QQQY is the Nasdaq 100 Enhanced Choices & 0DTE Revenue ETF image.

Contents

Defiance began this fund in September 2023.

The CEO of Defiance Funds is Sylvia Jablonski.

On the fund’s principal web page, it claims to be the “first put-write ETF utilizing each day choices.”

“Put-write” means promoting put choices and trying to gather possibility premiums for earnings.

“Every day choices” implies that these choices are zero-DTE choices expiring on the identical day they’re bought.

They might additionally make the most of different choices which have a number of days to expiry – referred to as “near-term choices.”

That is in an try and seize the speedy time-value decay of the choices which might be anticipated to run out nugatory by the tip of the day.

The fund supervisor actively manages these choices, and so they could also be bought or purchased at their discretion.

If you happen to take a look at the fund holdings, you won’t see many of those put gross sales.

That’s as a result of they’ve already expired or actively closed on the finish of the market session.

The holdings web page might not be up to date in actual time.

If you happen to take a look at the fund’s “schedule of investments,” you may see the premium collected from the choices gross sales.

A portion of the fund holds U.S. Treasury Payments and money.

The principle goal of this fund is to generate earnings through these possibility gross sales.

The second goal is to achieve publicity to the Nasdaq 100 Index.

Publicity to the Nasdaq 100 Index doesn’t imply that the fund invests instantly within the index, nor does it make investments instantly in any of the businesses that comprise the index.

Subsequently, shareholders should not entitled to any dividends from such corporations.

Publicity to the Nasdaq 100 index signifies that the fund’s efficiency tends to reflect the efficiency of the Nasdaq.

It is because the efficiency of brief places on the index tends to correlate to the efficiency of the underlying itself (for probably the most half).

Nevertheless, by promoting places, there’s a cap on the potential achieve.

Talking of efficiency, how did the QQQY fund do in 2024?

The Nasdaq-100 (NDX) had an upward-sloping curve of a achieve of 26% in 2024.

Earlier than you utterly dismiss the QQQY after seeing its chart for a similar time interval:

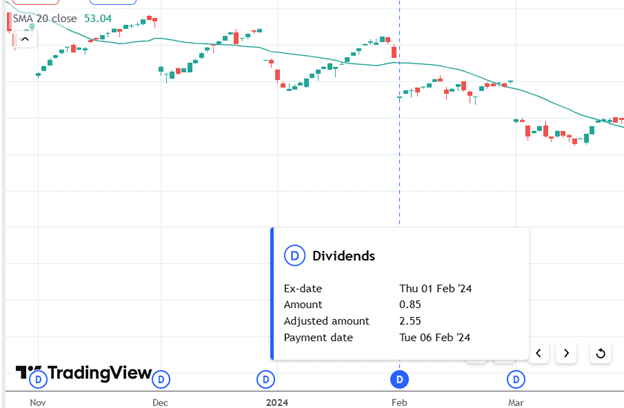

You need to take a look at all these tiny “D” symbols throughout that backside of the TradingView chart.

The fund is giving a reasonably excessive dividend distribution fee to its shareholders.

In late 2024, it elevated its distribution frequency to weekly.

Meaning the shareholders get earnings each week.

These distributions trigger an erosion on the fund’s NAV, inflicting it to drop from $52.64 (split-adjusted value) to $30.86 in the course of the yr 2024.

Additionally, among the NAV erosion comes from the expense of operating the fund.

NAV is the Web Asset Worth, which represents the fund’s per-share worth and is often used to measure mutual funds, ETFs, and different funding funds.

These numbers should not completely correct both. As a result of on August 1, 2024, a tiny “S” image within the chart represents a 1-for-3 reverse inventory break up.

If you happen to had three shares of QQQY earlier than that day, then you definately would end up with just one share after that day.

In fact, your one share shall be value thrice as a lot as the unique share.

So, these splits haven’t any affect on the shareholders’ fairness.

TradingView is displaying the post-split adjusted value.

Whereas TradingView was displaying $52.64 on January 2, 2024, the shareholders had been seeing $17.54 on that day.

Pause right here to guess what you assume is the annual return of a zero-DTE.

Then, we’ll run the numbers to seek out out.

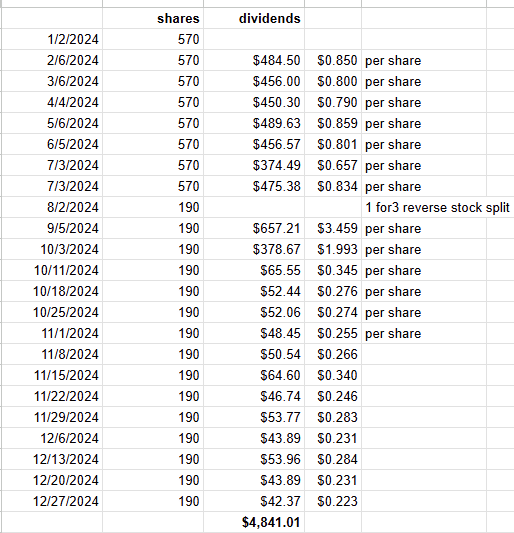

Suppose an investor needed to speculate $10,000 in QQQY on January 2, 2024; he would have purchased 570 shares that day.

On February 6, 2024, the investor would have acquired a dividend of $0.85 per share.

Free Earnings Season Mastery eBook

Bearing in mind every of the dividends acquired, the online dividends acquired by the tip of the yr can be $4841.

On August 1, 2024, the investor would have solely 190 shares as a result of one-for-three reverse inventory break up.

On the finish of the yr, with 190 shares and an NAV of $30.86, the investor would nonetheless have $5863.40 within the fund.

$5864.40 + $4841.01 = $10,704.41

The preliminary $10,000 funding had change into $10,704.41 on the finish of the yr, an annual yield of seven%.

Was this near your guess?

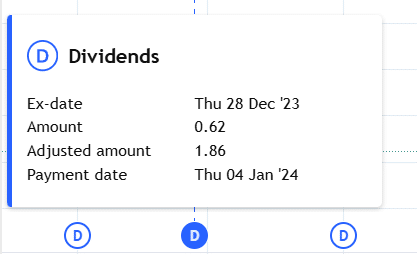

Why didn’t we calculate the $0.62 per share dividend shareholders acquired on January 4, 2024?

The investor is not going to obtain this dividend as a result of the investor has not but purchased into the fund on the ex-dividend date of December 28, 2023.

Equally, we didn’t calculate the dividend the investor would obtain on January 3, 2025, as a result of we’re solely trying on the investor’s efficiency in 2024.

However in case you had been to argue that this dividend needs to be included, even when the investor exited the fund on December 31, 2024 (the ex-dividend date), the dividend “examine is within the mail.”

Okay, then add an additional $45.41 to the return for that dividend examine.

At this time, we discovered that we can’t merely take a look at a line on a graph to find out the efficiency of a fancy fund.

By turning on the show of dividends and inventory splits, we will work out what would have occurred to an investor’s cash if that they had invested it in QQQY in 2024.

We hope you loved this text on the QQQY etf efficiency.

In case you have any questions, please ship an e-mail or depart a remark under.

Commerce secure!

Disclaimer: The knowledge above is for academic functions solely and shouldn’t be handled as funding recommendation. The technique introduced wouldn’t be appropriate for traders who should not acquainted with trade traded choices. Any readers on this technique ought to do their very own analysis and search recommendation from a licensed monetary adviser.