At the moment, we’ll take a look at a totally risk-free choices collar commerce.

Threat-free collars will not be synonymous with zero-cost collars.

The zero-cost collar simply means which you could add an choices collar round a inventory for zero further value.

These are widespread, however they don’t seem to be risk-free.

The choices collar we’re discussing is much less widespread, and the complete commerce has no threat of loss.

Contents

A collar is when an investor owns 100 shares of inventory.

The investor then buys a put choice to guard that inventory and sells a name choice to soak up a credit score to pay for that put choice.

If the credit score exceeds the price of the put choice, then now we have a zero-cost collar.

If the credit score exceeds the price of the put choice by a lot that it covers any losses from a declining inventory value, then you could have a risk-free commerce.

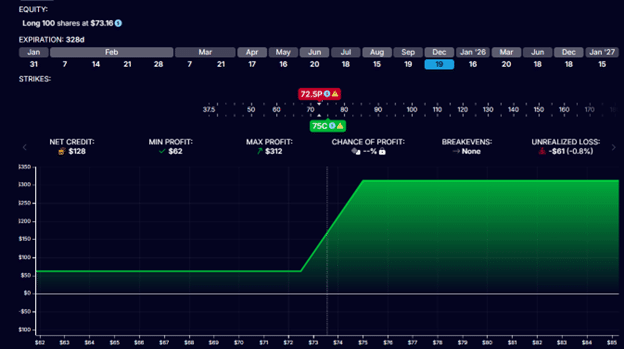

On January 23, 2025, an investor buys 100 Nike (NKE) shares for $73.16 per share.

He promptly buys a put choice with a strike value of $72.50, expiring on December 19, 2025.

This prices $710.

With commissions and charges, let’s say it prices $710.65.

He promptly sells a name choice with a strike value of $75, expiring on December 19, 2025.

This offers him a credit score of $839.33 (with commissions and charges taken out).

We see that is already a zero-cost collar as a result of the sale of the decision gave him more cash than it prices for the put choice.

Actually, he nets a credit score of $128.68.

This credit score can compensate him for any potential loss within the inventory value.

The put choice entitles the investor to promote 100 shares of Nike at $72.50 (offered it’s earlier than the choice’s expiration date).

Essentially the most that the investor can lose from the inventory then is $0.66 per share as a result of

$73.16 – $72.50 = $0.66

For 100 shares, essentially the most the investor can lose from a declining inventory is $66.

But when that have been to occur, the $128.68 credit score greater than compensates for this lack of $66.

Due to this fact, this funding mustn’t lose cash – until the investor makes a buying and selling error.

Actually, this commerce ought to make no less than $62 it doesn’t matter what occurs to the Nike inventory value.

If we have been to enter these costs into OptionStrat modeling software program, we might see that the danger graph would all the time be above the zero revenue line.

The revenue of the commerce is proven on the vertical axis.

It calculates the minimal revenue to be $62 and the utmost revenue potential to be $312.

Free Wheel Technique eBook

If Nike is above $75 per share at expiration, the put choice will expire nugatory.

The inventory might be referred to as away at $75.

With 100 shares, the investor would obtain $7500 at expiration to promote the 100 shares at $75 per share.

Due to this fact, the online revenue in that case could be

Buy of 100 shares: -$7316

Buy of put choice: -$710.65

Sale of name choice: $839.33

Sale of 100 shares: $7500

Web revenue: $312

Those that are observant will be aware that the expiry of the decision and put choices are 300 days out in time.

Which means it may take 300 days to make that $312 revenue.

Annualized to a 12 months that has one year, that will be equal to a revenue of $379.60 in a 12 months.

Since this commerce requires the acquisition of 100 shares, it ties up roughly, on common, $7316 of capital.

In share phrases, this comes out to be a 5.2% return on capital per 12 months.

$379.60 / $7316 = 5.2%

The final risk-free fee of return as of January 2025 is 4.2% based mostly on the three-month U.S. Treasury Invoice yield.

Due to this fact, our Nike risk-free collar makes about 1% greater than the risk-free fee of return.

Sure, it may.

And it may be stuffed at such costs.

The slight misalignment of costs in far-expiry choices and a few random motion of the inventory value can allow such costs to be realized.

These identical value anomalies may cause an uninformed dealer to exit such risk-free commerce at a loss.

Zero-risk is assured on the time of expiration of the choices.

Earlier than expiration, the commerce can expertise P&L which might be destructive.

If a dealer have been to exit at an inopportune time when the P&L occurs to be destructive, then the commerce will not be risk-free.

The chance could be the danger of human error.

By figuring out that $312 is the max revenue of the commerce, the investor might have the chance to exit the commerce in a a lot shorter period of time if he occurs to see the P&L being close to the max revenue resulting from value swings and/or choices value fluctuations.

This may occasionally allow the investor to get a barely better-annualized return and recycle the capital earlier.

Tying up capital for a lot of the 12 months additionally represents a possibility value as this cash cannot be used elsewhere the place the returns is likely to be higher.

Typically the market may give us a free lunch.

That free lunch could be only a little bit of butter on un-toasted white bread as a result of it’s barely above the risk-free fee of return.

However a free lunch continues to be higher than no lunch.

In our subsequent article, we’ll present find out how to search for risk-free trades in case anyone desires to make these their bread-and-butter trades.

We hope you loved this text on how a lot you may make from a risk-free choices collar commerce.

If in case you have any questions, please ship an electronic mail or depart a remark beneath.

Commerce protected!

Disclaimer: The knowledge above is for instructional functions solely and shouldn’t be handled as funding recommendation. The technique offered wouldn’t be appropriate for traders who will not be conversant in change traded choices. Any readers on this technique ought to do their very own analysis and search recommendation from a licensed monetary adviser.