Up to date on March twenty first, 2025 by Bob Ciura

Air Merchandise & Chemical substances (APD) will not be essentially the most well-known firm. It’s primarily a business-to-business producer and distributor of business gases.

Nonetheless, Air Merchandise & Chemical substances is an elite dividend inventory as a member of the Dividend Aristocrats, a gaggle of dependable dividend shares with 25+ years of consecutive dividend will increase.

We imagine the Dividend Aristocrats are among the many finest dividend progress shares to purchase for the long term.

With that in thoughts, we created a listing of all 69 Dividend Aristocrats, together with essential metrics like price-to-earnings and dividend yields.

You possibly can obtain a replica of our Dividend Aristocrats record by clicking on the hyperlink beneath:

Disclaimer: Positive Dividend will not be affiliated with S&P International in any manner. S&P International owns and maintains The Dividend Aristocrats Index. The data on this article and downloadable spreadsheet is predicated on Positive Dividend’s personal overview, abstract, and evaluation of the S&P 500 Dividend Aristocrats ETF (NOBL) and different sources, and is supposed to assist particular person traders higher perceive this ETF and the index upon which it’s primarily based. Not one of the info on this article or spreadsheet is official knowledge from S&P International. Seek the advice of S&P International for official info.

Air Merchandise & Chemical substances’ dividend historical past – 43 years of consecutive dividend will increase – signifies that the corporate is a mannequin of consistency.

The corporate has reinvented itself in recent times. A by-product and a separate important divestiture have been applied with the aim of streamlining the corporate’s enterprise mannequin and specializing in its core industrial gasoline operations.

Air Merchandise & Chemical substances seems poised to proceed elevating its dividend for a few years to return.

Enterprise Overview

Air Merchandise & Chemical substances is among the largest producers and distributors of atmospheric and course of gasses on the planet. Its prospects embrace different companies within the industrial, expertise, power, and supplies sectors.

Air Merchandise & Chemical substances was based in 1940 and has a present market capitalization of ~$65 billion.

It additionally has a major worldwide presence. Roughly 40% of the corporate’s annual gross sales are generated within the U.S. and Canada, with the rest unfold throughout Latin America, Europe, and Asia.

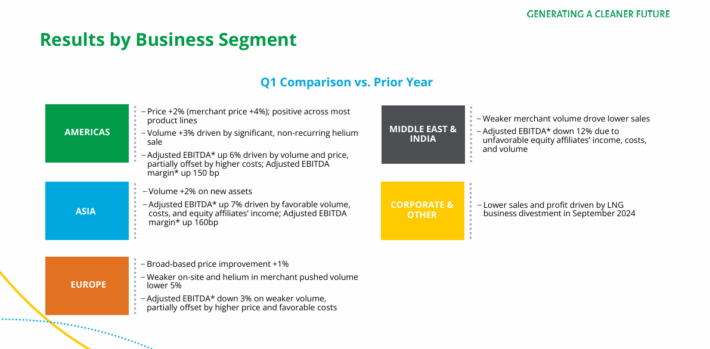

Air Merchandise & Chemical substances reported monetary outcomes for the primary quarter of fiscal 2025 in February. Income of $2.93 billion through the quarter, declined 2.3% year-over-year, lacking the analyst consensus estimate by $10 million.

Supply: Investor Presentation

The corporate’s prices declined much more than revenues, which nonetheless allowed for some earnings progress in comparison with the earlier yr’s quarter.

Air Merchandise & Chemical substances was in a position to generate earnings-per-share of $2.86 through the first quarter, which was up 1% in comparison with the earlier yr’s interval. EBITDA was up 1% as nicely through the interval.

Following a document yr in 2024, Air Merchandise & Chemical substances is guiding for an additional document revenue in fiscal 2025, with earnings-per-share seen at $12.70 to $13.00. The steering implies an earnings-per-share progress charge of round 3% this yr.

Progress Prospects

The streamlining initiatives undertaken by Air Merchandise & Chemical substances previously a number of years have led to important profitability enhancements for the economic gasoline big. The corporate’s EBITDA margin pattern during the last a number of years might be seen beneath:

Air Merchandise & Chemical substances has expanded its adjusted EBITDA margin by ~1400 foundation factors for the reason that second quarter of 2014 – a major enchancment, which has mixed with rising adjusted EBITDA to drive larger earnings-per-share and dividends.

It is going to additionally develop as a consequence of worldwide enlargement, as the corporate’s Gases Asia enterprise has delivered the very best progress charge within the current previous, though its American enterprise stays the most important phase.

Air Merchandise & Chemical substances has a lot of progress tasks both not too long ago accomplished or scheduled to be accomplished within the coming months.

Supply: Investor Presentation

Investments in NEOM will drive its inexperienced power publicity and develop its presence in Saudi Arabia, whereas Air Merchandise & Chemical substances can also be is increasing its hydrogen footprint in a number of markets, investing closely in recent times and for the foreseeable future on this business in an effort to profit from the anticipated market progress within the coming years.

These investments, coupled with margin progress initiatives, ought to result in significant earnings progress for the corporate over the approaching years. We count on 6% annualized EPS progress over the subsequent 5 years.

Aggressive Benefits & Recession Efficiency

Air Merchandise & Chemical substances has a lot of aggressive benefits. The primary and first benefit the corporate has is its dimension and market share.

Furthermore, the economic gasoline distribution enterprise advantages from excessive switching prices. These prices might not essentially be monetary – as an alternative, prospects are unlikely to modify as soon as their gasoline wants are being met by a specific provider as a result of it might be tough to discover a competitor that gives equivalent companies in a specific geographic area.

To that finish, Air Merchandise & Chemical substances’ dimension additionally advantages the corporate.

The corporate’s current divestitures and asset gross sales have given it an infusion of money, bolstering its company funds in a manner that ought to assist it endure any upcoming financial downturns. Furthermore, Air Merchandise & Chemical substances has a monitor document of performing moderately nicely throughout previous recessions.

Contemplate the corporate’s efficiency through the 2007-2009 monetary disaster for proof of this:

2007 adjusted earnings-per-share: $4.40

2008 adjusted earnings-per-share: $4.97 (13% enhance)

2009 adjusted earnings-per-share: $4.06 (18.3% decline)

2010 adjusted earnings-per-share: $5.02 (23.6% enhance)

Air Merchandise & Chemical substances skilled an 18.3% decline in adjusted earnings-per-share in 2009 through the monetary disaster, however the firm’s backside line surged to a brand new excessive by 2010.

The corporate additionally remained extremely worthwhile in 2020, a tough yr for the worldwide financial system as a result of coronavirus pandemic.

The U.S. financial system entered a recession on account of the pandemic, however Air Merchandise & Chemical substances skilled solely a gentle dip in earnings, which allowed it to proceed elevating its dividend.

Valuation & Anticipated Complete Returns

With a 6% anticipated EPS progress charge, along with a 2.4% dividend yield, one may anticipate excessive single-digit annual returns from the safety.

Nonetheless, it’s crucial to think about how valuation can influence future returns.

Utilizing $12.85 because the anticipated fiscal 2025 adjusted earnings-per-share, and a share value of $291, the safety is at the moment buying and selling fingers at 22.6 instances anticipated earnings.

For context, the inventory has traded at a median earnings a number of nearer to 19 during the last 10 years.

We imagine that 20 instances earnings is a good valuation estimate for Air Merchandise & Chemical substances, that means shares are barely overvalued. Imply reversion to a price-to-earnings ratio of 20 might decrease annualized returns by -2.4% over a 5-year time horizon.

As such, we count on complete annual returns to include the next:

6% earnings-per-share progress

2.4% dividend yield

-2.4% P/E a number of compression

We count on complete annual returns of 6.0% per yr by means of 2029.

Last Ideas

Air Merchandise & Chemical substances is a powerful dividend progress inventory, having raised its dividend annually for the previous 43 years.

The corporate has de-risked its enterprise mannequin and that enterprise transformation permits it to concentrate on its core enterprise of business gases.

Furthermore, it has a big slate of latest tasks to assist keep on monitor for progress within the coming years. This could profit shareholders within the type of continued dividend will increase on an annual foundation.

With anticipated annual returns of 6%, we charge the inventory as a maintain proper now.

If you’re keen on discovering extra high-quality dividend progress shares appropriate for long-term funding, the next Positive Dividend databases can be helpful:

The key home inventory market indices are one other stable useful resource for locating funding concepts. Positive Dividend compiles the next inventory market databases and updates them month-to-month:

Thanks for studying this text. Please ship any suggestions, corrections, or inquiries to assist@suredividend.com.