Up to date on Might twelfth, 2025 by Bob Ciura

Return on invested capital, or ROIC, is a helpful monetary ratio that traders can add to their analysis course of.

Understanding ROIC and utilizing it to display screen for prime ROIC shares is an efficient approach to give attention to the highest-quality companies.

With this in thoughts, we ran a inventory display screen to give attention to the best ROIC shares within the S&P 500.

You’ll be able to obtain a free copy of the highest 100 shares with the best ROIC (together with vital monetary metrics like dividend yields and price-to-earnings ratio) by clicking on the hyperlink under:

Utilizing ROIC permits traders to filter out the highest-quality companies which are successfully producing a return on capital.

This text will clarify ROIC and its usefulness for traders. It should additionally listing the highest 10 highest ROIC shares proper now.

Desk Of Contents

You need to use the hyperlinks under to immediately bounce to a person part of the article:

What Is ROIC?

Put merely, return on invested capital (ROIC) is a monetary ratio that exhibits an organization’s means to allocate capital. The frequent method to calculate ROIC is to divide an organization’s after-tax internet working revenue, by the sum of its debt and fairness capital.

As soon as the ROIC is calculated, it’s evaluated in opposition to an organization’s weighted common value of capital, generally known as WACC.

If an organization’s WACC shouldn’t be instantly out there, it may be calculated by taking a weighted common of the price of an organization’s debt and fairness.

Value of debt is calculated by averaging the yield to maturity for a corporation’s excellent debt. That is pretty simple to seek out, as a publicly-traded firm should report its debt obligations.

Value of fairness is often calculated by utilizing the capital asset pricing mannequin, in any other case often called CAPM.

As soon as the WACC is calculated, it may be in contrast with the ROIC. Buyers wish to see an organization’s ROIC exceed its WACC.

This means the underlying enterprise is efficiently investing its capital to generate a worthwhile return. On this manner, the corporate is creating financial worth.

Typically, shares producing the best ROIC are doing the most effective job of allocating their traders’ capital. With this in thoughts, the next part ranks the ten shares with the best ROIC.

The High 10 Highest ROIC Shares

The next 10 shares have the best ROIC within the Positive Evaluation Analysis Database. Shares are listed by ROIC, from lowest to highest.

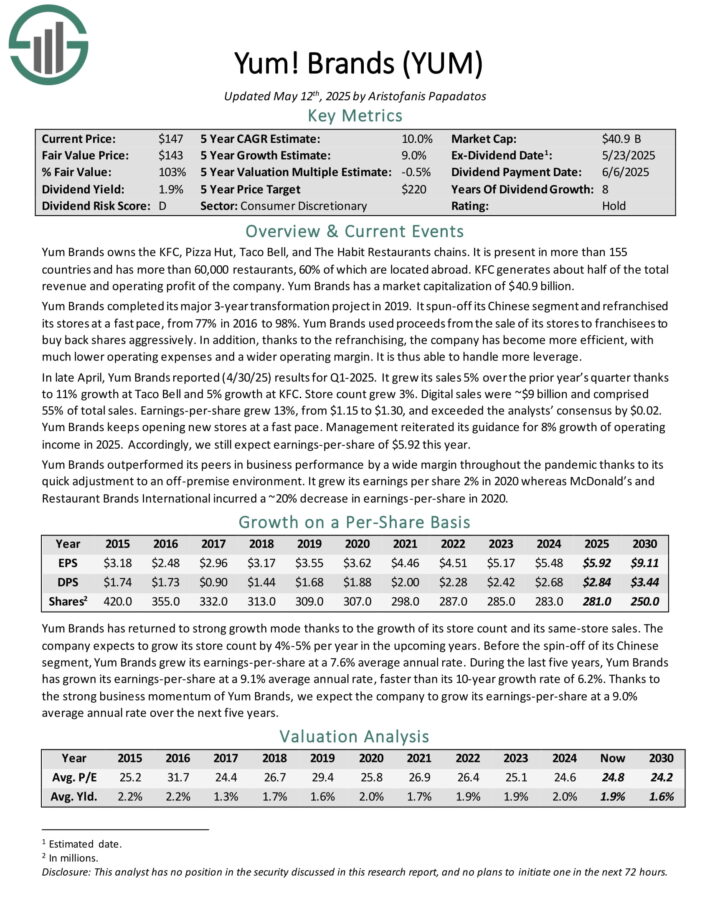

Excessive ROIC Inventory #10: Yum Manufacturers Inc. (YUM)

Return on invested capital: 44.6%

Yum Manufacturers owns the KFC, Pizza Hut, Taco Bell, and The Behavior Eating places chains. It’s current in additional than 155 nations and has greater than 59,000 eating places, 60% of that are situated overseas. KFC generates about half of the whole income and working revenue of the corporate.

In late April, Yum Manufacturers reported (4/30/25) outcomes for Q1-2025. It grew its gross sales 5% over the prior yr’s quarter because of 11% development at Taco Bell and 5% development at KFC. Retailer depend grew 3%.

Digital gross sales have been ~$9 billion and comprised 55% of whole gross sales. Earnings-per-share grew 13%, from $1.15 to $1.30, and exceeded the analysts’ consensus by $0.02.

Yum Manufacturers retains opening new shops at a quick tempo. Administration reiterated its steerage for 8% development of working earnings in 2025. Accordingly, we nonetheless anticipate earnings-per-share of $5.92 this yr.

Click on right here to obtain our most up-to-date Positive Evaluation report on YUM (preview of web page 1 of three proven under):

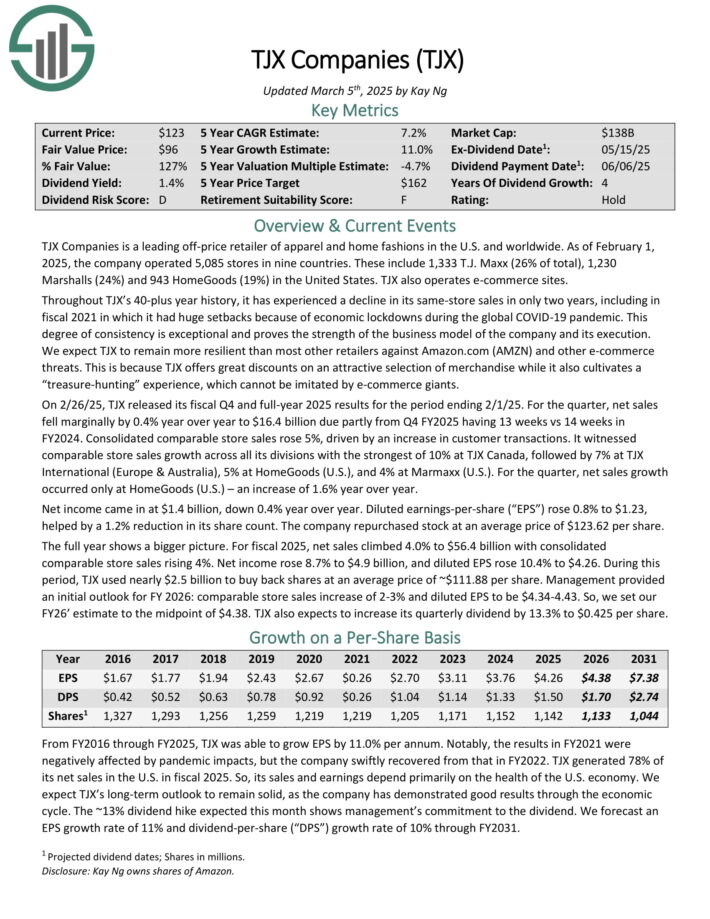

Excessive ROIC Inventory #9: TJX Firms (TJX)

Return on invested capital: 46.9%

TJX Firms is a number one off-price retailer of attire and residential fashions within the U.S. and worldwide. As of November 2, 2024, the corporate operated 5,057 shops in 9 nations.

These embody 1,331 T.J. Maxx (26% of whole), 1,219 Marshalls (24%) and 941 HomeGoods (19%) in america. TJX additionally operates e-commerce websites. In a standard yr, the corporate generates ~$50 billion in annual income and ~$4 billion in internet revenue.

On 2/26/25, TJX launched its fiscal This autumn and full-year 2025 outcomes for the interval ending 2/1/25. For the quarter, internet gross sales fell marginally by 0.4% yr over yr to $16.4 billion due partly from This autumn FY2025 having 13 weeks vs 14 weeks in FY2024.

Consolidated comparable retailer gross sales rose 5%, pushed by a rise in buyer transactions. It witnessed comparable retailer gross sales development throughout all its divisions with the strongest of 10% at TJX Canada, adopted by 7% at TJX Worldwide (Europe & Australia), 5% at HomeGoods (U.S.), and 4% at Marmaxx (U.S.).

Diluted earnings-per-share rose 0.8% to $1.23, helped by a 1.2% discount in its share depend. The corporate repurchased inventory at a mean value of $123.62 per share.

For fiscal 2025, internet gross sales climbed 4.0% to $56.4 billion with consolidated comparable retailer gross sales rising 4%. Internet earnings rose 8.7% to $4.9 billion, and diluted EPS rose 10.4% to $4.26. Throughout this era, TJX used almost $2.5 billion to purchase again shares at a mean value of ~$111.88 per share.

Administration supplied an preliminary outlook for FY 2026: comparable retailer gross sales improve of 2-3% and diluted EPS to be $4.34-4.43.

Click on right here to obtain our most up-to-date Positive Evaluation report on TJX (preview of web page 1 of three proven under):

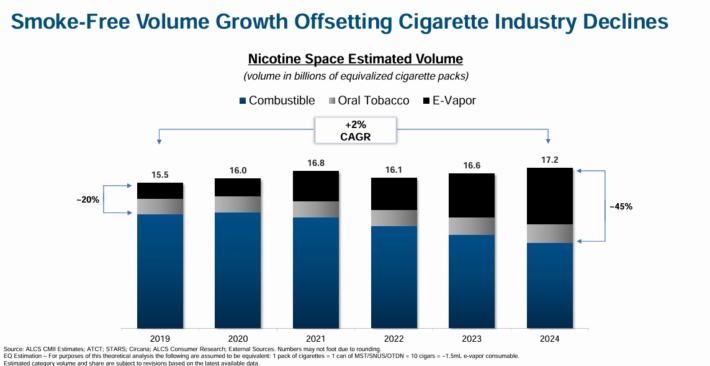

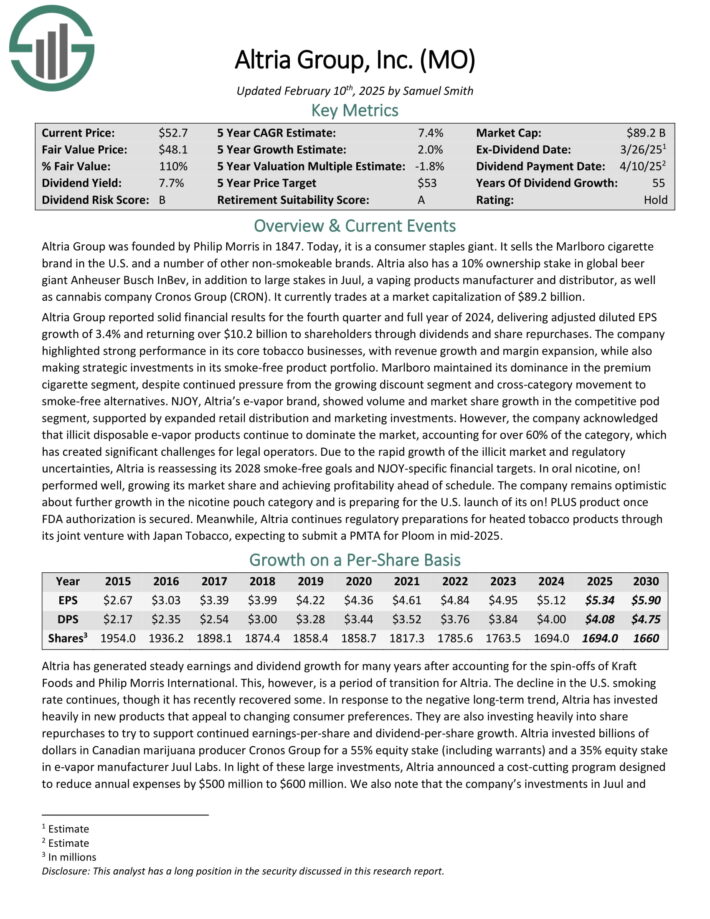

Excessive ROIC Inventory #8: Altria Group (MO)

Return on invested capital: 47.5%

Altria is a tobacco inventory that sells cigarettes, chewing tobacco, cigars, e-cigarettes, and extra beneath quite a lot of manufacturers, together with Marlboro, Skoal, and Copenhagen, amongst others.

With a present dividend yield of almost 8%, Altria is a perfect retirement funding inventory.

It is a interval of transition for Altria. The decline within the U.S. smoking charge continues. In response, Altria has invested closely in new merchandise that attraction to altering client preferences, because the smoke-free class continues to develop.

Supply: Investor Presentation

The corporate additionally has a 35% funding stake in e-cigarette maker JUUL, and a forty five% stake within the Canadian hashish producer Cronos Group (CRON).

Altria Group reported stable monetary outcomes for the fourth quarter and full yr of 2024. For the fourth quarter, income of $5.1 billion beat analyst estimates by $50 million, and elevated 1.6% year-over-year. Adjusted EPS of $1.29 beat by a penny.

For the complete yr, Altria generated adjusted diluted EPS development of three.4% and returned over $10.2 billion to shareholders by means of dividends and share repurchases.

For 2025, Altria expects adjusted diluted EPS in a spread of $5.22 to $5.37. This represents an adjusted diluted EPS development charge of two% to five% for 2025.

Click on right here to obtain our most up-to-date Positive Evaluation report on Altria (preview of web page 1 of three proven under):

Excessive ROIC Inventory #7: Starbucks Company (SBUX)

Return on invested capital: 51.2%

Starbucks started with a single retailer in Seattle’s Pike Place Market in 1971 and now has greater than 39,000 shops worldwide. Practically half of the shops are within the U.S. and almost 20% of the shops are in China.

The corporate operates beneath the Starbucks model, but in addition holds the Teavana, Evolution Recent, and Ethos Water manufacturers in its portfolio. The corporate generated $36 billion in annual income in fiscal 2024.

In late April, Starbucks reported (4/29/25) monetary outcomes for the second quarter of fiscal 2025. Comparable retailer gross sales declined -1% on account of a -2% decline within the variety of transactions.

Identical-store gross sales in China have been flat, after many damaging quarters in a row. Adjusted earnings-per-share decreased -40%, from $0.68 within the prior yr’s quarter to $0.41, and missed the analysts’ consensus by $0.07.

It was a disappointing quarter, because it signaled that the restoration is prone to take longer to materialize.

Click on right here to obtain our most up-to-date Positive Evaluation report on SBUX (preview of web page 1 of three proven under):

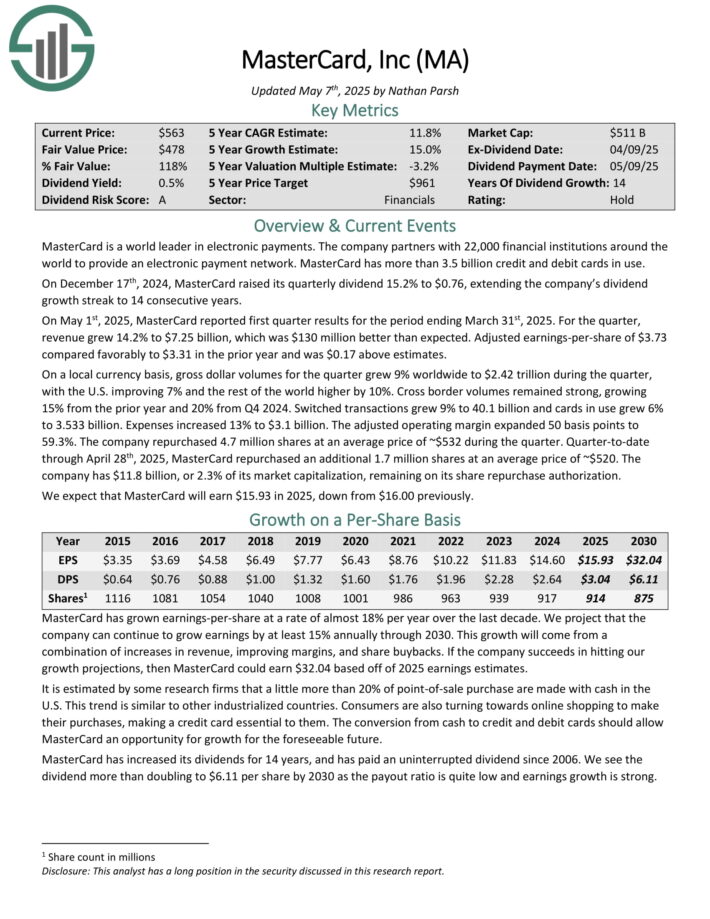

Excessive ROIC Inventory #6: Mastercard Inc. (MA)

Return on invested capital: 52.9%

MasterCard is a world chief in digital funds. The corporate companions with 25,000 monetary establishments all over the world to supply an digital fee community. MasterCard has greater than 3.1 billion credit score and debit playing cards in use.

On Might 1st, 2025, MasterCard reported first quarter outcomes for the interval ending March thirty first, 2025. For the quarter, income grew 14.2% to $7.25 billion, which was $130 million higher than anticipated. Adjusted earnings-per-share of $3.73 in contrast favorably to $3.31 within the prior yr and was $0.17 above estimates.

On an area foreign money foundation, gross greenback volumes for the quarter grew 9% worldwide to $2.42 trillion in the course of the quarter, with the U.S. bettering 7% and the remainder of the world greater by 10%. Cross border volumes remained sturdy, rising 15% from the prior yr and 20% from This autumn 2024.

Click on right here to obtain our most up-to-date Positive Evaluation report on Mastercard (preview of web page 1 of three proven under):

Excessive ROIC Inventory #5: Apple, Inc. (AAPL)

Return on invested capital: 54.1%

Apple designs, manufactures and sells merchandise equivalent to iPhones, iPads, Mac, Apple Watch and Apple TV. Apple additionally has a providers enterprise that sells music, apps, and subscriptions.

On January thirtieth, 2025, Apple reported monetary outcomes for the primary quarter of fiscal yr 2025 (Apple’s fiscal yr ends the final Saturday in September).

Whole gross sales grew 4% over the prior yr’s quarter, to a brand new file of $124.3 billion, because of sustained development in iPhone, iPad and Wearables throughout all areas.

Earnings-per-share grew 10%, from $2.18 to $2.40, and exceeded the analysts’ consensus by $0.05. Notably, Apple has missed the analysts’ estimates solely as soon as within the final 25 quarters.

Going ahead, Apple’s earnings development shall be pushed by a number of components. One among these is the continued cycle of iPhone releases, which creates lumpy outcomes. In the long term, Apple ought to have the ability to develop its iPhone gross sales, albeit in an irregular trend.

Click on right here to obtain our most up-to-date Positive Evaluation report on AAPL (preview of web page 1 of three proven under):

Excessive ROIC Inventory #4: Domino’s Pizza Inc. (DPZ)

Return on invested capital: 59.3%

Domino’s Pizza was based in 1960. It’s the largest pizza firm on the earth primarily based on world retail gross sales. The corporate operates greater than 21,000 shops in additional than 90 nations.

It generates almost half of its gross sales within the U.S. whereas 99% of its shops worldwide are owned by unbiased franchisees.

In late February, Domino’s reported (2/24/25) monetary outcomes for the fourth quarter of fiscal 2024. Its U.S. same-store gross sales grew 0.4% and its worldwide same-store gross sales rose 2.7% over the prior yr’s quarter.

Earnings-per-share grew 9%, from $4.48 to $4.89, because of greater gross sales and decrease promoting prices. Earnings-per-share missed the analysts’ consensus by $0.01, for the primary time after 8 consecutive quarters of large earnings beats.

Domino’s nonetheless expects to develop its world retail gross sales and its working earnings by 7% and eight% per yr, respectively, till the top of 2028.

The pizza chain has ample room to continue to grow for years. Its administration sees potential for the addition of greater than 10,000 new shops in its prime 15 markets.

As the present retailer depend in these nations is roughly 11,000, it’s evident that there’s nonetheless large development potential even with out bearing in mind the expansion potential within the different ~75 markets the place the corporate is current.

Click on right here to obtain our most up-to-date Positive Evaluation report on DPZ (preview of web page 1 of three proven under):

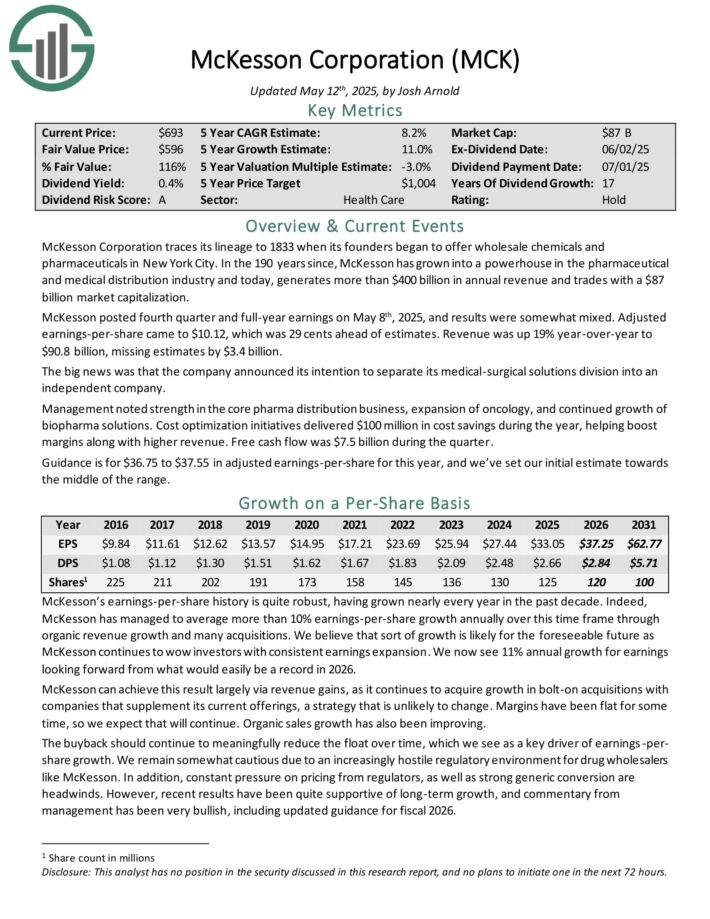

Excessive ROIC Inventory #3: McKesson Company (MCK)

Return on invested capital: 64.3%

McKesson Company traces its lineage to 1833 when its founders started to supply wholesale chemical substances and prescription drugs in New York Metropolis.

Within the 190 years since, McKesson has grown right into a powerhouse within the pharmaceutical and medical distribution business and at the moment, generates greater than $300 billion in annual income.

McKesson posted fourth quarter and full-year earnings on Might eighth, 2025, and outcomes have been considerably blended. Adjusted earnings-per-share got here to $10.12, which was 29 cents forward of estimates. Income was up 19% year-over-year to $90.8 billion, lacking estimates by $3.4 billion.

The large information was that the corporate introduced its intention to separate its medical-surgical options division into an unbiased firm.

Administration famous power within the core pharma distribution enterprise, growth of oncology, and continued development of biopharma options.

Value optimization initiatives delivered $100 million in value financial savings in the course of the yr, serving to enhance margins together with greater income. Free money circulate was $7.5 billion in the course of the quarter.

Click on right here to obtain our most up-to-date Positive Evaluation report on MCK (preview of web page 1 of three proven under):

Excessive ROIC Inventory #2: Otis Worldwide (OTIS)

Return on invested capital: 69.0%

Otis Worldwide Corp. debuted as an unbiased, publicly traded firm on April third, 2020, after being spun off from United Applied sciences (beforehand UTX, now Raytheon Applied sciences, RTX).

Right now Otis is the main firm for elevator and escalator manufacturing, set up, and repair.

On January twenty ninth, 2025, Otis reported monetary outcomes for the fourth quarter of fiscal 2024. Gross sales and natural gross sales grew 1.5% and a couple of%, respectively, whereas adjusted earnings-per-share grew 7%, from $0.87 to $0.93, although they missed the analysts’ consensus by $0.03.

Otis has missed the analysts’ estimates twice after 17 consecutive quarters of getting overwhelmed estimates. Backlog grew 10%. This bodes effectively for the efficiency of Otis within the upcoming quarters.

Because of sustained enterprise momentum, Otis supplied constructive steerage for 2025. It expects 2%-4% development of natural gross sales and adjusted earnings-per-share of $4.00-$4.10.

On the mid-point, this steerage implies 6% development over the prior yr.

Click on right here to obtain our most up-to-date Positive Evaluation report on OTIS (preview of web page 1 of three proven under):

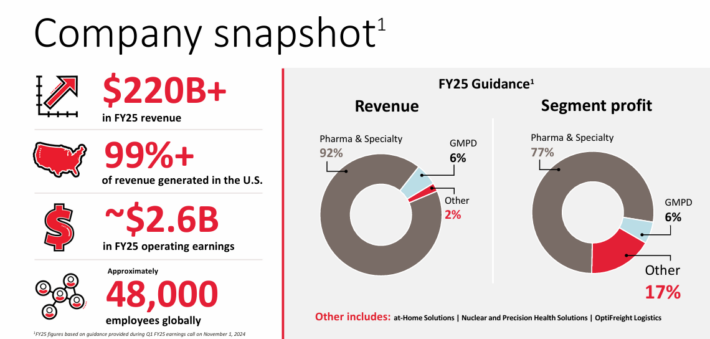

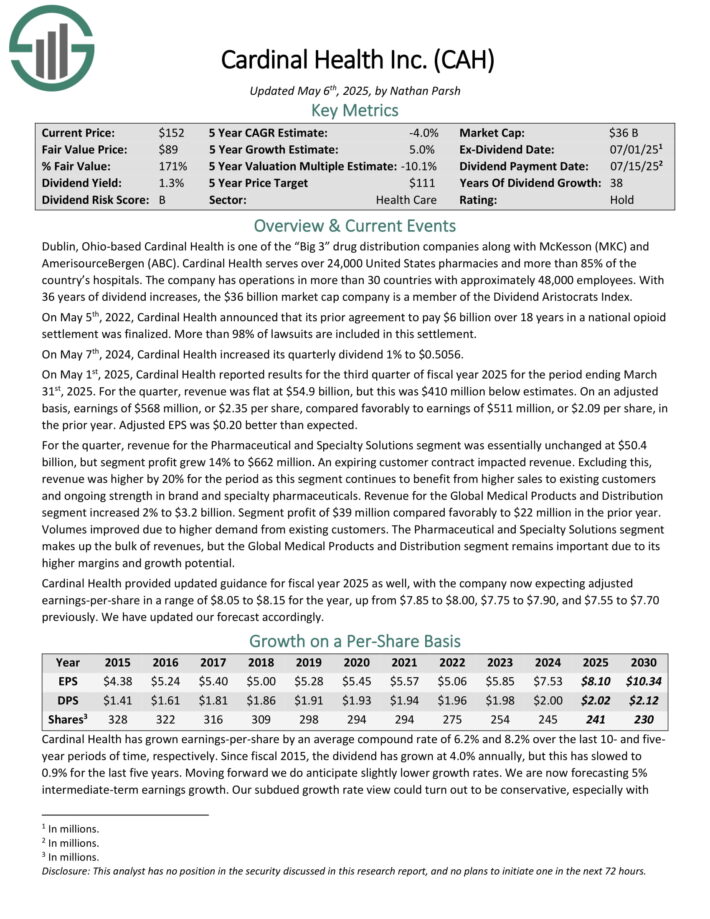

Excessive ROIC Inventory #1: Cardinal Well being (CAH)

Return on invested capital: 71.6%

Cardinal Well being is without doubt one of the “Huge 3” drug distribution corporations together with McKesson (MKC) and AmerisourceBergen (ABC). Cardinal Well being serves over 24,000 United States pharmacies and greater than 85% of the nation’s hospitals.

Over 90% of the corporate’s income comes from the Pharma & Specialty areas.

Supply: Investor Presentation

On Might 1st, 2025, Cardinal Well being reported outcomes for the third quarter of fiscal yr 2025 for the interval ending March thirty first, 2025. For the quarter, income was flat at $54.9 billion, however this was $410 million under estimates.

On an adjusted foundation, earnings of $568 million, or $2.35 per share, in contrast favorably to earnings of $511 million, or $2.09 per share, within the prior yr. Adjusted EPS was $0.20 higher than anticipated.

For the quarter, income for the Pharmaceutical and Specialty Options section was basically unchanged at $50.4 billion, however section revenue grew 14% to $662 million.

Click on right here to obtain our most up-to-date Positive Evaluation report on CAH (preview of web page 1 of three proven under):

Closing Ideas

There are numerous alternative ways for traders to worth shares. One widespread valuation methodology is to calculate an organization’s return on invested capital.

By doing so, traders can get a greater gauge of corporations that do the most effective job of investing their capital.

ROIC is certainly not the one metric that traders ought to use to purchase shares. There are numerous different worthwhile valuation strategies that traders ought to think about.

That stated, the highest 10 ROIC shares on this listing have confirmed the power to create financial worth for shareholders.

Additional Studying

In case you are interested by discovering high-quality dividend development shares appropriate for long-term funding, the next Positive Dividend databases shall be helpful:

Thanks for studying this text. Please ship any suggestions, corrections, or inquiries to help@suredividend.com.