Revealed on June tenth, 2025 by Bob Ciura

Meals shares are interesting to revenue buyers for numerous causes.

Because the saying goes, everybody has to eat. This implies the foremost meals producers and distributors see regular demand, even throughout financial downturns.

In flip, meals shares have the distinctive potential to proceed paying–and even elevating–their dividends every year, even by recessions.

As well as, many meals shares have excessive dividend yields effectively above the S&P 500 common.

Meals shares are a part of the broader client staples sector. The buyer staples sector is dwelling to a number of the most well-known dividend progress shares on the earth.

In truth, client staples shares are the most important particular person sector inside the Dividend Aristocrats, a choose group of 69 shares within the S&P 500 Index with 25+ consecutive years of dividend will increase.

You may obtain a duplicate of the Dividend Aristocrats checklist by clicking on the hyperlink under:

Disclaimer: Positive Dividend just isn’t affiliated with S&P International in any means. S&P International owns and maintains The Dividend Aristocrats Index. The knowledge on this article and downloadable spreadsheet relies on Positive Dividend’s personal assessment, abstract, and evaluation of the S&P 500 Dividend Aristocrats ETF (NOBL) and different sources, and is supposed to assist particular person buyers higher perceive this ETF and the index upon which it’s based mostly. Not one of the data on this article or spreadsheet is official information from S&P International. Seek the advice of S&P International for official data.

Inside the client staples sector, meals shares are recognized for significantly excessive dividend yields, steady payouts even by recessions, and constant dividend progress.

This text lists the 15 highest-yielding meals shares now, within the Positive Evaluation Analysis Database. The 15 shares are listed by dividend yield, from lowest to highest.

Desk of Contents

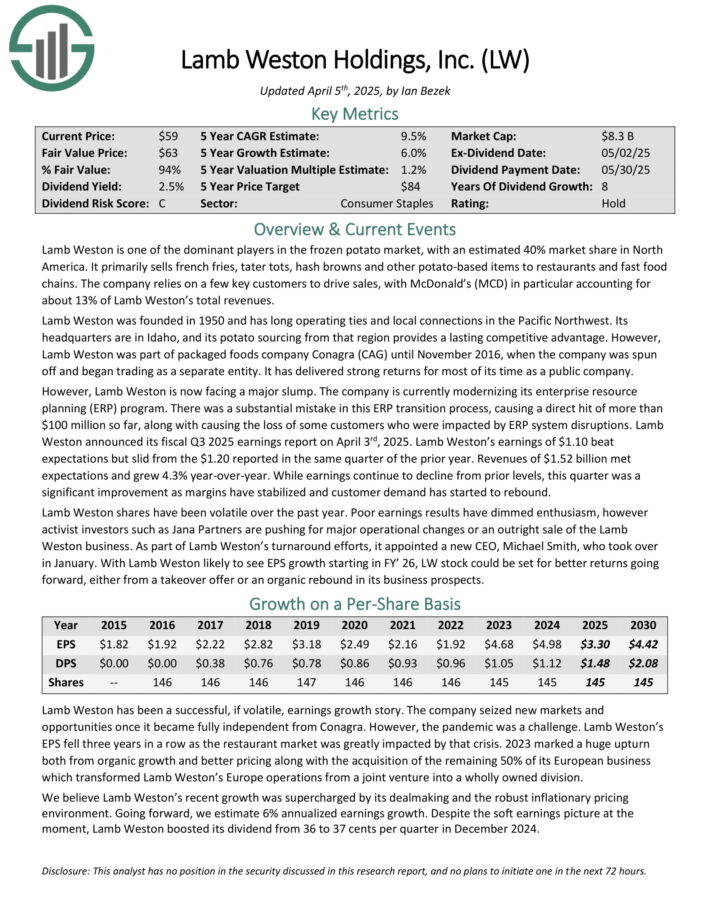

Highest-Yielding Meals Inventory #15: Lamb Weston Holdings (LW)

Lamb Weston is among the dominant gamers within the frozen potato market, with an estimated 40% market share in North America.

It primarily sells french fries, tater tots, hash browns and different potato-based objects to eating places and quick meals chains. The corporate depends on a number of key clients to drive gross sales, with McDonald’s (MCD) particularly accounting for about 13% of Lamb Weston’s complete revenues.

Weston introduced its fiscal Q3 2025 earnings report on April third, 2025. Lamb Weston’s earnings of $1.10 beat expectations however slid from the $1.20 reported in the identical quarter of the prior yr. Revenues of $1.52 billion met expectations and grew 4.3% year-over-year.

Whereas earnings proceed to say no from prior ranges, this quarter was a big enchancment as margins have stabilized and buyer demand has began to rebound.

Lamb Weston has a good bit of debt, and its BB+ credit standing from S&P International places it barely under funding grade. A steep financial downturn may stress the corporate’s dividend, that mentioned the corporate’s operations held up alright in the course of the pandemic and the comparatively low payout ratio leaves a big margin of security as we speak.

Click on right here to obtain our most up-to-date Positive Evaluation report on LW (preview of web page 1 of three proven under):

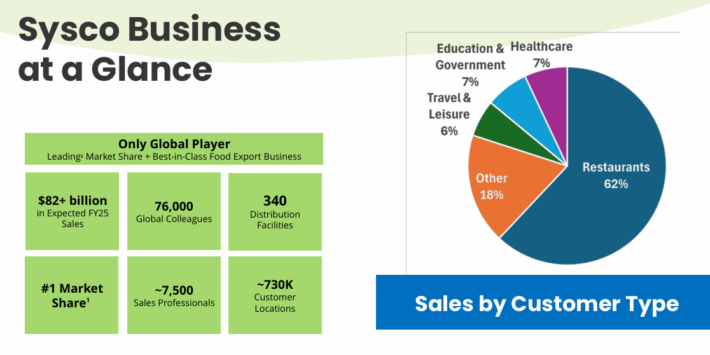

Highest-Yielding Meals Inventory #14: Sysco Corp. (SYY)

Sysco Company is the most important wholesale meals distributor in the USA. The corporate serves 600,000 places with meals supply, together with eating places, hospitals, colleges, lodges, and different services.

Supply: Investor Presentation

On April twenty ninth, 2025, Sysco reported third-quarter outcomes for Fiscal Yr (FY)2025. The corporate reported gross sales of $19.6 billion, up 1.1% from Q3 2024, regardless of a 2.0% decline in U.S. Foodservice quantity. Gross revenue fell 0.8% to $3.6 billion, with gross margin dropping 35 foundation factors to 18.3% because of decrease volumes and product combine.

Working revenue decreased 5.7% to $681 million, and adjusted working revenue fell 3.3% to $773 million, pushed by larger working bills from enterprise investments and provide chain prices. Web earnings dropped 5.6% to $401 million, with adjusted web earnings down 2.9% to $469 million.

Diluted EPS was $0.82, down 3.5%, whereas adjusted EPS remained flat at $0.96. Sysco revised its FY25 steering, projecting 3% gross sales progress and at the very least 1% adjusted EPS progress.

Click on right here to obtain our most up-to-date Positive Evaluation report on SYY (preview of web page 1 of three proven under):

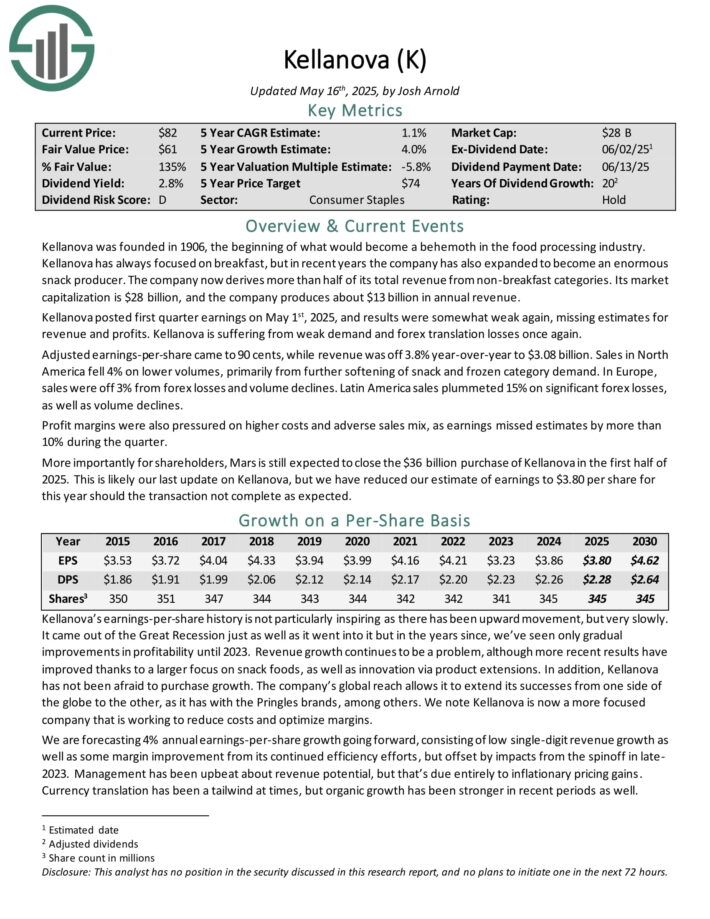

Highest-Yielding Meals Inventory #13: Kellanova Co. (Ok)

Kellanova was based in 1906, the start of what would change into a behemoth within the meals processing trade.

Kellanova has at all times targeted on breakfast, however in recent times the corporate has additionally expanded to change into an infinite snack producer. The corporate now derives greater than half of its complete income from non-breakfast classes.

It produces about $13 billion in annual income.

Kellanova posted first quarter earnings on Could 1st, 2025, and outcomes have been considerably weak once more, lacking estimates for income and income. Kellanova is affected by weak demand and foreign exchange translation losses as soon as once more.

Adjusted earnings-per-share got here to 90 cents, whereas income was off 3.8% year-over-year to $3.08 billion. Gross sales in North America fell 4% on decrease volumes, primarily from additional softening of snack and frozen class demand. In Europe, gross sales have been off 3% from foreign exchange losses and quantity declines.

Latin America gross sales plummeted 15% on important foreign exchange losses, in addition to quantity declines. Revenue margins have been additionally pressured on larger prices and antagonistic gross sales combine, as earnings missed estimates by greater than 10% in the course of the quarter.

Click on right here to obtain our most up-to-date Positive Evaluation report on Ok (preview of web page 1 of three proven under):

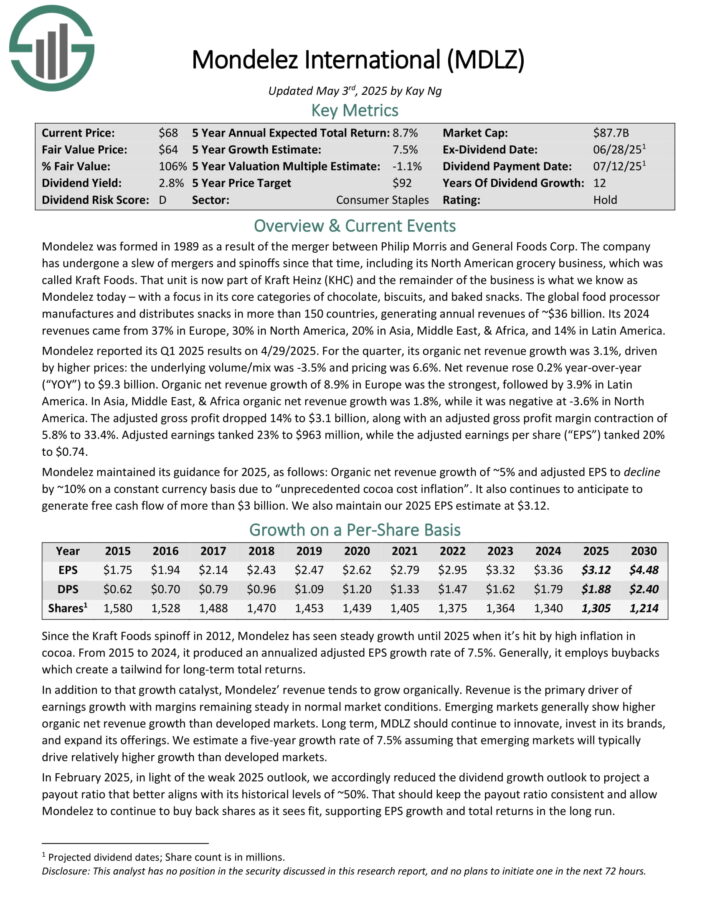

Highest-Yielding Meals Inventory #12: Mondelez Worldwide (MDLZ)

Mondelez was fashioned in 1989 on account of the merger between Philip Morris and Basic Meals Corp. It focuses on its core classes of chocolate, biscuits, and baked snacks. The worldwide meals processor manufactures and distributes snacks in additional than 150 international locations, producing annual revenues of ~$36 billion.

Its 2024 revenues got here from 37% in Europe, 30% in North America, 20% in Asia, Center East, & Africa, and 14% in Latin America.

Mondelez reported its Q1 2025 outcomes on 4/29/2025. For the quarter, its natural web income progress was 3.1%, pushed by larger costs: the underlying quantity/combine was -3.5% and pricing was 6.6%.

Web income rose 0.2% year-over-year to $9.3 billion. Natural web income progress of 8.9% in Europe was the strongest, adopted by 3.9% in Latin America. In Asia, Center East, & Africa natural web income progress was 1.8%, whereas it was detrimental at -3.6% in North America.

The adjusted gross revenue dropped 14% to $3.1 billion, together with an adjusted gross revenue margin contraction of 5.8% to 33.4%.

Mondelez maintained its steering for 2025, as follows: Natural web income progress of ~5% and adjusted EPS to say no by ~10% on a continuing forex foundation because of “unprecedented cocoa value inflation”. It additionally continues to anticipate to generate free money movement of greater than $3 billion.

Click on right here to obtain our most up-to-date Positive Evaluation report on MDLZ (preview of web page 1 of three proven under):

Highest-Yielding Meals Inventory #11: Hershey Firm (HSY)

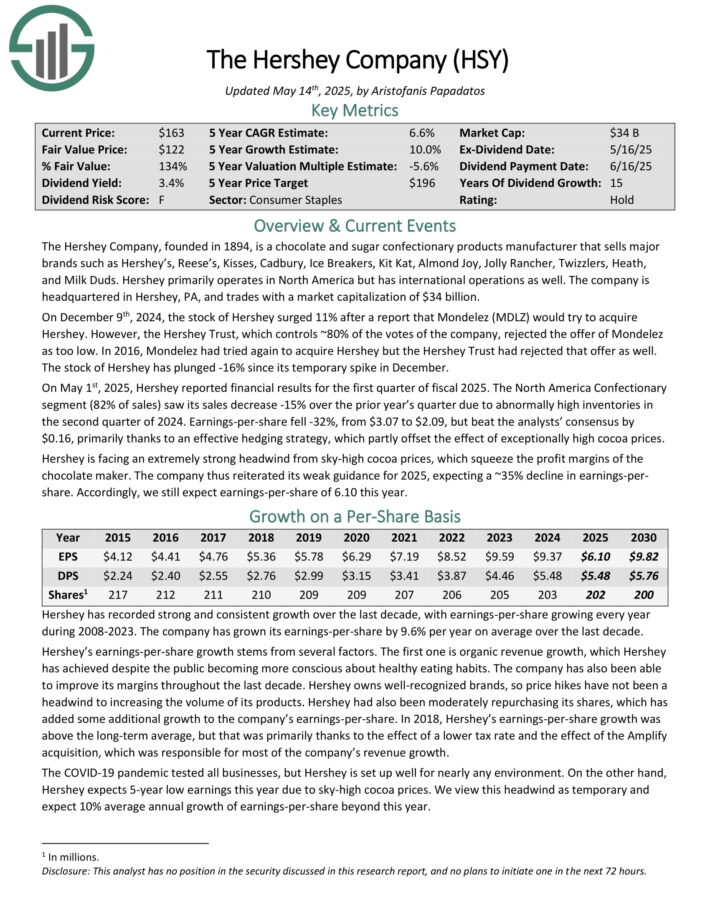

The Hershey Firm, based in 1894, is a chocolate and sugar confectionary merchandise producer that sells main manufacturers comparable to Hershey’s, Reese’s, Kisses, Cadbury, Ice Breakers, Package Kat, Almond Pleasure, Jolly Rancher, Twizzlers, Heath, and Milk Duds.

Hershey primarily operates in North America however has worldwide operations as effectively. The corporate is headquartered in Hershey, PA.

On Could 1st, 2025, Hershey reported monetary outcomes for the primary quarter of fiscal 2025. The North America Confectionary phase (82% of gross sales) noticed its gross sales lower -15% over the prior yr’s quarter because of abnormally excessive inventories within the second quarter of 2024.

Earnings-per-share fell -32%, from $3.07 to $2.09, however beat the analysts’ consensus by $0.16, primarily because of an efficient hedging technique, which partly offset the impact of exceptionally excessive cocoa costs.

Hershey is dealing with an especially robust headwind from sky-high cocoa costs, which squeeze the revenue margins of the chocolate maker. The corporate reiterated its weak steering for 2025, anticipating a ~35% decline in earnings-per-share.

Click on right here to obtain our most up-to-date Positive Evaluation report on HSY (preview of web page 1 of three proven under):

Highest-Yielding Meals Inventory #10: Tyson Meals (TSN)

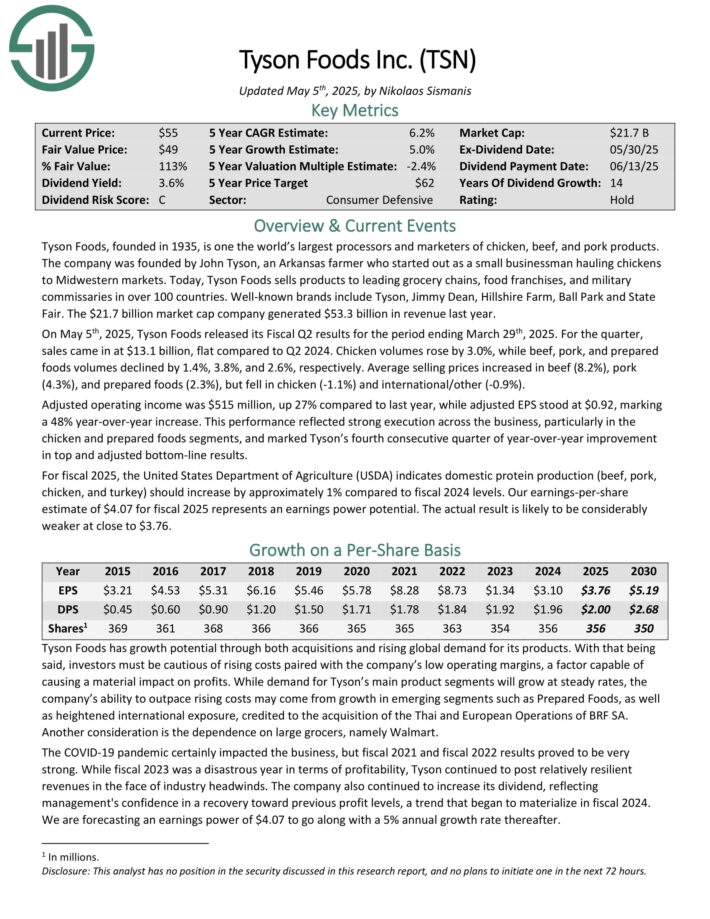

Tyson Meals, based in 1935, is one the world’s largest processors and entrepreneurs of rooster, beef, and pork merchandise. Tyson Meals sells merchandise to main grocery chains, meals franchises, and navy commissaries in over 100 international locations.

Nicely-known manufacturers embody Tyson, Jimmy Dean, Hillshire Farm, Ball Park and State Honest. The generated $53.3 billion in income final yr.

On Could fifth, 2025, Tyson Meals launched its Fiscal Q2 outcomes for the interval ending March twenty ninth, 2025. For the quarter, gross sales got here in at $13.1 billion, flat in comparison with Q2 2024. Rooster volumes rose by 3.0%, whereas beef, pork, and ready meals volumes declined by 1.4%, 3.8%, and a couple of.6%, respectively.

Common promoting costs elevated in beef (8.2%), pork (4.3%), and ready meals (2.3%), however fell in rooster (-1.1%) and worldwide/different (-0.9%).

Adjusted working revenue was $515 million, up 27% in comparison with final yr, whereas adjusted EPS stood at $0.92, marking a 48% year-over-year improve.

This efficiency mirrored robust execution throughout the enterprise, significantly within the rooster and ready meals segments, and marked Tyson’s fourth consecutive quarter of year-over-year enchancment in prime and adjusted bottom-line outcomes.

Click on right here to obtain our most up-to-date Positive Evaluation report on TSN (preview of web page 1 of three proven under):

Highest-Yielding Meals Inventory #9: Hormel Meals (HRL)

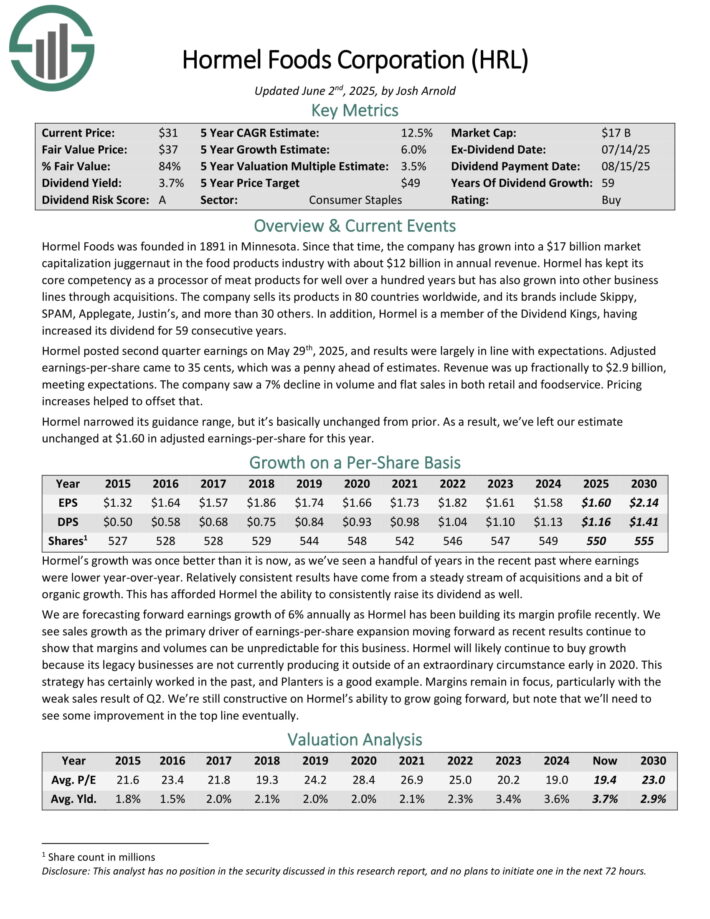

Hormel Meals was based again in 1891 in Minnesota. Since that point, the corporate has grown right into a juggernaut within the meals merchandise trade with almost $10 billion in annual income.

Hormel has stored with its core competency as a processor of meat merchandise for effectively over 100 years, however has additionally grown into different enterprise traces by acquisitions.

Hormel has a big portfolio of category-leading manufacturers. Only a few of its prime manufacturers embody embody Skippy, SPAM, Applegate, Justin’s, and greater than 30 others.

The corporate has elevated its dividend for 59 consecutive years.

Supply: Investor Presentation

Hormel posted second quarter earnings on Could twenty ninth, 2025, and outcomes have been largely according to expectations. Adjusted earnings-per-share got here to 35 cents, which was a penny forward of estimates.

Income was up fractionally to $2.9 billion, assembly expectations. The corporate noticed a 7% decline in quantity and flat gross sales in each retail and foodservice. Pricing will increase helped to offset that.

Click on right here to obtain our most up-to-date Positive Evaluation report on HRL (preview of web page 1 of three proven under):

Highest-Yielding Meals Inventory #8: J.M. Smucker Co. (SJM)

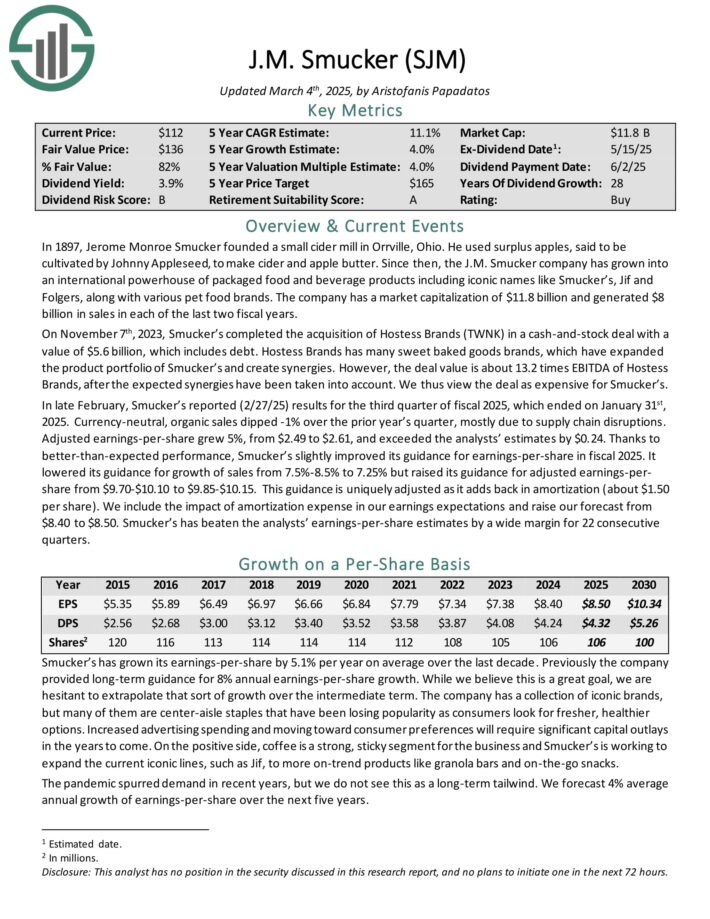

The J.M. Smucker firm has grown into a global powerhouse of packaged meals and beverage merchandise together with iconic manufacturers like Smucker’s, Jif and Folgers, together with varied pet meals manufacturers.

The corporate generated $8 billion in gross sales in every of the final two fiscal years.

Supply: Investor Presentation

In late February, Smucker’s reported (2/27/25) outcomes for the third quarter of fiscal 2025, which ended on January thirty first, 2025. Forex-neutral, natural gross sales dipped -1% over the prior yr’s quarter, principally because of provide chain disruptions.

Adjusted earnings-per-share grew 5%, from $2.49 to $2.61, and exceeded the analysts’ estimates by $0.24. Due to better-than-expected efficiency, Smucker’s barely improved its steering for earnings-per-share in fiscal 2025.

It lowered its steering for progress of gross sales from 7.5%-8.5% to 7.25% however raised its steering for adjusted earnings-per share from $9.70-$10.10 to $9.85-$10.15.

Click on right here to obtain our most up-to-date Positive Evaluation report on SJM (preview of web page 1 of three proven under):

Highest-Yielding Meals Inventory #7: WK Kellogg Co. (KLG)

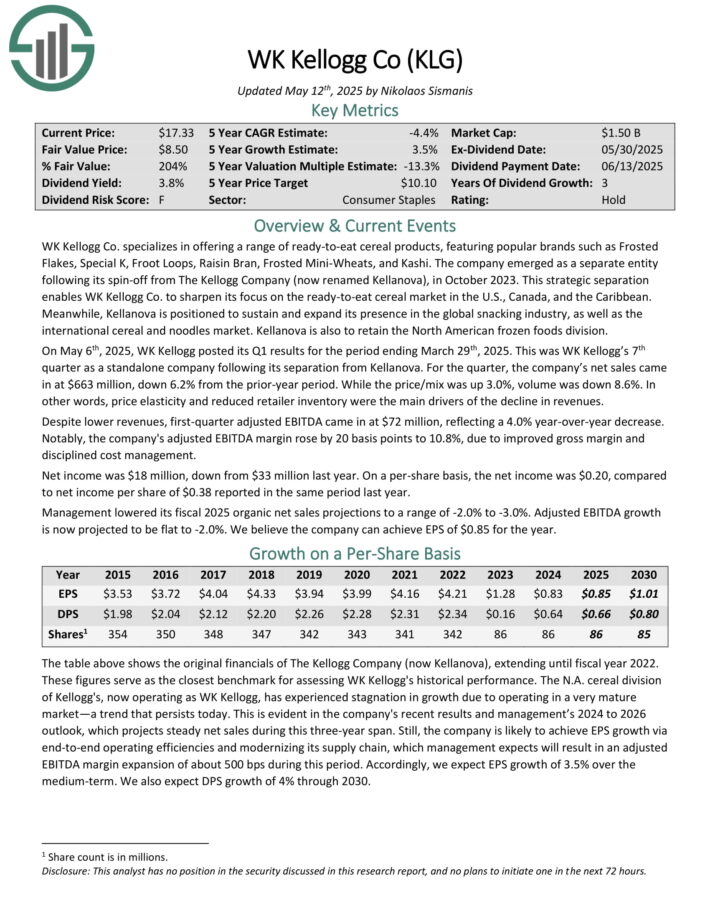

WK Kellogg Co. focuses on providing a spread of ready-to-eat cereal merchandise, that includes fashionable manufacturers comparable to Frosted Flakes, Particular Ok, Froot Loops, Raisin Bran, Frosted Mini-Wheats, and Kashi.

On Could sixth, 2025, WK Kellogg posted its Q1 outcomes for the interval ending March twenty ninth, 2025. This was WK Kellogg’s seventh quarter as a standalone firm following its separation from Kellanova. For the quarter, the corporate’s web gross sales got here in at $663 million, down 6.2% from the prior-year interval.

Whereas the worth/combine was up 3.0%, quantity was down 8.6%. In different phrases, value elasticity and decreased retailer stock have been the principle drivers of the decline in revenues.

Regardless of decrease revenues, first-quarter adjusted EBITDA got here in at $72 million, reflecting a 4.0% year-over-year lower. Notably, the corporate’s adjusted EBITDA margin rose by 20 foundation factors to 10.8%, because of improved gross margin and disciplined value administration.

Web revenue was $18 million, down from $33 million final yr. On a per-share foundation, the web revenue was $0.20, in comparison with web revenue per share of $0.38 reported in the identical interval final yr.

Administration lowered its fiscal 2025 natural web gross sales projections to a spread of -2.0% to -3.0%. Adjusted EBITDA progress is now projected to be flat to -2.0%.

Click on right here to obtain our most up-to-date Positive Evaluation report on KLG (preview of web page 1 of three proven under):

Highest-Yielding Meals Inventory #6: PepsiCo Inc. (PEP)

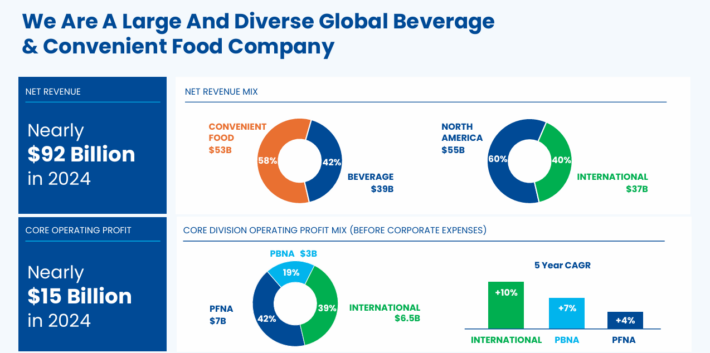

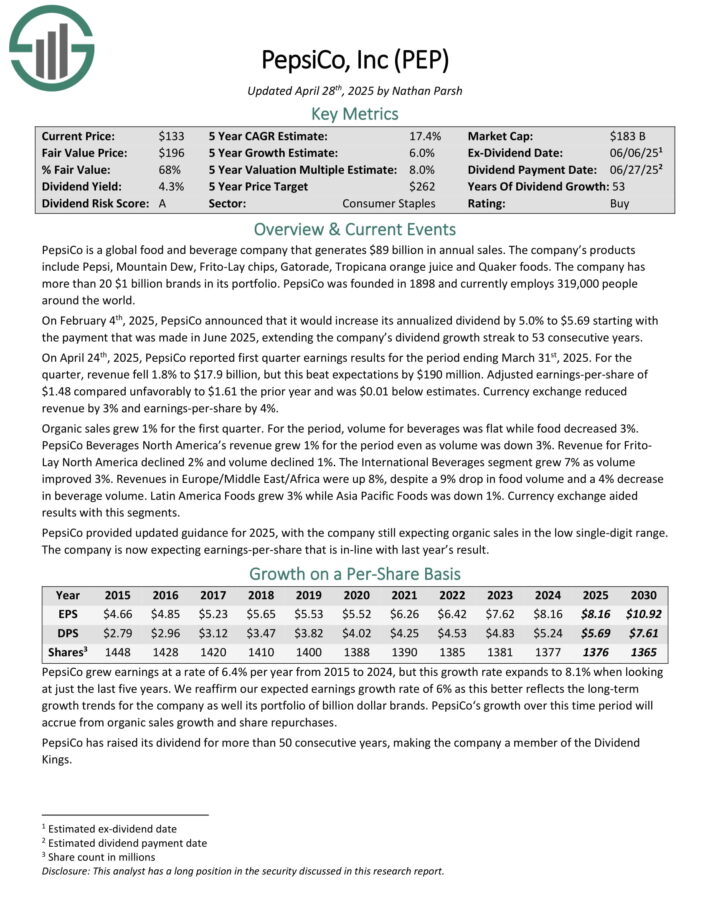

PepsiCo is a worldwide meals and beverage firm. Its merchandise embody Pepsi, Mountain Dew, Frito-Lay chips, Gatorade, Tropicana orange juice and Quaker meals.

Its enterprise is break up roughly 60-40 by way of meals and beverage income. It’s also balanced geographically between the U.S. and the remainder of the world.

Supply: Investor Presentation

On April twenty fourth, 2025, PepsiCo reported first quarter earnings outcomes for the interval ending March thirty first, 2025. For the quarter, income fell 1.8% to $17.9 billion, however this beat expectations by $190 million.

Adjusted earnings-per-share of $1.48 in contrast unfavorably to $1.61 the prior yr and was $0.01 under estimates. Forex trade decreased income by 3% and earnings-per-share by 4%.

Natural gross sales grew 1% for the primary quarter. For the interval, quantity for drinks was flat whereas meals decreased 3%. PepsiCo Drinks North America’s income grew 1% for the interval at the same time as quantity was down 3%.

Income for Frito Lay North America declined 2% and quantity declined 1%.

Click on right here to obtain our most up-to-date Positive Evaluation report on PEP (preview of web page 1 of three proven under):

Highest-Yielding Meals Inventory #5: Basic Mills (GIS)

Basic Mills is a packaged meals big, with greater than 100 manufacturers and operations in additional than 100 international locations. Basic Mills has not lower its dividend for 125 consecutive years.

In mid-March, Basic Mills reported (3/19/25) outcomes for Q3-2025. Web gross sales and natural gross sales fell -5% every over the prior yr’s quarter, primarily because of retailer stock reductions. It was the second-worst decline within the final 5 years.

Gross margin expanded from 33.5% to 33.9%, as value financial savings offset enter inflation. Adjusted earnings-per-share decreased -15%, from $1.18 to $1.00, however exceeded the analysts’ consensus by $0.04.

Basic Mills is dealing with powerful comparisons, because the pandemic has subsided. It generates 85% of its gross sales from at-home meals demand. It’s also dealing with excessive value inflation, which is more likely to persist for some time. As well as, it’s at present investing in its pet enterprise to reinvigorate progress, on the expense of short-term earnings.

Because of this, the corporate lowered its already cautious steering for fiscal 2025. It expects a 1.5%-2% decline in natural gross sales and a 7%-8% decline in earnings per-share (vs. a 2% decline in earlier steering).

Click on right here to obtain our most up-to-date Positive Evaluation report on GIS (preview of web page 1 of three proven under):

Highest-Yielding Meals Inventory #4: Campbell Soup (CPB)

Campbell Soup Firm is a multinational meals firm headquartered in Camden, N.J. The corporate manufactures and markets branded comfort meals merchandise, comparable to soups, easy meals, drinks, snacks, and packaged recent meals.

The corporate’s portfolio focuses on two particular companies: Campbell Snacks, and Campbell Meals and Drinks. Campbell generated annual gross sales of $9.6 billion in fiscal 2024.

On March 12, 2024, Campbell closed on its acquisition of Sovos Manufacturers (SOVO) for $23 per share in money, which represented a complete enterprise worth of $2.7 billion, and was funded by issuing new debt. Sovos is a pacesetter in excessive progress premium Italian sauces, and owns the market-leading Rao’s model.

Campbell Soup reported second quarter FY 2025 outcomes on March fifth, 2025. Web gross sales for the quarter improved by 9% year-over-year to $2.7 billion. This improve was principally a results of the Sovos Manufacturers acquisition. Adjusted EPS was 8% decrease year-over-year at $0.74 for the quarter, which beat expectations by two cents.

The corporate repurchased $56 million price of shares in H1. There stays $301 million remaining beneath the present $500 million share repurchase program, which is along with the present $205 million remaining on its anti-dilutive share repurchase program.

Management up to date its full-year fiscal 2025 steering. Administration now estimates that in fiscal 2025, Campbell’s adjusted earnings per share will probably be down 1% to 4%.

Click on right here to obtain our most up-to-date Positive Evaluation report on CPB (preview of web page 1 of three proven under):

Highest-Yielding Meals Inventory #3: Flowers Meals (FLO)

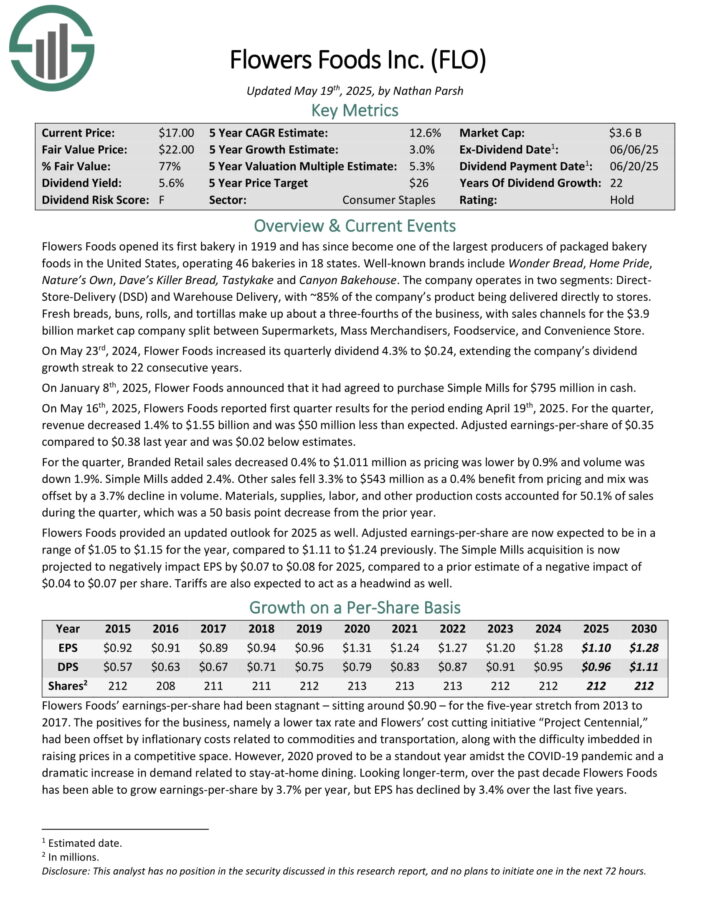

Flowers Meals opened its first bakery in 1919 and has since change into one of many largest producers of packaged bakery meals in the USA, working 46 bakeries in 18 states.

Nicely-known manufacturers embody Marvel Bread, House Satisfaction, Nature’s Personal, Dave’s Killer Bread, Tastykake and Canyon Bakehouse.

The corporate operates in two segments: Direct Retailer-Supply (DSD) and Warehouse Supply, with ~85% of the corporate’s product being delivered on to shops.

Recent breads, buns, rolls, and tortillas make up a few three-fourths of the enterprise, with gross sales channels break up between Supermarkets, Mass Merchandisers, Foodservice, and Comfort Retailer.

On Could sixteenth, 2025, Flowers Meals reported first quarter outcomes for the interval ending April nineteenth, 2025. For the quarter, income decreased 1.4% to $1.55 billion and was $50 million lower than anticipated. Adjusted earnings-per-share of $0.35 in comparison with $0.38 final yr and was $0.02 under estimates.

For the quarter, Branded Retail gross sales decreased 0.4% to $1.011 million as pricing was decrease by 0.9% and quantity was down 1.9%. Easy Mills added 2.4%. Different gross sales fell 3.3% to $543 million as a 0.4% profit from pricing and blend was offset by a 3.7% decline in quantity.

Click on right here to obtain our most up-to-date Positive Evaluation report on FLO (preview of web page 1 of three proven under):

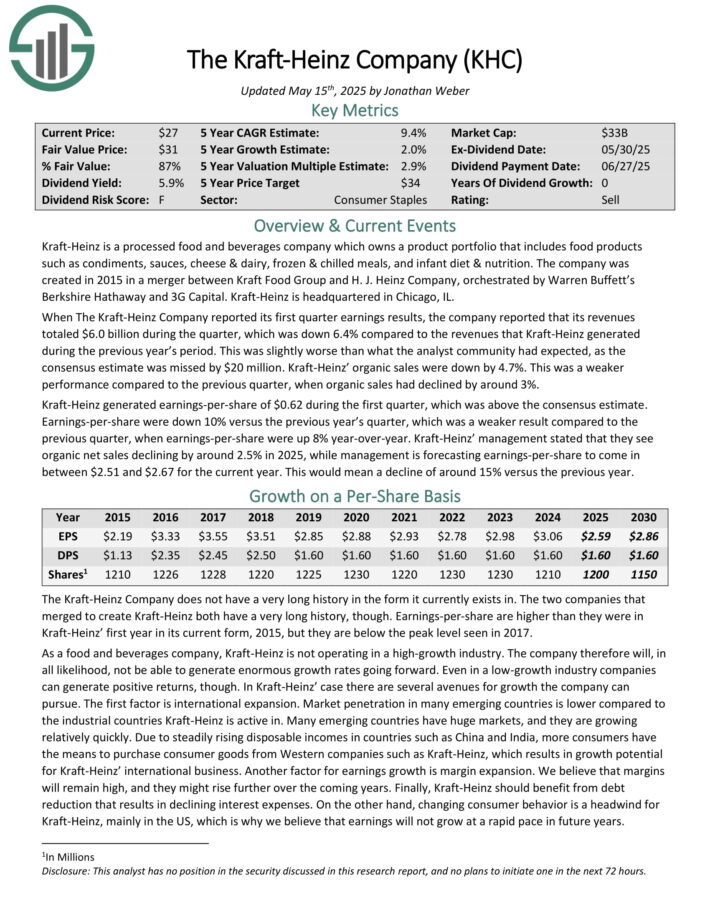

Highest-Yielding Meals Inventory #2: Kraft-Heinz Co. (KHC)

Kraft-Heinz is a processed meals and drinks firm which owns a product portfolio that features meals merchandise comparable to condiments, sauces, cheese & dairy, frozen & chilled meals, and toddler eating regimen & diet.

When The Kraft-Heinz Firm reported its first quarter earnings outcomes, the corporate reported that its revenues totaled $6.0 billion in the course of the quarter, which was down 6.4% in comparison with the revenues that Kraft-Heinz generated in the course of the earlier yr’s interval.

This was barely worse than what the analyst neighborhood had anticipated, because the consensus estimate was missed by $20 million. Kraft-Heinz’ natural gross sales have been down by 4.7%.

Kraft-Heinz generated earnings-per-share of $0.62 in the course of the first quarter, which was above the consensus estimate. Earnings-per-share have been down 10% versus the earlier yr’s quarter, which was a weaker outcome in comparison with the earlier quarter, when earnings-per-share have been up 8% year-over-year.

Kraft-Heinz’ administration said that they see natural web gross sales declining by round 2.5% in 2025, whereas administration is forecasting earnings-per-share to come back in between $2.51 and $2.67 for the present yr. This might imply a decline of round 15% versus the earlier yr.

Click on right here to obtain our most up-to-date Positive Evaluation report on KHC (preview of web page 1 of three proven under):

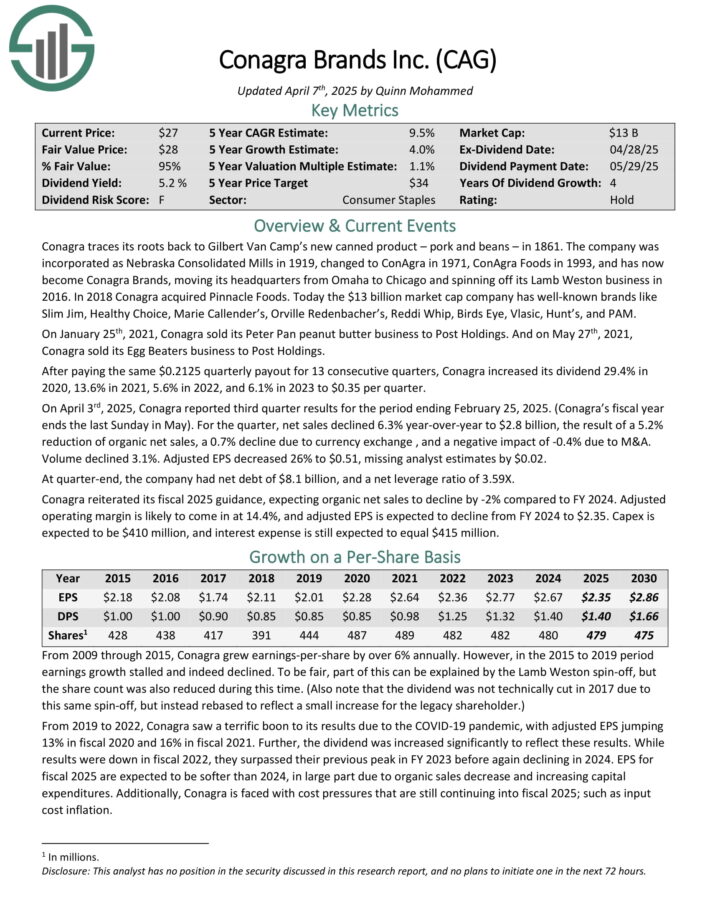

Highest-Yielding Meals Inventory #1: Conagra Manufacturers (CAG)

Conagra has well-known manufacturers like Slim Jim, Wholesome Alternative, Marie Callender’s, Orville Redenbacher’s, Reddi Whip, Birds Eye, Vlasic, Hunt’s, and PAM.

On April third, 2025, Conagra reported third quarter outcomes for the interval ending February 25, 2025. For the quarter, web gross sales declined 6.3% year-over-year to $2.8 billion, the results of a 5.2% discount of natural web gross sales, a 0.7% decline because of forex trade , and a detrimental influence of -0.4% because of M&A.

Quantity declined 3.1%. Adjusted EPS decreased 26% to $0.51, lacking analyst estimates by $0.02. At quarter-end, the corporate had web debt of $8.1 billion, and a web leverage ratio of three.59X.

Conagra reiterated its fiscal 2025 steering, anticipating natural web gross sales to say no by -2% in comparison with FY 2024. Adjusted working margin is more likely to are available at 14.4%, and adjusted EPS is anticipated to say no from FY 2024 to $2.35.

Click on right here to obtain our most up-to-date Positive Evaluation report on CAG (preview of web page 1 of three proven under):

Remaining Ideas

Excessive-yield dividend shares have nice attraction to revenue buyers. The S&P 500 Index yields simply ~1.2% proper now on common, making excessive yield shares much more engaging by comparability.

The 15 meals shares on this checklist have yields at the very least double the S&P 500 Index common. And, every of those shares has a demonstrated observe report of elevating their dividends over time.

Because of this, revenue buyers could discover these 15 meals shares engaging.

Additional Studying

In case you are all in favour of discovering high-quality dividend progress shares and/or different high-yield securities and revenue securities, the next Positive Dividend sources will probably be helpful:

Excessive-Yield Particular person Safety Analysis

Different Positive Dividend Sources

Thanks for studying this text. Please ship any suggestions, corrections, or inquiries to help@suredividend.com.