Merchants, I sit up for sharing a few of my prime intraday and swing focuses for the upcoming week with you all, together with my entry and exit plans.

Final week, I noticed a number of failed breakouts and main names giving approach to their 10- and 20-day SMAs, together with a number of different main names starting to increase to the upside. For the upcoming week, I will likely be extra cautious and conservative than typical when contemplating new swing positions, till I see a number of names pull in and reset, together with the general market.

There was additionally been improbable vary and liquidity in small-cap gappers final week, in order that will likely be a substantial focus intraday as properly for the upcoming week.

Day 3 Exhaust in CRCL

First up is the current scorching IPO, CRCL, with unbelievable momentum to the upside over the earlier two days. Arguably one of the best alternative approaching Friday, with the lengthy opp above Thursday’s excessive, a textbook consolidation and day 2 IPO breakout.

*Please notice that the costs and different statistics on this web page are hypothetical, and don’t mirror the impression, if any, of sure market components resembling liquidity, slippage and commissions.

Going ahead, nevertheless, I’ll be seeking to change biases quickly and stalking a brief place. Ideally, the inventory gaps up close to or above Friday’s excessive, or traps and pushes larger early Monday, solely to fail to comply with by means of.

In the end and ideally for an A+ setup, I’m searching for a day 3 blowout and exhaustion to the upside, together with a transparent momentum shift. This might contain failing above Friday’s highs and holding beneath the intraday VWAP. For draw back momentum intraday, multi-day VWAP, $108, and $104 will likely be key ranges to control.

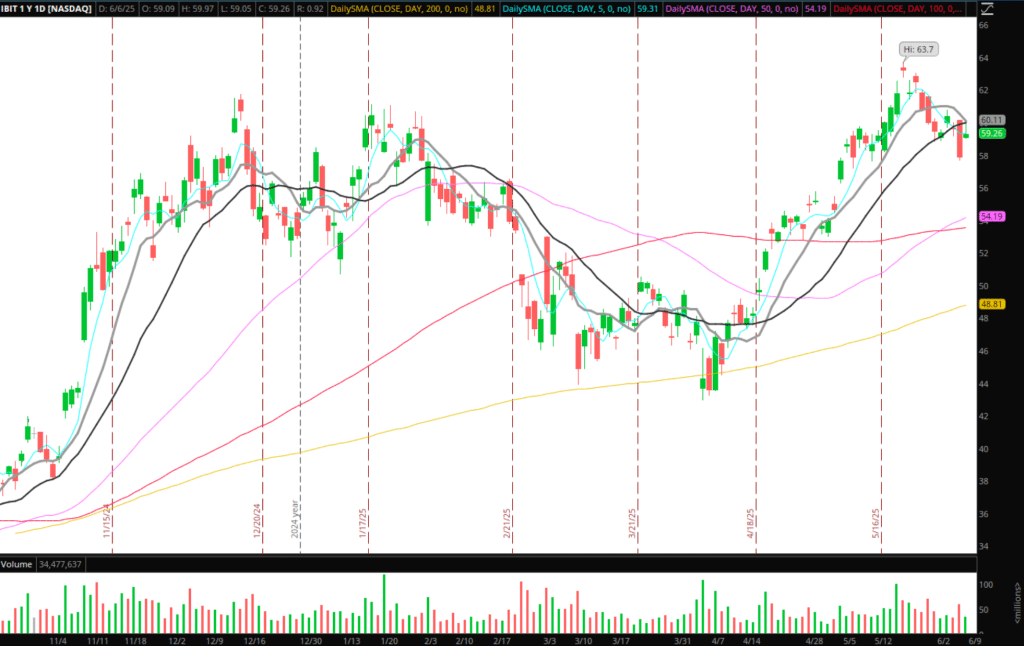

Continuation in Bitcoin

A pleasant regular pullback in Bitcoin, with a current failure beneath key short-term shifting averages. For a protracted to be thought of, I would want to see IBIT break and maintain again above $60, firmly reclaiming its 10 and 20-day shifting averages. If Bitcoin can reclaim its relative ranges, I’d contemplate going lengthy IBIT towards the LOD/10-day SMA for a swing lengthy.

*Please notice that the costs and different statistics on this web page are hypothetical, and don’t mirror the impression, if any, of sure market components resembling liquidity, slippage and commissions.

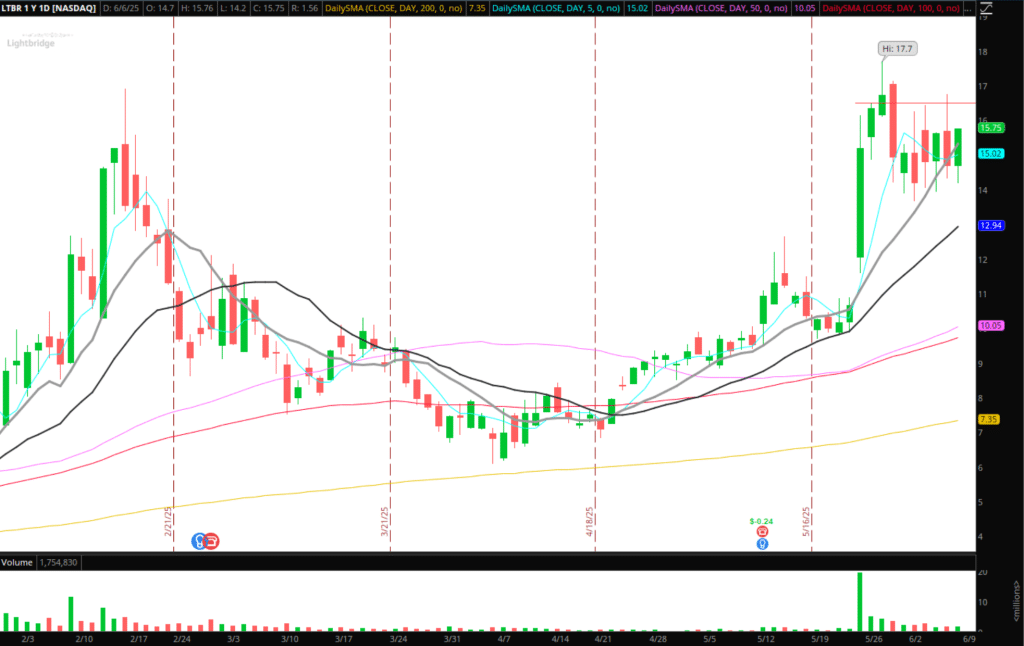

Continuation in LTBR

LTBR is part of a red-hot theme proper now, being nuclear energy era. Throughout the board, a number of names are positioning for momentum to the upside, together with SMR, OKLO. The one purpose I wouldn’t be aggressive on a swing entry right here is that a lot of the names throughout the sector are prolonged from their mid- to long-term key SMAs.

*Please notice that the costs and different statistics on this web page are hypothetical, and don’t mirror the impression, if any, of sure market components resembling liquidity, slippage and commissions.

As an alternative, I’d look to get lengthy LTBR, for instance, for an intraday breakout and probably simply maintain a small core for continuation. So, if LTBR takes out $ 16.50 and shows some relative power in its sector, I’d look to go lengthy intraday towards the 5-minute larger low, concentrating on continuation intraday and the current excessive of $17.70s, or a measured ATR transfer. I’d be out of most into that space, and path a small place.

Further Names on Watch:

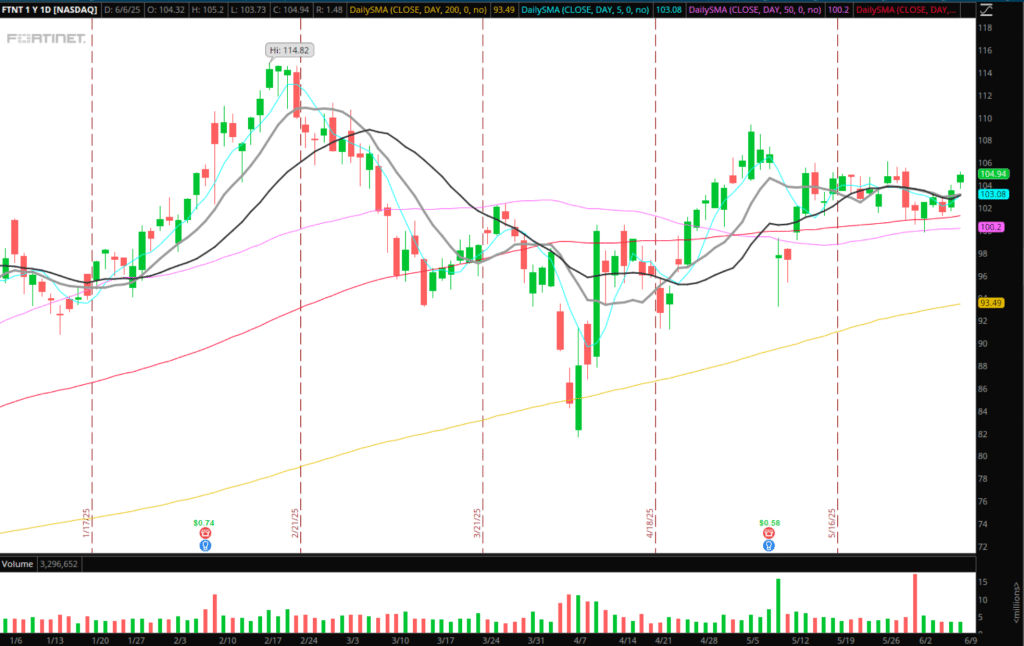

FTNT: Technical bullish formation, holding up firmly in a number one sector. Over $106, I’d contemplate going lengthy towards the LOD for a breakout.

*Please notice that the costs and different statistics on this web page are hypothetical, and don’t mirror the impression, if any, of sure market components resembling liquidity, slippage and commissions.

SEZL: Distinctive earnings continuation. Nonetheless, like many different main names, it’s starting to broaden considerably. RSI approaching 90. Any failed continuation or failed follow-through on a spot or push larger or relative weak point and FRD, and I’d search for a pullback brief. Ideally, $140+ first.

*Please notice that the costs and different statistics on this web page are hypothetical, and don’t mirror the impression, if any, of sure market components resembling liquidity, slippage and commissions.

RKLB: Doubtlessly eyeing dip-buys towards its 10-day SMA for a retest of 52-week highs.

*Please notice that the costs and different statistics on this web page are hypothetical, and don’t mirror the impression, if any, of sure market components resembling liquidity, slippage and commissions.

Get the SMB Swing Buying and selling Analysis Template Right here!

Essential Disclosures