-month beta is 0.79. KO’s beta is 0.45.

Because the volatility of the S&P 500 has a beta reference worth of 1.0, each COKE and KO are much less risky than the S&P 500.

Since a decrease beta means decrease volatility, KO is much less risky than COKE.

Folks have been recognized to confuse the 2 Coca-Cola inventory symbols, KO and COKE.

Now you received’t be one in all them.

We hope you loved this text on the distinction between the KO and COKE shares.

You probably have any questions, ship an e-mail or depart a remark beneath.

Commerce secure!

Disclaimer: The knowledge above is for instructional functions solely and shouldn’t be handled as funding recommendation. The technique introduced wouldn’t be appropriate for traders who should not conversant in trade traded choices. Any readers on this technique ought to do their very own analysis and search recommendation from a licensed monetary adviser.