Merchants, Let’s assessment my high concepts for the week. After all, the market setting has shifted dramatically, favoring intraday strikes slightly than swing trades. As I’ve talked about over the earlier a number of weeks, that’s the place my focus will proceed till the market construction shifts.

So, let’s assessment my high move-to-move concepts for the week forward. With quite a lot of financial knowledge, comparable to CPI, PPI, and jobless claims, popping out this week, vital emphasis is once more on momentum buying and selling versus swing buying and selling.

Lengthy Scalps in Tesla: Some good aid in client discretionary, tech, and the general market on Friday. Suppose QQQs and discretionary could make some floor above Friday’s excessive towards their declining 5-day MA. In that case, I’d be centered on TSLA as one avenue for lengthy momo scalps, particularly focusing on increased low entries or consolidation breakouts intraday. I’ll keep away from if we’re holding under Friday’s excessive or displaying notable relative weak spot—related ideas in NVDA and PLTR.

*Please be aware that the costs and different statistics on this web page are hypothetical, and don’t mirror the affect, if any, of sure market elements comparable to liquidity, slippage and commissions.

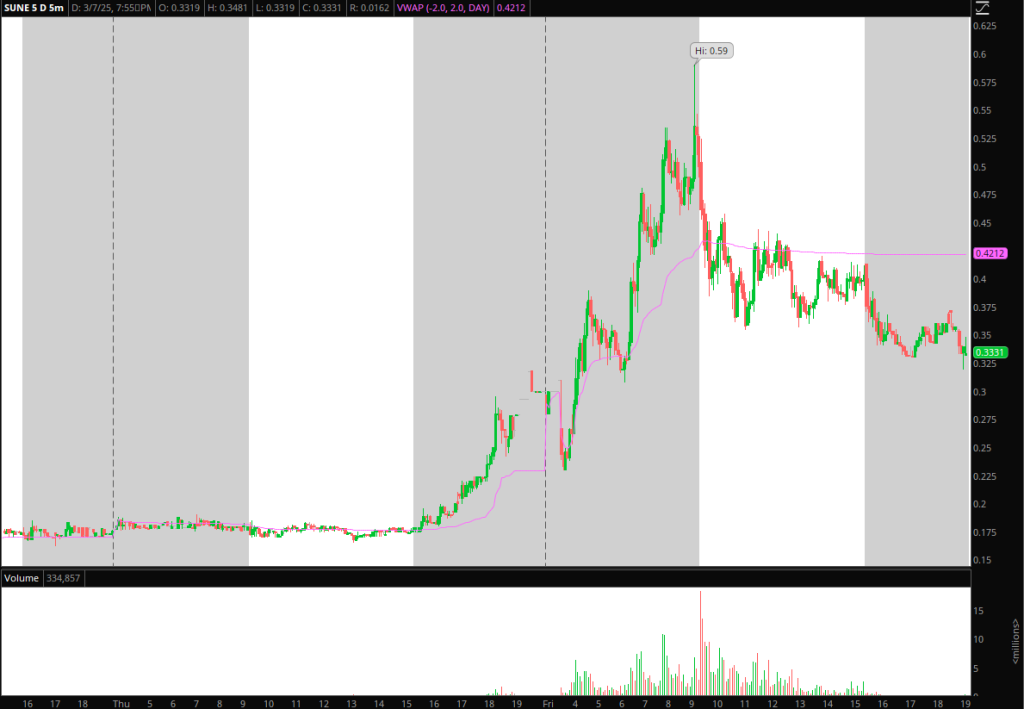

Pops to Brief in SUNE: I’d wish to see a push again into provide close to $.45 – $.50 and sharp fail to get brief versus the HOD for extra unwind. Traditionally a dilutive and poisonous title. Nevertheless, if the inventory reclaims $.40s and bases, the concept is void as it would change into a possible liquidity lure candidate.

*Please be aware that the costs and different statistics on this web page are hypothetical, and don’t mirror the affect, if any, of sure market elements comparable to liquidity, slippage and commissions.

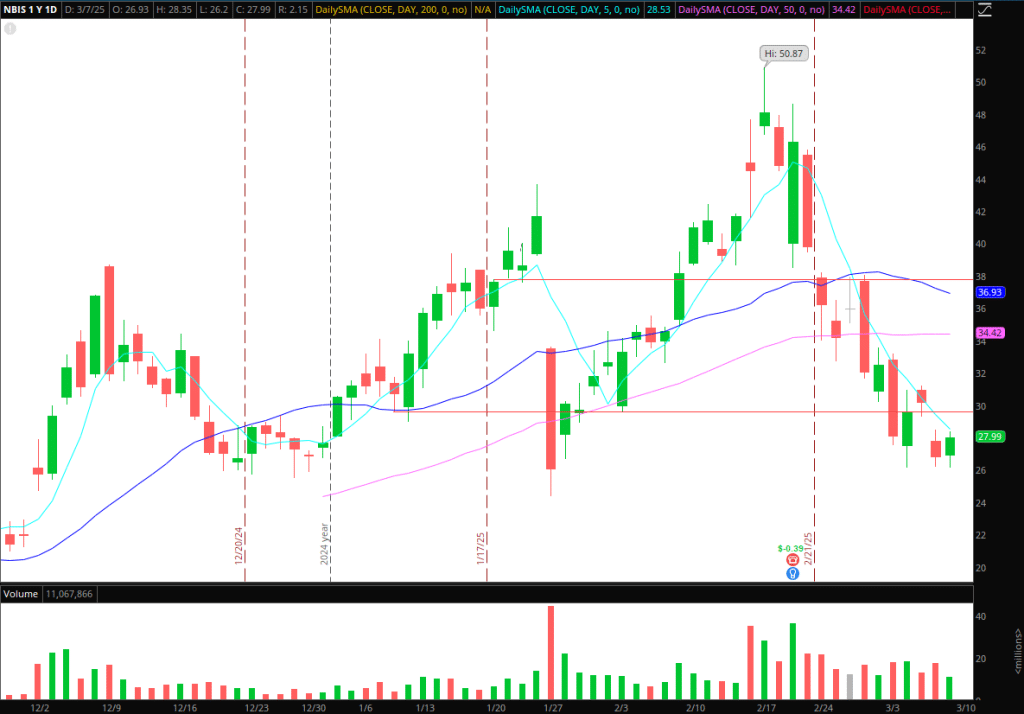

Reduction Rally in NBIS: Crushed down AI title, nearly 50% off its 52-week highs. Leaning towards lengthy momentum right here if we get some aid within the sector and total market. Particularly, I’d be searching for a breakout above Thursday – Friday’s excessive, trailing towards the LOD or breakout degree. Alternatively, if we expertise a spot increased, I’d be searching for a better low entry or Friday’s excessive to change into help within the brief time period.

*Please be aware that the costs and different statistics on this web page are hypothetical, and don’t mirror the affect, if any, of sure market elements comparable to liquidity, slippage and commissions.

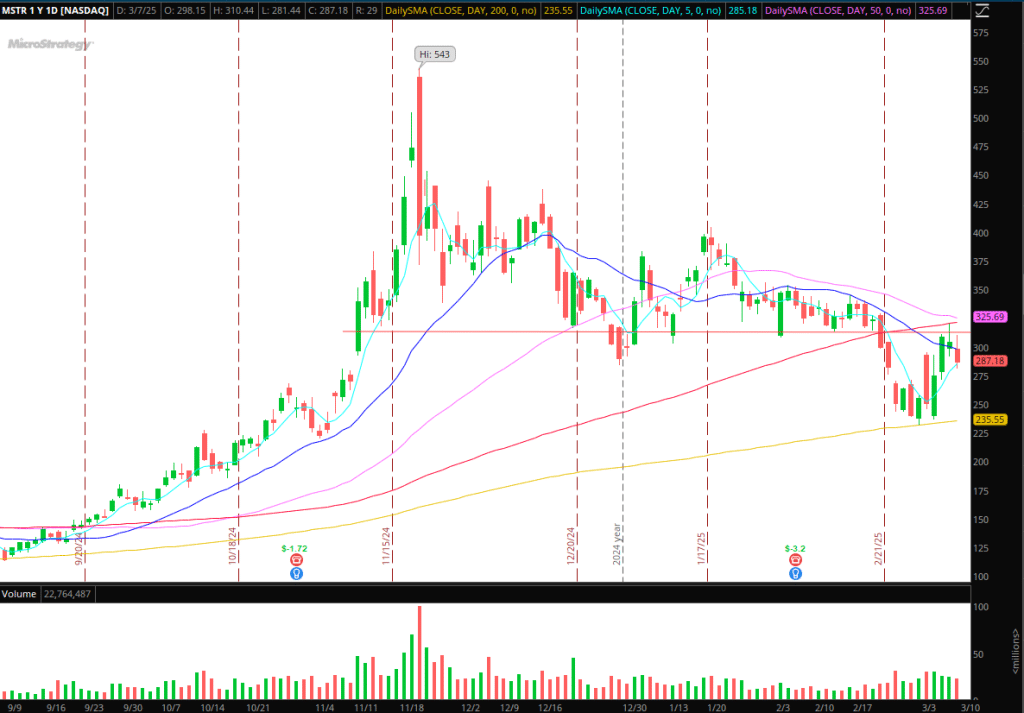

Momentum Shorts in Bitcoin (MSTR / IBIT): Taking a look at IBIT, earlier help close to $52 is performing as newfound resistance. If pops proceed to face promoting stress, I’ll lean brief. For MSTR, it’s an analogous story, as $300 – $310 is now changing into main resistance. So long as the decrease excessive holds on a better timeframe, I’ll search for pops and failed follow-through close to this space to lean brief intraday for momentum strikes.

*Please be aware that the costs and different statistics on this web page are hypothetical, and don’t mirror the affect, if any, of sure market elements comparable to liquidity, slippage and commissions.

Failed Observe-By way of in PSTV: Nice dealer on Thursday and Friday. If this pops again towards $1.8 – $2 and stuffs exhausting, I’d lean brief versus the HOD for a transfer again towards Friday’s low. Alternatively, if it reclaims its multi-day VWAP and bases, it will likely be on look ahead to a possible squeeze out into the excessive $2s.

*Please be aware that the costs and different statistics on this web page are hypothetical, and don’t mirror the affect, if any, of sure market elements comparable to liquidity, slippage and commissions.

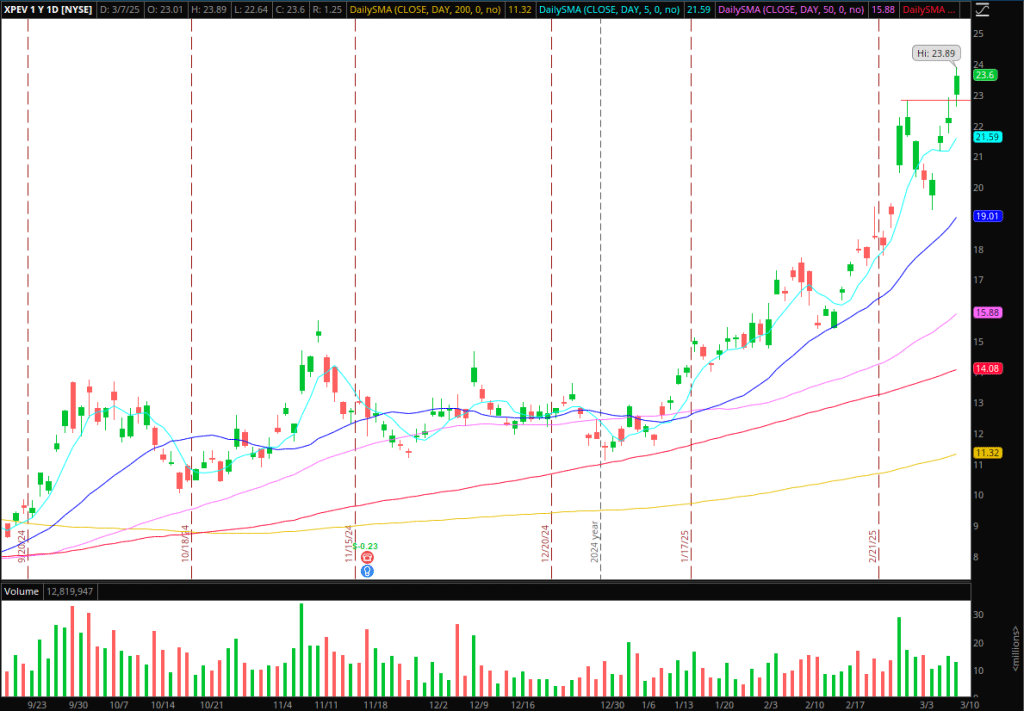

Reversion in XPEV: Lastly, I’m stalking XPEV for a possible reversion alternative within the coming days. Ideally, this has additional gaps and extensions to the upside, establishing an A+ imply reversion alternative. Nevertheless, if we get any detrimental headlines or profit-taking within the China basket, I’d lean brief on a FRD setup.

*Please be aware that the costs and different statistics on this web page are hypothetical, and don’t mirror the affect, if any, of sure market elements comparable to liquidity, slippage and commissions.

Get the SMB Swing Buying and selling Analysis Template Right here!

Vital Disclosures